A Temporary Pause Before Bullish Continuation?

[ad_1] USD/JPY, EUR/JPY FORECAST: Your Free Guide to the Yen for the Rest of Q3 Below Recommended by Zain Vawda Get Your Free JPY Forecast MOST READ: Finance Minister Suzuki Sticks to Script as EUR/JPY, USD/JPY Advance The Yen has held firm this morning against the Euro and the Greenback as USD/JPY reaches overbought territory.

[ad_1]

USD/JPY, EUR/JPY FORECAST:

Your Free Guide to the Yen for the Rest of Q3 Below

Recommended by Zain Vawda

Get Your Free JPY Forecast

MOST READ: Finance Minister Suzuki Sticks to Script as EUR/JPY, USD/JPY Advance

The Yen has held firm this morning against the Euro and the Greenback as USD/JPY reaches overbought territory. A possible retracement lies ahead but will it be another shallow pullback before bulls seize control once more? It appears so with no change from the BoJ and a hawkish tone from the Fed Minutes release USD/JPY looks to be in for an interesting end to the week.

FED MINUTES AND CHINA’S WOES SOUR SENTIMENT

The Federal Reserve minutes release yesterday provided mixed messaging but leaned on the hawkish side. The minutes revealed that Fed policymakers still see the need for higher rates but share concerns about over-tightening with no recession forecast for 2023. The Fed also acknowledged tighter credit conditions and concerns around the commercial real estate market with declining values in the sector affecting Banks.

The situation around China continues to dampen sentiment as the Yuan slipped towards its 2007 lows. This prompted a response from Chinese Authorities as they look to instill a sense of calm with a stronger than expected reference rate for the Yuan and the largest injection of cash into the financial system since February. As uncertainty continues, we heard the US treasury issue a warning as well about the potential impacts of the situation in China. A continuation of this theme would likely result in further US Dollar strength as safe haven flows continue which could push USD/JPY toward the coveted 150.00 psychological level once more.

Given the Current Bullish Trend on Yen Pairs Get Your Free Guide to Trend Trading Below

Recommended by Zain Vawda

The Fundamentals of Trend Trading

JAPANESE DATA AND THE DAY AHEAD

In the Asian session we did have some positive data for the Yen as imports and exports both came in above forecasts, but machinery orders and the balance of trade figure came in lower than expected.

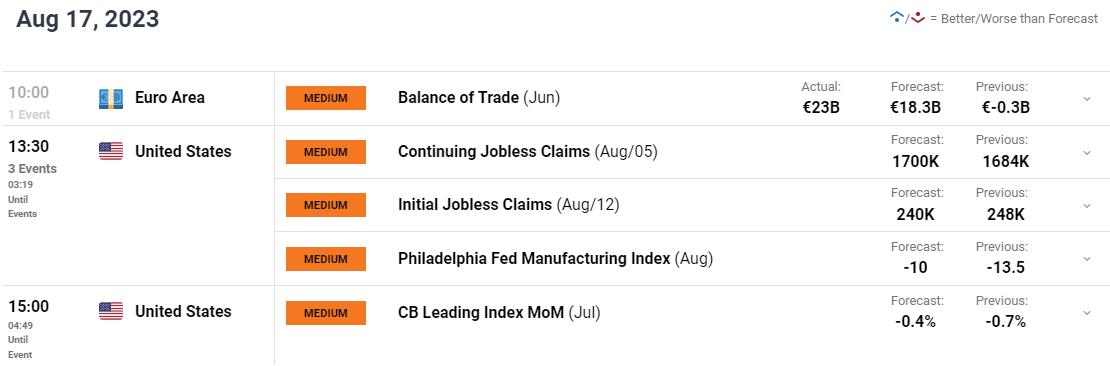

On the data front today it is a relatively quiet one with some medium impact US data expected in the form of jobless claims and the Philadelphia Manufacturing Index. Neither of these events are expected to have a significant impact on the US Dollar.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

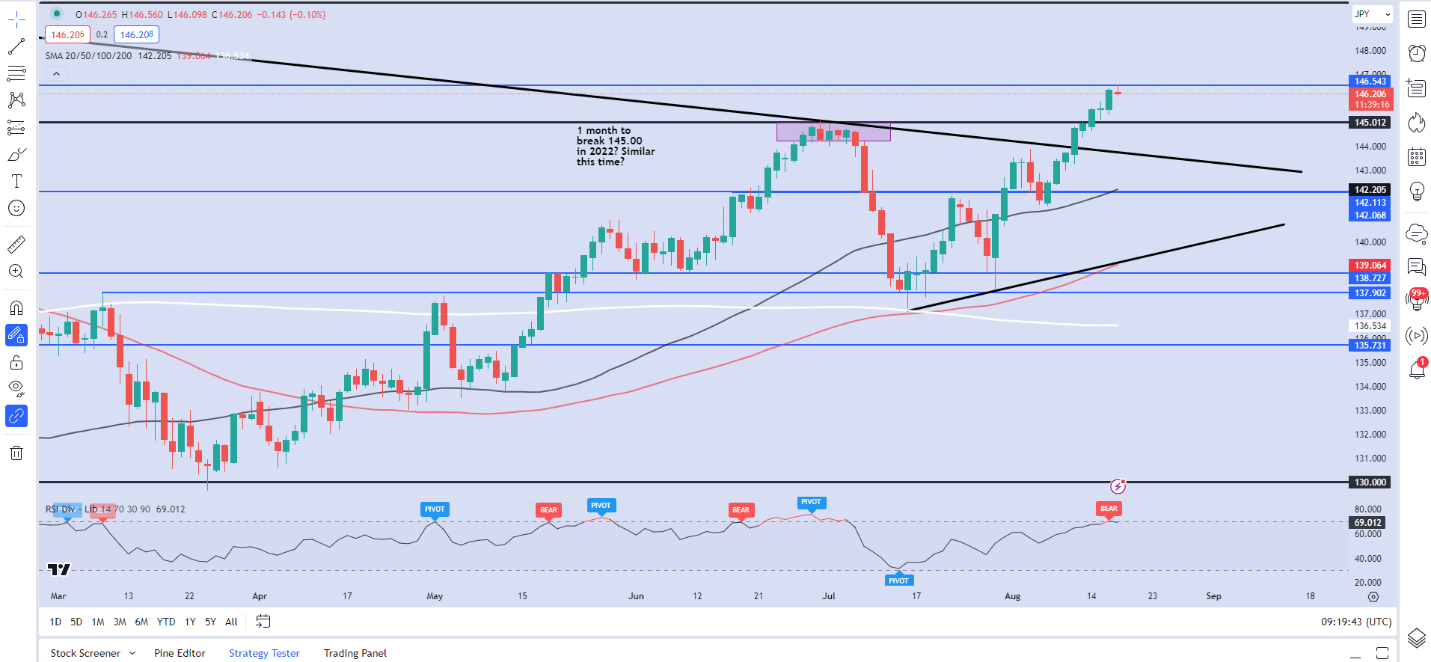

USDJPY is on a tear at the minute and as discussed in my piece on Tuesday has run into resistance at the 146.50 handle. Price has since stalled and dropped back toward the 146.00 handle with support now at the 145.00 before a retest of the descending trendline becomes a possibility. The RSI (14) has also reached overbought territory which is a positive sign for a potential pullback. The question however is, will it be a deep pullback or more of a consolidation phase before the next leg to the upside?

As I have mentioned over the past couple of weeks, FX intervention from Japanese authorities remains a possibility. The issue is there is no warning or sign as to when this may occur with Japanese authorities saying one thing but doing the complete opposite of late. Barring intervention, I honestly don’t see any other reason to expect a significant push to the downside with any push lower likely to provide bulls with another opportunity to join the trend.

USD/JPY Daily Chart – August 17, 2023

Source: TradingView

EURJPY

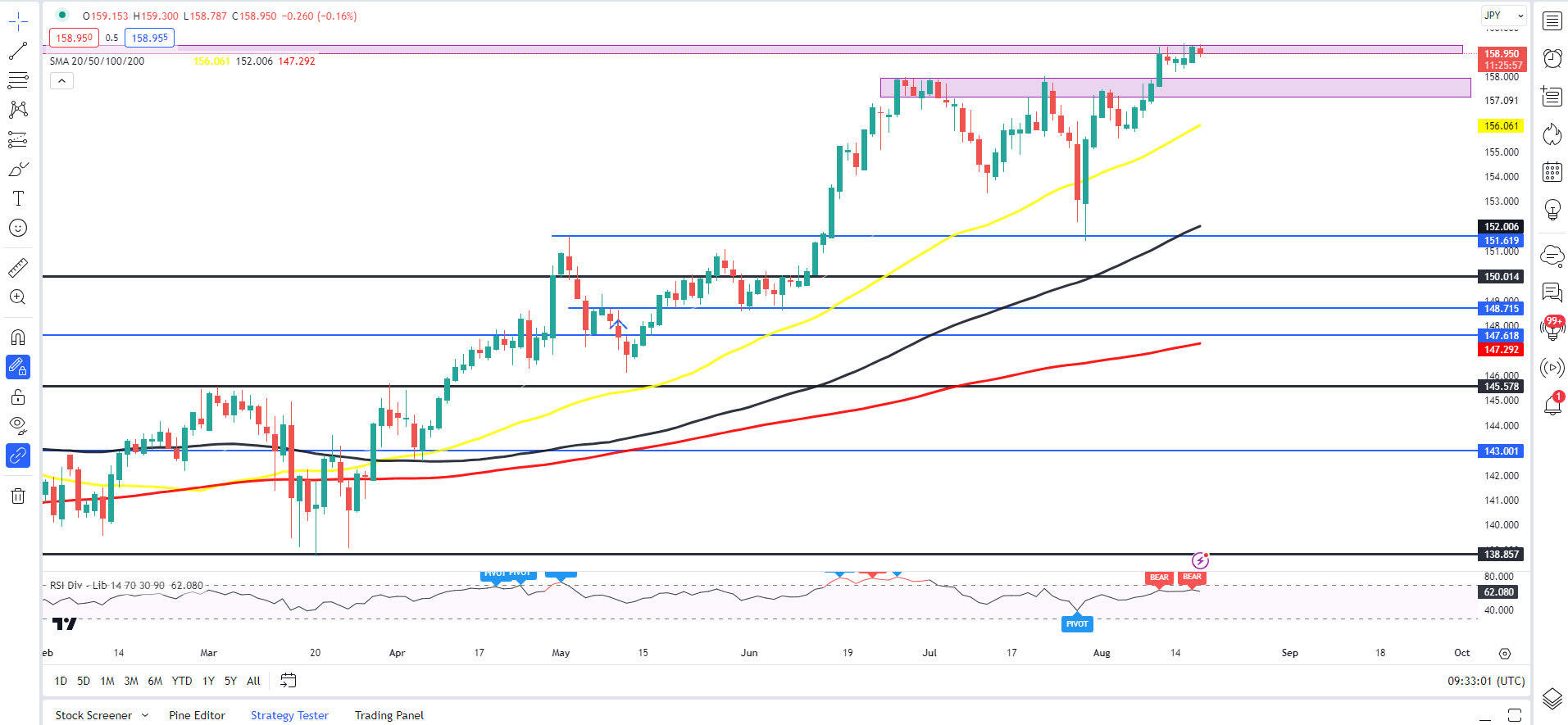

EURJPY hasn’t changed much since my Tuesday outlook remaining around the 159.00 handle. So far attempts to break higher toward the key psychological 160.00 mark. Looking beyond the 160.00 handle and there isn’t much in terms of significant resistance holding the pair back from testing multi-year highs around the 170.00. Similar to USDJPY however, I do expect the Japanese authorities to intervene should we see an aggressive move above the 160.00 handle.

EUR/JPY Daily Chart – August 17, 2023

Source: TradingView

IG CLIENT SENTIMENT

IGCS shows retail traders are overwhelmingly SHORT on EURJPY with 79% of traders Net-Short on EURJPY.

For a Full Breakdown on Client Sentiment Including Daily and Weekly Changes Get Your Free Guide Below

| Change in | Longs | Shorts | OI |

| Daily | -12% | -4% | -5% |

| Weekly | -4% | -8% | -7% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Bullish ، Continuation ، Pause ، Temporary

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0