SEC ایالات متحده از گروه کاری برای شروع کار روی مقررات ارزهای دیجیتال توسط رویترز پرده برداری می کند

(رویترز) – رهبری جدید کمیسیون بورس و اوراق بهادار ایالات متحده روز سهشنبه اعلام کرد که در اولین اقدام مهم دولت جدید دونالد ترامپ، رئیسجمهور آمریکا برای اصلاح سیاست ارزهای دیجیتال، یک کارگروه برای توسعه یک چارچوب نظارتی برای داراییهای کریپتو ایجاد کرده است. ترامپ که بر اساس وعدههای خود مبنی بر «رئیسجمهوری رمزارز» فعالیت

شاخص داوجونز در روز سه شنبه 450 واحد صعود کرد زیرا سرمایه گذاران ترس از تعرفه را کنار گذاشتند. دونالد ترامپ، رئیسجمهور آمریکا بر تهدیدات خود مبنی بر اعمال تعرفههای یک روزه تاکید کرد. تهدیدات تعرفهای از سوی کاخ سفید هنوز درز میکند و اکنون برای فوریه است. میانگین صنعتی داوجونز (DJIA) با خوشحالی، محوریت

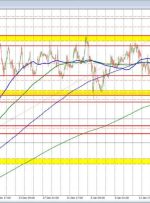

Feeling lost in the world of forex trading? You’re not alone. Many beginners find it hard to understand this complex market. The market is huge, with $7.5 trillion traded every day. But don’t worry. This guide will make the basics easy to learn. We’ll cover everything from currency pairs to winning strategies. You’ll learn how