© Reuters. Chinese Yuan and U.S. dollar banknotes are seen in this illustration taken March 10, 2023. REUTERS/Dado Ruvic/Illustration/File Photo By Samuel Shen and Rae Wee SHANGHAI/SINGAPORE (Reuters) – Global companies are making a beeline for China’s debt markets, issuing record amounts of yuan-denominated bonds and borrowing heavily from mainland banks, capitalising on rock-bottom yuan

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any

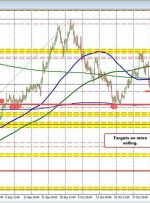

USDCHF remains below the 0.8900 level. Sellers in control. The tumble lower in the USDCHF took the price below its 100-day moving average at 0.8896 (blue overlayed step line on the chart above), 50% retracement at 0.88999, and Swing level near the 0.89000 level (see red circles on the chart above). Since then, the price

© Reuters. FILE PHOTO: Japanese Yen and U.S. dollar banknotes are seen in this illustration taken March 10, 2023. REUTERS/Dado Ruvic/Illustration By Herbert Lash and Iain Withers NEW YORK/LONDON (Reuters) – The dollar posted its second-steepest weekly decline versus other major currencies this year on Friday, while the yen strengthened sharply, and the dollar traded

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any

There is a ‘big gap’ between the data and how consumers/businesses feel about the economy Inflation is front-of-mind to me Inflation is improving but still too high The Fed’s Collins is due up on CNBC in a couple minutes. This article was written by Adam Button at www.forexlive.com. لینک منبع : هوشمند نیوز

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any