DXY Drops after FOMC and a Likely Peak in Rates

[ad_1] US Dollar (DXY) News and Analysis Fed holds interest rates but nods to ever tightening conditions Are US treasuries signaling a peak in US interest rates? Markets turn to fundamental data to gauge the effect of restrictive policy The analysis in this article makes use of chart patterns and key support and resistance levels.

[ad_1]

US Dollar (DXY) News and Analysis

- Fed holds interest rates but nods to ever tightening conditions

- Are US treasuries signaling a peak in US interest rates?

- Markets turn to fundamental data to gauge the effect of restrictive policy

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Fed holds interest rates but acknowledges Further tightening conditions

Yesterday the Federal Reserve held interest rates steady at 5.25 to 5.50% for the second consecutive meeting. This was largely expected but markets had been pricing in the possibility of a one more rate hike before the end of the year after an impressive run of hot U.S. economic data which saw US GDP canter to 4.9% (annualized) growth in Q3.

In the FOMC statement The Fed upgraded its language describing the strong performance of the US economy from “solid” to “strong”. In the ensuing press a conference Jerome Powell acknowledged that the economy was starting to feel the effects of tighter monetary policy but that the committee still sees a greater chance of a further rate hike than it does right cuts over the coming months. This makes sense as the Fed does not wish to provide a signal for the markets to go ahead and price in immediate rate cuts which would run the risk of loosening financial conditions, posing a risk to inflation.

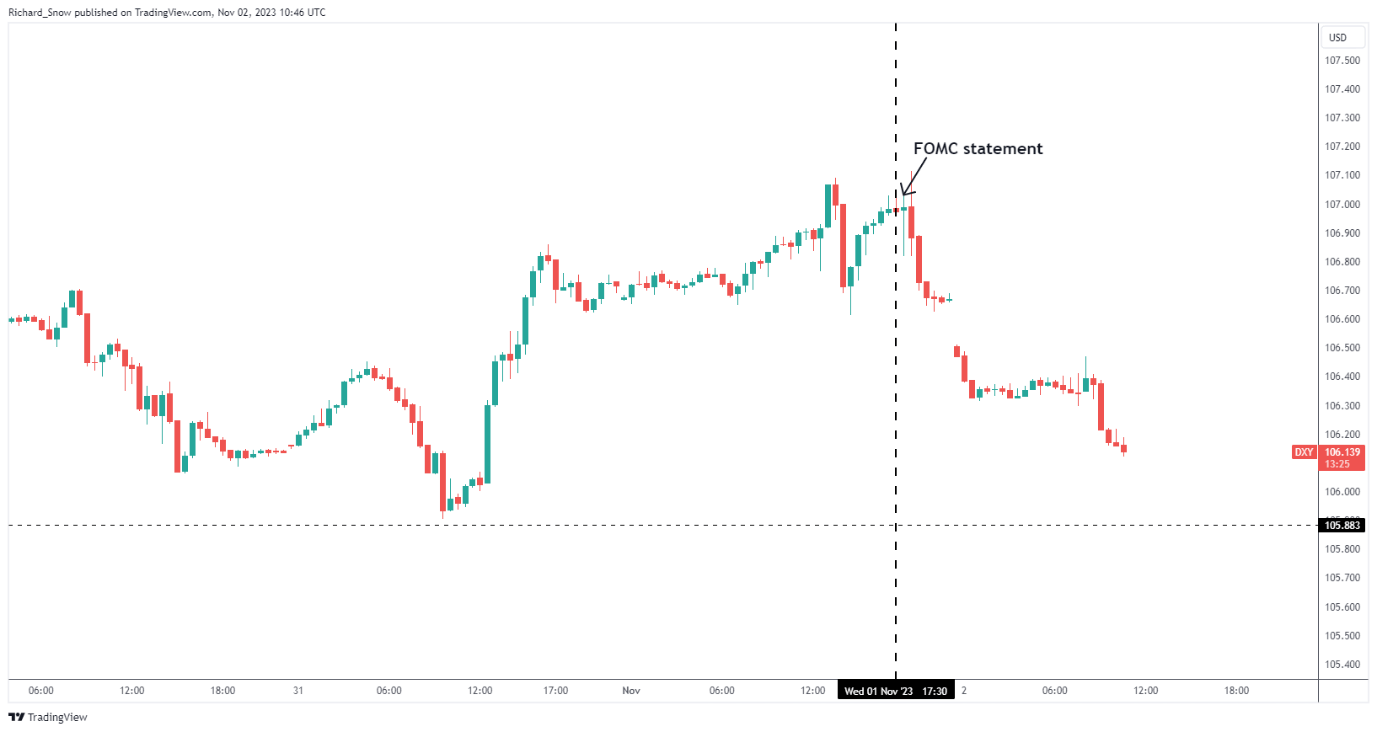

Immediately after the FOMC statement the dollar basket eased of the US yields saw a notable decline in the run up to the meeting. The ball for a bullish continuation in the dollar still remains high despite the fact that U.S. data is strong due to the continuing tightening thanks to elevated yields.

US Dollar Basket (DXY) 30-minute chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Get Your Free USD Forecast

Are US Treasuries Signaling a Peak in US Interest Rates?

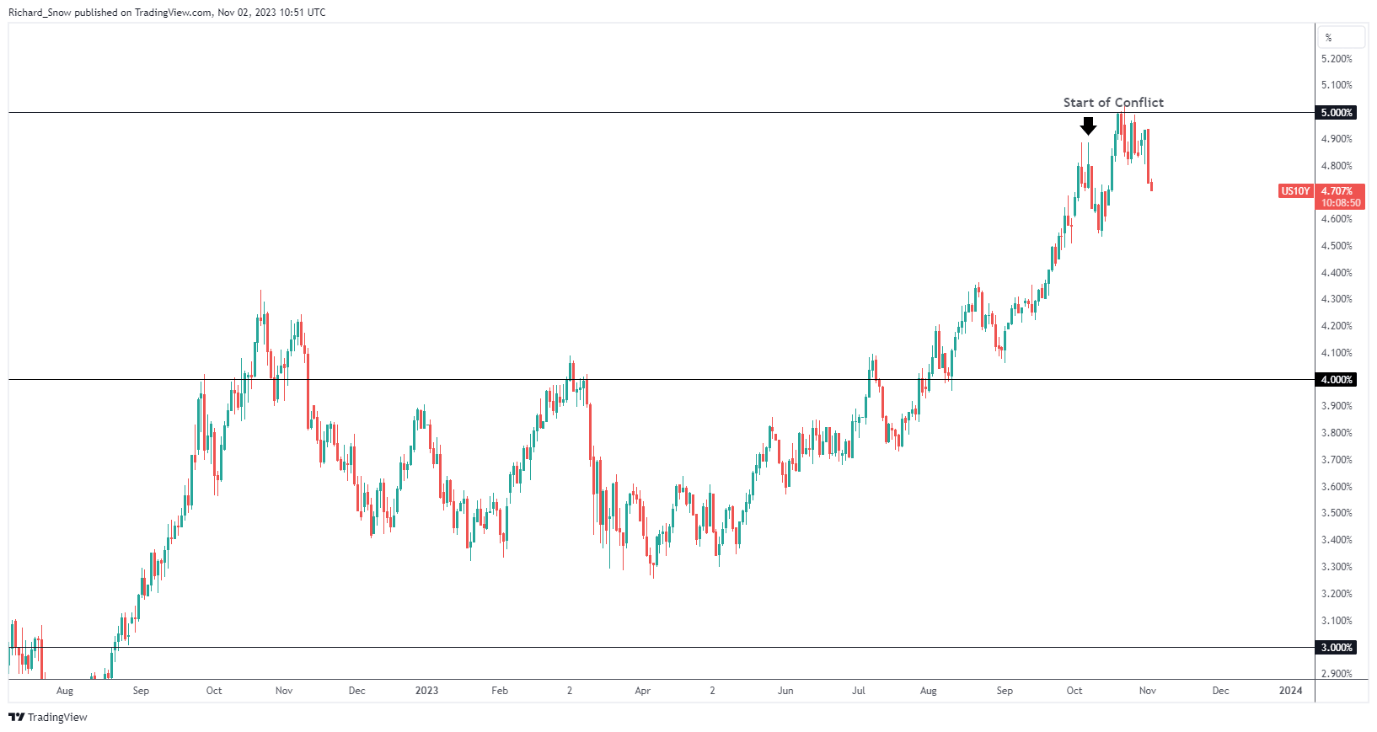

U.S. Treasury yields eased in the lead up to the FOMC announcement potentially suggesting a peak in US interest rates. Longer dated US yields have been extremely elevated through a number of weeks now placing further pressure on financial conditions and credit markets.

US 10 Year Treasury Note Yield

Source: TradingView, prepared by Richard Snow

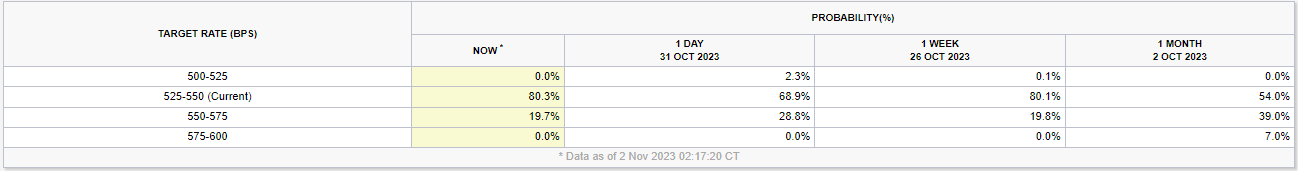

Fed funds futures have been rather enlightening, with recent moves suggesting a lesser likelihood of another rate hike before the end of this year. one month ago markets had priced in just under 40% of a rate hike in December and this has slowly been declining and now so it’s just under 20%.

FedWatch Tool Showing Market Implied Probabilities of Another Rate Hike

Source: CME FedWatch tool

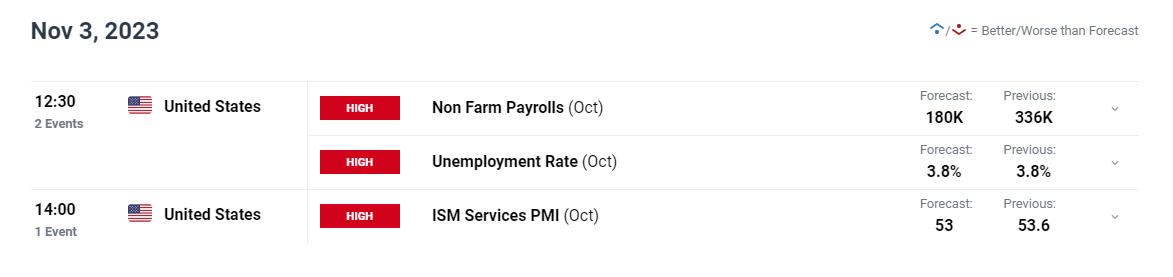

Markets Turn to Fundamental Data to Gauge the Effect of Restrictive Policy

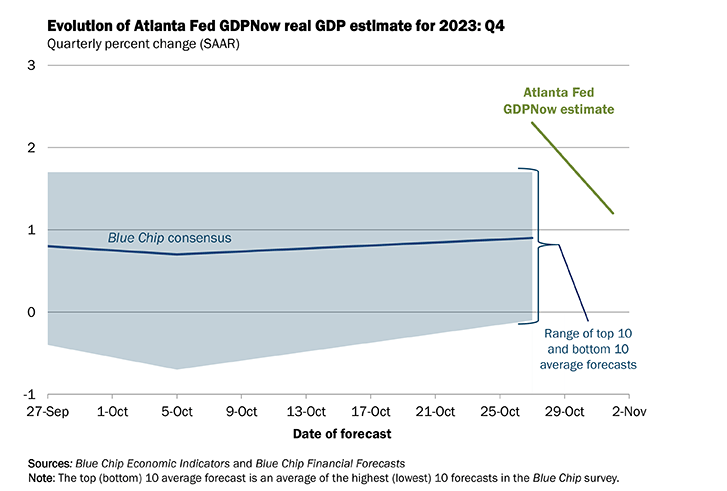

U.S. data has generally been outperforming it’s peers, but yesterday’s ISM manufacturing PMI data missed estimates by some margin and the Atlanta feds very own ‘GDP Now’ forecast has come crashing down from around 4% to a mere 1.2% for fourth quarter growth – based on current data.

It will take a lot to change the narrative of US exceptionalism and these are only a couple of data points but what it does do is highlight the importance of future data as far as it refers to potential stresses within the US economy. Up next we get US ISM services PMI and NFP.

Atlanta Fed’s GDPNow Forecast for Q4 (Based on Current Data)

Source: Atlanta Fed, prepared by Richard Snow

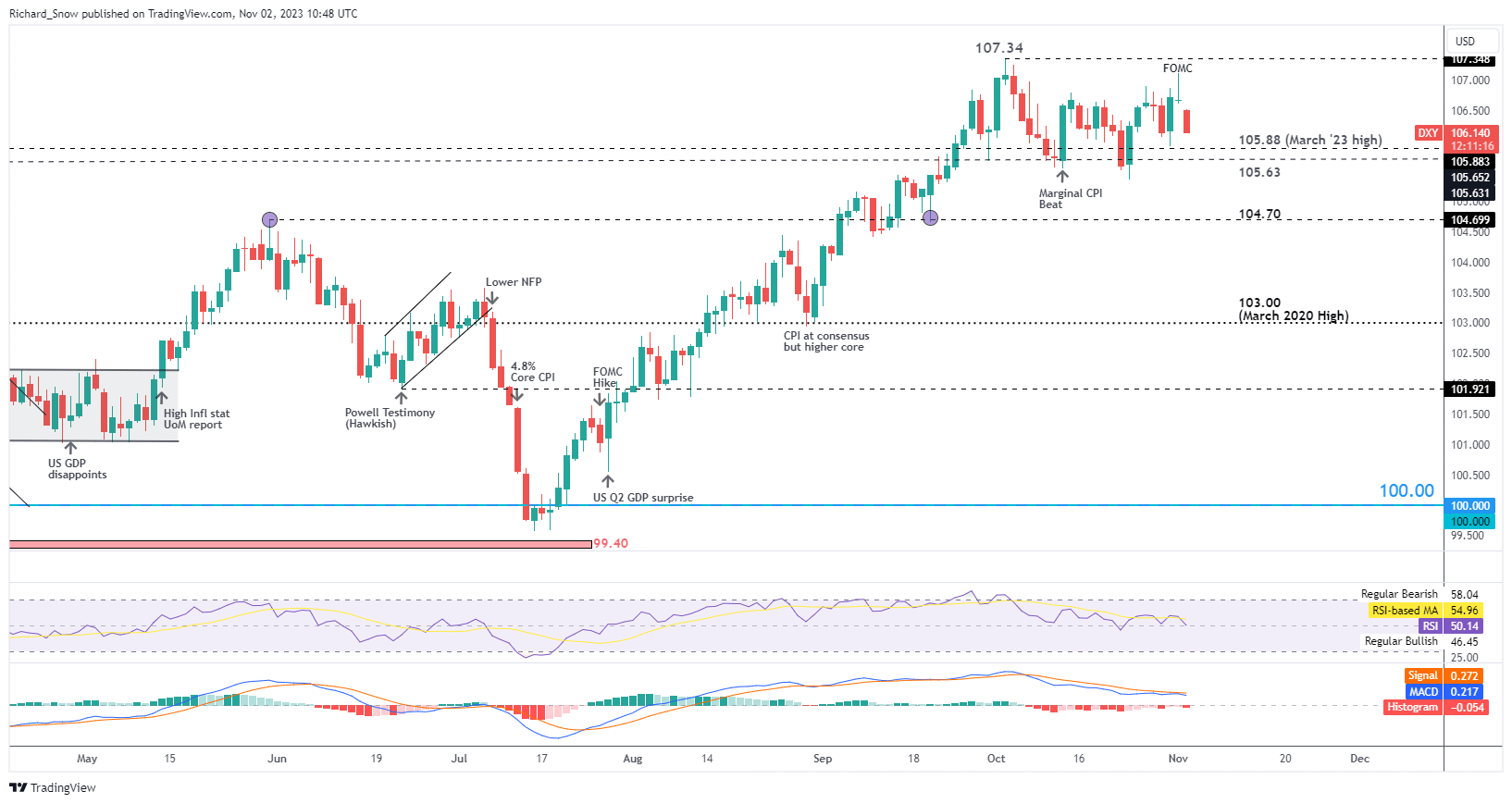

US Dollar Reversed off Yesterday’s High

The dollar reversed sharply after the intraday spike witnessed yesterday and continues the selloff in the London session today. Softer yields have contributed towards the decline along with the notion that interest rates have risen for the final time in this hiking cycle, at least, this is what the market is implying after digesting the statement and words of Jerome Powell.

given all of this it is still difficult to sell be dollar which remains at elevated levels. in the absence of pockets of stress or dislocations appearing in the broader U.S. market conditions may favour a range bound approach, looking to fade USD strength at elevated levels.

US Dollar Basket (DXY) Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade EUR/USD

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0