Main Takeaways from the 2023 UK Autumn Statement Main national insurance rate to be cut by 2%, from 12% to 10% for 27 million people Full expensing of capital investment for businesses made permanent. Business investment to improve by £20bn per year according to estimates State pensions to rise by 8.5% from April 2024 Welfare

News Filter EA sends a PUSH notification to the MT4 APP on your phone when News comes. You can download here: https://www.mql5.com/en/market/product/108232 You only need to authorize this url in the MT4 options: https: To authorize this url in MT4 you must go to Tools, Options, Expert Advisors, Allow Web Request, add the url and

© Reuters. FILE PHOTO: A bank employee counts U.S. dollar notes at a Kasikornbank in Bangkok, Thailand, January 26, 2023. REUTERS/Athit Perawongmetha By Samuel Indyk and Brigid Riley LONDON (Reuters) -The dollar rebounded from a 2-1/2 month low on Wednesday as the minutes from the Federal Reserve’s last meeting hinted that interest rates would likely

Share: Economists at Commerzbank expect the EUR/CHF pair to enjoy modest gains next year. Scope for a stronger Franc again in 2025 We see a moderate depreciation of the Franc against the Euro next year. The EUR should benefit from the fact that market expectations regarding interest rate cuts in the Eurozone are

In the fast-paced world of financial trading, having the right tools at your disposal is crucial for success. One such tool that has been gaining significant attention in recent times is the M W Pattern MT4 Indicator. In this article, we will delve into the intricacies of this indicator, exploring its features, functionality, and how

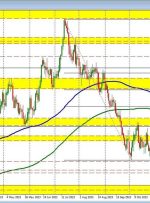

EUR/USD Forecast – Prices, Charts, and Analysis FOMC minutes give little away, leaving the US dollar rudderless. UK Autumn Statement may give Sterling a boost. Download our Complimentary Guide to Trading EUR/USD Recommended by Nick Cawley How to Trade EUR/USD The Federal Reserve is very unlikely to cut interest rates anytime soon and may hike

EURUSD – Dollar Climbs After FOMC Meeting Minutes The EURUSD ended the day lower for the first time after climbing for 3 consecutive days. The minutes of the November meeting of the US Federal Reserve supported the Dollar but also had factors which concerned Dollar buyers. Certain members of the Fed’s Committee stated they expect

USD/CAD ANLAYSIS & TALKING POINTS Moderating Canadian inflation unable to shake CAD bulls just yet. US durable goods orders, consumer sentiment and BoC’s Macklem in focus later today. Will channel support hold firm once again? Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of