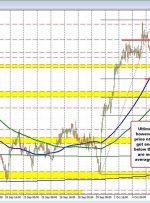

Osmosis is an advanced data driven automated trading robot which uses dynamic price differential algorithm and market volume to trade retracement on Gold (XAUUSD) . The price differential algorithm identifies various possible prices of execution, simultaneously pends and modifies orders until it gets the best possible price of execution. This makes the EA to use a