Dallas Fed October manufacturing index -19.2 vs -18.1 prior

[ad_1] Details: Output (production) +5.2 vs +7.9 prior New orders -8.8 vs -5.2 prior Employment +6.7 vs +13.6 prior Outlook -17.1 vs -17.5 prior Prices paid for raw materials +13.6 vs +25.0 prior Prices received -2.1 vs +1.8 prior Wages +24.4 vs +34.8 prior Comments in the report: Chemical manufacturing The Middle East situation has

کد خبر : 422955

تاریخ انتشار : دوشنبه 30 اکتبر 2023 - 18:35

[ad_1]

Details:

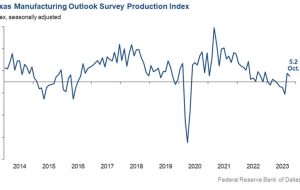

- Output (production) +5.2 vs +7.9 prior

- New orders -8.8 vs -5.2 prior

- Employment +6.7 vs +13.6 prior

- Outlook -17.1 vs -17.5 prior

- Prices paid for raw materials +13.6 vs +25.0 prior

- Prices received -2.1 vs +1.8 prior

- Wages +24.4 vs +34.8 prior

Comments in the report:

Chemical manufacturing

- The Middle East situation has raised uncertainty.

- With the unrest in the Middle East, there is now additional

global uncertainty and about how it will impact the U.S. and overall

global economy. There is limited optimism; we will see a very slow

recovery in the first quarter depending on the global impacts of

additional conflict.

Computer and electronic product manufacturing

- Overall customer projections are said to be up for 2024, but our forecasts don’t match and are down.

- We are working our way to find a cyclical bottom. The overall

economy is still the wild card, and it’s not helping. If things stay

stable in the economy overall, customer inventories should have stopped

draining, and our growth should resume sometime by mid next year.

Fabricated metal product manufacturing

- Supply-chain issues, particularly with the Panama Canal

[bottleneck], have created delays that have resulted in reduced sales

over the summer. Hopefully, these have been sorted out now. - Business is great. Our profit, great.

- We are seeing a pronounced slowdown in owners going forward with

new projects. There is too much uncertainty in the economy and

globally.

Food manufacturing

- Reduction in government grants, cash flow issues with customers

and the uncertainty created by the lack of border controls [are issues

affecting our business]. - Food service demand is soft. Retail (grocery) demand has remained

steady. Our premium pet food business has fallen off significantly. - We have experienced a small reduction in our workforce over the

last several weeks as we have shifted our strategy with our maintenance

team. This reduction in workforce has not impacted our volume or sales.

We expect mild growth next year.

Machinery manufacturing

- Business has slowed down significantly; we see no signs of improvement in business activity.

- Six months from now is actually quite scary. The economy is

uncertain, and customers cannot predict with any certainty what they

see. Political pressure and the wars are now forcing customers to

reevaluate their business activities and reduce their outlook. It’s

very uncertain. - Oh, how we long for the days of a stable market. We just lost

another long-time customer to China where the pricing for the finished

product was what we pay for the raw material. With the inflation we

have being imposed on us here in the U.S., we won’t ever see those

customers come back. - We are off by 20 percent this year so far. I don’t expect it to

get better. Prices of goods are going up. Shipping is going up.

Miscellaneous manufacturing

- The continuing UAW [United Auto Workers] strike is beginning to decrease our sales.

- In a consumer business, we are hearing a lot more “I can’t afford this” than we ever have before.

Paper manufacturing

- Activity is definitely slowing down. We remain optimistic at this point for a turnaround, but cautiously.

Primary metal manufacturing

- The economy is slowing.

- Our industry continues to be severely damaged by foreign

countries dumping product into the U.S. and our territories. That,

coupled with overall business being down, has caused a loss of jobs and

capital dollars going back into our industry. - We anticipate that business conditions will remain constant or

decline over the next three to four months, based on the rate that we

are receiving orders. Oil and gas orders have been weak all year, which

is strange since oil prices have been high and are anticipated to

continue to increase with the uncertainty in the world order.

Printing and related support activities

- We are starting to get slow and have seen this coming for a

while. Quote levels are way down, which is a bad indicator of what’s to

come. We did, however, get a large reorder on a job we have done many

times over the years, which will buffer the slowness for a while. I

believe we are trending into a softer economy that is going to have

repercussions for our industry for a while.

Textile product mills

- Order and sales volume have slightly increased month over month

from September. We have seen longer delivery times and lead/wait times

at the Los Angeles port, causing slight delays with inventory

shipments. Overall uncertainty as to demand is high. The general

consensus among other manufacturers/sellers is that demand/sales are

weak, and no one is sure what the short-term future holds.

Transportation equipment manufacturing

- We are currently forecasting a 20 percent drop in 2024 versus

2023 (previously planned for a 13 percent drop), so the market forecast

has worsened month over month. - The lack of petroleum-based energy policy is troublesome.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0