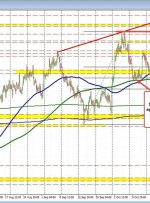

OIL PRICE FORECAST: Oil Slips on Demand Fears as US Exports and Imports are on a Steady Decline. Middle East Tensions Ease but Geopolitical Risk Remains and Will Keep Markets on Edge Moving Forward. IG Client Sentiment Shows Traders are 76% Net-Long on WTI at Present. To Learn More About Price Action, Chart Patterns and