Do you feel confused when you look at your trading screen, seeing prices go up and down without understanding why? It’s like trying to read a language you don’t know – frustrating and often doesn’t work.In your quest to understand price movements, you might have added a lot of indicators to your charts, making it

© Reuters. FILE PHOTO: A view shows the newly designed Russian 1000-rouble banknote during a presentation in Moscow, Russia October 16, 2023. REUTERS/Maxim Shemetov/File Photo By Alexander Marrow MOSCOW (Reuters) – The rouble leapt to a more than six-week high against the dollar on Friday after the Bank of Russia hiked interest rates by more

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any

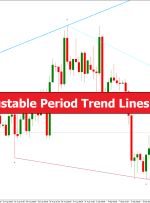

In the world of forex trading, having the right tools at your disposal can make all the difference between success and failure. One such tool that has gained popularity among traders is the Fractals Adjustable Period Trend Lines MT4 Indicator. In this article, we will explore what this indicator is, how it works, and why

UPCOMING EVENTS: Monday: Australia Retail Sales. Tuesday: Japan Jobs data, Japan Retail Sales and Industrial Production, Chinese PMI, BoJ Policy Decision, Swiss Retail Sales, Eurozone GDP and CPI, Canada GDP, US ECI, US Consumer Confidence, New Zealand Jobs data. Wednesday: Chinese Caixin Manufacturing PMI, US ADP, Canada Manufacturing PMI, US ISM Manufacturing PMI, US Job

© Reuters. FILE PHOTO: U.S. one dollar banknotes are seen in front of displayed stock graph in this illustration taken, February 8, 2021. REUTERS/Dado Ruvic/Illustration//File Photo By Saqib Iqbal Ahmed NEW YORK (Reuters) -The dollar edged down against a basket of currencies on Friday, pulled down by portfolio rebalancing, but was on track to end

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any

University of Michigan Consumer Sentiment Prelim was 63.0 Prior was 68.1 Details: Current conditions 70.6 vs 66.7 prelim (71.4 prior) Expectations 59.3 vs 60.7 prelim (66.0 prior) 1-year inflation 4.2% vs 3.8% prelim (3.2% prior) 5-10 year inflation 3.0% vs 3.0% prelim (2.8% prior) The Fed might be concerned about that bump in inflation expectations