Australian Dollar Jumps on Shocker CPI Data. Will AUD/USD Go Higher on an RBA Hike?

[ad_1] Australian Dollar, AUD/USD, CPI, US Dollar, RBA, Real Cash Rates – Talking Points The Australian Dollar found legs after CPI figures beat Q3 forecasts Both the headline and trimmed measures revealed tight price pressures The RBA might be looking for a move. If they lift rates, will AUD/USD get a boost? Recommended by Daniel

[ad_1]

Australian Dollar, AUD/USD, CPI, US Dollar, RBA, Real Cash Rates – Talking Points

- The Australian Dollar found legs after CPI figures beat Q3 forecasts

- Both the headline and trimmed measures revealed tight price pressures

- The RBA might be looking for a move. If they lift rates, will AUD/USD get a boost?

Recommended by Daniel McCarthy

Get Your Free AUD Forecast

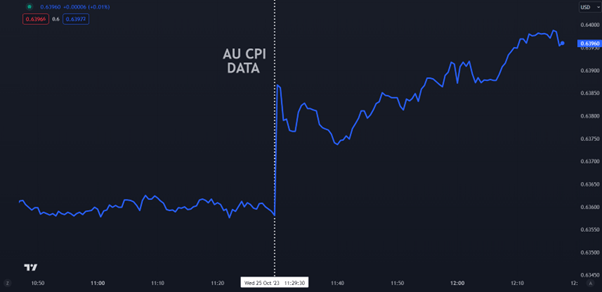

The Australian Dollar made gains in the aftermath of headline CPI of 5.4% beating forecasts of 5.3% year-on-year to the end of September and against 6.0% previously.

Perhaps crucially, the September quarter-on-quarter headline CPI was 1.2% rather than the 1.1% anticipated and 0.8% prior. This represents a re-acceleration of price pressures.

The RBA’s preferred measure of trimmed-mean CPI was 5.2% year-on-year to the end of September instead of estimates of 5.0% and 5.9% previously.

The trimmed mean quarter-on-quarter CPI read of 1.2% was above the 1.0% forecast and prior.

Today’s CPI is undeniably undesirable, especially for the RBA’s preferred trimmed mean measure.

Some commentators are at ease about today’s CPI, citing that the annual number has decreased. This decrease in the yearly figure is the base effect rather than an indication of the current state of play. Q/Q headline CPI for 3Q 2022 was 1.8% against today’s 3Q 2023 read of 1.2%, which allows for a drop in the annual number.

The problem for policymakers is that inflation has been reignited over the third quarter.

The lead-up to today’s CPI figure saw an intriguing run of commentary from the RBA. Let’s go to the Hansard –

Wednesday 11th – RBA Assistant Governor Chris Kent said, “Some further tightening may be required to ensure that inflation, that is still too high, returns to target.”

Tuesday 17th October – RBA October meeting minutes published and stated, “The Board has a low tolerance for a slower return of inflation to target than currently expected. Whether or not a further increase in interest rates is required would, therefore, depend on the incoming data and how these alter the economic outlook and the evolving assessment of risks.”

Wednesday 18th October – RBA Governor Michele Bullock said, “The problem is we’ve had shock after shock after shock. The more that keeps inflation elevated, even if it’s from supply shocks, the more people adjust their thinking.”

Tuesday 24th October – RBA Governor Michele Bullock said in regards to getting inflation down, “It is possible that this can be done with the cash rate at its current level but there are risks that could see inflation return to target more slowly than currently forecast. The Board will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation.”.

She also restated, “The Board has been clear that it has a low tolerance for allowing inflation to return to target more slowly than currently expected.”

Recommended by Daniel McCarthy

Trading Forex News: The Strategy

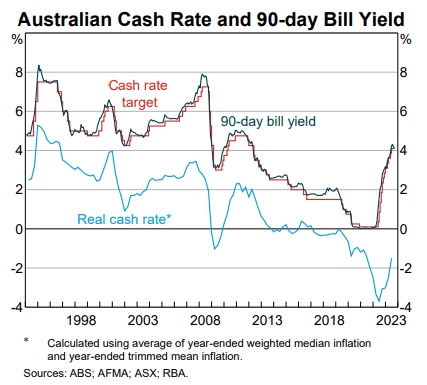

Looking at the chart below, published by the RBA earlier this month, two aspects stand out.

First is the depth of the negative real cash rate and second, the large gap between the real cash rate and the return on the 90-day Bank Bill.

The real cash rate is the RBA’s cash rate target less the headline inflation rate (CPI).

Negative real interest rates undermine the wealth of the nation with today’s money being more valuable than cash in the future. Savers in particular are most punished by these circumstances.

Of course, we know the answer is simple. The 2-ways to correct the situation are by lifting interest rates or by getting inflation down.

The chart reflects the recent achingly high inflation reads relative to the last 30-years, since inflation targeting was mandated by the Australian Government to the RBA.

That mandate went through a review process under the current Government and some tinkering was undertaken.

Of significance is that the inflation target has been maintained. Today’s reacceleration of price pressures depresses the real cash rate further. The longer inflation stays high and interest rates are unchanged, the more damage is done to the economy in the long run.

Going into today’s data, the interest rate futures markets ascribed close to a 0% probability of a 25 basis-point hike by the RBA at their monetary policy meeting on November 7th.

The dial moved toward a 60% possibility of a hike post-CPI.

The pandemic is mostly consigned to the history books, but inflation is still with us and growing.

Former RBA Governors have previously said, in the overall sense, that 25 basis points is here nor there for monetary policy. If the RBA does not hike at either the November or December meetings, then the next opportunity will not be until February.

An early insurance policy for the new Governor might be in the offing.

Recommended by Daniel McCarthy

How to Trade AUD/USD

AUD/USD SHORT TERM REACTION TO CPI BEAT

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0