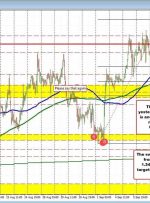

GOLD PRICE FORECAST Gold prices lack directional conviction as the U.S. dollar charges toward multi-month highs. Precious metals retain a somewhat bearish outlook from a fundamental standpoint. This article looks at XAU/USD’s key technical levels to watch in the coming days. Most Read: US Dollar Setups: USD/CAD, USD/JPY, and AUD/USD; Major Tech Levels Identified Gold