Australian Dollar Blipped Up on China Data. Will AUD/USD Continue to Recover?

[ad_1] Australian Dollar, China PMI, Hang Seng Index, CSI 300, AUD/USD, RBA – Talking Points The Australian Dollar briefly pipped higher after Chinese data beat expectations If China can gain economic momentum, it could have implications for AUD Tomorrow’s RBA meeting moves into view. Will AUD/USD continue to recover? Recommended by Daniel McCarthy How to

[ad_1]

Australian Dollar, China PMI, Hang Seng Index, CSI 300, AUD/USD, RBA – Talking Points

- The Australian Dollar briefly pipped higher after Chinese data beat expectations

- If China can gain economic momentum, it could have implications for AUD

- Tomorrow’s RBA meeting moves into view. Will AUD/USD continue to recover?

Recommended by Daniel McCarthy

How to Trade AUD/USD

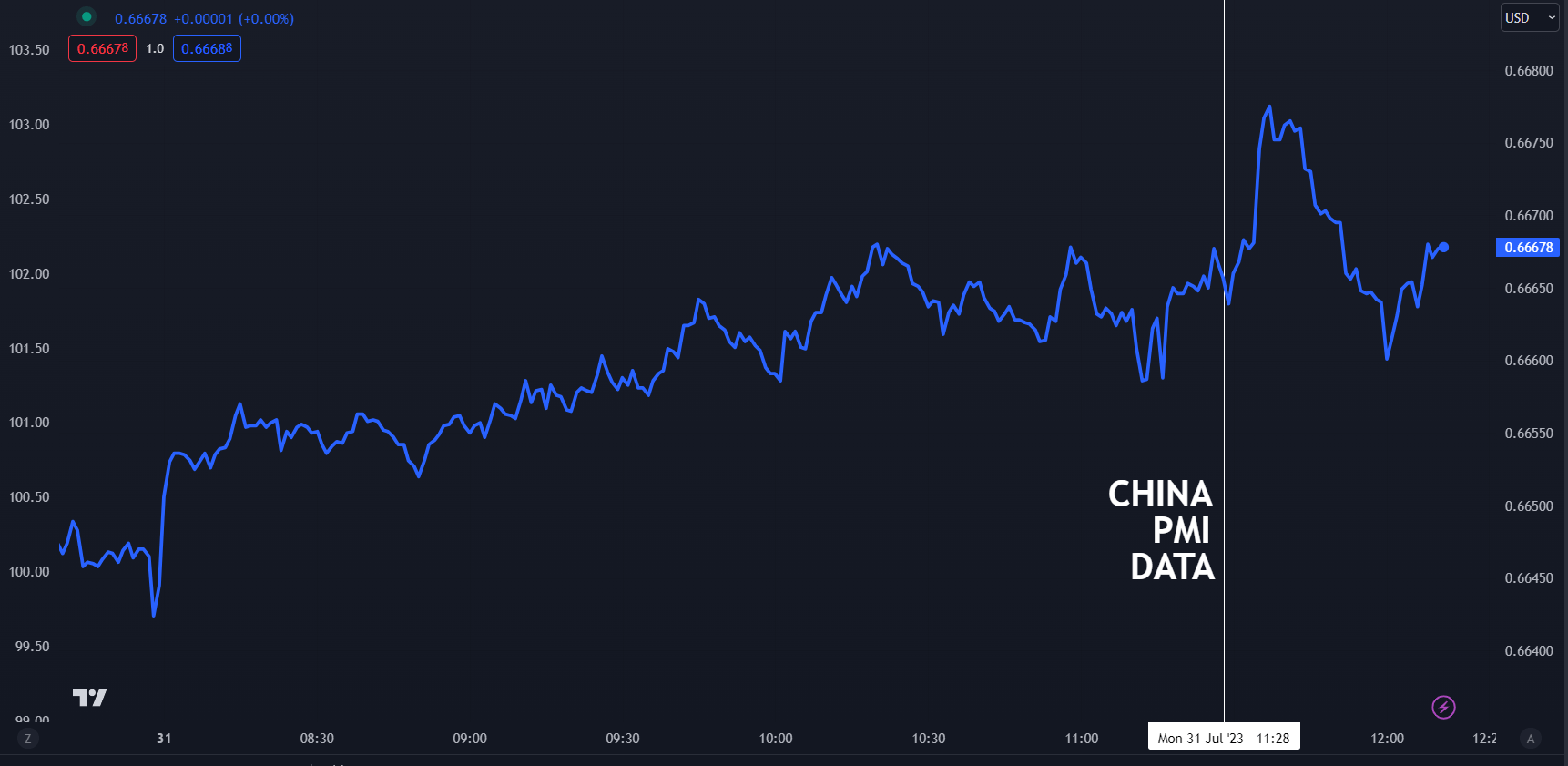

The Australian Dollar initially jumped after Chinese manufacturing PMI beat forecasts before settling back to near where it started.

The data appears to have provided some optimism that the world’s second-largest economy might be able to reignite growth as it re-emerges out of the pandemic era.

Chinese manufacturing PMI for May printed at 49.3 against the 48.9 anticipated and the non-manufacturing came in at 51.5, rather than the 53.0 forecast. This combined to give a composite PMI read of 51.1 against 52.3 previously.

The market tends to place more emphasis on manufacturing PMI due to the wider implications for economic activity.

The China PMI indices are the result of a survey of 3,000 manufacturers across China, mostly large firms. It is a diffusion index, so a reading over 50 is viewed as a positive of the economic outlook for the Middle Kingdom.

Recommended by Daniel McCarthy

How to Trade FX with Your Stock Trading Strategy

Earlier today, the Peoples Bank of China (PBOC) set the Yuan reference rate at 7.1305 below market estimates of 7.1532.

Hong Kong’s Hang Seng (HSI) and mainland China’s CSI 300 indices made a 2-month high after the data on the back of a solid rally last week.

While the data boosted the prospects for Australian exporters, a focus for Aussie Dollar traders this week will be Tuesday’s Reserve Bank of Australia’s (RBA) monetary policy meeting. There is degree of uncertainty about whether or not they will tighten rates or not.

A Bloomberg survey of economist is only marginally in favour of a 25 basis point hike but the interest rate futures market see only a very minimal chance of a lift in the cash rate.

AUD/USD PRICE REACTION – 1-MINUTE CHART

Chart created in TradingView

AUD/USD TECHNICAL ANALYSIS

Although AUD/USD collapsed last week it remains in the five-month trading range of 0.6459 – 0.6900.

The medium-term bearishness unfolded after a Double Top was formed as mentioned here at the time.

The selloff on Friday saw the price move below all-period daily Simple Moving Averages (SMA). This may indicate that more bearish momentum might evolve.

It is unusual for all these SMAs to lie in the tight band that they currently are between 0.6690 and 0.6740. Bulls would find more comfort if this band were overcome.

Resistance could be at the recent high near 0.6820 ahead of the prior peaks in the 0.6900 – 0.6920 zone ahead of possible resistance in the 0.7010 – 0.7030 area.

On the downside, support might be near the recent low of 0.6622 ahead of the previous lows of 0.6600, 0.6595, 0.6574 and 0.6565.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0