Decoding How Gold, US Dollar and Yields Might React

[ad_1] US LABOR MARKET REPORT KEY POINTS: The U.S. Bureau of Labor Statistics will release its latest nonfarm payrolls survey on Friday The economy is forecast to have created 170,000 jobs in August With the Fed embracing a data-centric stance, the strength or weakness of the data will help guide the monetary policy outlook, setting

[ad_1]

US LABOR MARKET REPORT KEY POINTS:

- The U.S. Bureau of Labor Statistics will release its latest nonfarm payrolls survey on Friday

- The economy is forecast to have created 170,000 jobs in August

- With the Fed embracing a data-centric stance, the strength or weakness of the data will help guide the monetary policy outlook, setting the tone for the U.S. dollar, yields, and gold prices in financial markets.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: US Dollar Crumbles; Unstoppable Nasdaq 100 Hits Key Level, Defying Gravity

During the Jackson Hole Symposium, Fed Chair Powell delivered a candid message: inflation has slowed but remains undefeated despite the aggressive series of rate hikes implemented since 2022. This hawkish assessment, however, was tempered by a prudent note: policymakers will “proceed carefully” in any further move, signaling a resolute commitment to data-driven decisions ahead.

The shift towards a data-dependent approach will inject a new level of significance into incoming economic information. For this reason, the next labor market report scheduled to be released on Friday morning may play a critical role in the central bank’s reaction function, becoming a compass of sorts to guide the policy-formulation process at FOMC meetings.

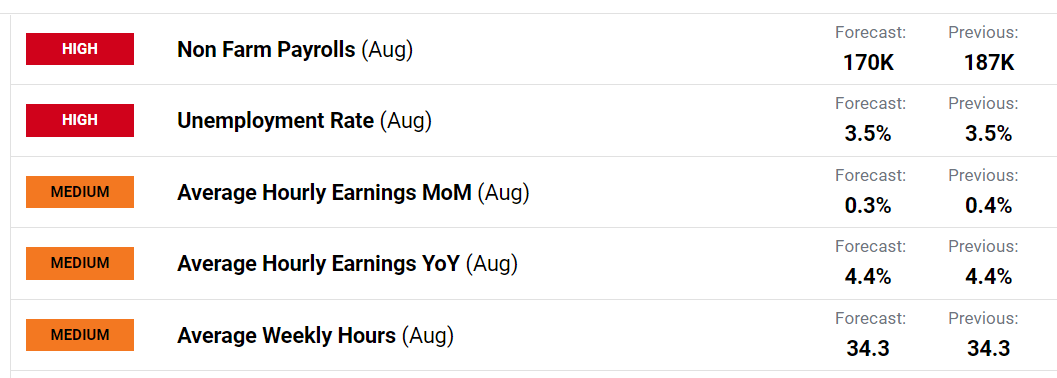

Focusing on the upcoming U.S. employment survey, nonfarm payrolls (NFP) are expected to have grown by 170K in August after a 187K increase in July, allowing the unemployment rate to hold steady at 3.5%. Meanwhile, average hourly earnings are seen rising 0.3% monthly and 4.4% year-on-year, with the latter figure somewhat too high and inconsistent with the inflation target of 2.0%.

Elevate your trading game by downloading your third-quarter fundamental and technical outlook for the U.S. dollar. It is free!

Recommended by Diego Colman

Get Your Free USD Forecast

US JOBS REPORT EXPECTATIONS

Source: DailyFX Economic Calendar

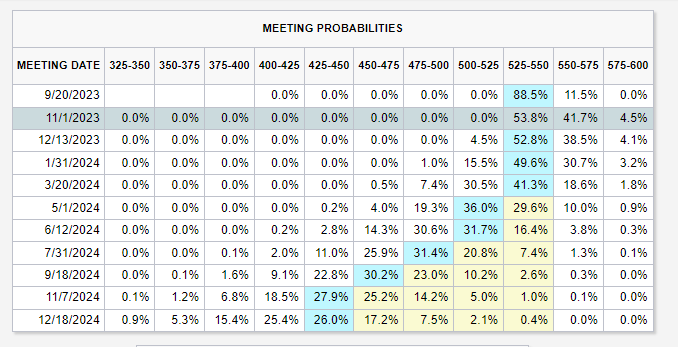

Over the past few days, a string of lackluster economic indicators, including JOLTS, consumer confidence and private sector hiring, has prompted investors to repriced lower the Fed’s hiking path, sending yields lower. Interest rate expectations may fall further if job growth disappoints, but could shoot upwards swiftly in the event of very strong labor market report.

FOMC MEETING PROBABILITIES

Source: CME FedWatch Toll

In terms of possible scenarios, two possible cases are worth highlighting:

Crack the code to successful gold trades by downloading your free “How to Trade Gold” guide. Major strategies are discussed in the guide.

Recommended by Diego Colman

How to Trade Gold

Scenario 1: Strong job gains and rapid growth in average hourly earnings

Employment gains above 200,000 and hot wages will reinforce upside inflation risks, increasing the probability of one or two additional quarter-point hikes in 2023 and higher rates for longer. This scenario should be a tailwind for the U.S. dollar and Treasury yields, but would put downward pressure on gold prices and other rate-sensitive assets.

Scenario 2: Soft employment growth and weaker-than-expected average hourly earnings

Should the headline NFP print fall below the 150,000 threshold and wage growth moderate more than envisioned, traders may quickly recalibrate the Fed monetary policy outlook, reducing wagers in favor of further rate hikes on the assumption that the economy is starting to roll over. This scenario would weigh on Treasury yields and drag the U.S. dollar, but would stand to boost gold prices.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0