در اینجا شرح کاملی از تنظیمات ورودی برای ربات معامله گر، “Apple” ارائه شده است که بر اساس دسته بندی سازماندهی شده است. ***** تنظیم جفت ***** **جفت **: GBPAUD، EURUSD، USDCAD، USDJPY، GBPJPY، EURAUD، AUDCAD، EURCAD، CHFJPY اینها نمادهایی هستند که ربات با آنها معامله خواهد کرد. شما می توانید لیست را بر اساس

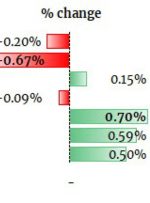

Investing.com — به گفته تحلیلگران UBS، بانک مرکزی اروپا و بانک انگلستان احتمالاً مواضع سیاست پولی آتی “یکسانی” را اتخاذ خواهند کرد، اگرچه انتظار میرود بانک مرکزی اروپا رویکردی کمی تندروانهتر در پیش بگیرد. در یادداشتی به مشتریان، تحلیلگران افزودند که وضعیت اقتصادی در هر دو منطقه “نسبتاً مشابه است، با شیب اندکی به سمت