Australian PMI Data Not Much Better

[ad_1] Australia’s manufacturing industry has been in decline for six consecutive months, a situation which is still ongoing. The manufacturing PMI declined slightly from 49.6 in July to 49.4 in August. Expectations were low due to reduced new orders, resulting in reduced production and no indication that global demand is picking up. Deflation and economic

[ad_1]

Australia’s manufacturing industry has been in decline for six consecutive months, a situation which is still ongoing. The manufacturing PMI declined slightly from 49.6 in July to 49.4 in August. Expectations were low due to reduced new orders, resulting in reduced production and no indication that global demand is picking up. Deflation and economic failure in China, Australia’s main trading partner, will exacerbate the manufacturing sector’s problems.

Although the services sector experienced three consecutive months of growth at the start of the year, it is also struggling. The PMI fell from 47.9 to 46.7 points in August, its lowest in 19 months. The PMI report provided more evidence of a slowdown in the Australian economy, supporting the RBA’s decision to scale back interest rate hikes. The challenge facing the central bank is to stick to a path of interest rates that will allow the economy to settle down and make a soft landing without triggering a recession. The RBA took a pause in August and futures markets largely anticipate another pause at the September meeting.

Technical Review

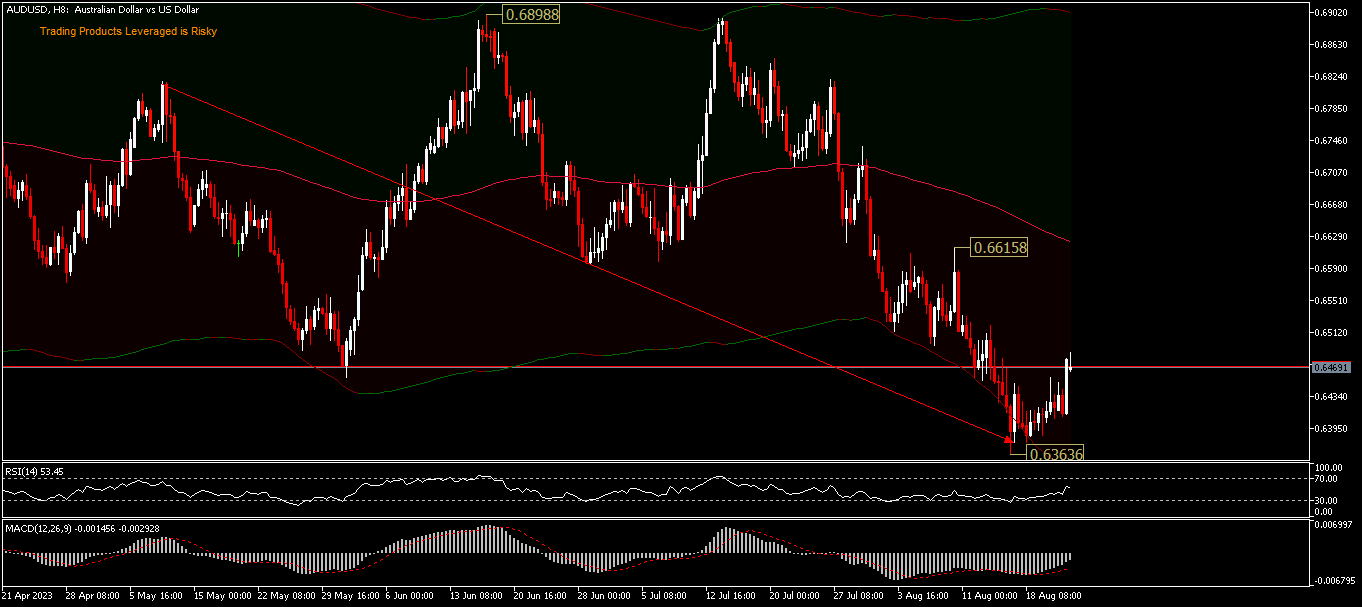

AUDUSD, D1 – current developments suggest that the downtrend from 0.8006 is still ongoing. A decisive break of the 0.6169 support will target the FE61.8% projection of 0.8006-0.6169 and 0.7157 at 0.6021. The level will now remain an option as long as 0.6898 holds. On the H4 period, the intraday bias remains neutral and consolidation from 0.6363 could continue further, but downward movement leaves room for 0.6169. While a stronger recovery can’t be ruled out, it’s likely to be capped by the 0.6615 resistance.

Price is currently still trading below the 200 EMA, and the rebound due to weaker US PMI data looks to be a “dead cat bounce”, although RSI is in the expansion area but MACD is still in the selling area.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Australian ، Data ، PMI

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0