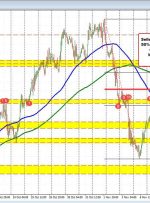

AUSTRALIAN DOLLAR PRICE, CHARTS AND ANALYSIS: Most Read: Bitcoin (BTC/USD) Forecast: Open Interest Surge to Ignite a Fresh Bout of Volatility? Supercharge your trading prowess with an in-depth analysis of the Australian Dollar outlook, offering insights from both fundamental and technical viewpoints. Claim your free Q4 trading guide now! Recommended by Zain Vawda Get Your