Australia’s GDP Outperforms, Nikkei Eyeing Break of Bullish Flag

[ad_1] Market Recap of clients are net long. of clients are net short. Change in Longs Shorts OI Daily 6% -1% 1% Weekly 5% 3% 4% US indices started the week on a more subdued tone, with a jump in oil prices to a new 10-month high not providing much reassurances for the global inflation

[ad_1]

Market Recap

| Change in | Longs | Shorts | OI |

| Daily | 6% | -1% | 1% |

| Weekly | 5% | 3% | 4% |

US indices started the week on a more subdued tone, with a jump in oil prices to a new 10-month high not providing much reassurances for the global inflation outlook. This follows after major oil producers, Russia and Saudi Arabia, announced to extend voluntary oil cuts to the end of the year, which is a longer timeline than what was initially expected.

The move seems set to widen the current deficit in the oil market further, amid declining inventories in the US and underproduction among some OPEC+ members, with a break in oil prices above its months-long ranging pattern potentially pointing to further upside.

US Treasury yields reacted higher as investors positioned for a high-for-longer rate outlook, with the US dollar rising in-tandem to a new ten-month high. Recent US inflation and jobs data still leave a rate hold from the Federal Reserve (Fed) as the wide consensus for the September meeting, but the Fed’s guidance for policymaking to be on a meeting-by-meeting basis has kept bets of additional tightening in November/December alive.

Ahead, focus will be on the US Institute for Supply Management (ISM) services purchasing managers index (PMI) data today. A softer read from the previous month (est 52.5 versus previous 52.7) may be preferred in showing more tamed demand from US consumers, given the prevailing worries of a resurgence in inflation.

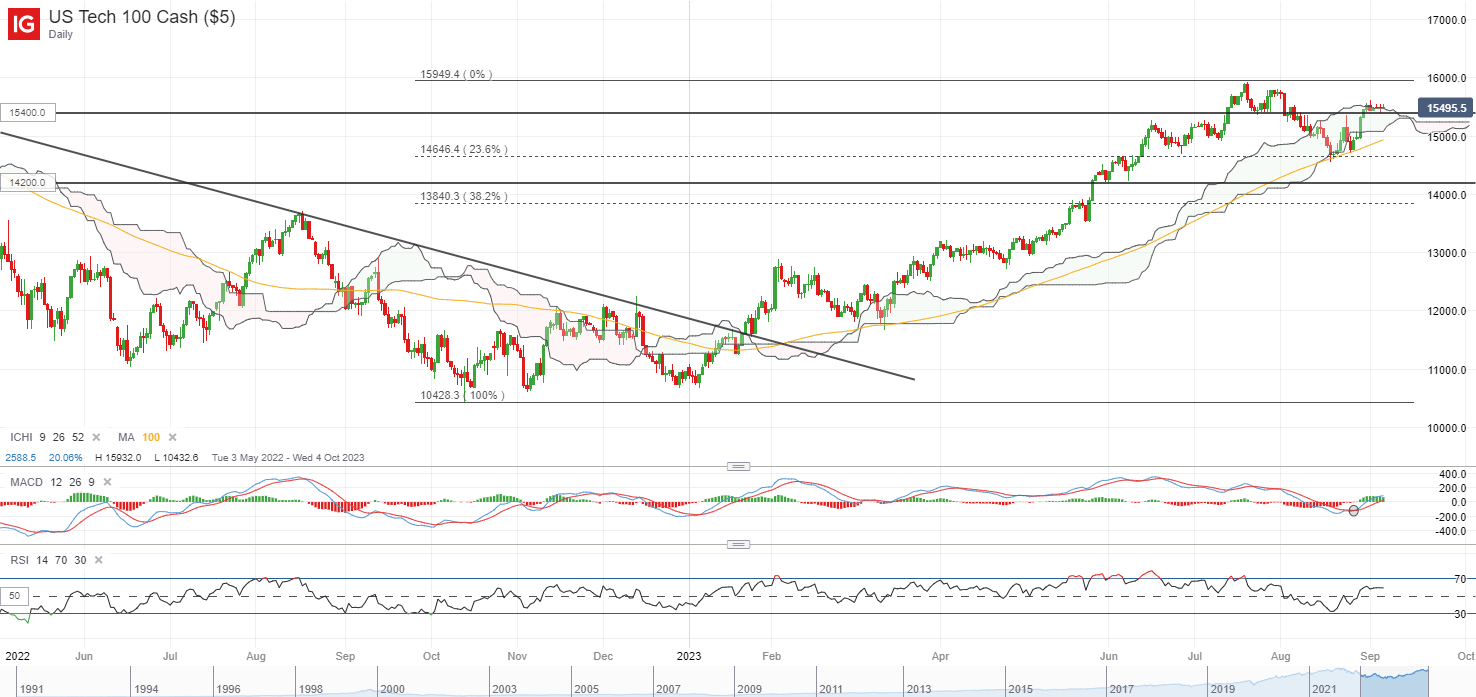

One to watch may be the Nasdaq 100 index, which continues to trade above last Thursday’s high and may still leave odds of a continuation of the upward trend in place. The upper edge of its Ichimoku cloud on the daily chart is providing some near-term resistance to overcome for now, with any break above its current consolidation phase likely to pave the way to retest its year-to-date high at the 15,940 level.

Source: IG charts

Asia Open

Asian stocks look set for a mixed open, with Nikkei +0.75%, ASX -0.27% and KOSPI -0.06% at the time of writing. Along with the more downbeat tone from Wall Street overnight, sentiments continue to reel in from the downside surprise in China’s Caixin services PMI (51.8 versus 53.6 forecast) yesterday, with the quicker-than-expected tapering in reopening momentum offsetting earlier optimism around the resilience in manufacturing activities. The Hang Seng Index gave back its Monday’s gains, closing 2.3% lower yesterday.

This morning, Australia’s 2Q gross domestic product (GDP) growth rate outperformed expectations at 2.1% year-on-year (1.8% consensus). Quarter-on-quarter, it is up 0.4%, above the 0.3% consensus. The confluence of declining 2Q prices but more resilient growth conditions may allow the Reserve Bank of Australia (RBA) to deliver more wait-and-see, validating earlier expectations for an end to its tightening process but for rates to be kept high for longer through mid-2024.

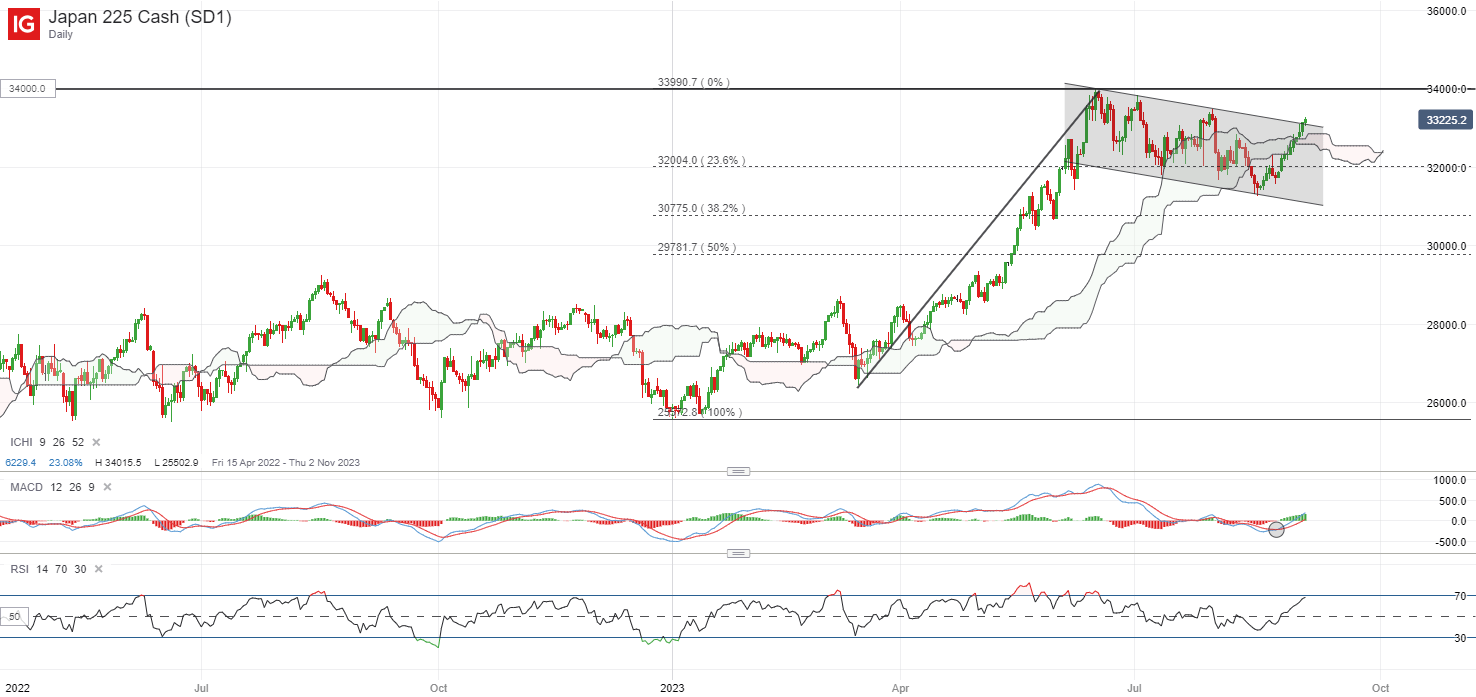

Aside, one to watch may be the Nikkei 225 index. The index has displayed a bullish flag formation on the daily chart since the start of the year, with recent upmove attempting for a break above the downward-sloping consolidation channel. That may leave the year-to-date high at the 34,000 level on watch for a retest over coming weeks, with the price projection based on the flag pole leaving its 1990 high in focus over the longer term.

Recommended by Jun Rong Yeap

Get Your Free Equities Forecast

Source: IG charts

On the watchlist: Gold prices retracing from resistance confluence

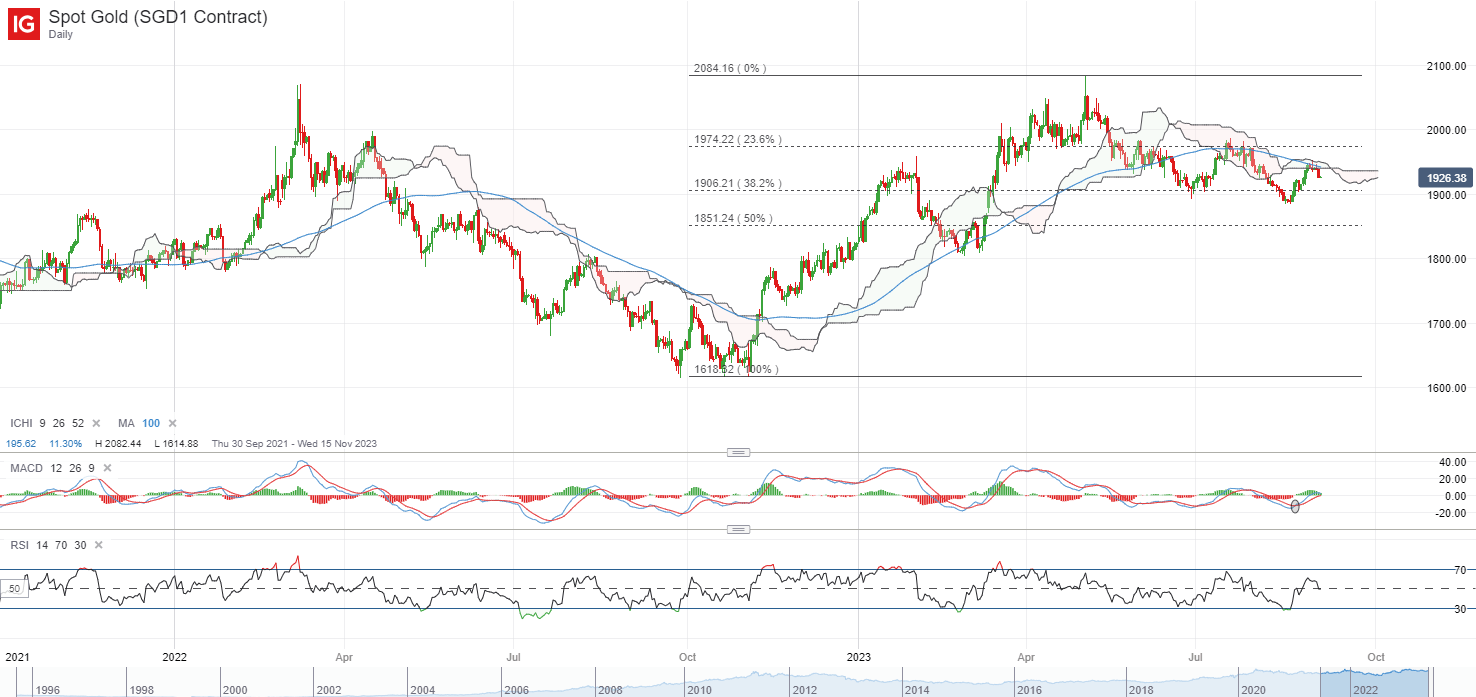

A jump in US Treasury real yields for the second straight day and a stronger US dollar at its four-month high have kept the pressure on gold prices overnight, with prices retracing off a resistance confluence at the US$1,950 level. This level is where its 100-day moving average (MA) stands in line with the upper band of its Ichimoku cloud on the daily chart. Failure to trade above the cloud may still keep a downward trend in place, with greater conviction for buyers potentially coming from a move above the US$1,950 level.

For now, its weekly relative strength index (RSI) is back to retest its 50 level, following a dip below the level last month. Any further downside in prices could leave the US$1,895 level on watch as immediate support, where dip-buyers had held up prices at this level on two previous occasions since June this year.

Recommended by Jun Rong Yeap

How to Trade Gold

Source: IG charts

Tuesday: DJIA -0.56%; S&P 500 -0.42%; Nasdaq -0.08%, DAX -0.34%, FTSE -0.20%

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Australias ، Break ، Bullish ، Eyeing ، Flag ، GDP ، Nikkei ، outperforms

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0