POUND STERLING ANALYSIS & TALKING POINTS

- BoE peak rate market pricing continues to fall.

- UK labor data & US CPI the focal points this week.

- 1.25 tentatively holds.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD FUNDAMENTAL BACKDROP

The British pound has started the week on the front foot as the US dollar softened but with key US economic data scheduled this week (see economic calendar below), the downside may be temporary. Markets will be focused on US CPI that is expected to show mixed figures on both headline and core metrics for August. Any signs of ‘stickiness’ could maintain USD ascendency and weigh negatively on the pound.

From a UK perspective, jobs data that has been steadily weakening will be under the spotlight. Although the weakness seen in unemployment and employment change measures have been a positive from a Bank of England (BoE) standpoint, average earnings continues to add inflationary pressure within the UK. This factor will be of utmost importance from a currency viewpoint and if the upward trend is to extend then the hawkish rhetoric could gain traction once more.

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

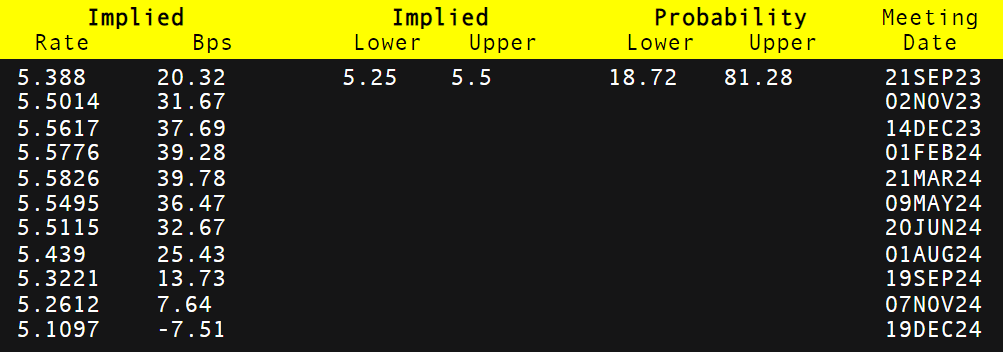

Market expectations (refer to table below) now sees the peak just under 40bps; revised lower from last week where estimates were closer to 50bps. The messaging from the BoE is one of sustained elevated interest rates as opposed to additional hikes which has led to the dovish re-pricing seen below.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

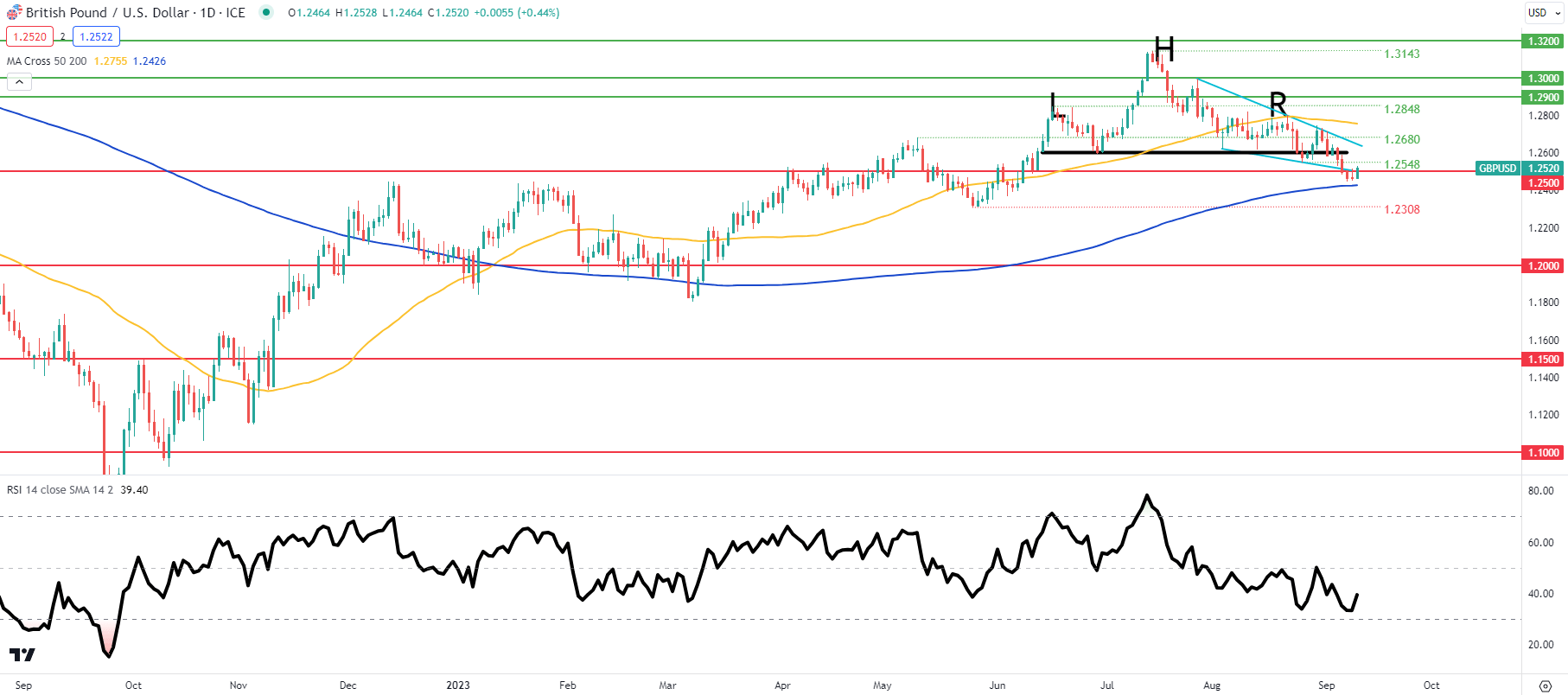

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart above is yet to show any convincing breakouts as markets keenly await the aforementioned fundamental releases. It is clear that traders remain cautious ahead of these risk events and are seeking guidance before committing to a dominant view. The 200-day moving average (blue) still holds as support but if there is any weakness via the UK jobs report, this zone may soon turn to resistance while exposing subsequent support levels.

Key resistance levels:

- 1.2680

- Wedge resistance

- 1.2548

Key support levels:

- 1.2500

- 200-day moving average (blue)

- 1.2308

MIXED IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 62% of traders holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GBP/USD sentiment and outlook!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰