Australian Dollar Holds Gains After CPI Accelerates; What’s Next for AUD/USD, AUD/NZD?

[ad_1] Australian Dollar Vs US Dollar, Australia Monthly CPI – Talking Points: AUD held early gains after Australia monthly CPI rose last month. AUD/USD faces still resistance ahead; AUD/NZD is testing key support. What are the key levels to watch in AUD/USD and AUD/NZD? Recommended by Manish Jaradi How to Trade AUD/USD The Australian dollar

[ad_1]

Australian Dollar Vs US Dollar, Australia Monthly CPI – Talking Points:

- AUD held early gains after Australia monthly CPI rose last month.

- AUD/USD faces still resistance ahead; AUD/NZD is testing key support.

- What are the key levels to watch in AUD/USD and AUD/NZD?

Recommended by Manish Jaradi

How to Trade AUD/USD

The Australian dollar held early gains after consumer price inflation accelerated last month, reinforcing the growing view that interest rates will remain higher for longer.

Australia’s CPI accelerated to 5.2% on-year in August, in line with expectations Vs. 4.9% in July, and 5.4% in June. While the monthly CPI figures tend to be volatile and not necessarily a good predictor of the quarterly CPI, which holds more relevance from the Reserve Bank of Australia’s (RBA) perspective, stubbornly high inflation raises the risk that the RBA remains hawkish for the foreseeable future.

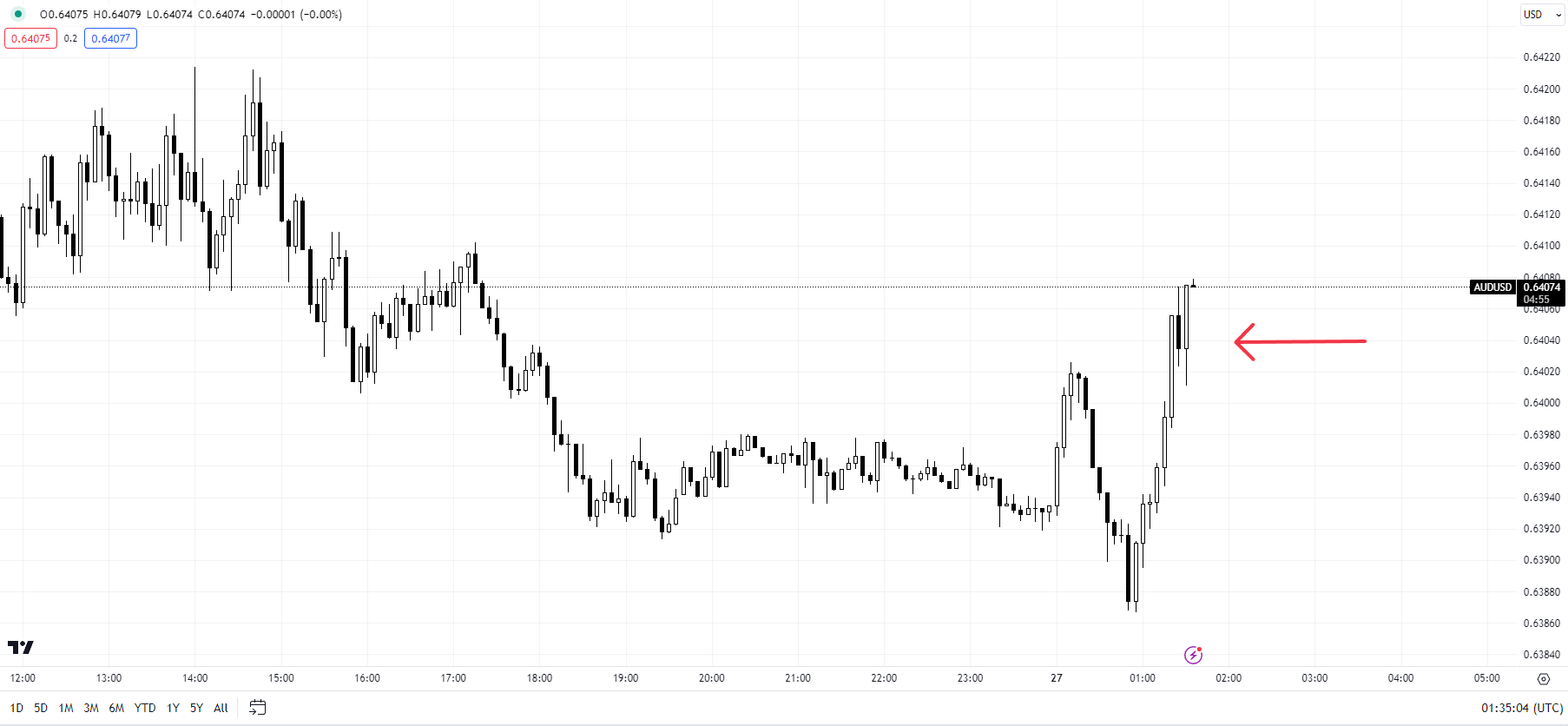

AUD/USD 5-minute Chart

Chart Created by Manish Jaradi Using TradingView

Former chief of RBA Philip Lowe said earlier this month that there is a risk that wages and profits could run ahead of levels that are consistent with inflation returning to target in late 2025. RBA held the benchmark rate steady at 4.1% at its meeting earlier this month saying recent data is consistent with inflation returning to the 2-3% target range by late 2025. Markets are pricing in one more RBA rate hike early next year and have priced out any chance of a cut in 2024.

Meanwhile, risk appetite has taken a back seat, thanks to surging US yields amid the growing conviction of higher-for-longer US rates. Chicago Fed president Austan Goolsbee highlighted the central bank’s priority, saying the risk of inflation staying higher than the Fed’s 2% target remains a greater risk than higher rates slowing the economy more than needed.

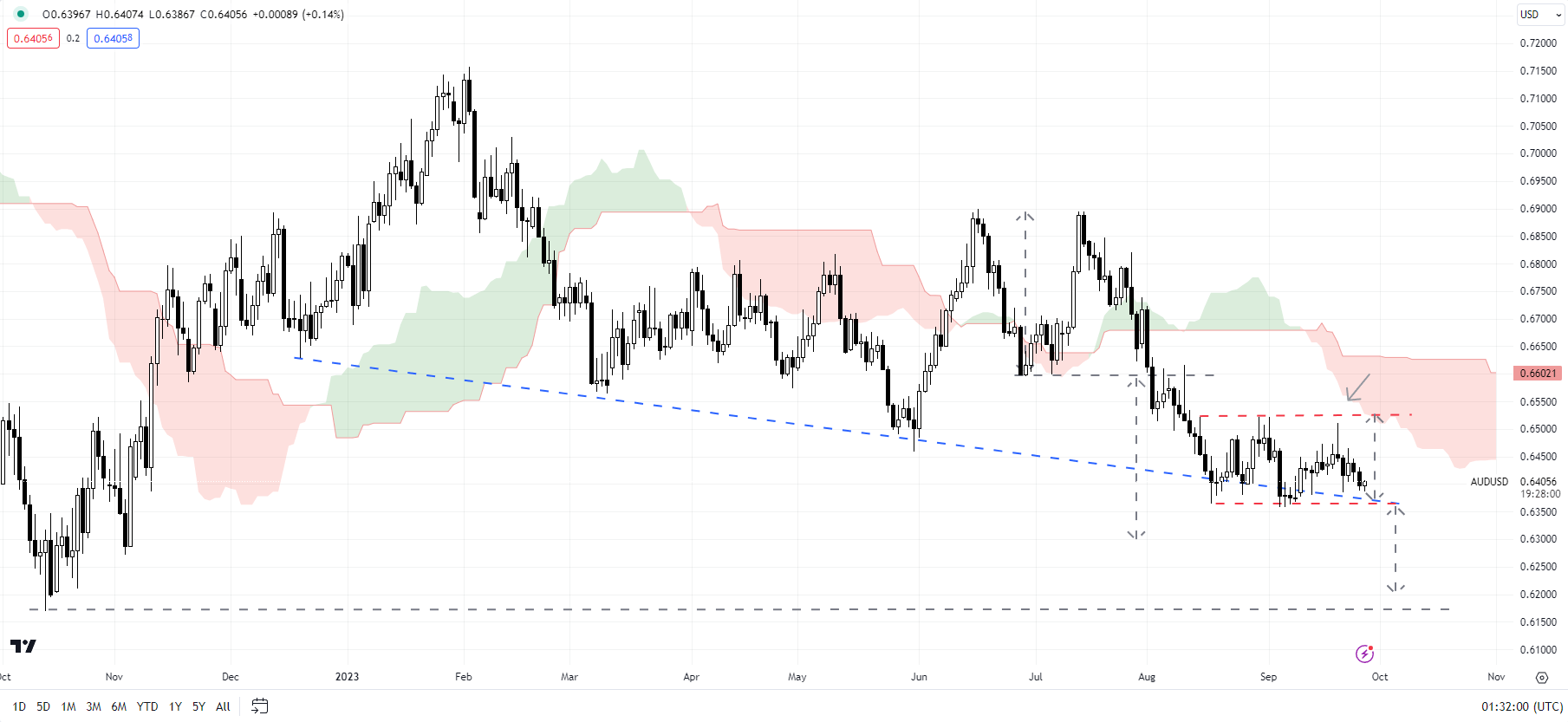

AUD/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

Furthermore, worries regarding the Chinese economy and geopolitical tensions continue to weigh on sentiment. While authorities have responded in recent months with several support measures, those measures have yet to trigger a meaningful turnaround in sentiment.

AUD/USD: Holds below crucial resistance

On technical charts, AUD/USD’s rebound has run out of steam at vital resistance at the late-August high of 0.6525. The possibility of a minor rebound was highlighted in the previous updates – see “US Dollar Flirts with Resistance After Powell; EUR/USD, GBP/USD, AUD/USD Price Action,” published August 28, and “Australian Dollar Looks to Recoup Losses Ahead of CPI; AUD/USD, AUD/NZD, AUD/JPY,” August 29.

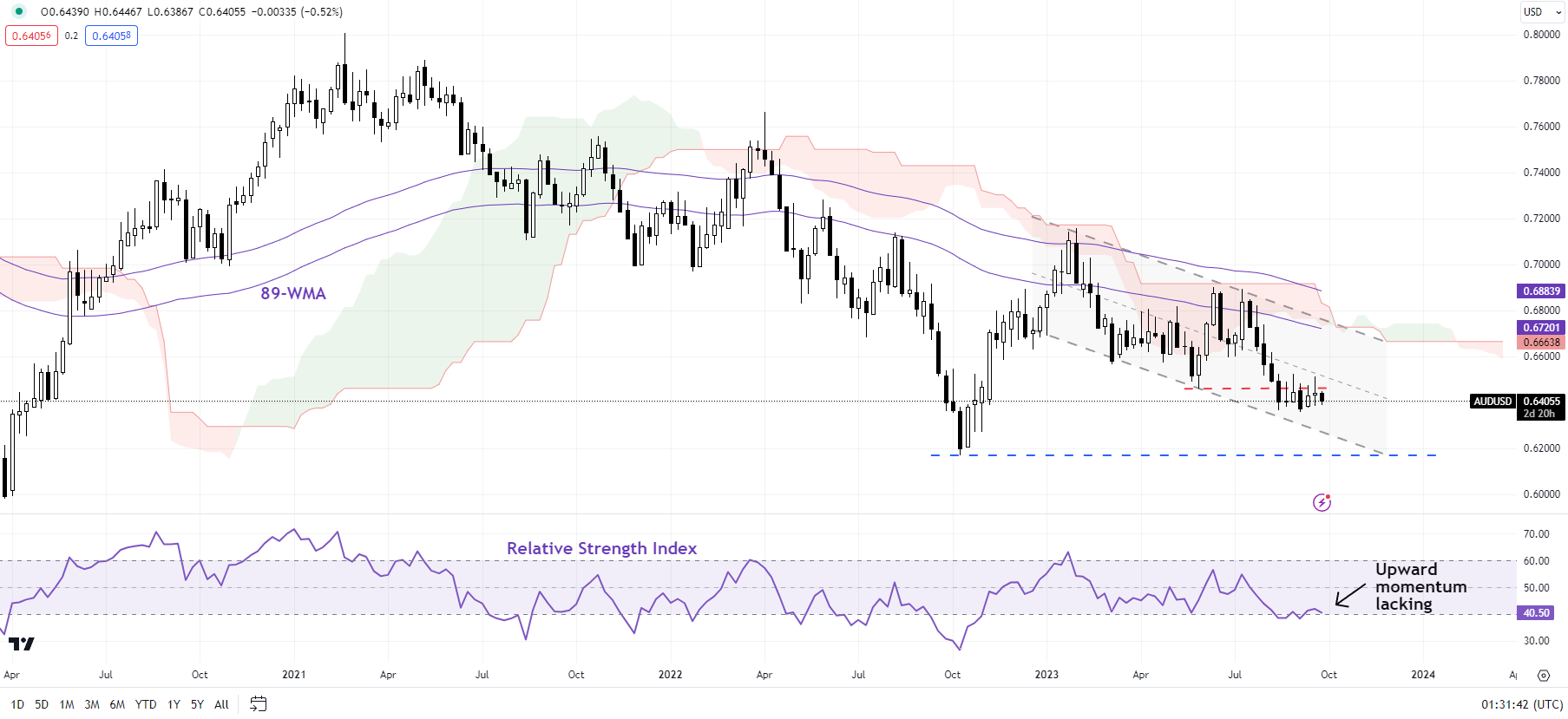

AUD/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

Given the failure so far to clear 0.6525, the path of least resistance for AUD/USD remains sideways to down, given the lack of upward momentum on higher timeframe charts (see the weekly chart). Any break below the early-September low of 0.6350 would trigger a minor double top (the August and the September highs), opening the gates toward the October 2022 low of 0.6170.

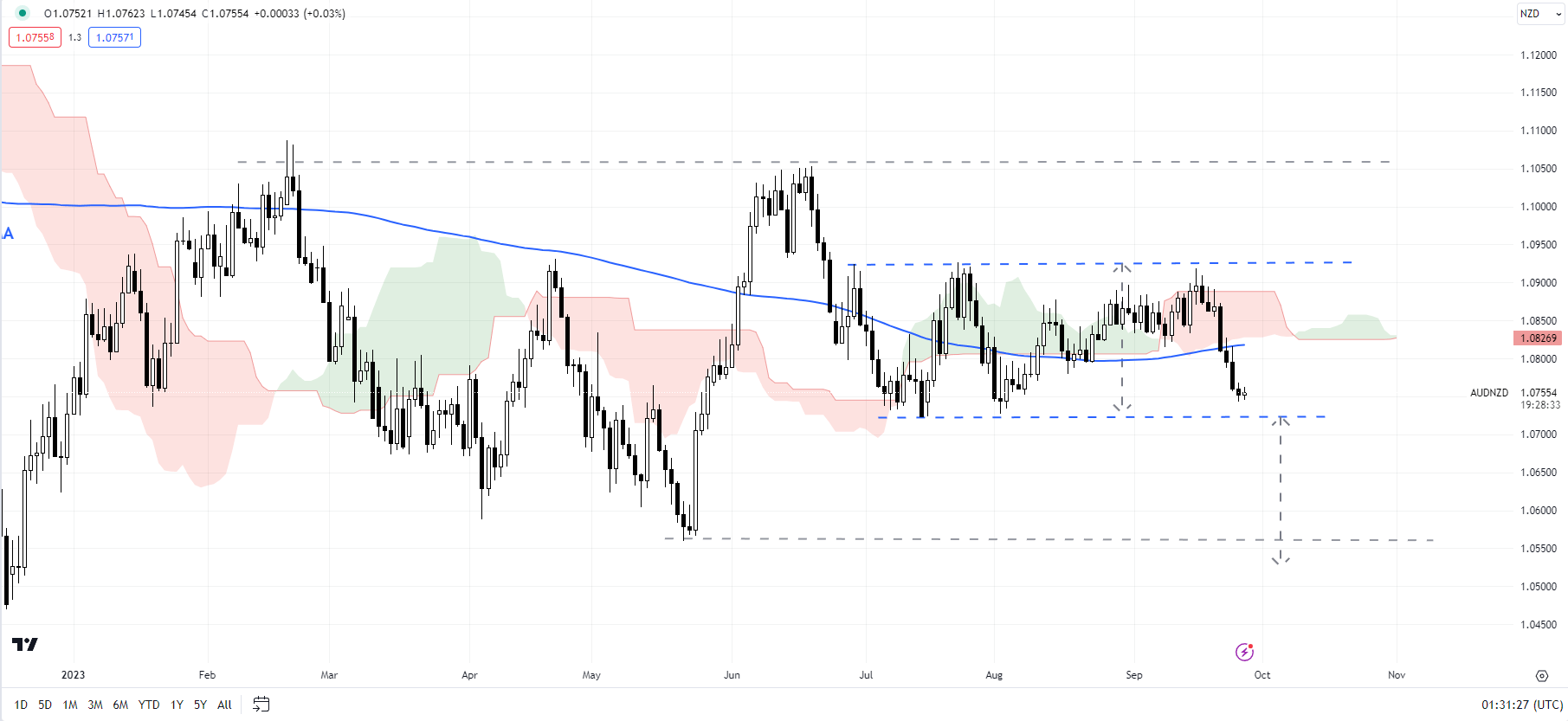

AUD/NZD Daily Chart

Chart Created by Manish Jaradi Using TradingView

AUD/NZD: At the lower end of the range

AUD/NZD is testing the lower end of the range at the July low of 1.0720. Any break below could clear the path initially toward the May low of 1.0550. However, broadly the cross remains in the well-established range 1.05-1.11 so a break below 1.0550 wouldn’t necessarily shift the bias to unambiguously bearish.

Recommended by Manish Jaradi

Traits of Successful Traders

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Accelerates ، AUDNZD ، AUDUSD ، Australian ، CPI ، Dollar ، Gains ، Holds ، Whats

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0