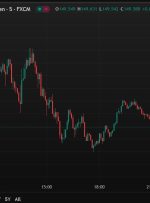

Forex traders must keep up with endless news that affects currency markets. The forex market operates 24/5. This means staying informed is key. Economic data releases can cause big price swings, over 100 pips in minutes. Many traders find it hard to understand and use this news well. This can lead to missing chances or