Dollar Index Slides as PCE Data Declines in Line with Estimates

[ad_1] US Core PCE Key Points: MOST READ: Oil Price Forecast: WTI Rangebound as Demand Concerns Resurface. $80 a Barrel Incoming? Elevate your trading skills and gain a competitive edge. Get your hands on the US Dollar Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar. Recommended

[ad_1]

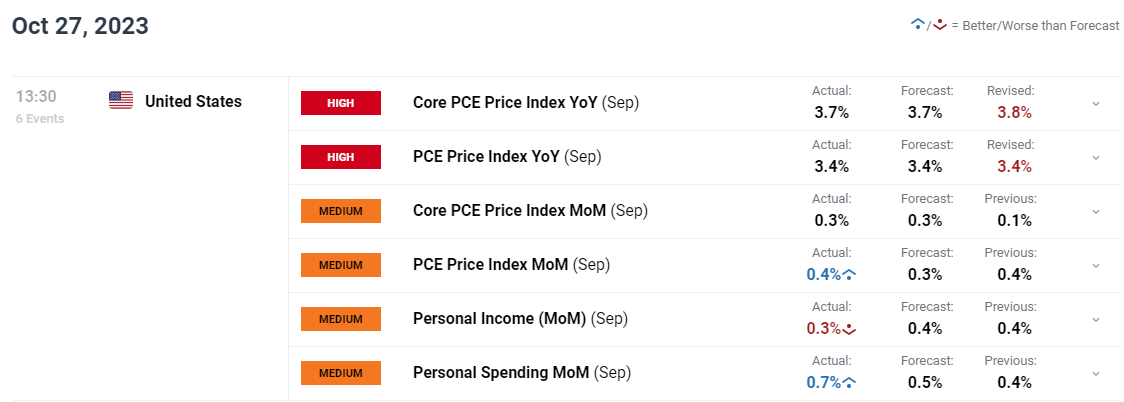

US Core PCE Key Points:

MOST READ: Oil Price Forecast: WTI Rangebound as Demand Concerns Resurface. $80 a Barrel Incoming?

Elevate your trading skills and gain a competitive edge. Get your hands on the US Dollar Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Zain Vawda

Get Your Free USD Forecast

Personal income increased $77.8 billion (0.3 percent at a monthly rate) in September, according to estimates released today by the Bureau of Economic Analysis. This comes following a 0.4% increase in August and beating the market consensus of a 0.5% advance. Spending on services saw a substantial increase of $96.2 billion, or 0.8%, while spending on goods also rose by $42.5 billion, or 0.7%. Among services, spending was up for other services, particularly international travel; housing and utilities, mainly housing expenses; health care, dominated by hospitals and nursing homes; and transportation, primarily air transportation.

Customize and filter live economic data via our DailyFX economic calendar

The Core PCE price index increased by 0.3% from the previous month in September of 2023, the most in 4 months, aligning with market estimates and accelerating from the 0.1% increase from the earlier month. The YoY rate which remains the Feds preferred Inflation Gauge eased slightly to 3.7%, the lowest since May 2021, but held sharply above the central bank’s target of 2%.

US ECONOMY AHEAD OF THE FOMC MEETING

Q3 GDP data came out from the US beating estimates comfortably in what was largely an expected print of 4.9%. The jump was attributed to strong government and consumer spending during the end of the summer period. However, as I alluded to in my piece post the GDP release there are a lot of headwinds for the US and Global economy in Q4.

As the higher rates for longer idea takes hold and keeps consumers stretched financially a similar print in Q4 does not look promising. The concerns for the Economy are down to reasons such as depleted savings for households, student loan repayments have resumed. All of the above would point to a moderate growth print for Q4 of 2023.

Net Week we have the FOMC meeting and rate decision with another hold largely expected. It will be key to gauge the rhetoric of Fed Chair Powell as there are still some who see a December hike as a possibility. Today’s data is unlikely to sway that conversation in any particular direction given the small change in the PCE data unlikely to see the Fed completely rule out a further rate hike with the Central Bank likely to leave the door open should the need arise.

MARKET REACTION

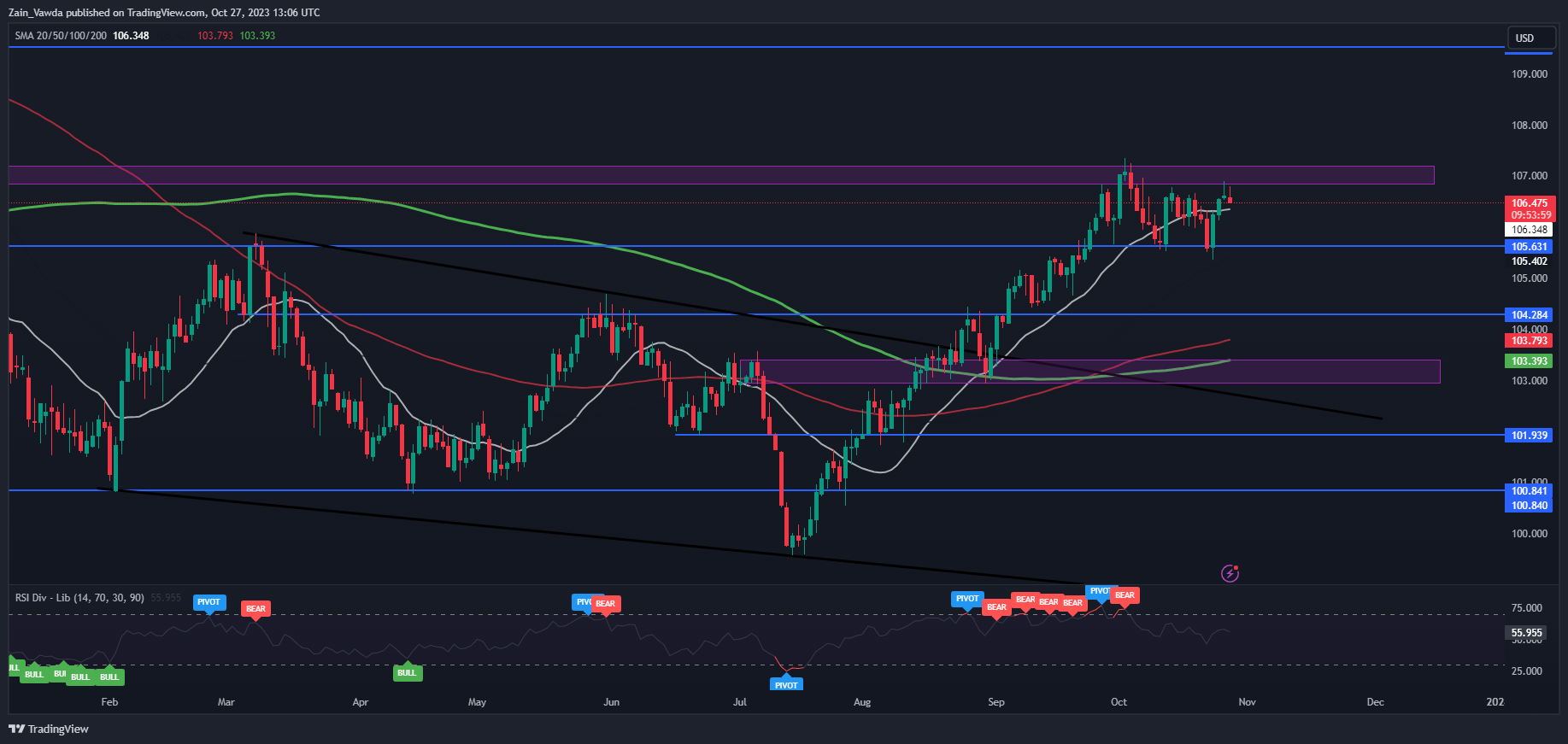

Following the data release the dollar index declined and rejected off the key resistance area around the 106.80-107.20 mark. The index continues to struggle at tis key inflection point and may remain rangebound ahead of next week’s FOMC meeting.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

Dollar Index Daily Chart- October 27, 2023

Source: TradingView, prepared by Zain Vawda

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter!

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0