Elevated Yields, Weaker Wall Street Handover Keeps Wait-and-See in Place

[ad_1] Recommended by IG Forex for Beginners Market Recap Despite a resilient start to the week, Wall Street did not manage to find much follow-through overnight (DJIA -0.51%; S&P 500 -0.28%; Nasdaq +0.06%), as elevated Treasury yields and the lack of further heavy-lifting by Nvidia (-2.8%) kept a cautious tone in place. The US two-year

[ad_1]

Recommended by IG

Forex for Beginners

Market Recap

Despite a resilient start to the week, Wall Street did not manage to find much follow-through overnight (DJIA -0.51%; S&P 500 -0.28%; Nasdaq +0.06%), as elevated Treasury yields and the lack of further heavy-lifting by Nvidia (-2.8%) kept a cautious tone in place. The US two-year yields have edged above the 5% level, while the 10-year yields continue to consolidate around its 16-year high.

There was not much of a trigger for the calibration in yields yesterday, except for a caution from Richmond Fed President Thomas Barkin that the reacceleration in demand may make the case for further tightening. More broadly, it seems that the series of resilient US economic data are providing a reckoning for rates to be kept high for longer, with the US economic surprise index hovering at its highest level since March 2021.

The day ahead will leave a series of flash PMI data in focus. Previous month’s readings have seen further weakening in global economic activities across the board, but expectations are for the US economy to hold up in July. Consensus are looking for the US flash PMI figures to stay largely unchanged from the previous month (52.0), with a more lukewarm outcome preferred by pointing to softer demand but also keep hopes of a soft landing in place.

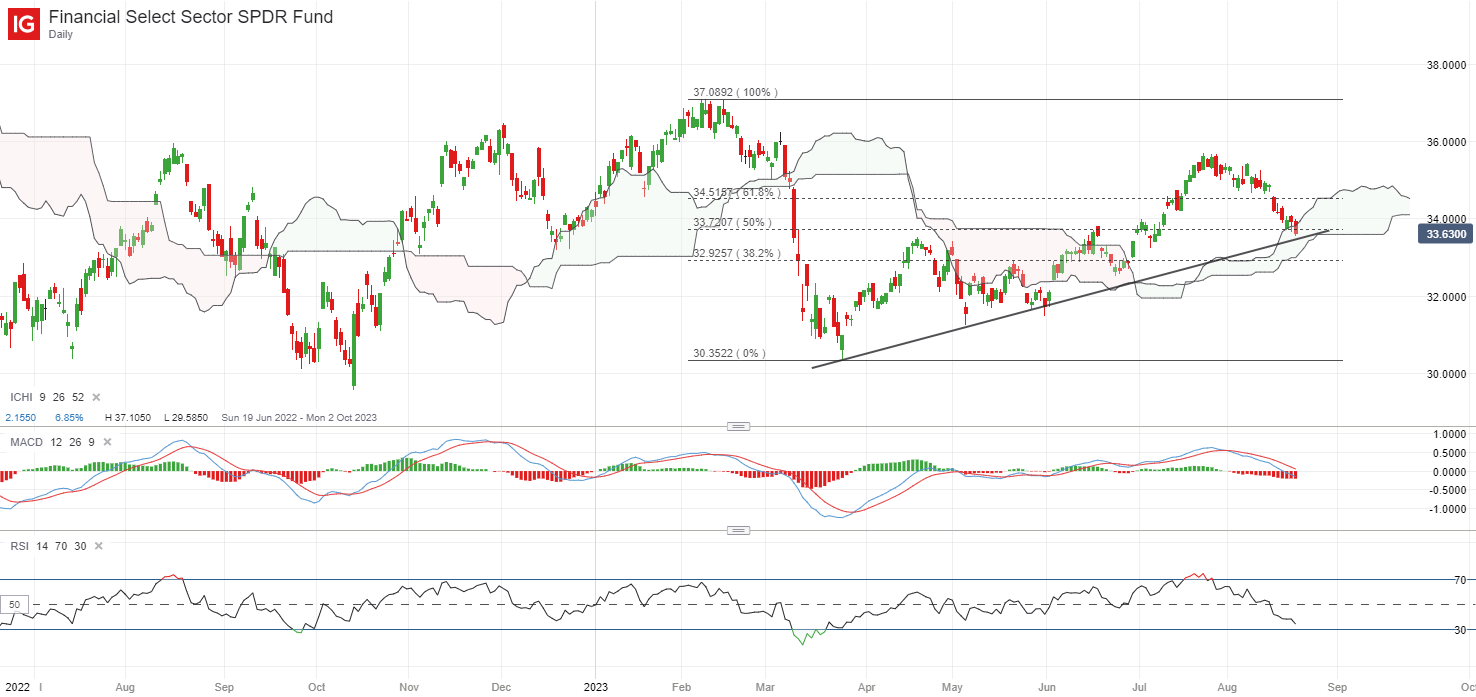

Perhaps one to watch may be the Financial Select Sector SPDR Fund (XLF), in which recent S&P’s downgrade of five US regional banks has put the sector down by 0.9% overnight. That brought the XLF back towards a trendline support, which coincides with its Ichimoku cloud support zone on the daily chart. However, a break below its 200-day moving average (MA) overnight does not provide much conviction for the bulls, who now face the task of having to reclaim the MA line. Any break below the trendline support could place the 32.50 level on watch next.

Source: IG charts

Asia Open

Asian stocks look set for a subdued open, with Nikkei +0.11%, ASX +0.47% and KOSPI -0.03% at the time of writing. Elevated US yields and the weaker handover from Wall Street may put on some wait-and-see in the region in the lead-up to Nvidia’s result release today, which may determine if the AI hype and tech rally could find another round of invigoration. On another note, Chinese equities saw a late-afternoon bounce in yesterday’s trading session, with one to watch for any follow-through today.

The economic calendar today saw Australia’s flash composite PMI dipping further into contractionary territory (47.1 versus previous 48.2) on softer services activities, while a slightly firmer footing is found in Japan’s PMI data (52.6 versus previous 52.2). The day ahead will leave Singapore’s Consumer Price Index (CPI) data on the radar next.

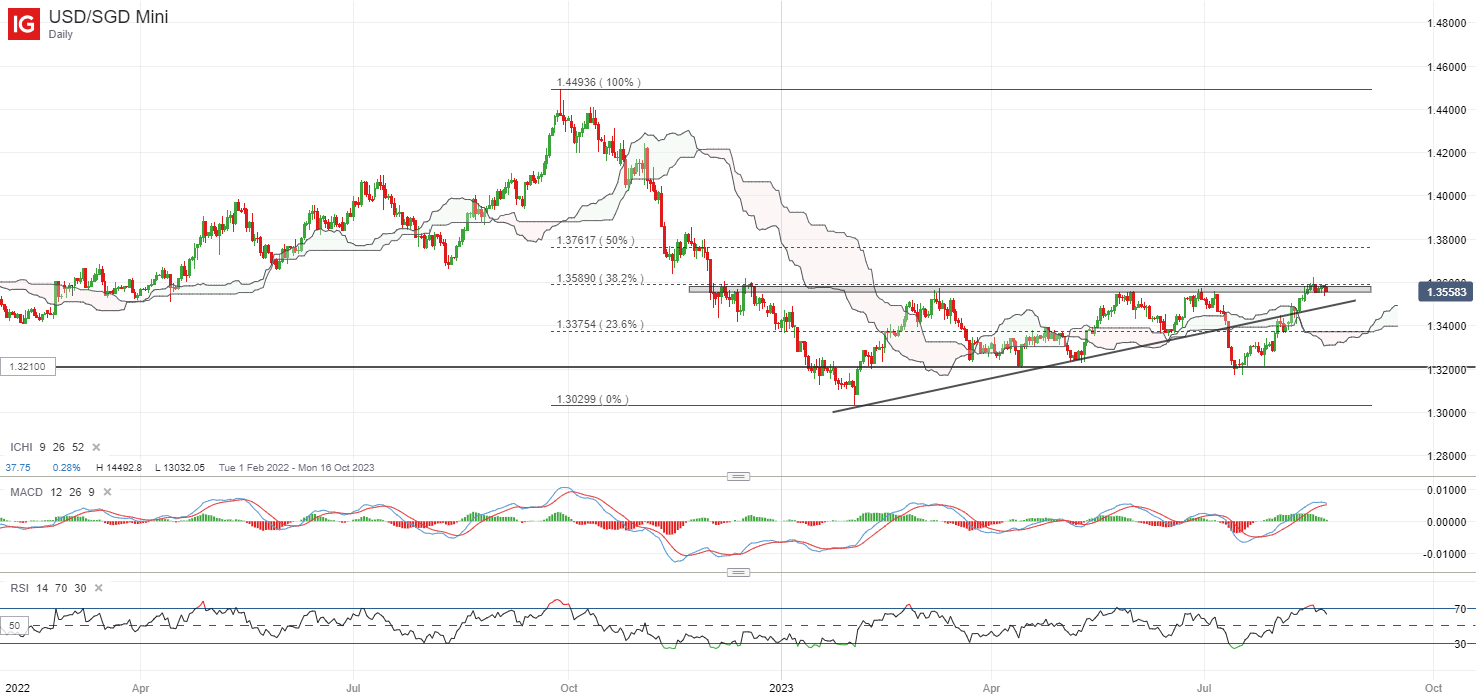

Thus far, the series of policy tightening by the MAS has been working its way into economic conditions, with headline inflation receding from its earlier peak of 7.5% to the current 4.5%, while the core aspect softened below 5% for the second straight month. Expectations are for the moderating trend in inflation to continue, with headline inflation to further ease to 4.1% and core CPI to head below the 4% mark at 3.8% in July.

The USD/SGD continues to hover around its year-to-date high at the 1.360 level. Trading above its 200-day MA for the first time since November 2022 could still place buyers in control, while its weekly RSI heads above the 50 level. Any softer read in Singapore’s inflation numbers could support the pair further, with any break above the 1.360 level potentially paving the way to retest the 1.376 level next.

Source: IG charts

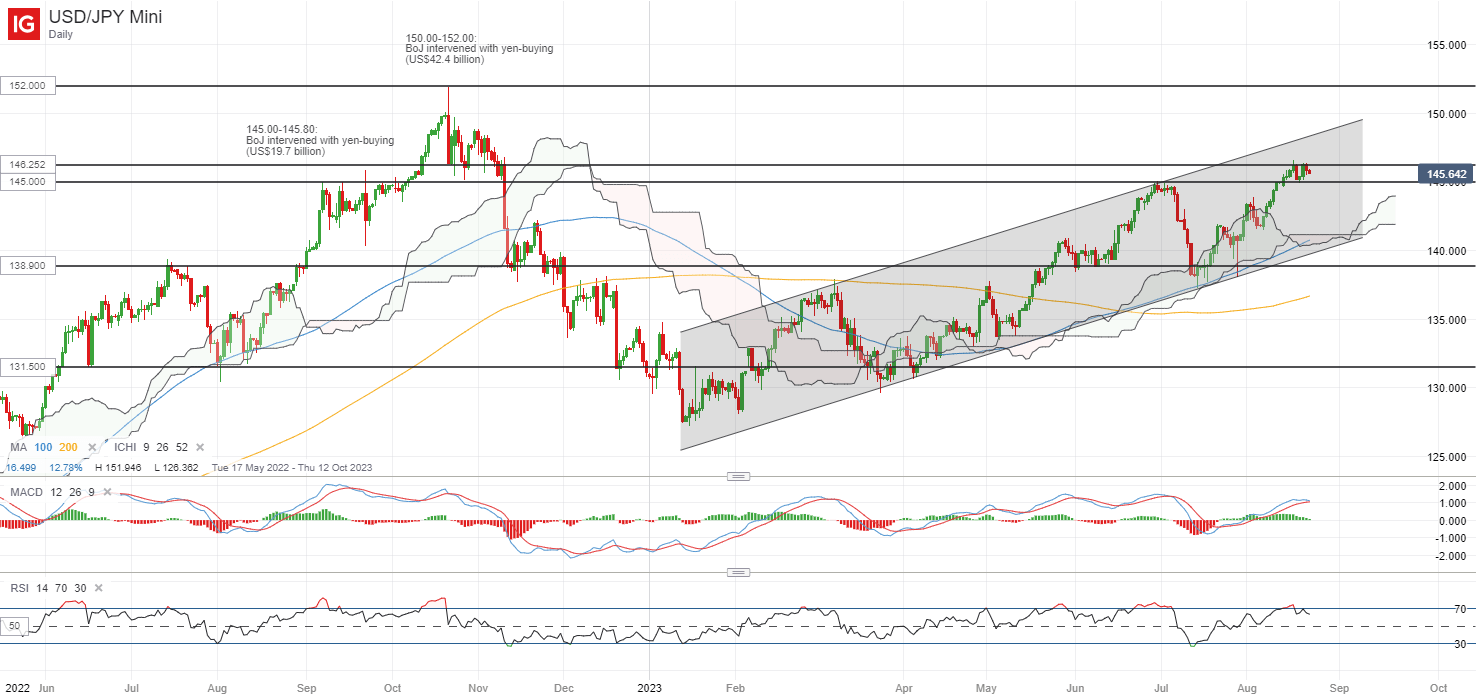

On the watchlist: USD/JPY attempting to defend 145.00 level

Despite a firmer US dollar overnight, the USD/JPY continues to face a near-term test of resistance at the 145.00-145.80 level, where an earlier yen-buying intervention by the Bank of Japan (BoJ) was executed in September 2022. Some signs of exhaustion are displayed for now, with lower highs in the daily RSI on recent tops, as sentiments are kept in check for fresh clues on the Fed’s policy outlook ahead of the key Jackson Hole Symposium. The 145.00 level will have to see some defending from the bulls, failing which could call for a retest of the 141.80 level next, while the 146.25 level will be an immediate resistance to overcome.

Source: IG charts

Tuesday: DJIA -0.51%; S&P 500 -0.28%; Nasdaq +0.06%, DAX +0.66%, FTSE +0.18%

Article written by IG Strategist Jun Rong Yeap

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0