AUD/USD ANALYSIS & TALKING POINTS

- RBA minutes and stronger iron ore prices back AUD.

- US retail sales and Fed speak the focal point for today’s session.

- AUD recovery cannot be labeled as a reversal just yet.

Elevate your trading skills and gain a competitive edge. Get your hands on the Australian dollar Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar managed to find support against a stringer USD this Tuesday morning after some comparatively hawkish commentary via the Reserve Bank of Australia (RBA) meeting minutes left the door open for possible future interest rate hikes. Some statements from the release include:

“low tolerance for a slower return to target”

“labor market has reached a turning point”

“further tightening may be required if inflation is more persistent”

“challenges to China economy could impact Australia if not contained”

The weak Chinese economy has weighed negatively on the Aussie dollar of recent despite stimulus measures to promote growth. Tomorrow’s Chinese GDP report will likely provide some volatility around the AUD/USD pair.

From an export perspective, Australia’s top export iron ore rallied today, supplementing AUD upside. US retail sales (see economic calendar below) will be the next high impact release later today and if actual data falls in line with forecasts, the AUD could rally further. Fed speak will be scattered throughout the trading day and will give insight into the Fed’s thinking considering recent economic data and the Israel-Hamas conflict. Ongoing efforts to diplomatically resolve the war has decreased risk aversion in global markets adding to AUD positivity.

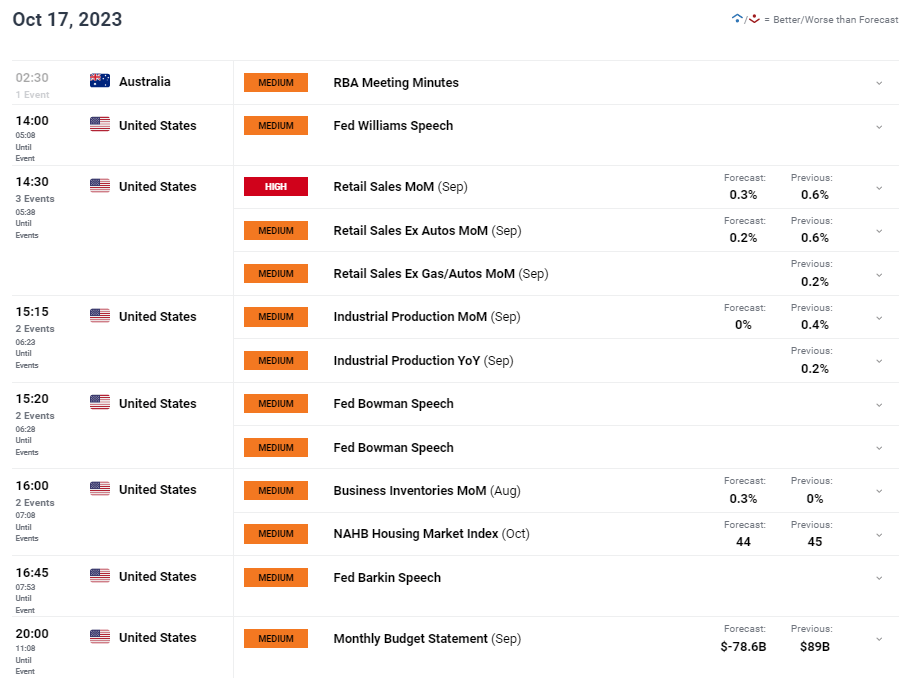

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

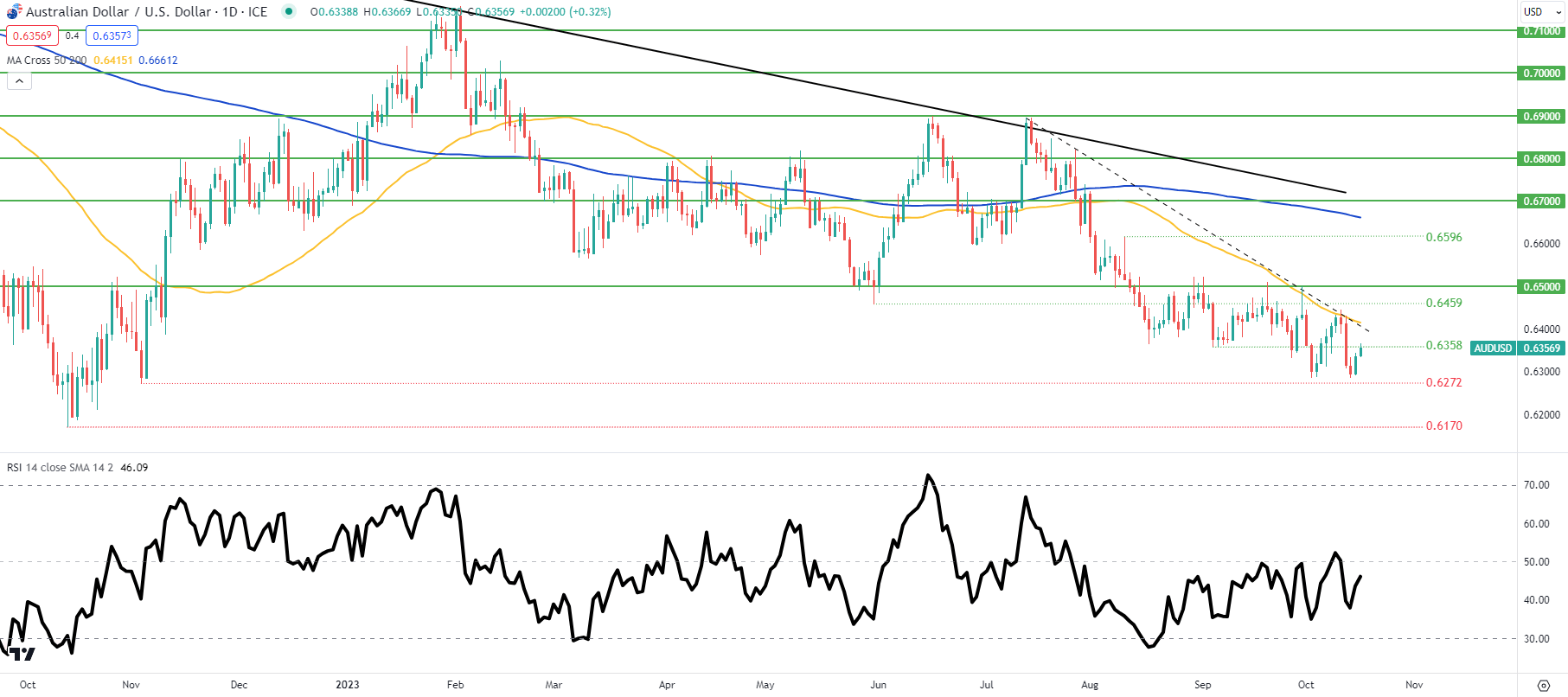

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

Daily AUD/USD price action above yet again did not breach the November 2022 swing low at 0.6272 but could be forming a descending triangle type formation that could see the pair breakdown further. That being said, a confirmation close above trendline resistance (dashed black line)/50-day moving average (yellow) could invalidate this pattern and see a run up back towards the 0.6459 level and beyond.

Key resistance levels:

- 0.6500

- 0.6459

- 50-day moving average (yellow)/Trendline resistance

- 0.6358

Key support levels:

IG CLIENT SENTIMENT DATA: MIXED (AUD/USD)

IGCS shows retail traders are currently net LONG on AUD/USD, with 80% of traders currently holding long positions.

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0