© Reuters Investing.com — Most Asian currencies sank on Monday, while the dollar rose to a five-week high as a stronger-than-expected U.S. inflation reading drove up fears that the Federal Reserve could keep raising interest rates. Concerns over worsening economic conditions in China also kept sentiment towards Asian assets dim, especially amid reports of a

Share: AUD/USD struggles to defend the bounce off YTD low despite probing five-day losing streak ahead of multiple data/events. Fears surrounding China, firmer US Treasury bond yields weigh on Aussie pair. RBA Minutes need to defend hawkish interest to recall AUD/USD buyers. China Industrial Production, Retail Sales will be eyed closely amid economic

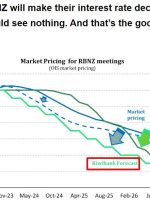

Coming up at 2pm New Zealand time on Wednesday, 16 August 2023 is the RBNZ policy decision. 0200 GMT and 10pm US Eastern time (on Tuesday, 15 August 2023) RBNZ Governor Orr’s press conference will follow an hour later Preview comments via ANZ: We expect the RBNZ will leave the OCR unchanged at 5.50%, reiterating

Crude Oil, WTI, Retail Trader Positioning, Technical Analysis – IGCS Commodities Update Crude oil prices weakened over the past couple of days Retail traders are beginning to increase upside exposure Meanwhile, a Bearish Engulfing was confirmed, where to? Recommended by Daniel Dubrovsky Get Your Free Oil Forecast WTI crude oil prices have been aiming cautiously

GBP PRICE, CHARTS AND ANALYSIS: Recommended by Zain Vawda Get Your Free GBP Forecast Read More: EUR/USD Eyes Short-Term Retracement as DXY Runs Into Confluence Area GBP has struggled over the past few weeks since retreating from recent highs. The GBPUSD and EURGBP have remained rangebound as market participants remain unclear on the Bank of

Australian central bank leaders believe that higher interest rates and rising costs of living will continue to put unprecedented pressure on households and, as a result, on consumption, while per capita output will decline in the second half of the year. Whether there will be more rate hikes this year will depend on data coming

© Reuters Investing.com – The U.S. dollar rose in early European trade Monday, trading near a five-week high on concerns the Federal Reserve could keep raising interest rates, while property sector concerns weighed on the Chinese yuan. At 03:20 ET (07:20 GMT), the , which tracks the greenback against a basket of six other currencies,

Share: EUR/GBP declined for a second consecutive day, and fell towards 0.8605, below the 20-day SMA. All eyes are now on labour market and inflation data from the UK. The Eurozone will release its preliminary Q2 GDP report on Wednesday. At the start of the week, the EUR/GBP fell below the 20-day Simple

Japanese Yen (USD/JPY) Analysis and Charts USD/JPY Posts new 2023 high as risk aversion, yield differentials boost the Dollar Key 145 region now in play The Bank of Japan bought Yen above this point in 2022 Learn How to Trade USD/JPY Below Recommended by David Cottle How to Trade USD/JPY The Japanese Yen weakened further