Share: EUR/GBP maintains its upward momentum, trading at 0.8731, as it solidifies the 0.8700 level as a crucial support. The pair shows a bullish bias, but a failure to surpass the 0.8755 high could invite bearish activity. Key levels to watch include resistance at 0.8800 and 0.8834, with support at the 200-DMA of

In the ever-evolving world of Forex trading, staying ahead of the curve is paramount to success. Traders are constantly on the lookout for tools and indicators that can provide them with an edge in the market. One such tool that has garnered attention in recent times is the Quasimodo MT4 Indicator. In this article, we

UPCOMING EVENTS: Monday: Japan PPI. Tuesday: UK Jobs data, German ZEW, NFIB Small Business Optimism Index, US CPI. Wednesday: Japan GDP, Australia Wage data, China Industrial Production and Retail Sales, UK CPI, US PPI, US Retail Sales, PBoC MLF. Thursday: Australia Jobs data, US Jobless Claims, US Industrial Production, NAHB Housing Market Index, New Zealand

© Reuters. FILE PHOTO: Four thousand U.S. dollars are counted out by a banker counting currency at a bank in Westminster, Colorado November 3, 2009. REUTERS/Rick Wilking/File Photo By Karen Brettell NEW YORK (Reuters) – The dollar dipped against the euro on Friday but gained against the yen as investors evaluated comments by Federal Reserve

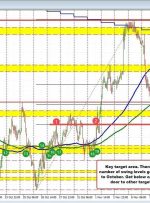

The AUDUSD is down for the 5th consecutive day. Recall on Friday last week, and then on Monday, the price of the AUDUSD was testing/moving above it’s key 100-day MA near 0.6515. The high price reached 0.65224, but ultimately stalled and started a run to the downside, leading to a move from 06522 to the

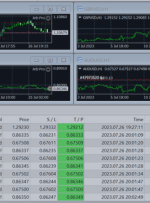

In the dynamic realm of Forex trading, where opportunities and market fluctuations dance together, traders are constantly in search of strategies to navigate these complex waters. One such strategy that has captured the spotlight is the Zone Recovery strategy. In this discussion, we will delve into the principles, advantages, and considerations of this strategy, providing

© Reuters. The Euro has ascended to a six-month peak against the Pound Sterling, capping off a week with consistent gains as the pair approached 0.8750. This rise comes despite mixed economic data from both the European Union and the United Kingdom, where the UK’s figures have notably underperformed even when exceeding forecasts. At the

Share: The USD/SEK is seen at 10.908 with 0.10% loses US Treasury yields retreated after sharply rising on Thursday. All eyes are on next week’s CPI data from October from the US. The USD/SEK showed minimal downward movements around the 10.908 area on Friday. The pair declined as the Greenback consolidated the week’s