رونمایی از استراتژی معاملاتی Sniper Forex برای دقت و سود – تجزیه و تحلیل و پیش بینی – 17 دسامبر 2024

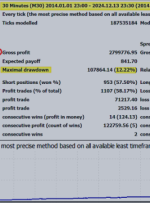

در دنیای پرشتاب معاملات فارکس، اتخاذ استراتژی های موثر برای موفقیت بسیار مهم است. در میان روشهای مختلف، استراتژی تک تیرانداز به دلیل رویکرد معاملاتی دقیق و سریع خود که برای استفاده از فرصتهای زودگذر بازار طراحی شده است، متمایز است. نکته اصلی برای تسلط بر این تکنیک، درک بهترین شاخص برای تجارت تک تیرانداز

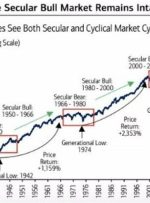

مک کواری ناآرامی های سیاسی در کانادا را به عنوان یک فرصت بالقوه برای سرمایه گذاران، به ویژه در بازارهای ارز، برجسته کرد. پس از استعفای کریستیا فریلند و دیگر افسران کابینه، جاستین ترودو، نخستوزیر کانادا، با فشارهای فزایندهای برای کنارهگیری مواجه میشود و درخواستهایی برای استعفای او از درون حزب لیبرال او مطرح میشود.

استراتژی تجارت فارکس Heiken Ashi Smoothed و Intraday Channel Breakout دو ابزار قدرتمند را برای معامله گرانی که بر روی گرفتن روندهای کوتاه مدت در بازار متمرکز هستند، ترکیب می کند. نشانگر Heiken Ashi Smoothed، یک نسخه پیشرفته از شمع های سنتی Heiken Ashi، قیمت را برای کاهش صدای بازار کاهش می دهد. این به