Could the Fed Trigger a Deeper Retreat in Bitcoin & Ethereum? BTC/USD & ETH/USD Price Action

[ad_1] Bitcoin, BTC/USD, Ethereum, ETH/USD – Outlook: The upward pressure in Bitcoin appears to be fading in the very short term. ETH/USD continues to hold above a crucial support. What is the outlook and what are the key levels to watch in BTC/USD and ETH/USD? Recommended by Manish Jaradi Get Your Free Introduction To Cryptocurrency

[ad_1]

Bitcoin, BTC/USD, Ethereum, ETH/USD – Outlook:

- The upward pressure in Bitcoin appears to be fading in the very short term.

- ETH/USD continues to hold above a crucial support.

- What is the outlook and what are the key levels to watch in BTC/USD and ETH/USD?

Recommended by Manish Jaradi

Get Your Free Introduction To Cryptocurrency Trading

This week’s drop makes Bitcoin and Ethereum vulnerable to any hawkish tone from the FOMC meeting later Wednesday.

The Fed is widely expected to hike interest rates by 25 basis points at the end of the two-day FOMC meeting later today given inflation remains well above the central bank’s target – rate futures are pricing in near certainty of the move, according to the CME FedWatch tool. However, the Fed statement and Powell’s comments will be key.

A hawkish tone could boost US Treasury yields and the US dollar, weighing on Bitcoin and Ethereum, while a wait-and-watch or a dovish hike could bring cheer to USD bears. For more discussion on the potential Fed and USD scenarios, see “US Dollar Scenarios Ahead of Fed Rate Decision: EUR/USD, GBP/USD, USD/JPY Price Setups,” published July 26.

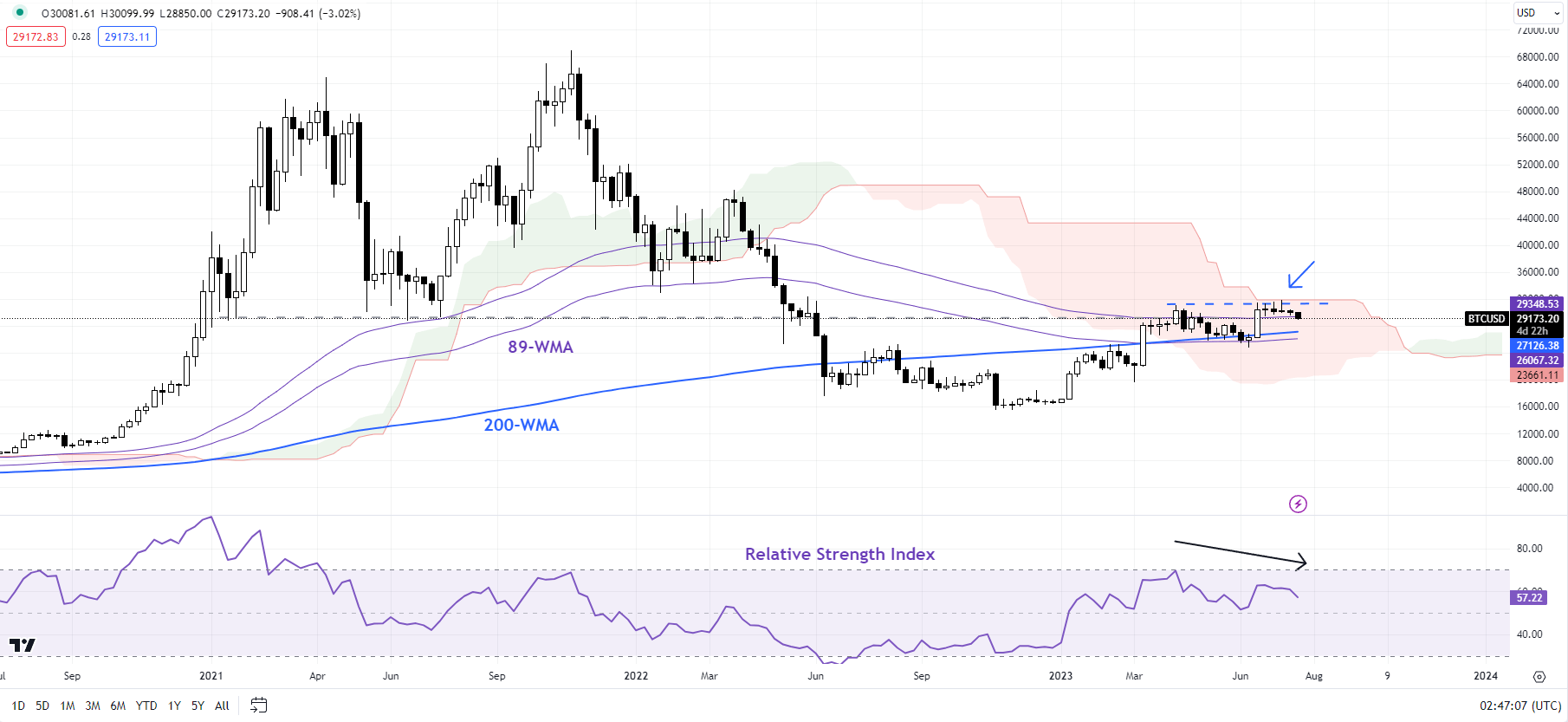

BTC/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

BITCOIN: Still looking for the bullish break

BTC/USD has struggled to break past a key converged barrier at the April high of around 31000, coinciding with the 89-week moving average and the upper edge of the Ichimoku cloud on the weekly chart. The back-to-back small body candles in recent weeks are a sign of indecision, given the significance of the resistance. A break above the barrier would be a strong signal that the medium-term bearish pressure is fading. Such a move could open the door toward 40000.

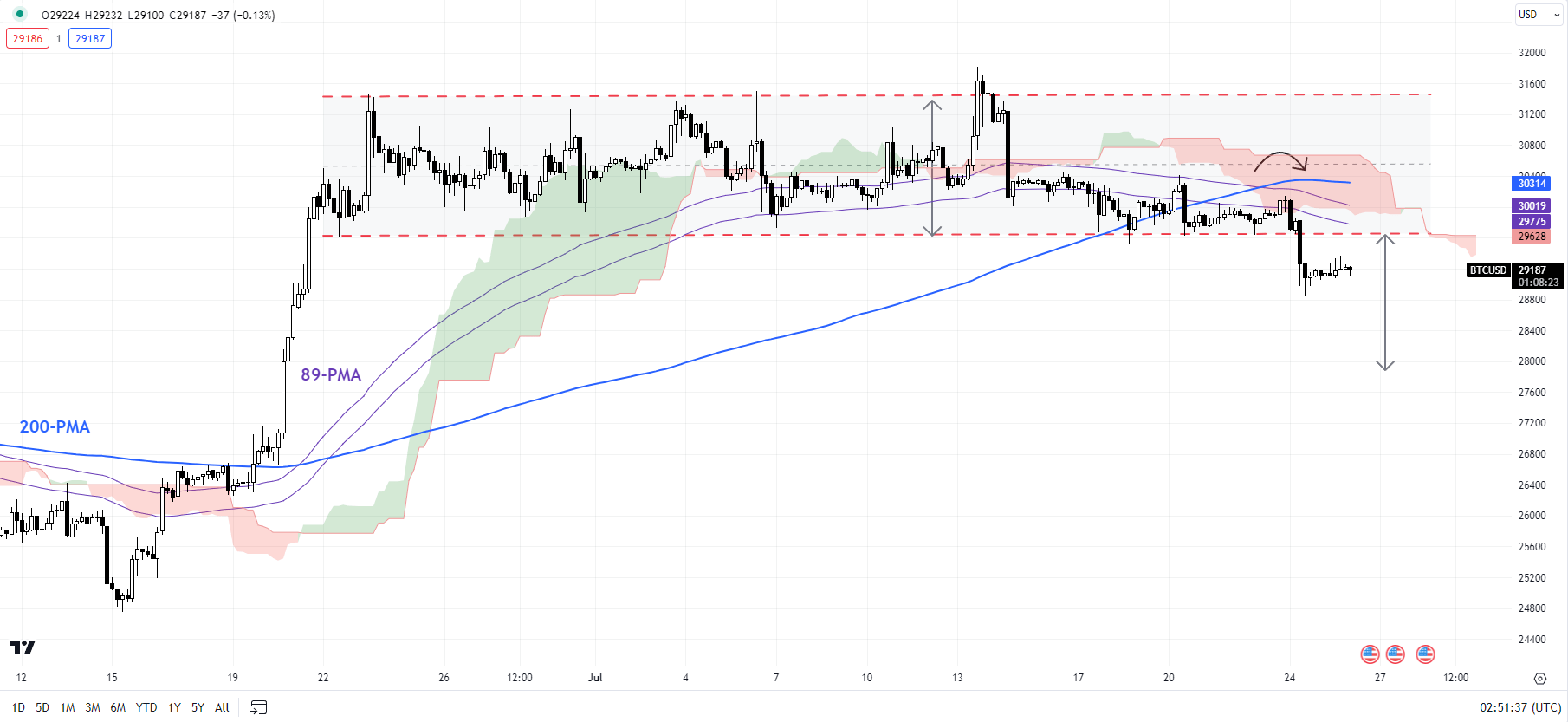

BTC/USD 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

Having said that, near-term technical charts suggest BTC/USD may have to wait a bit longer for the bullish move to ensue. On the 240-minute charts, BTC/USD has fallen below the 200-period moving average, and key support on the lower edge of a sideway channel since late June, potentially opening the door toward 28000 in the near term. Still, for the broader upward pressure to dissipate, BTC/USD needs to fall below the crucial floor at the June low of 24750.

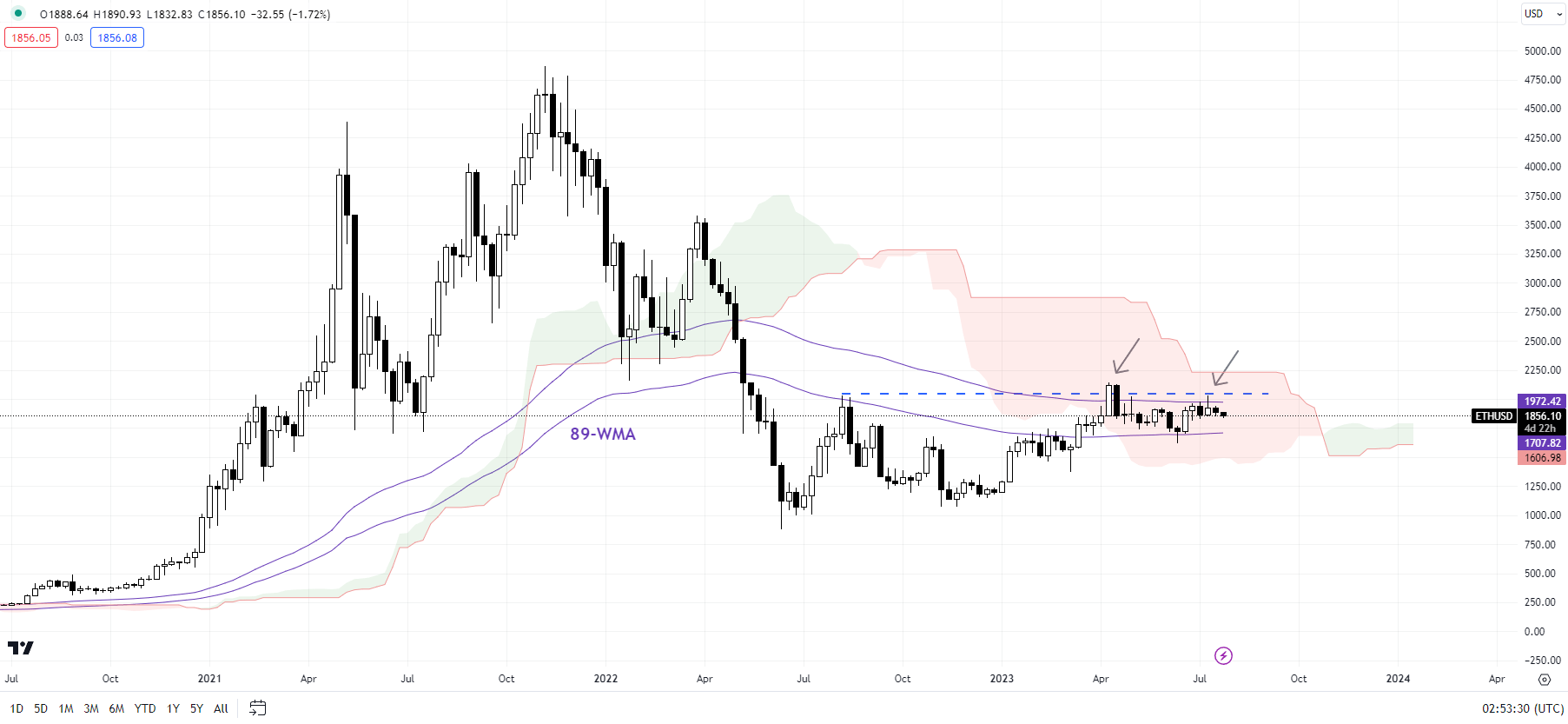

ETH/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView; Refer to notes at the bottom

ETHEREUM: Holding the above key support

Follow-through gains have been lacking after ETH/USD in April rose above the August high of 2030. However, it hasn’t broken any significant support either to suggest the rebound from the end of 2022 is over. In this regard, the June low of 1620 is crucial support – ETH/USD needs to hold above this support for the broader upward trajectory to remain intact.

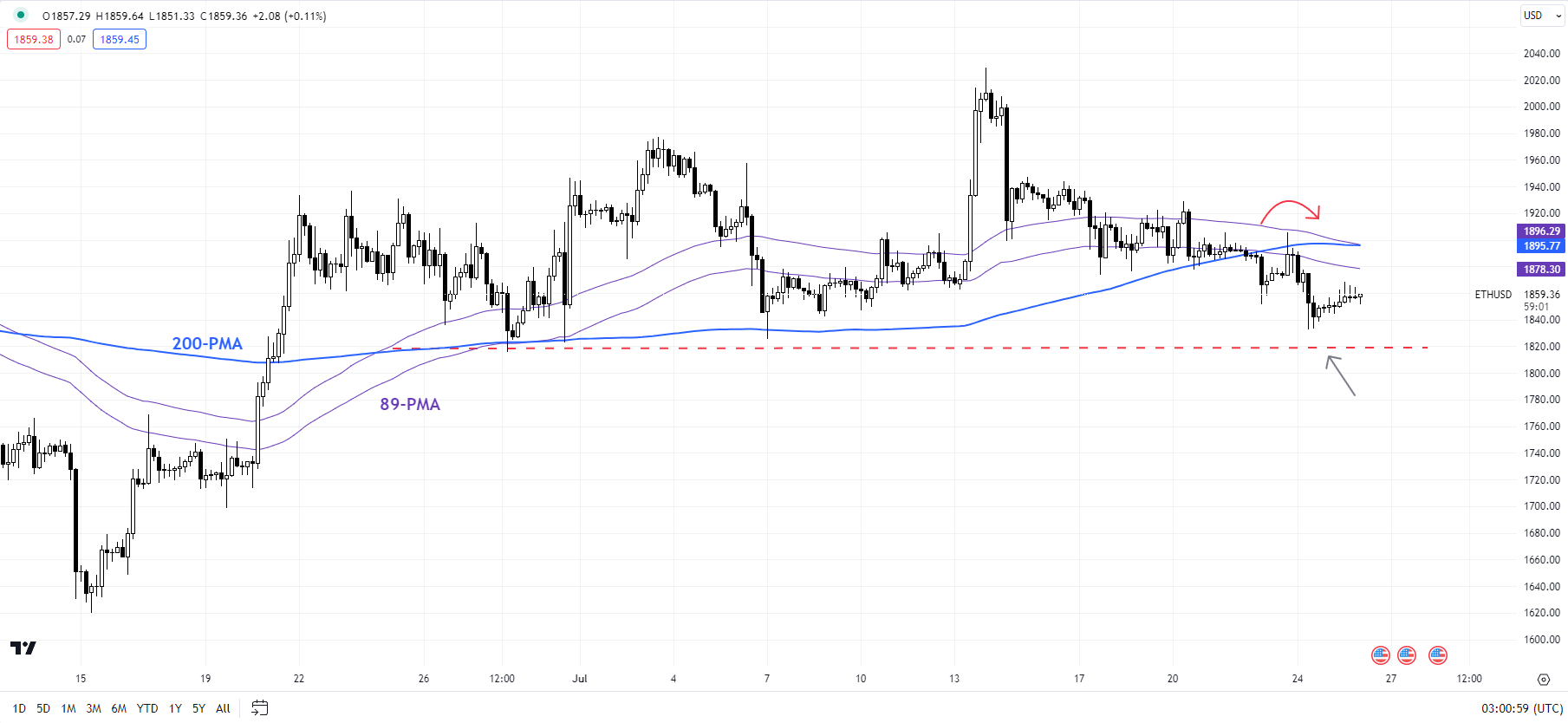

ETH/USD 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

In the near term, though, ETH/USD has a tough cushion on a horizontal trendline from late June at about 1815. Any break below would temporarily halt the bullish pressure, opening the door toward 1765 initially, potentially 1620.

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0