USD/CAD ANLAYSIS & TALKING POINTS

- Quiet trading anticipated today.

- US CPI under the spotlight tomorrow.

- USD/CAD negative divergence progresses.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

CANADIAN DOLLAR FUNDAMENTAL BACKDROP

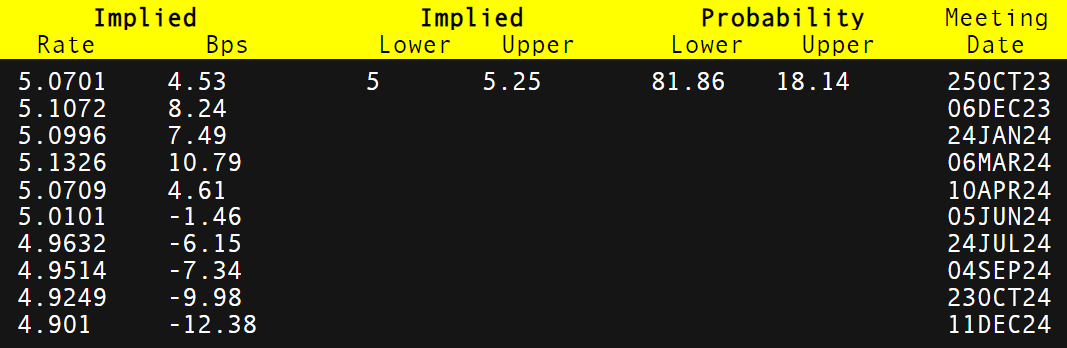

The Canadian dollar has managed to maintain strength against the USD in a week with little Canadian specific economic data. Last week’s Bank of Canada (BoC) rate announcement saw Governor Macklem leave the door open to additional hikes should incoming data necessitate. Subsequently, the local balance of trade and labor reports outlined the economies resilience and sustained upside pressures on inflation from an average earnings lens. Higher crude oil prices are also favorable for the CAD while supplementing the inflation narrative that could prompt the aforementioned hike early next year. This is reflected in BoC interest rate expectations (refer to table below) which have been ‘hawkishly’ re-priced to suggest a 10bps peak from 5bps just last week.

BANK OF CANADA INTEREST RATE PROBABILITIES

Source: Refinitiv

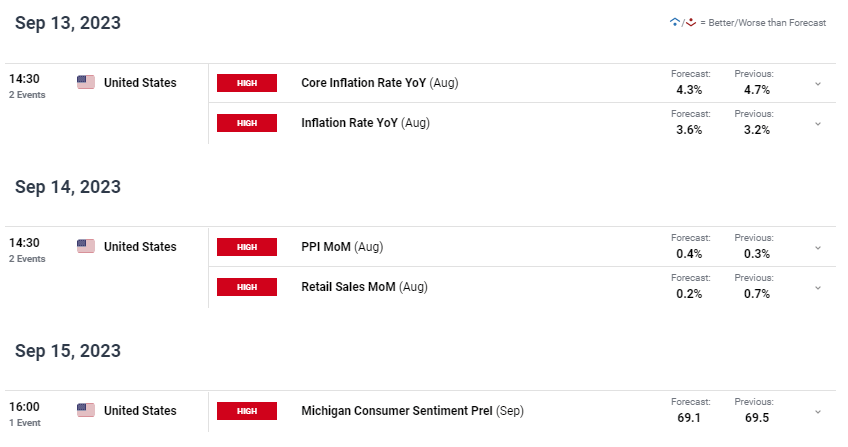

Considering the trading day is relatively light, focus will shift to the rest of the week (see economic calendar below) covering key US data. US CPI tomorrow could set the tone to Friday’s close with many analysts hinting at a potential upside surprise on the core print.

USD/CAD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

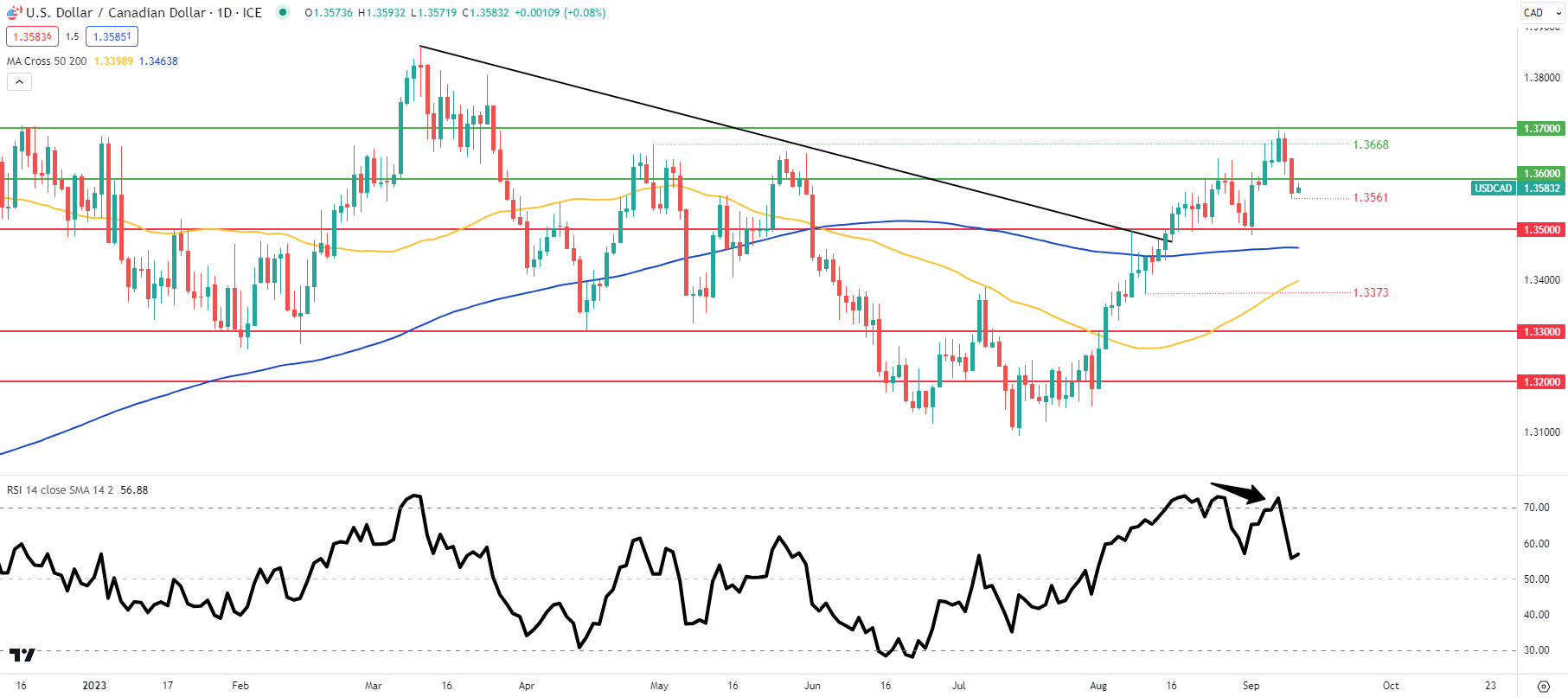

TECHNICAL ANALYSIS

USD/CAD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily USD/CAD price action shows bearish/negative divergence developing as the pair holds below the 1.3600 psychological handle. That being said, a strong US CPI release could provide bulls with another run up above this zone while a weaker inflation report could bring 1.3500 back into consideration.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently SHORT on USD/CAD , with 62% of traders currently holding short positions (as of this writing). Download the latest sentiment guide (below) to see how daily and weekly positional changes affect USD/CAD sentiment and outlook!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0