Gold, Silver Analysis

Gold prices ease after diplomatic efforts allow for momentary de-escalation

An agreement was reached that would see aid flowing to those affected in Gaza and two Israeli hostages made their way back home. This and other ongoing conversations could result in a momentary respite in what has otherwise been a frantic war with the potential to spillover into a regional conflict.

Of course, the fighting is expected to continue but Israel may be open to delay its ground offensive for the safe return of more hostages. This is in contrast to what we have witnessed since the start of the conflict as rockets have been fired from both sides with regularity.

Recommended by Richard Snow

Get Your Free Gold Forecast

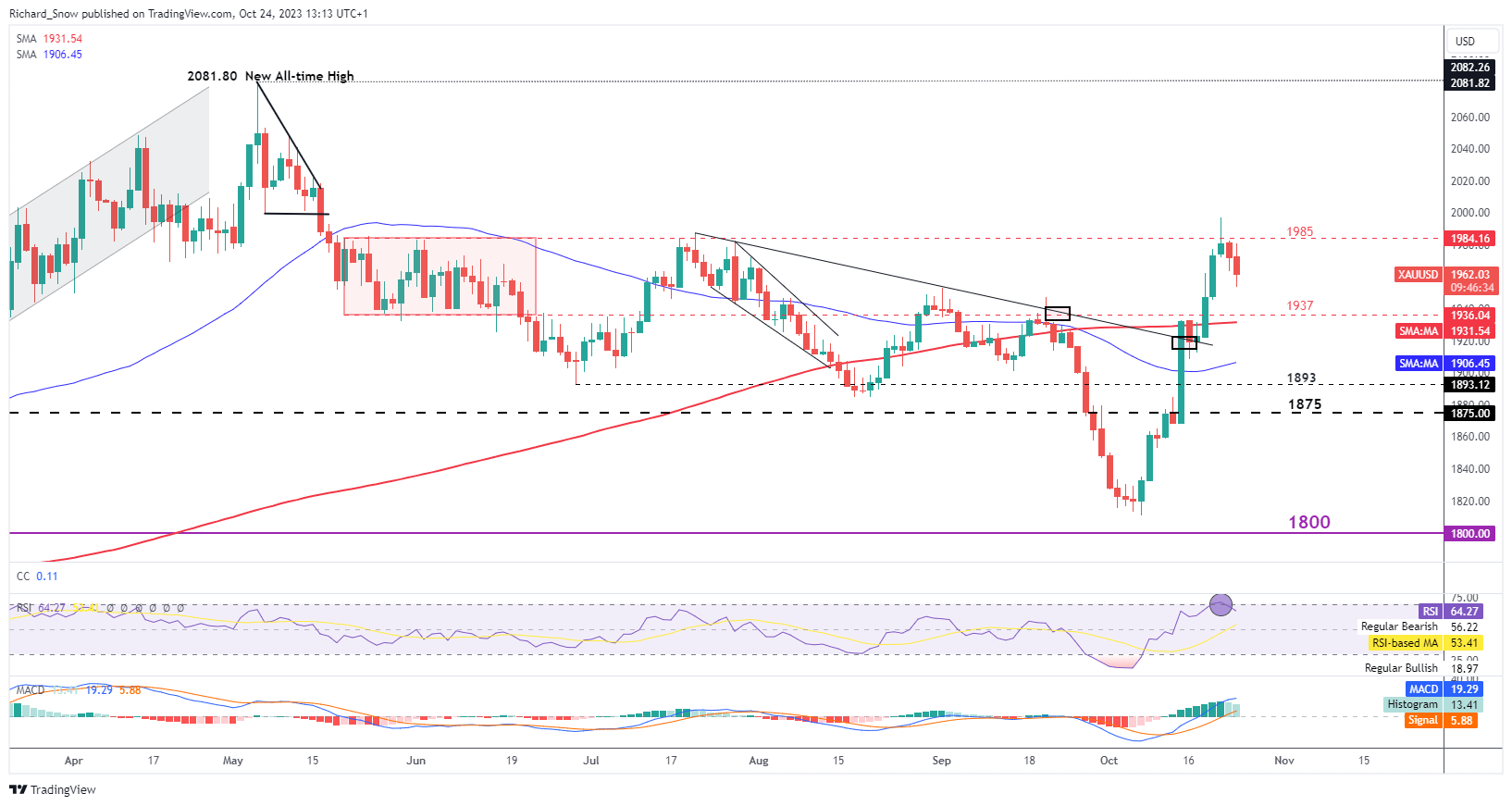

Therefore, the gold market has taken this an opportunity to take some risk off the table and reassess the next move. Panic buying of the safe haven metal led gold higher, only showing a loss of momentum around the $1985 level. However, the chances of an extended pullback appear unlikely with the war far from over. $1937 appears as potential support for the pullback and a prompt bid higher could see $1985 come into focus very quickly in the event tensions heat up again.

Gold Daily Chart

Source: TradingView, prepared by Richard Snow

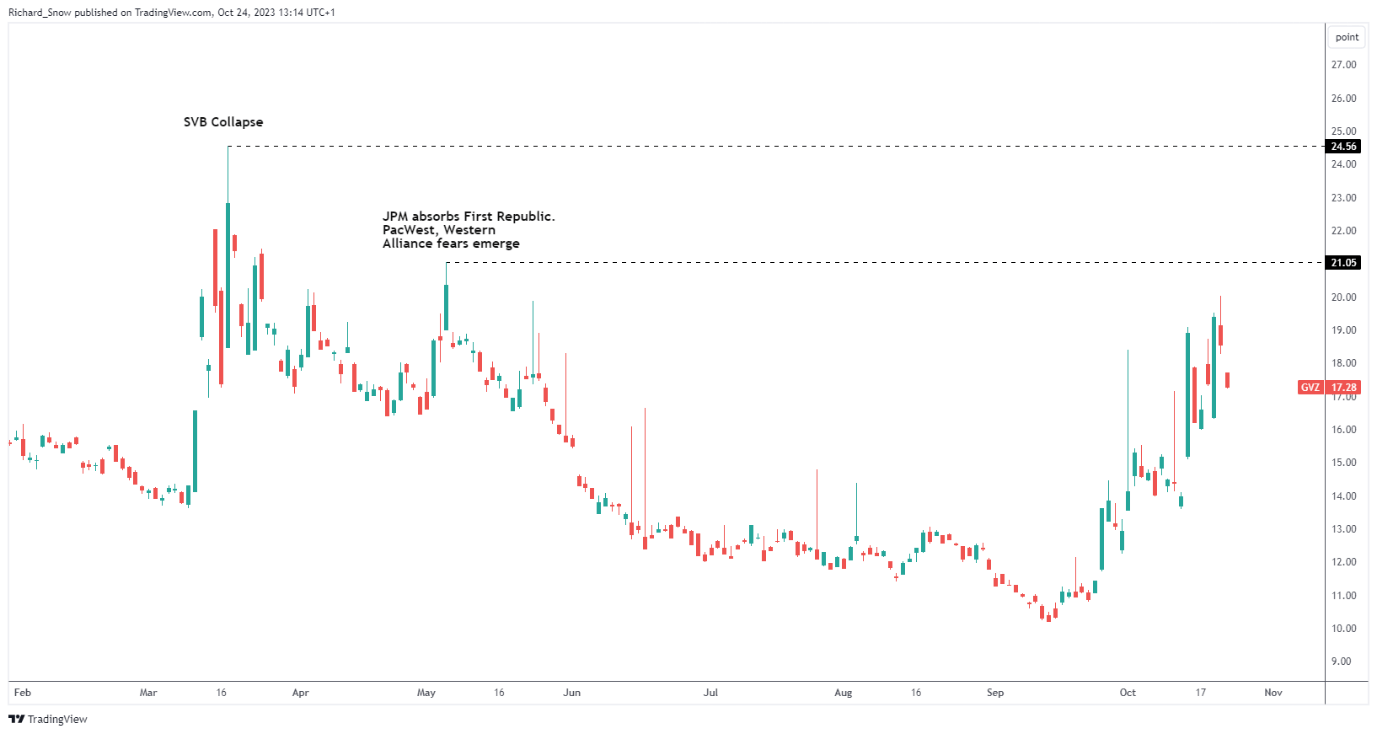

The 30-day expected gold volatility index (GVZ) has escalated towards levels not seen since the SVB demise and the return of regional banking turmoil in March and May this year. Such a surge in expected volatility suggests gold is likely to remain well supported as GVZ tends to rise more when gold prices accelerate.

Gold Volatility Index (GVZ)

Source: TradingView, prepared by Richard Snow

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter!

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

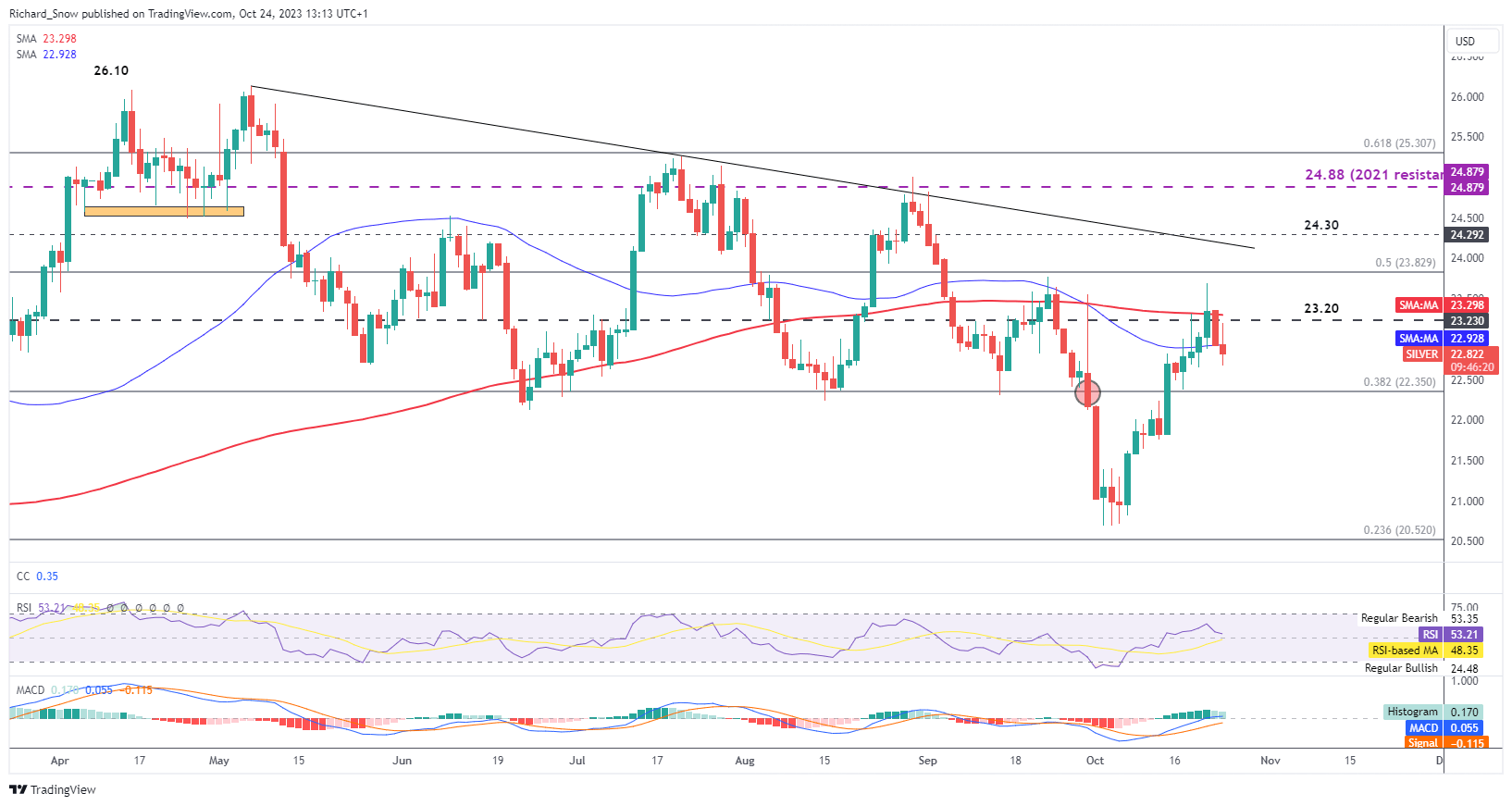

Silver Eases After Failing to Build on Break Above 200 SMA

Silver has risen but not to the same degree as the better-known safe haven that is gold. XAG/USD rose and breached the 200-day simple moving average, posting a close marginally above the line. The long upper wick provided the first clue of waning bullish momentum and since then, silver has been on the decline.

The temporary reprieve highlights the 38.2% Fibonacci retracement of the 2021 to 2022 major move around 22.35. However, the bullish bias remains intact, with a return to 23.20 not out of the question and even a possible advance towards the 50% Fibonacci level as a guideline.

Silver Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0