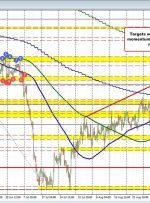

This week, the USDCHF has experienced an upward price movement, consistently remaining above the key swing area range of 0.89347 to 0.89472. The price surpassed this range in yesterday’s trading session and has maintained its position above this threshold today. Looking upwards, there’s a notable trend line at 0.8984, followed by a significant range between