British Pound (GBP/USD) Analysis and Charts

- Moody’s upgrade having little effect on Sterling.

- UK employment data and S&P PMIs are the next potential GBP drivers.

Recommended by Nick Cawley

Get Your Free GBP Forecast

The British Pound is little changed as traders open their books for the week with little macro news around to start a move. The situation in the Middle East remains unpredictable and very volatile, while the proposed Israel move into Gaza is seemingly still on hold. Market sentiment is risk-averse at the open and likely to stay that way ahead of a week packed full of potentially volatile releases and events. The delayed UK unemployment will be released tomorrow morning (07:00 UK) before the latest S&P Global PMIs hit the screens at 09:30 GMT.

For all market-moving economic data and events, see the DailyFX Calendar

Another rating agency, Moody’s, was in the news recently after it upgraded the UK’s long-term outlook to stable from negative and reaffirmed the UK’s Aaa3 rating. Moody’s placed a negative outlook on the UK after ex-PM Liz Truss’s disastrous mini-budget last year. The next UK Budget will be on November 22nd.

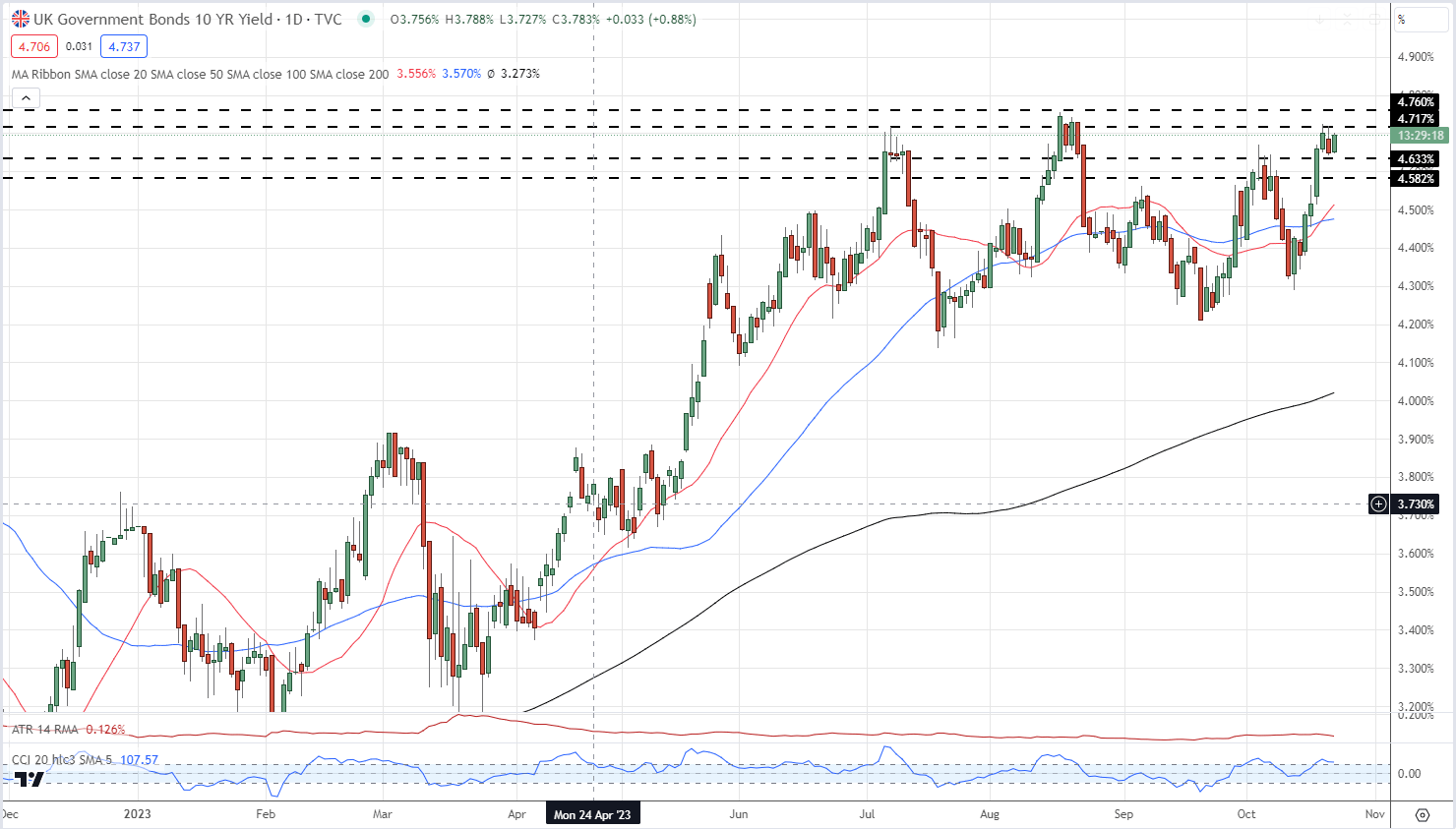

UK government bond yields remain elevated ahead of next week’s BoE meeting with the 10-year benchmark eyeing a fresh re-test of levels last seen in August 2008. The daily chart shows a triple top formation for UK 10-year yields, a pattern that normally suggests that the market is set to turn lower.

UK 10-Year Gilt Yields

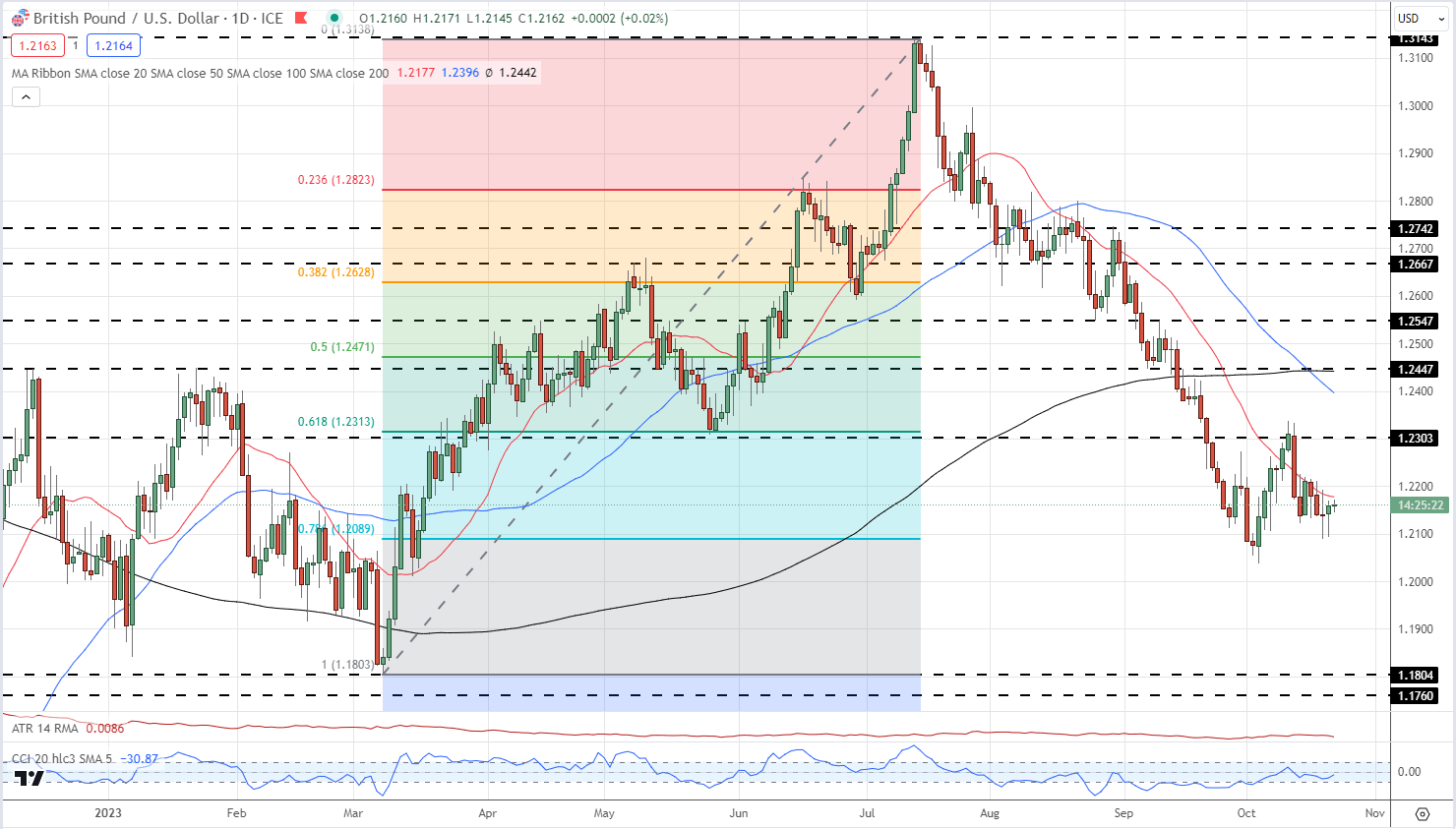

Cable remains stuck in a short-term range between 1.2089 (78.6% Fibonacci retracement) and a prior horizontal high of around 1.2303. The chart remains negative with a death cross formed last week, while the 20-day simple moving average continues to guide the pair lower.

Learn How to Trade GBP/USD

Recommended by Nick Cawley

How to Trade GBP/USD

GBP/USD Daily Price Chart

IG Retail Trader data shows 69.28% of traders are net-long with the ratio of traders long to short at 2.26 to 1. The number of traders net-long is 0.86% higher than yesterday and 4.78% lower from last week, while the number of traders net-short is 1.22% higher than yesterday and 14.46% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

| Change in | Longs | Shorts | OI |

| Daily | 3% | 6% | 4% |

| Weekly | -4% | 7% | -1% |

Charts using TradingView

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0