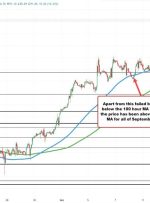

The currency pair has been climbing for the second consecutive day, reaching a nearly two-week high during Friday’s Asian trading session. The pair’s increase is largely attributed to optimism over additional stimulus from China and positive Chinese economic data. China’s National Bureau of Statistics (NBS) reported that the country’s August retail sales grew by 4.6%