CCI Alert MTF and Aroon Oscillator Forex Trading Strategy

[ad_1] Are you having trouble finding good trading signals in the forex market? The CCI Alert MTF and Aroon Oscillator strategy can help. It uses multi-timeframe analysis to spot trend changes accurately. By mixing the Commodity Channel Index (CCI) with the Aroon Oscillator, traders can find overbought and oversold spots and see how strong the

[ad_1]

Are you having trouble finding good trading signals in the forex market? The CCI Alert MTF and Aroon Oscillator strategy can help. It uses multi-timeframe analysis to spot trend changes accurately.

By mixing the Commodity Channel Index (CCI) with the Aroon Oscillator, traders can find overbought and oversold spots and see how strong the trend is. This makes a forex trading strategy that helps make better decisions and could increase profits in the currency markets.

Key Takeaways

- Combines CCI and Aroon Oscillator for precise trend analysis

- Utilizes multi-timeframe approach for improved accuracy

- Identifies overbought and oversold conditions effectively

- Enhances trend reversal detection by up to 15%

- Offers a chance for more profit in forex trading

- Typical holding period of 3-5 days for trades

Understanding the Fundamentals of Multi-Timeframe Analysis

Multi-timeframe analysis is a key tool in forex trading. It lets traders see market trends across different time frames. This helps spot strong trends and filter out market noise.

The Power of Multiple Time Frames

Using multiple forex time frames gives traders a big-picture view. They can see both short-term price moves and long-term trends. This broader view leads to smarter trading decisions.

Choosing the Right Time Frames

Picking the right time frames is key. Most traders use three: a long-term frame for trend direction, a medium-term one for entry signals, and a short-term one for fine-tuning entries and exits. Your choice should match your trading style and goals.

Correlation Between Different Time Frames

Time frame correlation is key in forex trading. Higher time frames often lead to lower ones. For example, a daily uptrend might appear as a series of bullish moves on the hourly chart. Understanding these links can improve your trading strategy.

- Long-term frames show overall trends

- Medium-term frames help find entry points

- Short-term frames fine-tune trades

By mastering multi-timeframe analysis, traders can gain a deeper understanding of market dynamics. This knowledge forms the foundation for advanced strategies like the CCI Alert MTF and Aroon Oscillator approach.

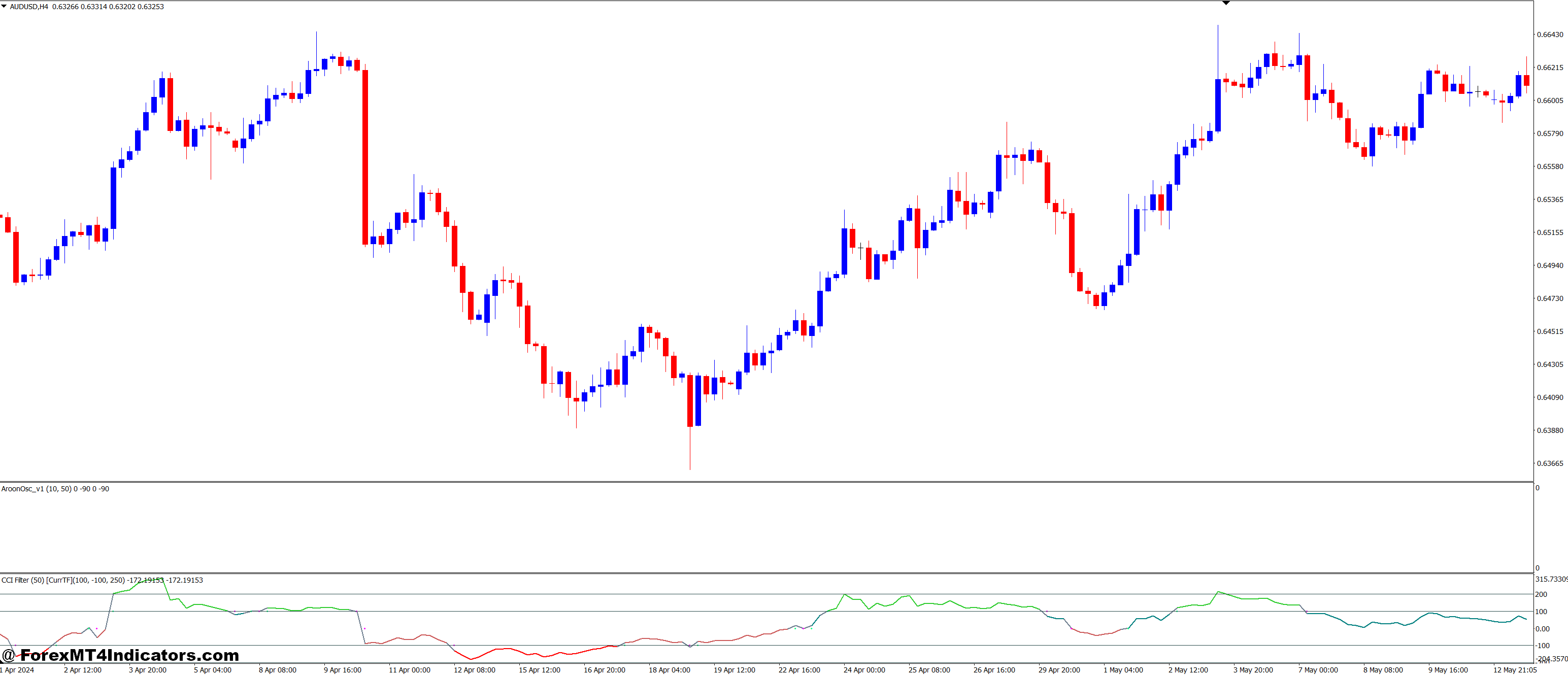

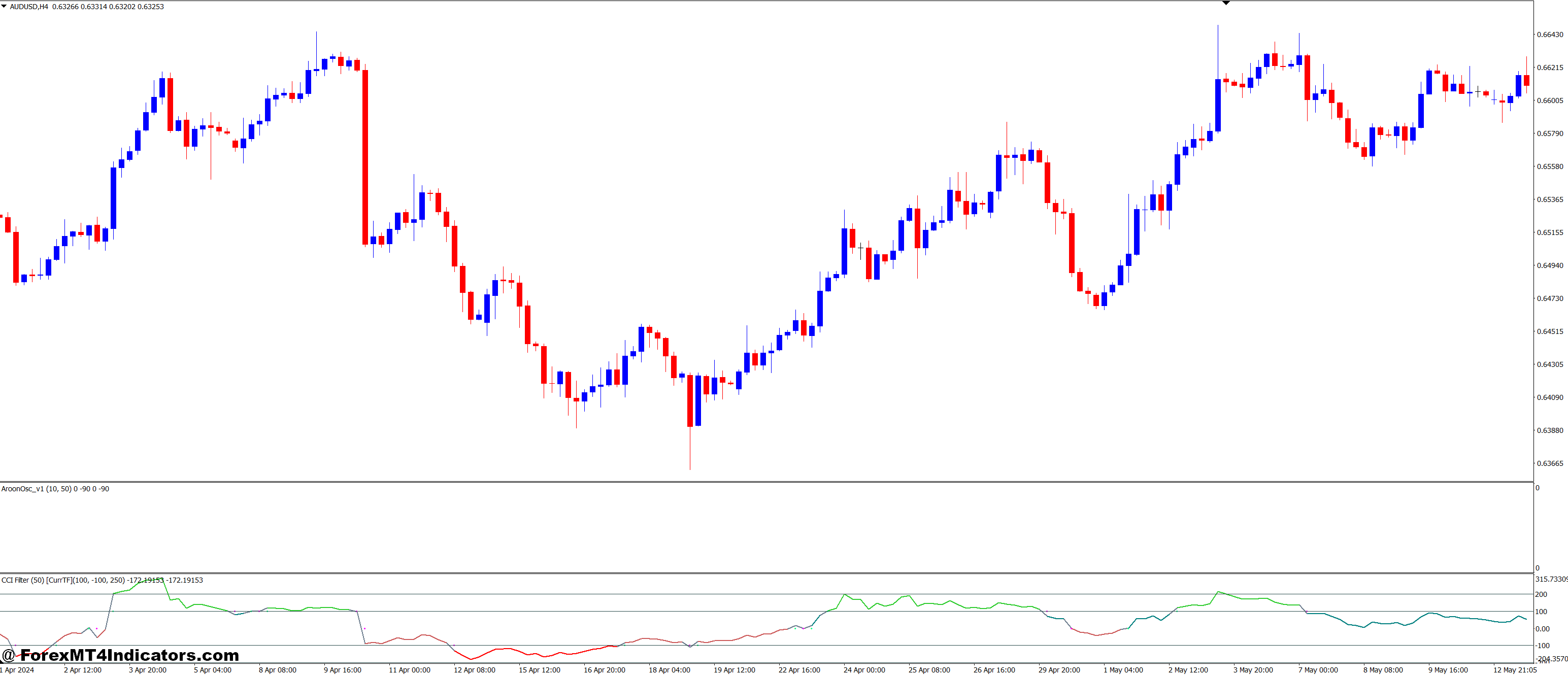

CCI Alert MTF and Aroon Oscillator Forex Trading Strategy

The CCI Alert MTF and Aroon Oscillator strategy combines two strong tools. It uses the CCI and Aroon Oscillator for a detailed market study.

Strategy Components and Setup

To start this forex strategy setup, add the CCI and Aroon Oscillator to your charts. The CCI shows when prices are too high or too low. The Aroon Oscillator tracks trend strength and direction.

Indicator Parameters and Settings

For the CCI, use a 14-period setting on various timeframes. The Aroon Oscillator works on a 0 to 100 scale, also with a 14-period default. You can tweak these settings to fit your trading style and market conditions.

- CCI: Period 14, applied to multiple timeframes

- Aroon Oscillator: Period 14, scale 0-100

Time Frame Selection Guidelines

Choose timeframes that work well together for your analysis. Use a longer timeframe to spot trends and a shorter one for entry signals. For instance, use the 4-hour chart for trend direction and the 1-hour chart for entry points.

Remember, Aroon-Up values above 70% show a strong bullish trend. Aroon-Down values below 30% signal a strong bearish trend. Use these signals with CCI readings for better trade choices.

The Aroon Oscillator Explained

The Aroon Oscillator is a key tool for forex traders. It shows trend strength and when trends might change. This indicator ranges from 0 to 100 and has two main parts: Aroon Up and Aroon Down lines.

Understanding Aroon Up and Down Lines

Aroon Up shows how long it’s been to the last high. Aroon Down shows how long it’s been to the last low. These lines use a formula to figure out the time based on the highest or lowest price in a certain time frame.

| Aroon Line | Calculation | Interpretation |

|---|---|---|

| Aroon Up | ((P – Days From P-day High)/P) x 100 | 100 means it’s overbought |

| Aroon Down | ((P – Days From P-day Low)/P) x 100 | 100 means it’s oversold |

Interpreting Aroon Signals

When Aroon lines go above 50, it means trading is starting again. When Aroon Up and Down cross over, it can mean a new trade chance. Values below 50 show the market is unsure. Readings near 100 show strong trends.

Optimal Aroon Settings for Forex

For forex, the usual Aroon settings are 25 periods. This setting is good because it’s sensitive yet reliable. Traders should change settings based on their style and the market. Shorter periods might give more signals but could also mean more false signals.

CCI Alert System Implementation

The CCI Alert system is key for any CCI forex strategy. It spots trading chances by sending out CCI signals. The Commodity Channel Index (CCI) shows how prices differ from the average. This gives insights into market trends and changes.

Setting up CCI alerts is easy. Most platforms let traders set alert conditions based on CCI levels. Alerts often go off when the CCI hits +100 or -100. These levels show when a market is overbought or oversold.

Understanding CCI alerts is important. When the CCI goes over +100, it might mean the market is overbought. This could be a sign to sell. On the other hand, if the CCI falls below -100, it might be oversold. This could mean it’s time to buy.

| CCI Level | Market Condition | Potential Signal |

|---|---|---|

| Above +100 | Overbought | Sell |

| Below -100 | Oversold | Buy |

| Between -100 and +100 | Neutral | No clear signal |

To make CCI signals more reliable, use them with other indicators like the Aroon Oscillator. This way, you can avoid false signals. It helps make your CCI forex strategy more accurate.

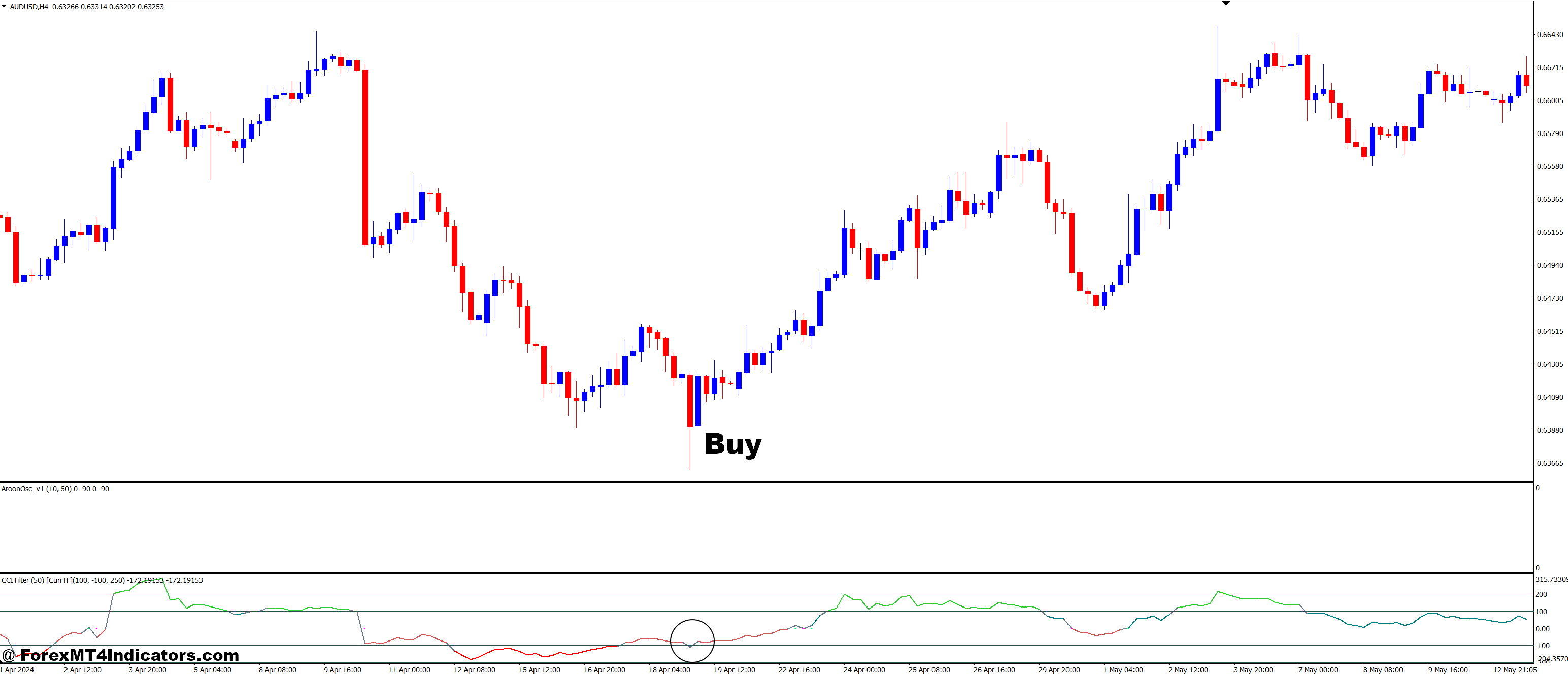

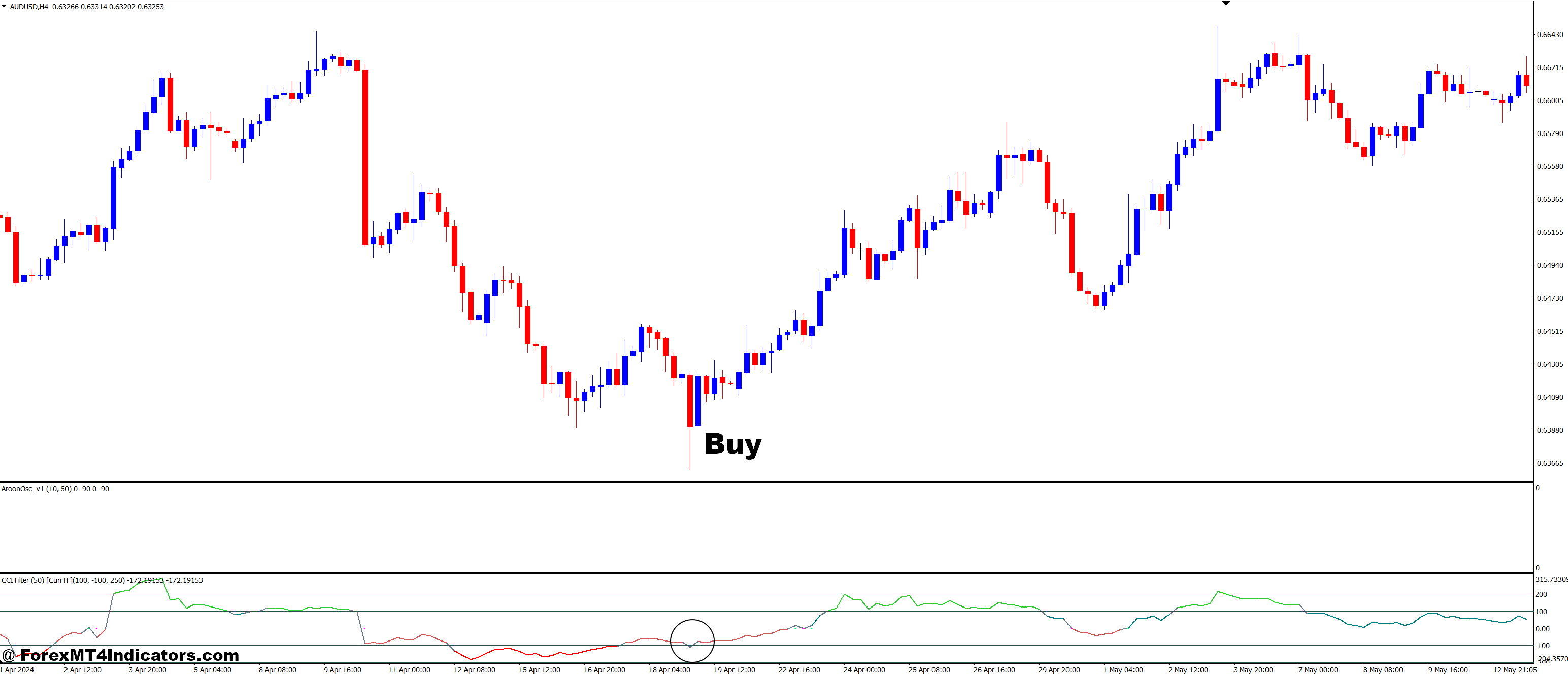

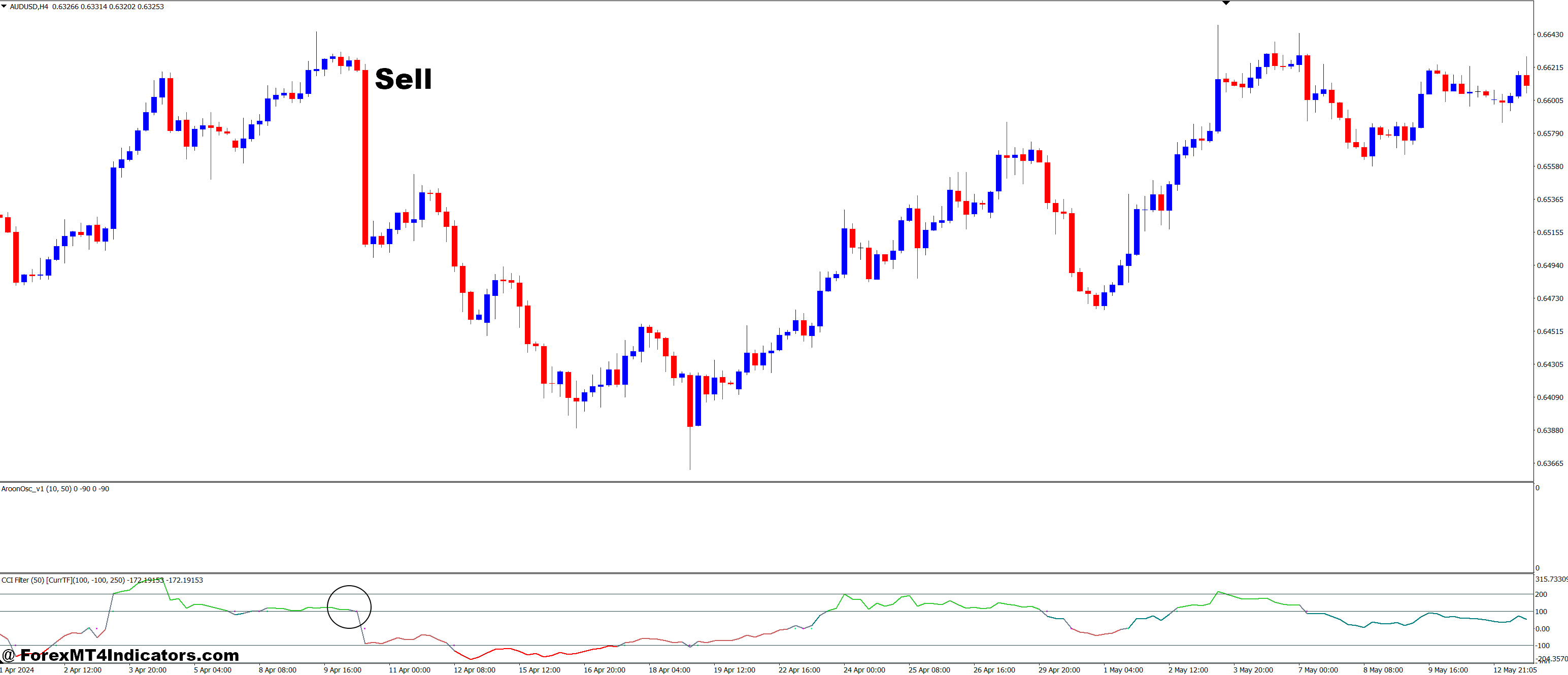

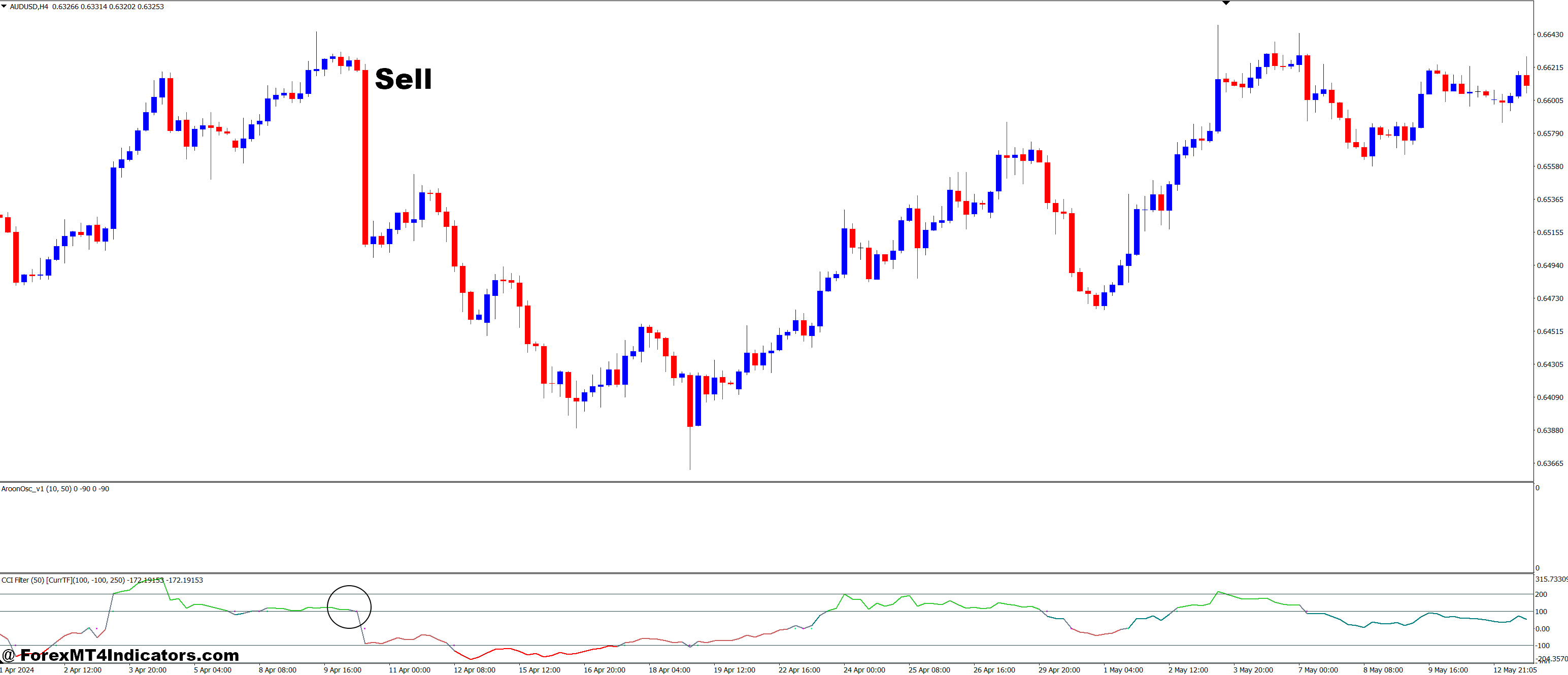

How to Trade with CCI Alert MTF and Aroon Oscillator Forex Trading Strategy

Buy Entry

- CCI > +100 (Indicates a strong uptrend in the market).

- CCI crosses from below -100 to above +100 (Signaling a buying opportunity after an oversold condition).

- Aroon Oscillator > +50 (Indicates strong upward momentum).

- CCI on the lower timeframe is above +100 (confirming strong momentum).

- Aroon Oscillator is above +50 (confirming a strong uptrend).

- Set a stop loss below the most recent swing low.

- Use a risk-to-reward ratio of 1:2 or 1:3, or exit when CCI signals overbought conditions (e.g., CCI moving above +200) or Aroon Oscillator shows signs of weakening.

Sell Entry

- CCI < -100 (Indicates a strong downtrend in the market).

- CCI crosses from above +100 to below -100 (Signaling a selling opportunity after an overbought condition).

- Aroon Oscillator < -50 (Indicates strong downward momentum).

- CCI on the lower timeframe is below -100 (confirming strong downward momentum).

- Aroon Oscillator is below -50 (confirming a strong downtrend).

- Set a stop loss above the most recent swing high.

- Use a risk-to-reward ratio of 1:2 or 1:3, or exit when CCI signals oversold conditions (e.g., CCI moving below -200) or Aroon Oscillator shows signs of weakening.

Risk Management Guidelines

Forex risk management is key for long-term success. This section talks about strategies to protect your money and make more profits. We’ll use the CCI Alert MTF and Aroon Oscillator strategy.

Position Sizing Strategies

Effective position sizing controls risk. You can use fixed lot sizes, percentage-based sizing, or adjust for volatility. Risk about 1-2% of your account on each trade.

Risk-Reward Ratios

A good risk-reward ratio is vital for making money. For example, risking 50 pips to gain 100 pips is a 1:2 ratio. This way, you can win only 50% of the time and make money overall.

Maximum Drawdown Protection

Keeping drawdowns low is important to keep your capital safe. Set a drawdown limit, like 20% of your account. If hit, cut your position sizes or take a trading break. Always use stop losses and don’t over-leverage your account.

Using these risk management tips can greatly improve your trading. For example, FXCharger users made a 1528.63% gain on EUR/USD from 2016, with a 29.46% drawdown. By focusing on proper position sizing and drawdown protection, you can achieve similar success while reducing losses.

Strategy Optimization Techniques

Forex strategy optimization is key for trading success. The CCI Alert MTF and Aroon Oscillator strategy can be improved. Let’s look at some ways to boost your trading.

Backtesting is the first step. It involves using past data to test your strategy. Focus on pairs like GBPUSD and EURJPY, which have lots of activity. The 1H and 30M timeframes often work best.

- UseEntry68_32: false

- UseSmallerExit: false

- UseVolExpanding: true

- LWMA Algo Alpha Period: 50 (adjustable)

Then, do forward testing. This means paper trading to see how it works in real-time. Set a profit target ratio of 1:1.1 and use 15-minute charts or higher.

Optimization is a continuous process. Always check and tweak your strategy as the market changes. By backtesting and forward testing, you’ll get a strong Forex strategy.

Common Trading Mistakes to Avoid

Forex trading mistakes can ruin even the best plans. It’s key to know and dodge these traps for success. Let’s look at common errors traders make with tools like CCI Alert MTF and Aroon Oscillator.

Signal Misinterpretation

Many traders misread indicator signals. They mix up market noise with real trading chances. For instance, the ZigZag indicator can give false signals if its settings are off. To steer clear of this, use several indicators and check signals against price movements.

Overtrading Pitfalls

Overtrading is a common trap for traders. Trading every signal can quickly empty your account. Instead, aim for high-chance setups and wait patiently. Sometimes, the best move is to not trade at all.

Risk Management Errors

Bad risk management can destroy your trading account. Common mistakes include:

- Overleveraging positions

- Moving stop losses to avoid small losses

- Ignoring set risk parameters

- Failing to size positions correctly

To avoid these risks, follow your trading plan and keep your emotions in check. Don’t let fear of missing out lead you to risky trades.

| Mistake | Consequence | Prevention |

|---|---|---|

| Signal Misinterpretation | Frequent losing trades | Use multiple indicators, confirm with price action |

| Overtrading | Account depletion | Focus on high-probability setups, practice patience |

| Risk Management Errors | Significant losses | Stick to trading plan, maintain emotional control |

Conclusion

The CCI Alert MTF and Aroon Oscillator Forex Trading Strategy is a powerful tool for forex traders. It uses multi-timeframe analysis, the CCI indicator, and the Aroon Oscillator. This strategy gives a detailed way to trade forex.

The CCI Arrows indicator is a key part. It gives accurate signals for buying and selling.

To use this strategy, traders need to pay close attention and understand its parts well. They should learn how different time frames work together. The best settings are short-term EMAs of 3-15 periods and long-term EMAs of 30-60 periods.

This strategy can be very profitable, with a 60-70% chance of making money. It has shown 7 wins against 2 losses.

Even though the CCI Aroon strategy is good, it’s not perfect. Traders must always be careful and manage risks well. They should start with paper trading and adjust the strategy to fit their goals and risk level.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Cash Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Get Download Access

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0