Article by IG Chief Market Analyst Chris Beauchamp

Dow Jones, Nasdaq 100, CAC 40 Analysis and Charts

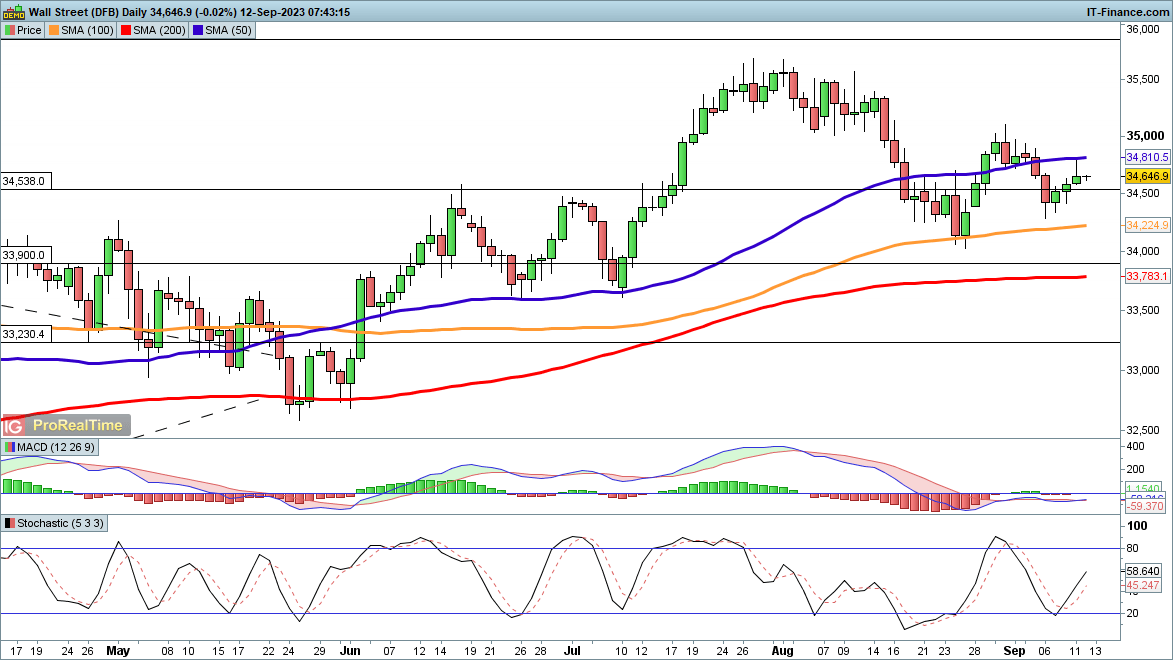

Dow makes further gains

The index has spent the past three sessions rallying from last week’s low and is now challenging the 50-day SMA from below. A close above 35,000 is critical to a renewed bullish view emerging, as this would signal that a higher low has formed in late August and early September, and could see a fresh move back to 35,600, the high from July.

Sellers will need a close back below 34,280 in order to suggest that a new leg lower is developing.

Dow Jones Daily Chart

Recommended by IG

Top Trading Lessons

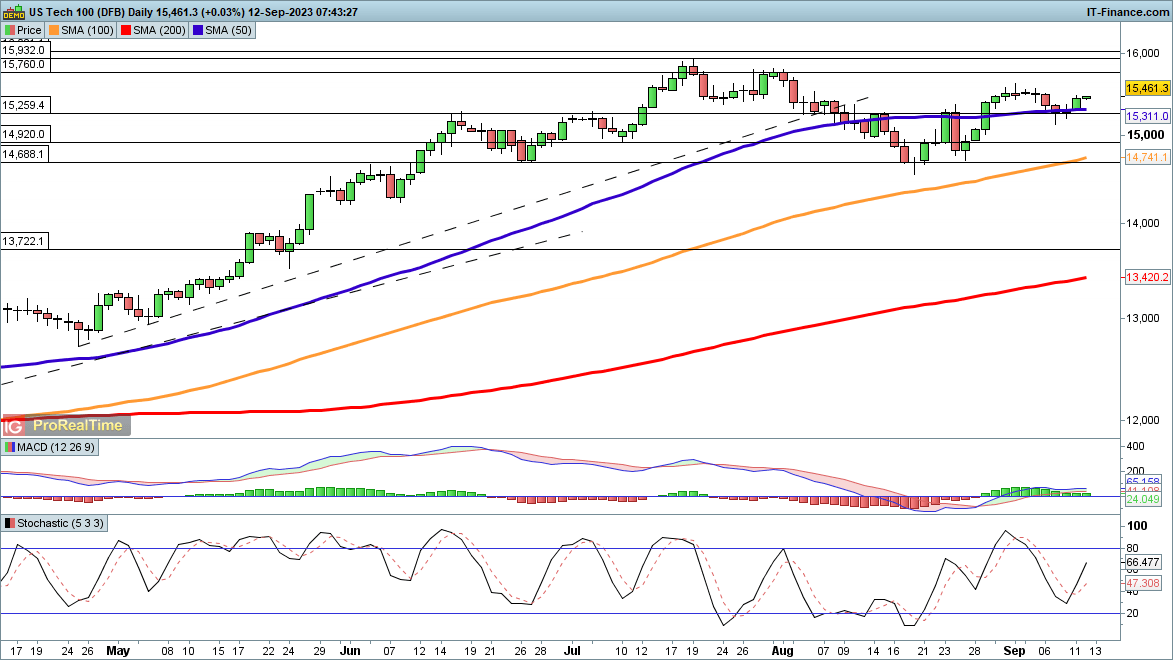

Nasdaq 100 rallies off 50-day MA

After stabilizing on Friday, the index pushed back above the 50-day SMA on Monday, setting up another possible attempt to break above the late August high. From there the 15,760, 15,932, and then the 16,021 levels come into view. The recovery from the August lows has helped to renew the bullish view.

It would require a move back below 15,270 to negate the short-term bullish view, and this might then bring the 14,690 support zone back into play.

Nasdaq 100 Daily Chart

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

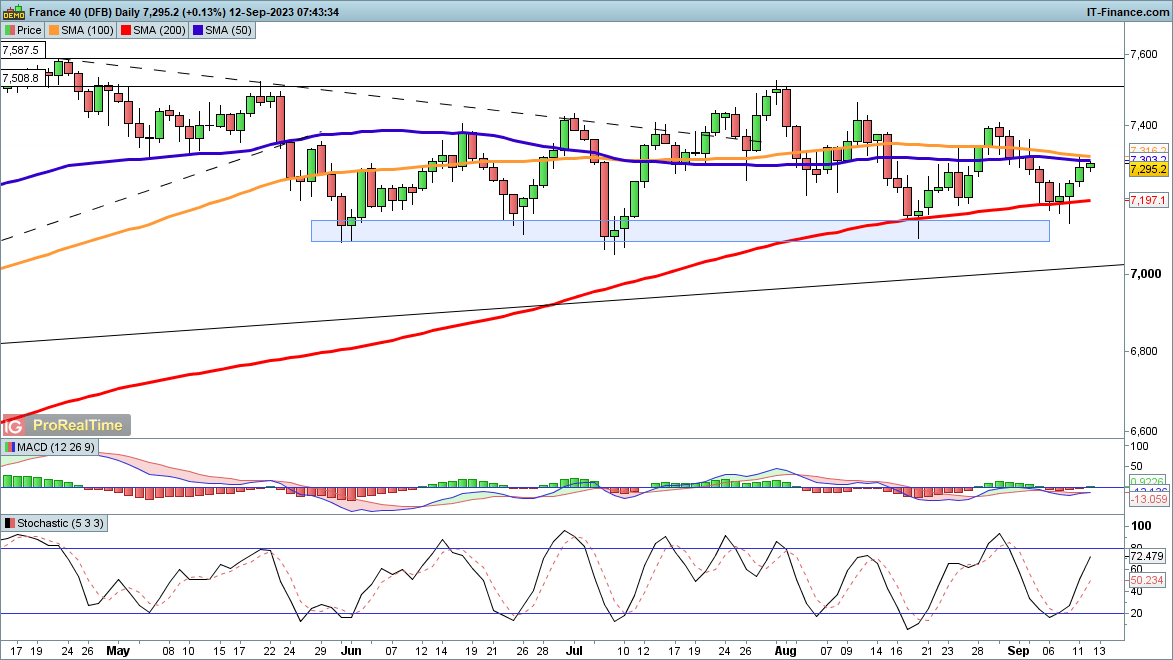

CAC40 rises for another day

The index maintained the bullish momentum seen on Friday after the price rallied back above the 200-day SMA. Having averted a deeper pullback for now, the index could now push back to 7400, or on to the late July highs at 7509. This would then put the index back on course to target the 2023 high at 7588.

Sellers will need a close back below 7110 to result in another test of the 7100 support zone.

CAC 40 Daily Chart

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0