Copper Trading Tips and Strategies

[ad_1] Copper Trading: Copper Trading Tips and Strategies Copper is a highly tradeable commodity. Copper is priced in US Dollars; so the price of the dollar affects the price of copper. Copper is gaining more traction as an investment option along with various other alternatives. As looked at in our primer for copper, copper prices

[ad_1]

Copper Trading: Copper Trading Tips and Strategies

- Copper is a highly tradeable commodity.

- Copper is priced in US Dollars; so the price of the dollar affects the price of copper.

- Copper is gaining more traction as an investment option along with various other alternatives.

- As looked at in our primer for copper, copper prices tend to do well when emerging markets are growing as demand derives from building and construction.

- Trading strategies for copper can include both technical and fundamental analysis.

Copper is a global commodity that has several key uses throughout industry and is highly correlated to economic growth. Copper trading is often used by hedgers and speculators as protection or exploitation of future price movements. Both individuals and institutions are able to gain exposure to copper and copper trading, making this metal popular choice within the commodity trading spectrum.

Why Trade Copper and How Does Copper Trading Work?

One advantage of copper trading is accessibility. Copper is traded through a variety of avenues like futures, options, equities and CFDs. You can also gain exposure to copper via copper ETFs (exchange traded funds) like CPER (United States Copper Index Fund) or JJCB (iPath Series B Bloomberg Copper Subindex Total Return ETN).

Copper is a soft malleable metal with properties like gold and silver. It derives most of its demand from building construction, transportation equipment and electronic products. It is a strong conductor of electricity and heat, and therefore has a wide range of industrial uses which also leads it to trade in high volumes – a good thing for traders because it can lead to reduced spreads and potentially cleaner chart patterns.

Movements in the price of copper are heavily dependent on demand from emerging market economies like China and India. During times of economic growth, these nations demand large quantities of copper, the demand of which helps to increase the metal’s price. Alternatively, during economic downturns demand for copper drops, price tends to fall as well. Traders should be aware of this dynamic when trading copper.

Many copper traders use technical and/or fundamental analysis to inform their trading strategy which helps a trader forecast whether the price of copper will rise or fall. Once a trader is confident in their forecast, he/she can buy or sell copper in an attempt to profit from price movements. In this way, a trading strategy can also help a trader to manage their risk, identify buy and sell signals in the market and set reasonable take-profit and stop-loss levels with aim of positive risk to reward ratios.

View current price movements of copper using our chart

Copper Trading Hours

Copper trades on the CME Globex and CME ClearPort:

Sunday – Friday 6:00 p.m. – 5:00 p.m. (5:00 p.m. – 4:00 p.m. Chicago Time/CT) with a 60-minute break each day beginning at 5:00 p.m. (4:00 p.m. CT)

What Factors Affect the Price of Copper?

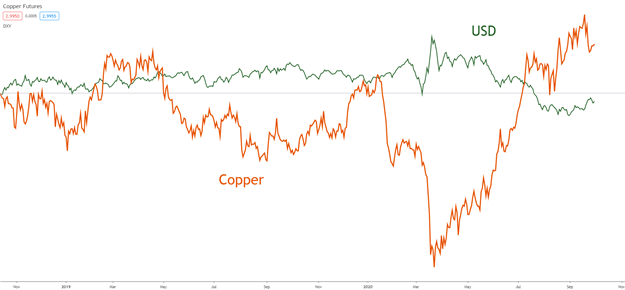

US Dollar

Like many other metals, copper is inversely correlated (see chart below) to the US Dollar which means that when the US Dollar depreciates, copper prices generally rise and vice versa. It is important to note that this relationship is not one-to-one (delta 1) but does carry a high degree of correlation.

The reason why the US Dollar is an influencing factor on copper is because copper is priced in USD. For example, when the Dollar falls, a buyer will have to pay fewer of his/her domestic currency to purchase a specified amount of copper. Therefore, the commodity (copper) becomes cheaper to buy. This tends to cause an increase in demand and ultimately a rise in the price of copper.

Recommended by Warren Venketas

Building Confidence in Trading

Copper and USD chart inverse correlation representation:

Chart prepared by Warren Venketas, TradingView

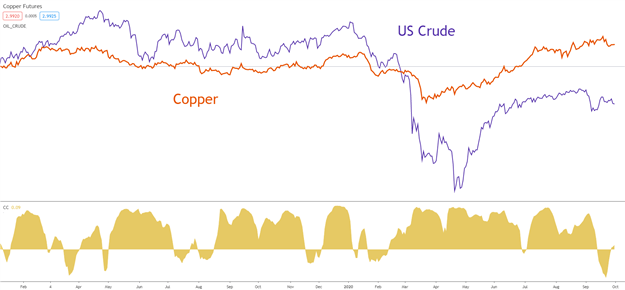

Oil

The refining of copper involves melting down the metal to remove impurities. This process is extremely energy exhaustive and accounts for a large portion of overall cost. Oil prices tend follow a similar trajectory to copper (see chart below). This being said, oil prices are affected by many of the same factors as copper which could support the traditional positive relationship. Regardless of specifics it is clearly noticeable that a relationship exists between both copper and oil, which could provide valuable insight into the copper market. Renewable energy sources are growing in popularity which could interrupt the historical price dynamic between copper and oil.

Recommended by Warren Venketas

Understanding the Core Fundamentals of Oil Trading

Chart prepared by Warren Venketas, TradingView

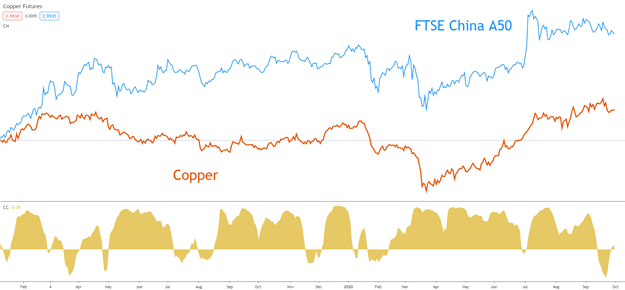

Copper as a Barometer for Global Growth

Copper is often linked to industrial growth and therefore overall economic growth. Infrastructure, manufacturing and construction now play a huge role in economic expansion which heavily relies on copper. Consumption (demand) for copper tends to reflect in the price of copper as an increase in demand is generally followed by an increase in copper price and vice versa. Copper is broadly regarding as the king amongst base metals as it is the most widely used metal in growing both emerging market and established economies.

The general economics of supply and demand are observed which can be used as a rule of thumb when trading copper:

- Increase in supply ↔ Lesser demand

- Decrease in supply ↔ Higher demand

A major influence on the demand/supply of copper comes via China. China is the single biggest buyer of copper in the world. Although China has mines of its own, Chinese demand requires additional supply which is sourced from other major copper producing countries. This is why the Chinese economy is such an important factor to consider when trading copper. If China continues on its growth trajectory, one can expect sustained demand for copper (see chart below). It is important to note that China is determined on being self-sufficient in the long-term which could disrupt future supply/demand dynamics.

Copper and FTSE China A50 chart positive correlation representation:

Chart prepared by Warren Venketas, TradingView

Copper supply and production costs

Copper mining is primarily focused within South America which can have a large bearing on the price of copper. Shortage of supply, quality of copper and the variations in production costs can all have resultant impacts on price. This leads on to country specific risk which can affect supply due to political instability or work related issues.

In mid 2018, Chilean (worlds largest copper producer) copper workers declared they would strike unless their increased wage demands were met. This significantly manipulated copper prices as the threat of a supply shortage may ensue, causing a surge to multi-year highs at the time (see chart below).

Copper price reaction to Chilean copper strike:

Chart prepared by Warren Venketas, TradingView

Copper as an Investment

Copper has historically been regarded as a commodity without many investment benefits. The majority of copper trading was executed as a hedge against future price fluctuations to lock in a specific price. This has changed over the past few decades as speculative traders have increased their impact on copper prices. Large institutions and hedge funds have increased their stake in copper as an investment which is highly correlated to economic growth. For example, a fund manager bullish on economic growth may also be bullish on copper. There may be some cyclicality to this, and could be a good diversification tool away from traditional alternatives.

Trading Copper: Strategies

Copper’s versatility and dependency on various fundamental factors create a diverse combination in terms of trading strategies. Trading strategies can be purely technical, fundamental or a combination of both. Understanding how the technical and fundamental components work both individually and in unison with one another can lead to a comprehensive copper trading strategy.

Technical Strategy example:

The example below incorporates several technical analysis techniques to derive a trading decision. It is important to note that this is only one of various approaches that can be implemented into a technical strategy.

To learn more on alternative technical trading strategies, visit our DailyFX education center!

Chart prepared by Warren Venketas, IG

The weekly copper chart above uses price action, support and resistance and a technical indicator to determine a possible setup in copper. The Fibonacci retracement drawing is taken from the January 2016 low to the June 2018 high. This drawing has resulted in several support and resistance zones. It is clear that several of these zones are areas of confluence to which price adheres/respects.

The $1.93 per pound low (black) was a significant level of support as price approached in March 2020. From a technical perspective, as price moved toward the 2016 low the inclination would be to buy if price did not break through the $1.93 support zone.

The Relative Strength Index (RSI) supported this rationale with an oversold signal below the 30 level (blue). Combining these two simple techniques gave a stronger motivation for a long position. In this case, a long trade would have been successful as price reversed into the current medium-term upward trend.

Fundamental Strategy example:

Chart prepared by Warren Venketas, IG

Becoming familiar with the fundamental levers involved in copper trading will allow for appropriate trading strategies to follow. The daily chart above shows the impact of the global COVID-19 pandemic and its influence on copper.

Reverting back to the factors affecting copper, it is well-known that copper is highly correlated (positive) with economic growth. Therefore, a disruption in economic growth should in theory, disrupt supply and demand subtleties. With the global pandemic ensuing at the start of 2020, it is sensible to forecast a slump in economic growth as the virus spreads around the globe.

Recommended by Warren Venketas

Introduction to Forex News Trading

As expected, a decline in economic growth was realized with copper following suit. From January 2020 to mid March 2020, copper prices fell roughly 30% due to the COVID-19 pandemic. This is one such scenario whereby understanding the dynamics of fundamentals in copper trading can result in prudent decision-making.

Fundamental and Technical Strategy example:

Utilizing both fundamental and technical analysis in a trading strategy requires more time but this extra effort may produce a superior model as it will include more input data. At the beginning of 2019 copper prices were trading at a one and a half year low due to trade tensions between the US and China along with a decrease in import volume by the Chinese. However, as trade tensions fizzled out with support from a weaker US Dollar copper prices appreciated over the next few months.

Chart prepared by Warren Venketas, IG

Managing these complexities from a trading perspective may start with a basic technical set up beginning with a simple Fibonacci retracement. The Fibonacci drawing above was taken from the January 2016 low to the June 2018 high as used in the prior technical example. Using the Fibonacci alone reveals that the 50% $2.62 per pound zone is a key area of support at the start of January. At this point, there is no directional bias as fluctuates around this support zone.

This is where fundamental factors play an integral role in trading copper. Market participants who follow macroeconomic events such as the US-China trade talks would be aware of decreased volatility and intensity around the topic as it slowly dissolved. With this knowledge supplemented by a dwindling USD, the likelihood of copper prices rising in the near term would gain more traction. With prices respective of the 50% $2.62 per pound Fibonacci level, and the bullish macroeconomic environment, a copper trader may look to enter into a long position from this support zone in anticipation of an upward price move.

Stop losses could have been placed at the recent swing low around the $2.54 – $2.56 support zone (black) for more risk seeking traders or the 50% $2.62 level for more risk averse traders. Risk management is key to any strategy and should be practiced consistently and appropriately to ensure sensible trading.

The next level of resistance would have been the 38.2% $2.79 per pound Fibonacci level whereby traders may look to exit long positions and look for possible reversals or an extension of the already strong bullish move. In this case, the Moving Average (MA) indicator was useful as the 50-day MA (red) crossed above the 100-day MA (black) which is suggestive of a bullish price movement. This crossover appeared in mid January 2019 and with sustained supportive macroeconomic conditions, copper prices extended further. Additional data inputs such as the bullish MA crossover can give traders the information required to select a focused trade.

How to Trade Copper: Summary

Copper has progressed into a well diversified metal and can now been seen as an investment possibility. Perceptive interpretation of copper technicals and fundamentals can place market participants in favorable positions to exploit price movement. These wide ranging influences on copper can prove difficult to navigate through but greater exposure and awareness should allow for more clarity.

Resources to Help you Trade Copper

Beginner and advanced traders alike can benefit from the many resources DailyFX provides to inform trading strategies and improve confidence when trading commodities, such as Copper:

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Copper ، Strategies ، Tips ، Trading

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0