AUD/USD TECHNICAL OUTLOOK

- AUD/USD rises for the fourth straight day, pressing against trendline resistance.

- Despite its recent recovery, the Aussie maintains a bearish profile.

- This article looks at AUD/USD’s key technical levels worth watching in the coming trading sessions.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Oil Price Forecast – Geopolitical Turmoil to Spur Bullish Energy Market Sentiment

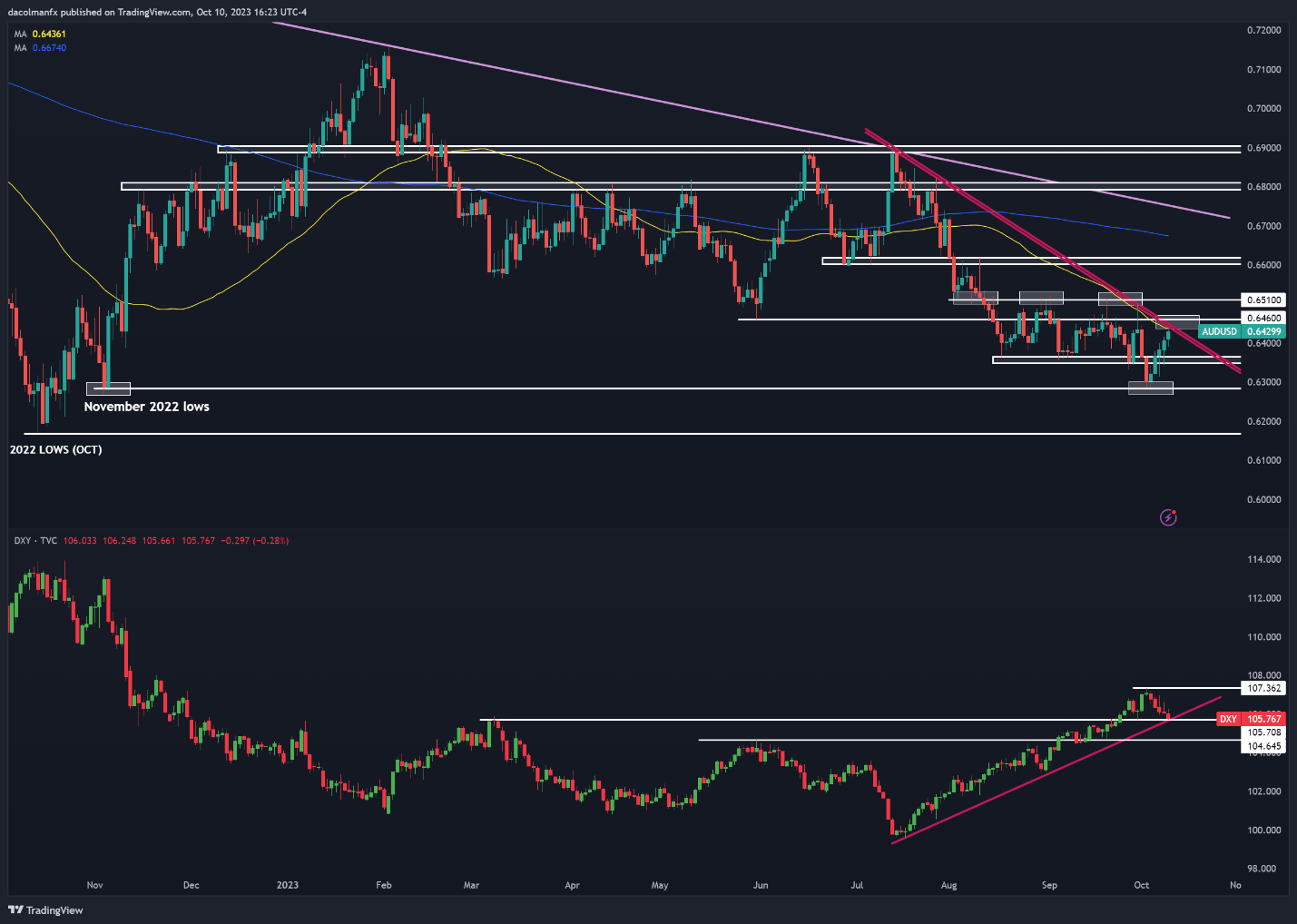

Market sentiment has improved in recent days, allowing AUD/USD to make a moderate turnaround from the middle of last week, when it briefly hit its lowest level since November last year. The Aussie’s recovery phase has coincided with the pullback in the broader U.S. dollar, which has been correcting lower for the past four trading sessions, as shown in the daily chart below.

Despite the rebound, AUD/USD maintains a negative profile in the near term, with the exchange rate significantly below important moving averages and situated beneath a short-term descending trendline that has been guiding the market lower since July. However, the tide could turn in the pair’s favor if the bulls manage to take out overhead resistance, stretching from 0.6440 to 0.6460.

In the event that prices breach the 0.6440/0.6460 ceiling decisively, buying momentum could gather pace, setting the stage for a rally towards 0.6510. With continued strength, the bullish camp might gain the confidence to mount an assault on the psychological 0.6600 handle. Beyond that threshold, the focus transitions to the 200-day simple moving average.

On the flip side, should sellers reemerge and initiate a bearish reversal from current levels, the first relevant support area rests around 0.6350. AUD/USD may find stability around this floor during a pullback before bouncing back, but in the case of a breakdown, downward pressure could intensify, laying the groundwork for a descent towards the 2023 lows a touch below 0.6300.

Eager to gain insights into AUD/USD’s future path? Secure your Q4 trading forecast, offering an in-depth technical and fundamental analysis of the Australian dollar!

Recommended by Diego Colman

Get Your Free AUD Forecast

AUD/USD TECHNICAL CHART

AUD/USD Chart Prepared Using TradingView

Discover the power of crowd mentality. Download our free sentiment guide to understand how changes in AUD/USD’s positioning can act as a key technical indicator of upcoming price movements.

| Change in | Longs | Shorts | OI |

| Daily | -5% | 11% | -1% |

| Weekly | -19% | 71% | -5% |

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0