Australian Dollar Price Action Setups: AUD/USD, GBP/AUD

[ad_1] AUD/USD, GBP/AUD PRICE, CHARTS AND ANALYSIS: Most Read: Gold Price Forecast: Rejection at $2000 Level Leaves the Door Open for a Move Lower Trade Smarter – Sign up for the DailyFX Newsletter Receive timely and compelling market commentary from the DailyFX team Subscribe to Newsletter AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP The Reserve Bank of Australia

[ad_1]

AUD/USD, GBP/AUD PRICE, CHARTS AND ANALYSIS:

Most Read: Gold Price Forecast: Rejection at $2000 Level Leaves the Door Open for a Move Lower

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Reserve Bank of Australia (RBA) released the minutes of the most recent meeting where the Central Bank delivered another 25bps hike. The Aussie Dolla surprisingly faced a selloff following the hike which looking at the minutes is surprising to say the least. The minutes revealed that the hike was intended to lower the risk of a “larger monetary policy response”, given stubbornly high inflation and a strong economy.

The minutes also see inflation risks remaining tilted toward the upside despite the recent comments by RBA Governor Bullock stating inflation has peaked. The Governor did however mention that bringing inflation within the target range will remain a challenge for the Economy and could take as long as 2 years. This does not surprise as I have always stated my belief that inflation never truly comes down enough with some items remaining higher moving forward while others may become cheaper. I do expect part of the recent inflationary pressures globally to be entrenched and thus the next couple of months should prove particularly interesting for Central Banks.

The Australian Dollar has remained relatively firm since the initial selloff in the aftermath of the rate hike. I expect this to continue as intimated by Governor Bullock the economy des remain quite strong thanks to strong demand. The labor market is expected to remain strong according to Governor Bullock and this in turn could keep the demand side going as well which does pose upside risks to inflation.

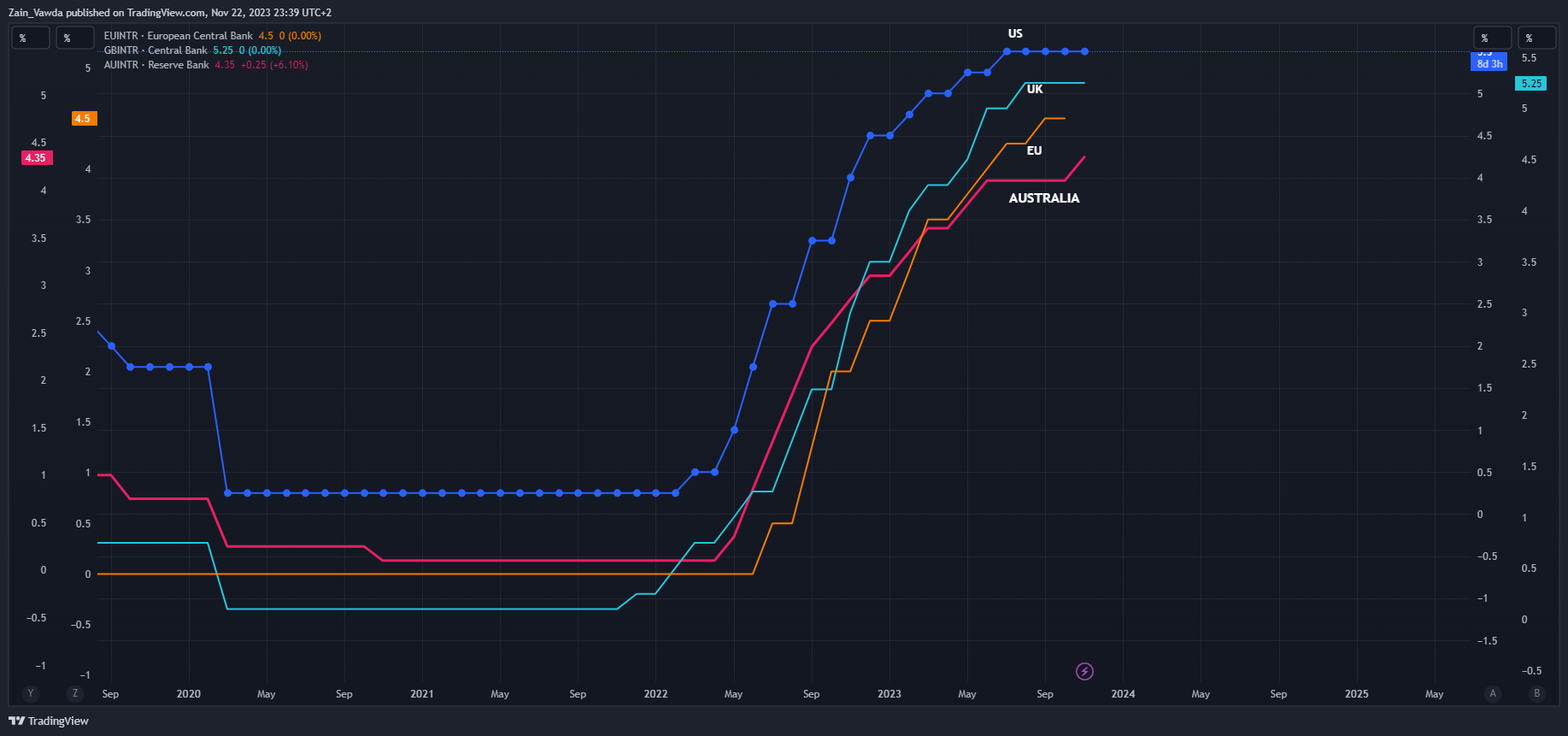

Looking at an interest rate comparison and the RBA are still in a good position to effect another rate hike should they feel it is warranted. The RBA still enjoy the lowest rate in comparison to the UK, EU and the United States as you can see on the chart below.

Source: TradingView

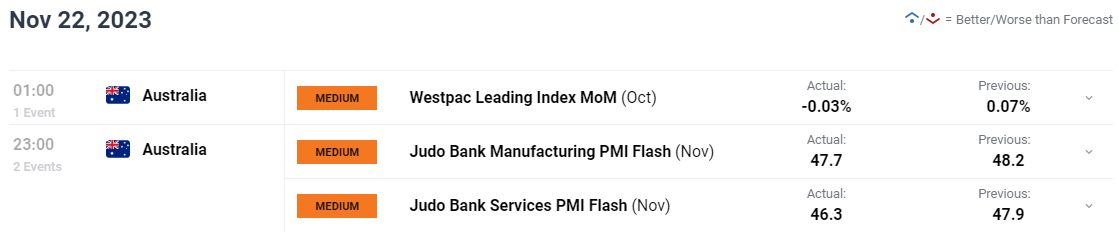

We did have some data a short while ago as well with the release of the Judo Bank Manufacturing and Services PMI Flash numbers. Manufacturing and Services both declined slightly from the October print but seemed to have little immediate impact on the Australian Dollar.

For all market-moving economic releases and events, see the DailyFX Calendar

Recommended by Zain Vawda

How to Trade AUD/USD

PRICE ACTION AND POTENTIAL SETUPS

AUDUSD

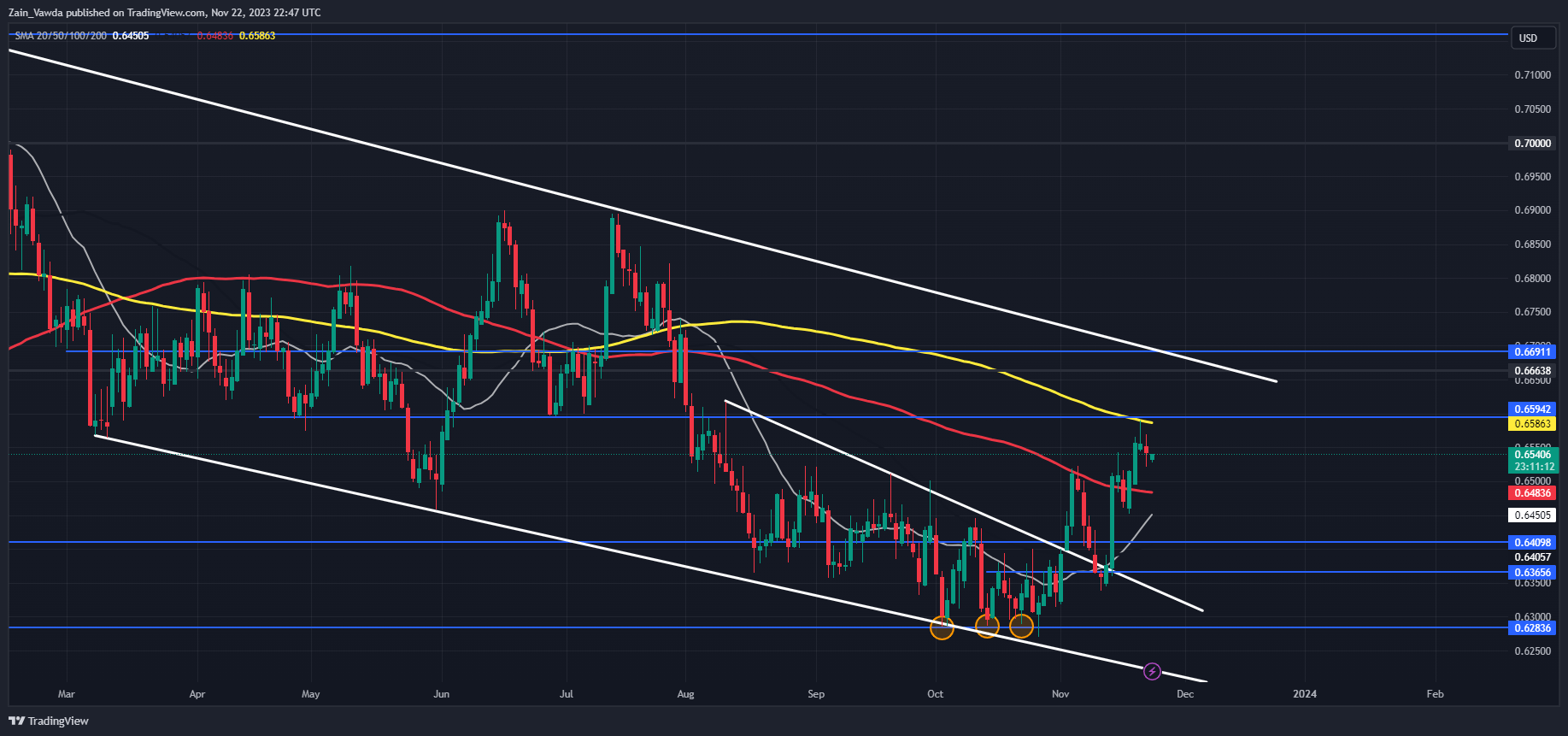

AUDUSD had been on an impressive rally since the Central Bank raised rates and we had an initial selloff to retest support at the 0.6350 mark. Since then, AUDUSD has exploded printing a fresh higher high and keeping the overall bullish structure going.

AUDUSD also remains with a long-term descending channel but may find it hard to push on from here without some form of retracement. Resistance has been provided by the 200-day MA at the 0.6600 level. The issue for sellers is that there remains a lot of downside support as well which could hamper a sustained move lower. It would also appear that a golden cross pattern may be developing as the 20-day MA eyes a cross above the 100-day MA which would be a nod to potential bullish continuation.

Personally, I would prefer some form of retracement here before potentially joining the trend as we have just printed a higher high. I will be keeping a close eye on support at 0.6484, 0.6440 and 0.6400 for potential long opportunities. A break and daily candle close below the 0.6350 mark will be needed for a change in structure, and this would then invalidate the bullish setup.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

AUD/USD Daily Chart

Source: TradingView, prepared by Zain Vawda

GBPAUD

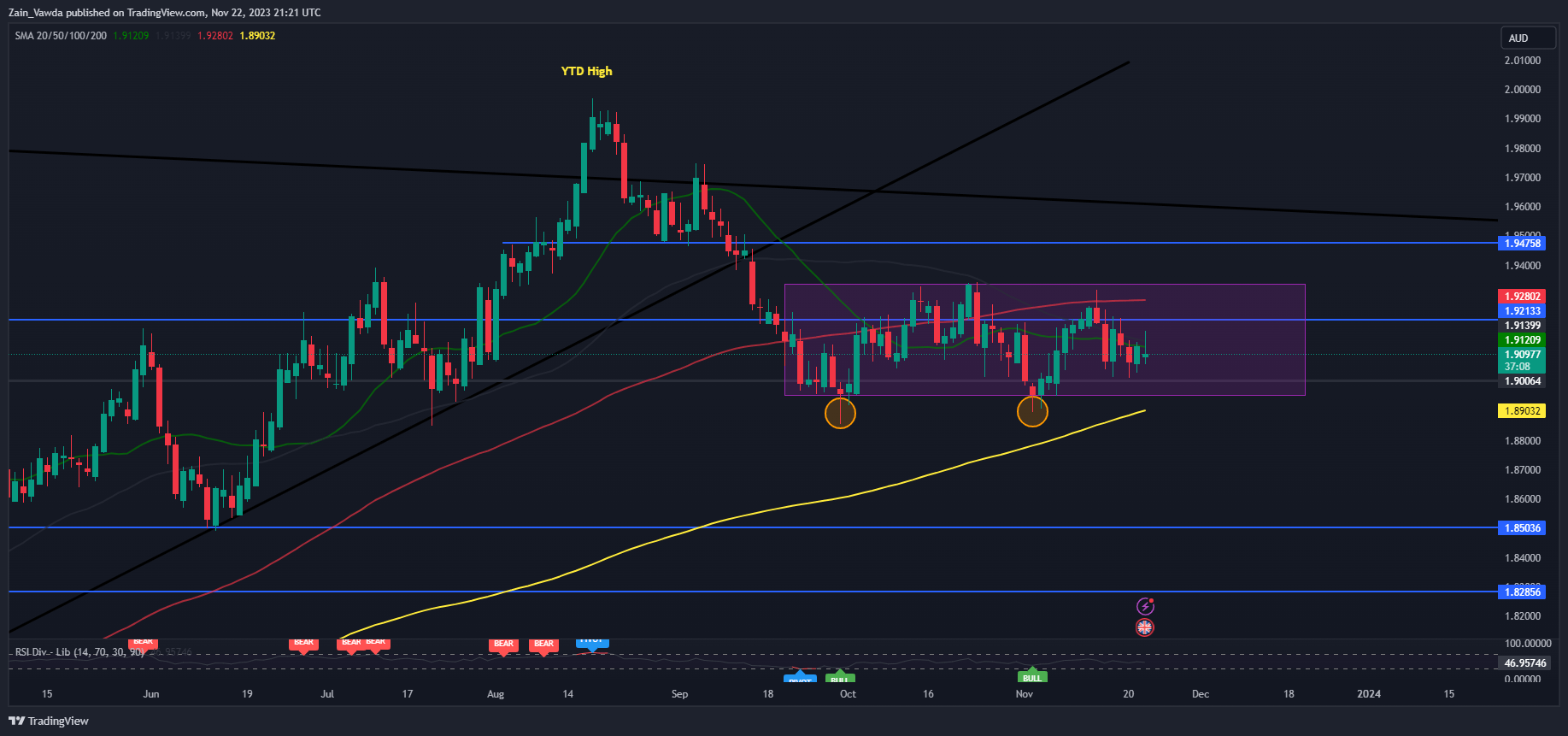

GBPAUD has been rangebound for the best part of two months. For many pairs a 400-pip range is quite large but in the case of an exotic like GBPAUD it is not. As things stand there is a clearly defined range and some key areas of support and resistance which may be used for potential opportunities in the interim, which i will highlight below.

Support on the downside rests at the 1.9000 handle and just below at the 1.8950 mark. A move lower also brings the possibility that we may spike slightly lower to tap into the 200-day MA at 1.8911.

Key Levels that may provide resistance for potential shorts will be the 1.9211 area and then the 1.9278 before the range high at 1.9338 comes into focus. All these levels may provide an opportunity for potential shorts as even a breakout will only serve to improve the risk to reward ratio.

GBP/AUD Daily Chart

Source: TradingView, prepared by Zain Vawda

For tips and tricks regarding the use of client sentiment data, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -6% | -1% |

| Weekly | 2% | 0% | 1% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0