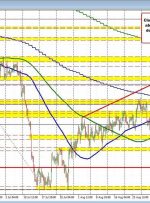

USD/JPY FORECAST: Monetary policy divergences between the Federal Reserve and the Bank of Japan will continue to weigh on the outlook for the Japanese yen The U.S. dollar retains a constructive profile for now This article looks at USD/JPY key levels to watch in the coming days Trade Smarter – Sign up for the DailyFX