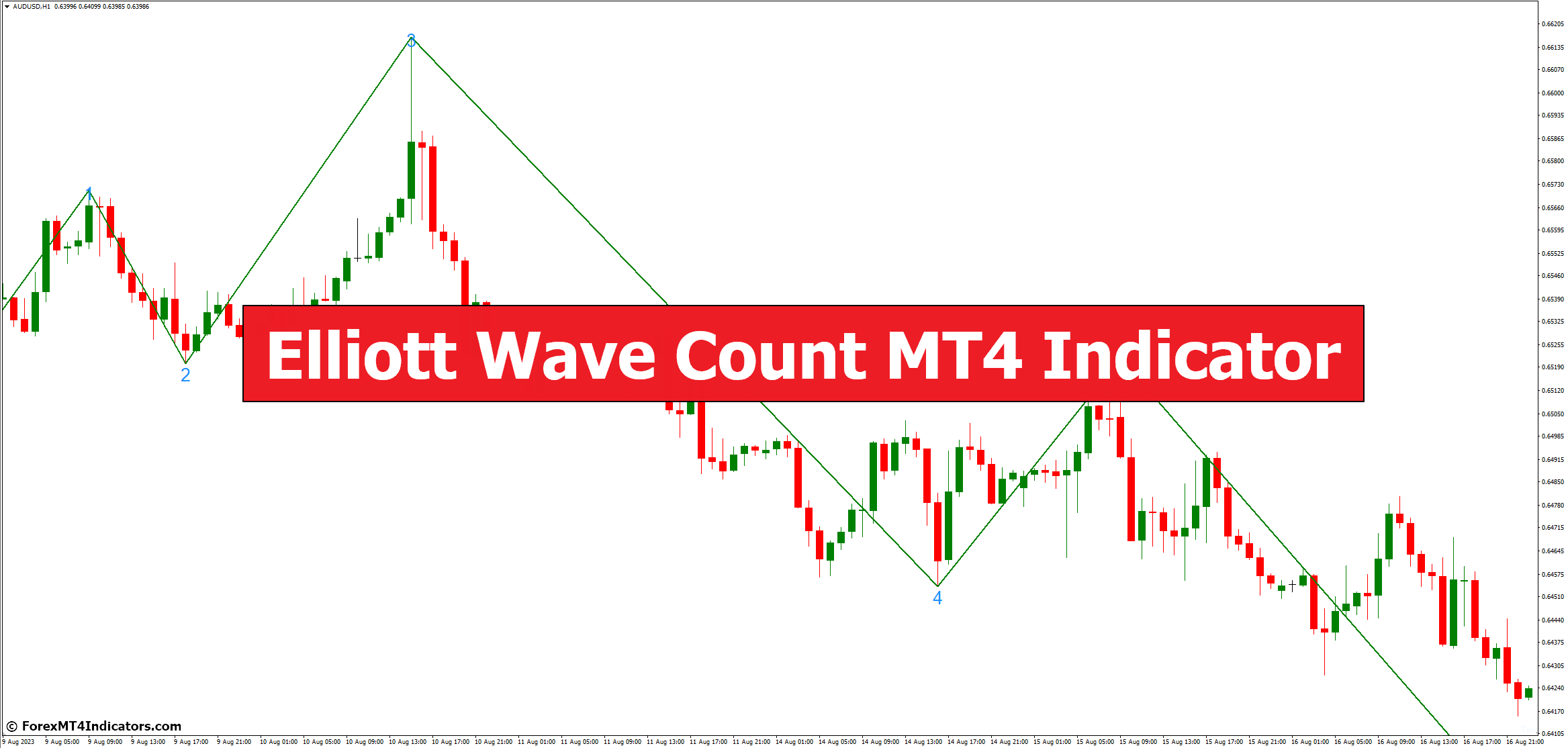

Elliott Wave Count MT4 Indicator

[ad_1] Are you a trader looking to enhance your technical analysis capabilities? The Elliott Wave Count MT4 Indicator could be the tool you’ve been searching for. In this article, we’ll delve into the intricacies of this indicator, exploring how it works, its benefits, and how to effectively integrate it into your trading strategy. Whether you’re

[ad_1]

Are you a trader looking to enhance your technical analysis capabilities? The Elliott Wave Count MT4 Indicator could be the tool you’ve been searching for. In this article, we’ll delve into the intricacies of this indicator, exploring how it works, its benefits, and how to effectively integrate it into your trading strategy. Whether you’re a seasoned trader or just getting started, understanding the Elliott Wave Principle and its application through the MT4 Indicator can significantly elevate your trading prowess.

The Elliott Wave Principle, developed by Ralph Nelson Elliott in the 1930s, is a technical analysis approach that identifies recurring wave patterns in financial markets. According to this theory, market price movements follow specific patterns of optimism and pessimism, creating waves that can be categorized as impulse waves and corrective waves.

Understanding Wave Theory

At its core, the Elliott Wave Theory is based on the idea that market psychology and sentiment are reflected in price movements. The theory asserts that price trends are not random but rather a result of crowd psychology. This psychological aspect leads to the formation of distinct waves that can be analyzed for potential trading opportunities.

Principles of the Elliott Wave Theory

The Elliott Wave Theory revolves around a few key principles:

- Wave Patterns: The market moves in a series of impulsive waves (upward) and corrective waves (downward).

- Wave Degrees: Waves are categorized into different degrees, including Grand Supercycle, Supercycle, Cycle, Primary, Intermediate, Minor, Minute, and Minuette waves.

- Fibonacci Ratio: Price movements within waves often adhere to Fibonacci ratios, offering traders a tool to predict potential reversal and continuation points.

The Significance of Elliott Wave Count

The Elliott Wave Count holds paramount importance in technical analysis due to its predictive power and ability to identify trends within a broader market context.

Identifying Market Trends with Waves

The Elliott Wave Count provides traders with a structured framework to identify the prevailing trend within a market. By categorizing waves into impulses and corrections, traders can distinguish between bullish and bearish phases, aiding in making informed trading decisions.

Predictive Power of Wave Patterns

One of the most intriguing aspects of the Elliott Wave Count is its predictive nature. By recognizing specific wave patterns and their corresponding Fibonacci ratios, traders can anticipate potential price targets and reversal levels. This forecasting ability enhances a trader’s ability to strategize entry and exit points effectively.

Exploring the MT4 Indicator

The MT4 Elliott Wave Indicator simplifies the application of the Elliott Wave Principle, offering traders an intuitive tool to visualize wave patterns directly on their trading platform.

Key Features of the Elliott Wave MT4 Indicator

The MT4 Elliott Wave Indicator offers several features that aid traders in their analysis:

- Wave Count Labels: The indicator automatically labels wave counts on the chart, streamlining the identification process.

- Fibonacci Levels: The indicator plots Fibonacci retracement levels, helping traders spot potential reversal zones.

- Customization: Traders can adjust settings like color, line style, and timeframes to suit their preferences.

With the MT4 Elliott Wave Indicator, traders can seamlessly integrate the power of the Elliott Wave Principle into their trading strategy.

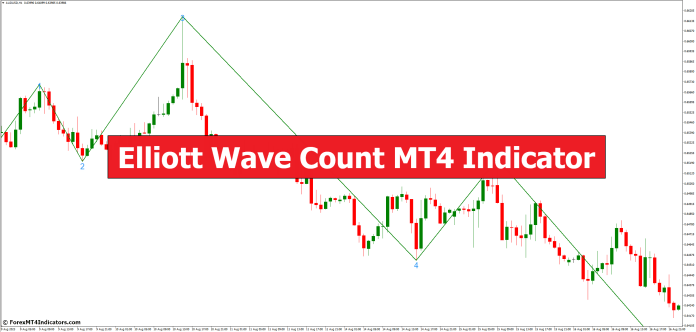

How to Interpret Wave Counts

Interpreting wave counts is the cornerstone of effectively utilizing the Elliott Wave Principle for trading decisions.

Differentiating Between Impulse Waves and Corrective Waves

Impulse waves (1, 3, 5) signify the direction of the prevailing trend, while corrective waves (2, 4) represent temporary price retracements. Understanding the characteristics of each wave type is essential for accurate wave counting.

Using Fibonacci Retracement Levels

Fibonacci retracement levels help traders identify potential support and resistance levels within wave patterns. These levels, derived from the Fibonacci sequence, often coincide with reversal points, enhancing the accuracy of predictions.

Incorporating Elliott Wave Count into Your Trading Strategy

While the Elliott Wave Principle offers valuable insights, combining it with other technical indicators can refine your trading strategy.

Confirmation with Other Technical Indicators

To validate Elliott Wave patterns, consider using indicators like Moving Averages, Relative Strength Index (RSI), and MACD. Confluence of signals enhances the probability of successful trades.

Setting Realistic Price Targets and Stop-Loss Levels

Wave counts provide price target estimations. Pair this information with proper risk management by setting stop-loss levels to protect your capital in case the market moves against your prediction.

Advantages of Using the MT4 Elliott Wave Indicator

The MT4 Elliott Wave Indicator brings forth numerous advantages for traders seeking to leverage the Elliott Wave Principle.

Enhanced Decision-Making

The indicator’s visual representation simplifies complex wave patterns, aiding traders in making quicker and more informed decisions.

Time-Efficient Analysis

Manual wave counting can be time-consuming and prone to errors. The MT4 Indicator automates the process, allowing traders to focus on other aspects of their trading strategy.

Limitations and Risks

While the Elliott Wave Principle is a powerful tool, it’s essential to acknowledge its limitations.

False Signals and Misinterpretations

Like any technical tool, the Elliott Wave Indicator is not infallible. False signals and misinterpretations can occur, leading to suboptimal trading decisions.

Over-Reliance on the Indicator

Relying solely on the MT4 Elliott Wave Indicator can lead to neglecting other crucial aspects of trading, such as fundamental analysis and market news.

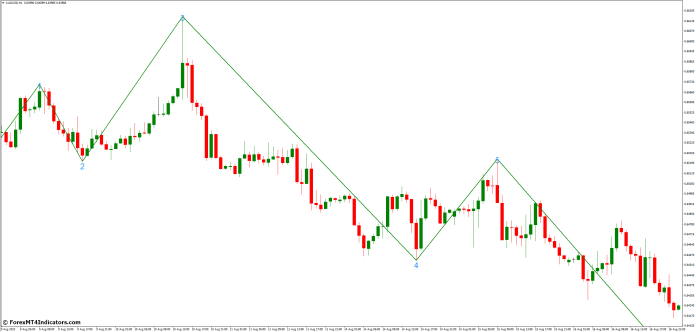

Case Studies: Real-Life Applications

To grasp the practical application of the Elliott Wave Principle, consider these case studies.

Forex Trading Example

Imagine applying the Elliott Wave Principle to the EUR/USD currency pair. By identifying wave patterns, traders can predict potential trend reversals or continuation points, leading to well-timed trades.

Tips for Effective Usage

Maximize the benefits of the Elliott Wave Principle with these tips.

Stay Updated with Market News

Market events can impact wave patterns. Stay informed about economic announcements and geopolitical developments to make informed trading decisions.

Continuous Learning and Practice

Becoming proficient in wave counting requires practice. Continuously analyze charts, apply the Elliott Wave Principle, and refine your skills over time.

Combining Fundamental and Technical Analysis

For well-rounded trading decisions, combine the insights of fundamental and technical analysis.

The Symbiotic Relationship

Fundamental analysis provides the “why” behind market movements, while technical analysis, including the Elliott Wave Principle, offers the “how” and “when” of trading.

Common Mistakes to Avoid

Steer clear of these common errors when using the Elliott Wave Principle.

Neglecting Fundamentals

While technical analysis is crucial, ignoring fundamental factors can lead to misguided trades. Balance both approaches for a holistic view.

Chasing Perfection

Wave counting can be complex, and over-analyzing patterns might lead to missed opportunities. Strive for accuracy, but avoid perfectionism.

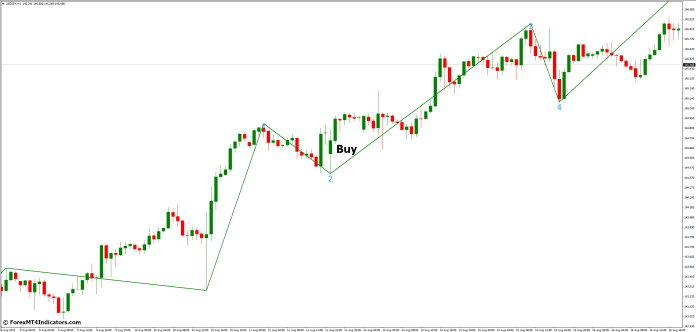

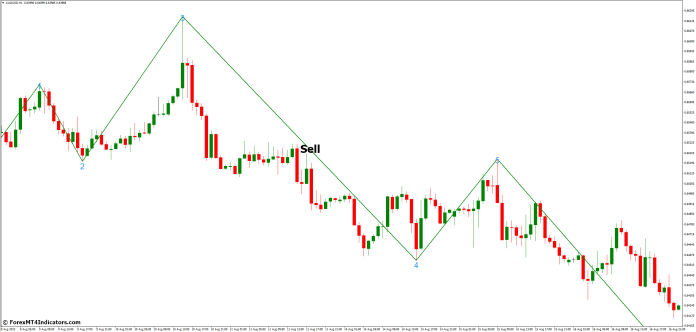

How to Trade with Elliott Wave Count MT4 Indicator

Buy Entry

- Look for a completed Elliott Wave pattern indicating the end of a downward move and the start of an upward move.

- Wait for confirmation of a bullish reversal pattern, such as a bullish engulfing candlestick or a hammer.

- Enter a buy trade when the price breaks above the high of the confirming candlestick.

Sell Entry

- Identify a completed Elliott Wave pattern that suggests a potential downward move is likely.

- Wait for confirmation of a bearish reversal pattern, such as a bearish engulfing candlestick or a shooting star.

- Enter a sell trade when the price breaks below the low of the confirming candlestick.

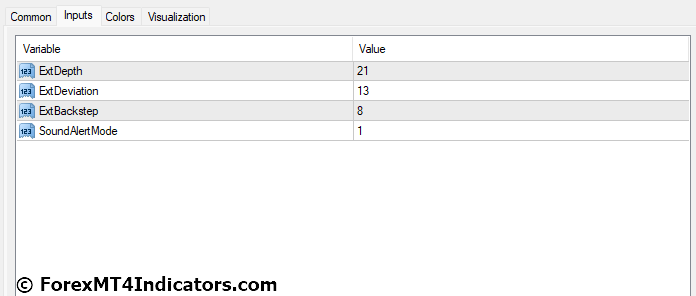

Elliott Wave Count MT4 Indicator Settings

Conclusion

Incorporating the Elliott Wave Count MT4 Indicator into your trading arsenal can be a game-changer. This powerful tool equips you with the ability to analyze market trends, predict potential price movements, and make informed trading decisions. However, remember that no tool is foolproof. Combine the insights gained from the Elliott Wave Principle with other technical and fundamental analysis methods to build a robust trading strategy that stands the test of time.

FAQs

Q1: Is the Elliott Wave Principle suitable for all types of financial markets?

A: Yes, the Elliott Wave Principle can be applied to various financial markets, including stocks, forex, commodities, and more.

Q2: Can I solely rely on the MT4 Elliott Wave Indicator for my trading decisions?

A: While the indicator is a valuable tool, it’s recommended to use it in conjunction with other technical and fundamental analysis methods.

Q3: Does the Elliott Wave Principle work in both trending and ranging markets?

A: The principle is designed to identify trends, making it more effective in trending markets. However, it can still offer insights in ranging markets.

Q4: What role does psychology play in wave patterns?

A: Psychology drives market sentiment, which in turn influences wave patterns. Understanding crowd behavior is key to accurate wave counting.

MT4 Indicators – Download Instructions

Elliott Wave Count MT4 Indicator is a Metatrader 4 (MT4) indicator and the essence of this technical indicator is to transform the accumulated history data.

Elliott Wave Count MT4 Indicator provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust their strategy accordingly. Click here for MT4 Strategies

Recommended Forex MetaTrader 4 Trading Platform

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click Here for Step-By-Step XM Broker Account Opening Guide

How to install Elliott Wave Count MT4 Indicator.mq4?

- Download Elliott Wave Count MT4 Indicator.mq4

- Copy Elliott Wave Count MT4 Indicator.mq4 to your Metatrader Directory / experts / indicators /

- Start or restart your Metatrader 4 Client

- Select Chart and Timeframe where you want to test your MT4 indicators

- Search “Custom Indicators” in your Navigator mostly left in your Metatrader 4 Client

- Right click on Elliott Wave Count MT4 Indicator.mq4

- Attach to a chart

- Modify settings or press ok

- Indicator Elliott Wave Count MT4 Indicator.mq4 is available on your Chart

How to remove Elliott Wave Count MT4 Indicator.mq4 from your Metatrader Chart?

- Select the Chart where is the Indicator running in your Metatrader 4 Client

- Right click into the Chart

- “Indicators list”

- Select the Indicator and delete

Elliott Wave Count MT4 Indicator (Free Download)

Click here below to download:

Download Now

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0