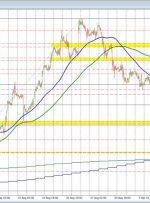

استراتژی تجارت فارکس Breakout کانال درون روز و نوسان حرفه ای به عنوان یک ابزار قدرتمند برای معامله گرانی که به دنبال سرمایه گذاری بر روی نوسانات کوتاه مدت و روندهای بلندمدت هستند، ظاهر شده است. این رویکرد بهطور یکپارچه تصمیمگیری سریع در معاملات روزانه را با استراتژی صبورانه معاملات نوسانی ادغام میکند و به