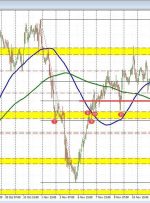

The latest tracker is down to 2.0% from 2.2%. After recent releases from the US Census Bureau, the US Bureau of Labor Statistics, and the US Department of the Federal Reserve Board of Governors, the nowcast of fourth-quarter real gross private domestic investment growth decreased from -0.8 percent to -1.8 percent. The consensus is just