AUD/USD ANALYSIS & TALKING POINTS

- Encouraging news from China back AUD.

- US data in focus later today.

- AUD/USD faces trendline resistance.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

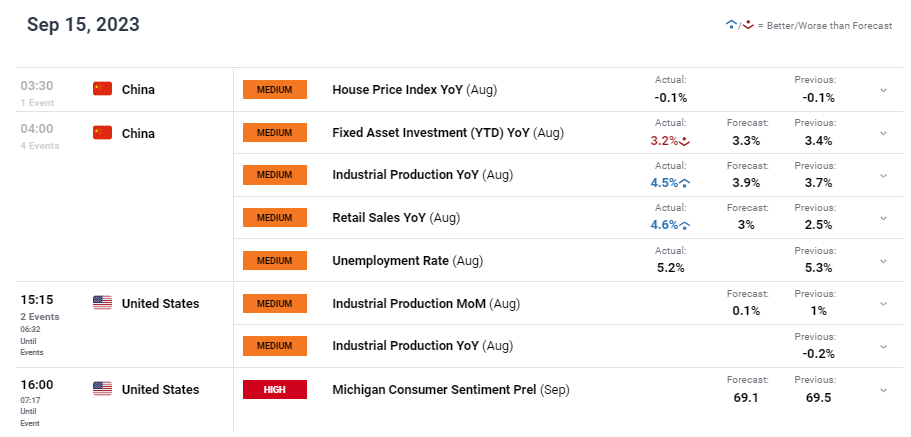

The Australian dollar is tentatively pushing higher this morning after being depressed for some time. Chinese economic data (see economic calendar below) bolstered the ‘pro-growth’ currency as industrial production and retail sales surprised to the upside. A welcome statistic for Chinese officials considering recent data has suggested weak economic growth leaving closely linked currencies like the AUD weakened.

Although the US dollar is trading marginally lower today, yesterday’s robust US data should reinforce the ‘higher for longer’ message. Today’s industrial production and Michigan consumer sentiment are expected to soften that could allow for the AUD to hold on to its gains heading into next week. Some key risk events to look out for next week include RBA meeting minutes, US building permits report, Fed interest rate decision and Australian PMI’s.

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

On a side note, RBA Governor Philip Lowe handed over the reigns to his Deputy Michele Bullock who will commence the role of Governor next week Monday. This had little impact on the currency showing markets confidence in the new RBA leader.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

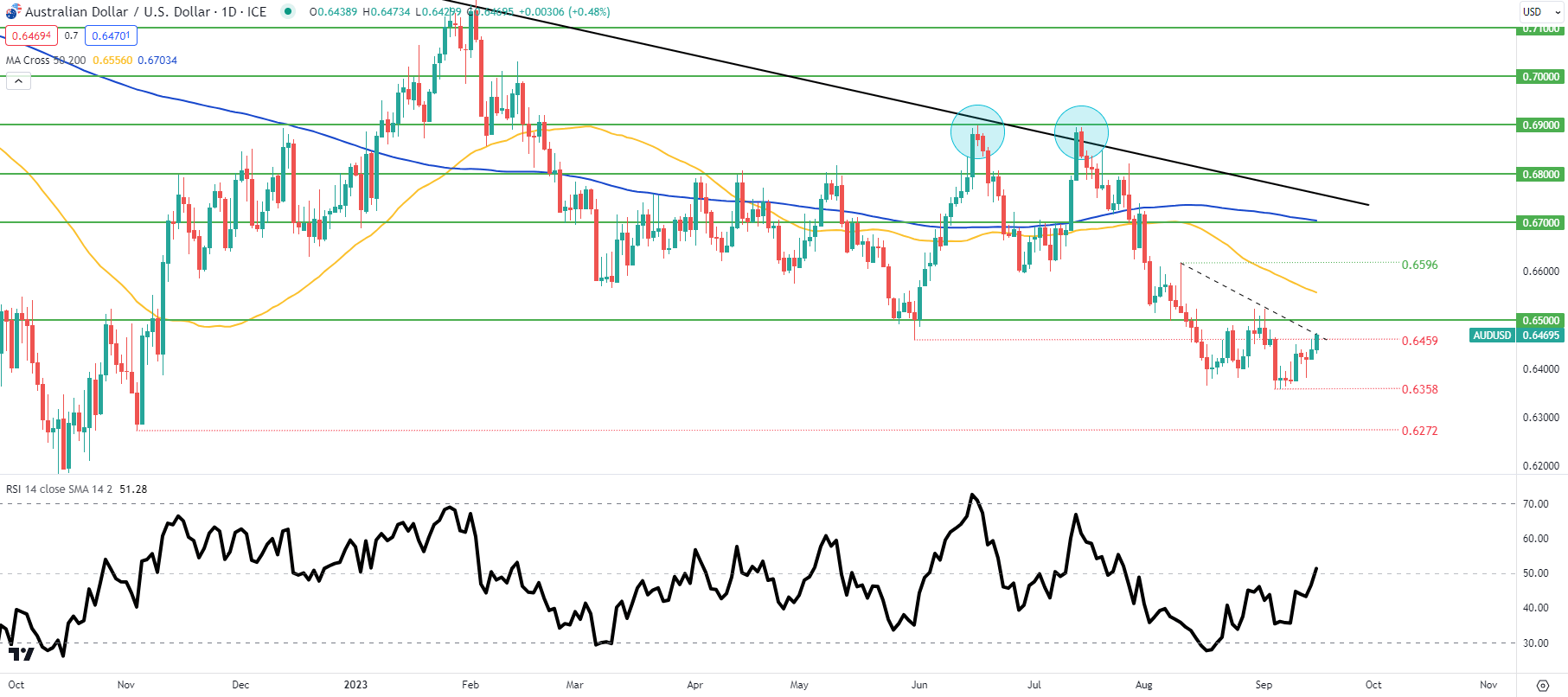

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

Daily AUD/USD price action looks to test the short-term trendline resistance (dashed black line) that coincides with the 0.6459 swing level. A confirmed break above this zone could see a retest of the 0.6500 psychological handle but the pair remains firmly within a bearish trend. Next week’s Fed rate announcement could provide the catalyst to short-term directional bias; whereby a hawkish slant may keep the pair subdued and vice versa.

Key resistance levels:

- 50-day moving average (yellow)

- 0.6500

- Trendline resistance

Key support levels:

IG CLIENT SENTIMENT DATA: BULLISH (AUD/USD)

IGCS shows retail traders are currently net LONG on AUD/USD, with 74% of traders currently holding long positions. Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0