Our strategists had an extraordinary week with arguably four out of four strategy discussions catching solid moves in FX and gold! Our anticipation of global risk-off vibes played out well, so read further to see how fundamentals drove price and what lessons can be learned for your own trading! NZD/USD 1-Hour Forex Chart by TV

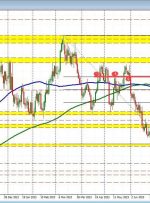

The USDCAD has found sellers near the 61.8% retracement of the 2023 trading range. With the USDCAD up each of the trading days today, will the sellers look to lean against the retracement level and start a corrective move to the downside? The 61.8% retracement comes in at 1.35674. The high price stalled at 1.3573

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any

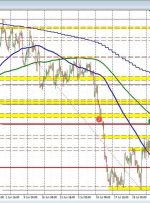

The USDCHF has chopped parsley higher this week. On the downside, a swing area support held near 0.8742. On the top side, there were some modest moves above a swing area high near 0.88193 that failed. However, as we head closer to the close for that week, the price is retesting that swing area between

Share: EUR/JPY dropped near 158.00, still trading in cycle highs. After two consecutive weeks of gains, the cross will close a weekly decline of 0.30%. The Japanese National CPI from July came in higher than expected. On Friday, the JPY traded strongly against most of its rivals, making the EUR/JPY cross retreat to

How to install the demo version of the product: The process of installing is similar to “Trader Assistant MT5”, so click to see. Trader Assistant Mini MT5: This is a handy tool for every trader who uses MT5. It has three modes of trade volume calculation, 1) fixed volume (lot size),2) fixed cash, and 3)