British Pound, GBP/USD, Technical Analysis, Retail Trader Positioning – IGCS Update

- British Pound has been under pressure by the US Dollar

- Retail traders have recently turned net-long GBP/USD

- This is a sign that further losses may be in store ahead

Recommended by Daniel Dubrovsky

Get Your Free GBP Forecast

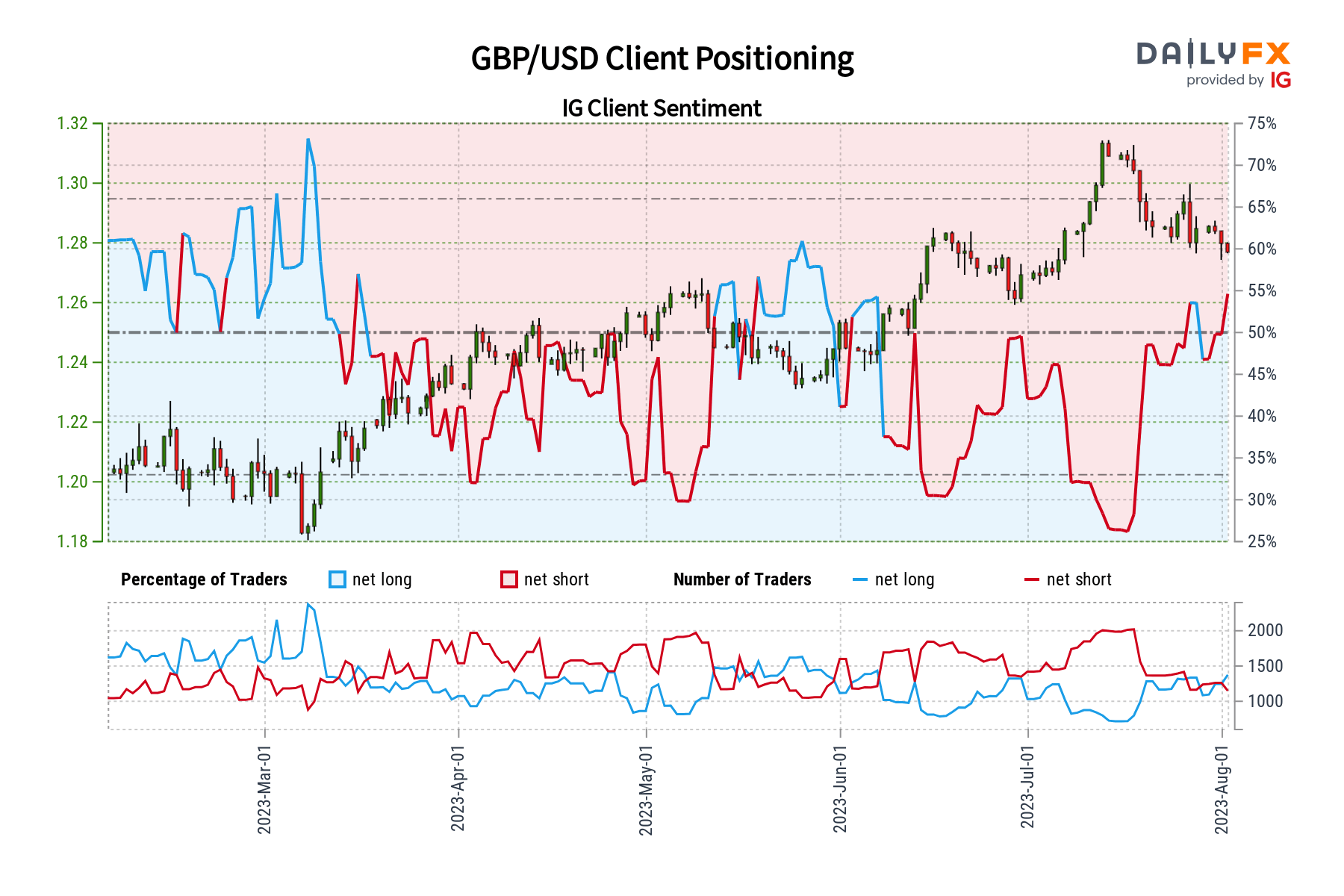

The British Pound has been under pressure from the US Dollar since the middle of July, with Sterling now around its lowest in a month. In response retail traders have been increasing GBP/USD net-long exposure. This can be seen by looking at IG Client Sentiment (IGCS). IGCS tends to function as a contrarian indicator. With that in mind, could further losses be ins tore for the British Pound?

GBP/USD Sentiment Outlook – Bearish

The IGCS gauge shows that about 54% of retail traders are net-long. In fact, this is the most since early June. Since the majority are now biased higher, this suggests that prices may fall down the road. This is as upside exposure increased by 9.82% and 2.05% compared to yesterday and last week, respectively. With that in mind, the combination of current sentiment and recent changes produces a stronger bearish contrarian trading bias.

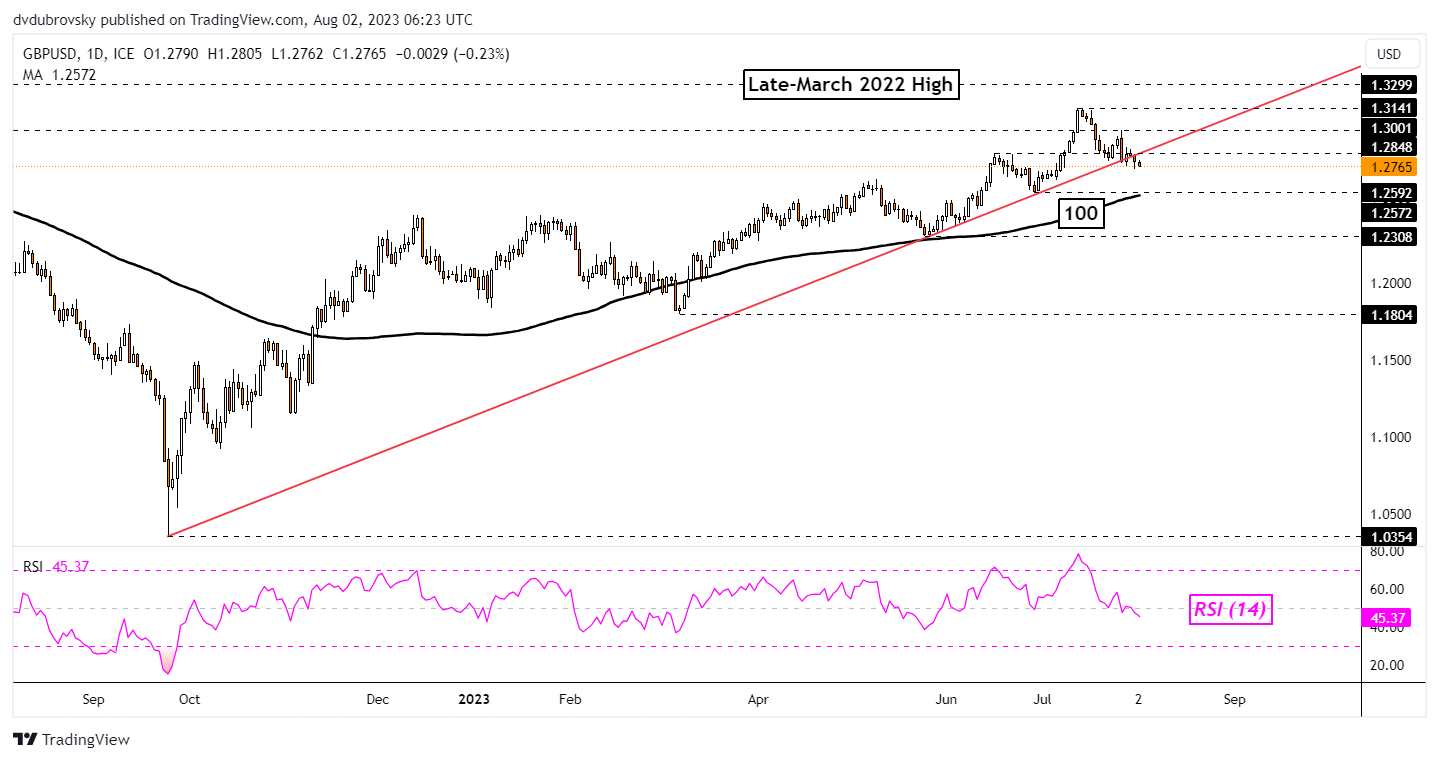

British Pound Daily Chart

On the daily chart, GBP/USD is testing a breakout under a key long-term rising trendline from the end of September. Further downside from here could mark a major turning point for Sterling. Immediately below is the June 29th low of 1.2592, which is key support. Meanwhile, the 100-day Moving Average (MA) is also hovering around that price.

As such, this combination could prove to be tricky to break through. But, if that is the case, the technical bias may shift to a stronger bearish standpoint. Otherwise, a turn higher from here places the focus on immediate resistance at 1.2848. This is an inflection point from early June. Extending gains beyond that then places the focus on the July high of 1.3141.

Recommended by Daniel Dubrovsky

How to Trade GBP/USD

Chart Created in Trading View

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0