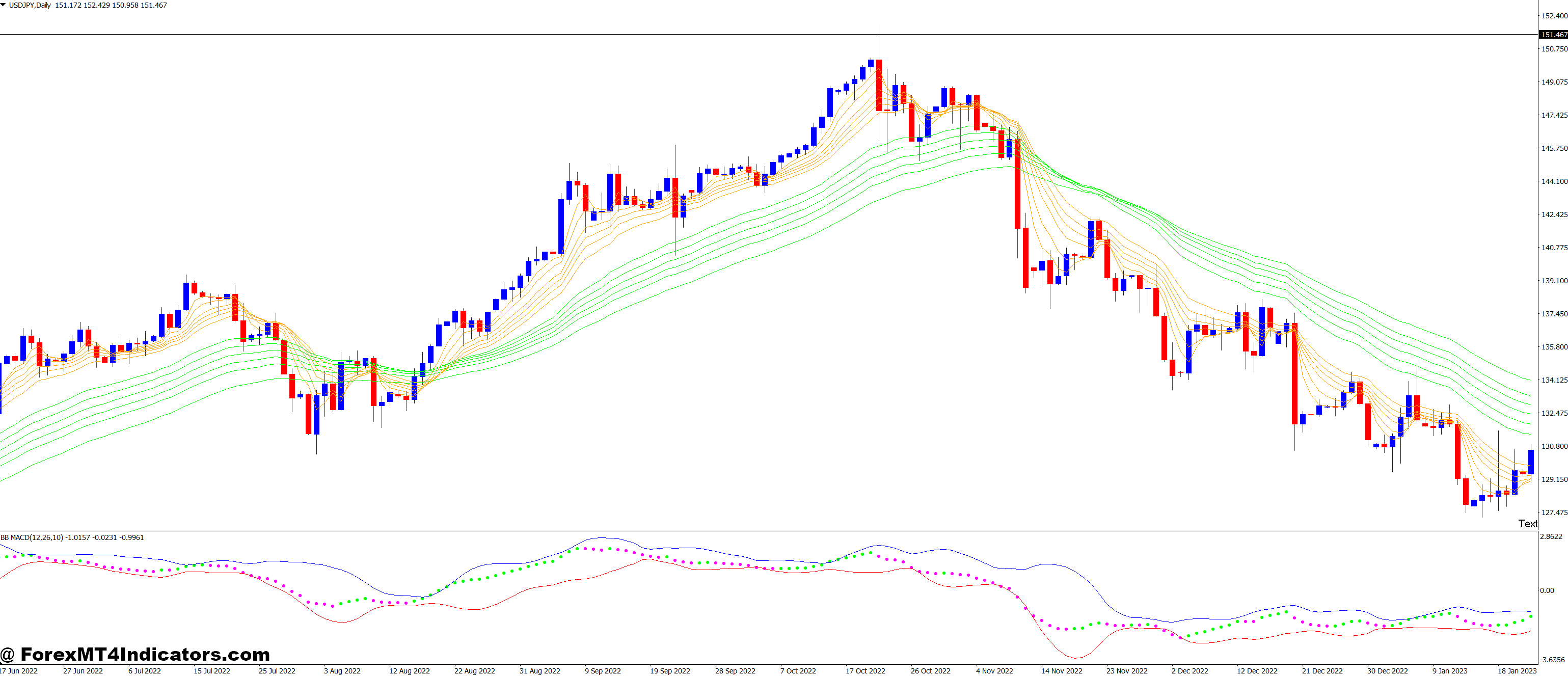

BB MACD and Guppy Long and Short Forex Trading Strategy

Are you tired of feeling lost in the Forex market? The ups and downs can be tough to handle. But there’s hope! The BB MACD and Guppy Long and Short Forex Trading Strategy is here to help. It uses Bollinger Bands, MACD, and Guppy indicators to give you clearer signals and better trades. This strategy

Are you tired of feeling lost in the Forex market? The ups and downs can be tough to handle. But there’s hope! The BB MACD and Guppy Long and Short Forex Trading Strategy is here to help. It uses Bollinger Bands, MACD, and Guppy indicators to give you clearer signals and better trades.

This strategy combines several technical indicators to improve your trading. It’s perfect for timeframes of 15 minutes or more. It has a 60-70% success rate, helping both new and seasoned traders.

Key Takeaways

- Combines Bollinger Bands, MACD, and Guppy indicators for enhanced accuracy

- Suitable for timeframes of 15 minutes or higher

- Potential success rate of 60-70%

- Works with major and minor currency pairs, gold, and oil

- Utilizes CCI Stochastic Oscillator and GMMA for entry signals

- Implements a profit target ratio of 1:1.1 to 1:1.2

- Provides clear entry and exit rules for both long and short positions

Understanding Bollinger Bands and MACD Fundamentals

Technical indicators are key in forex trading. Bollinger Bands and MACD are two important tools. They help traders make better choices.

What Are Bollinger Bands

Bollinger Bands show how much prices move. John Bollinger created them in the 1980s and 1990s. They have three lines: a middle line and two outer bands.

The bands get wider when prices move a lot. They get closer when prices are stable. This helps traders spot big moves and trends.

MACD Indicator Explained

MACD shows trends and how fast they move. It uses two moving averages: 12 and 26 days. The difference between these is the MACD line.

A 9-day moving average of the MACD is the signal line. It helps decide when to buy or sell.

The Power of Combined Indicators

Using Bollinger Bands and MACD together gives a full view of the market. Bollinger Bands show volatility and possible price jumps. MACD confirms the trend and its strength.

| Indicator | Primary Function | Key Component |

|---|---|---|

| Bollinger Bands | Volatility Measure | 20-period SMA, Standard Deviation |

| MACD | Trend and Momentum | 12 and 26-day EMAs, Signal Line |

Knowing these indicators and how they work together helps traders. They can analyze the market better and improve their strategies.

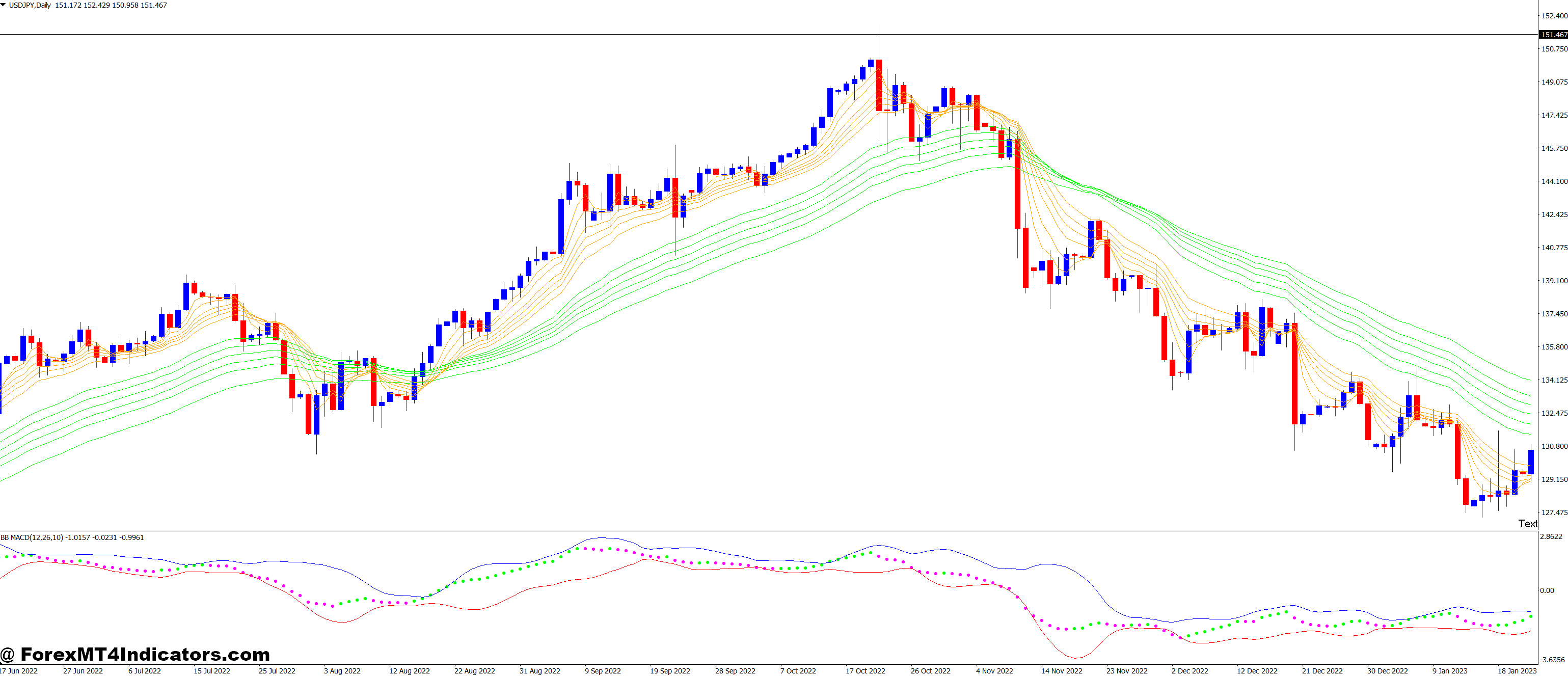

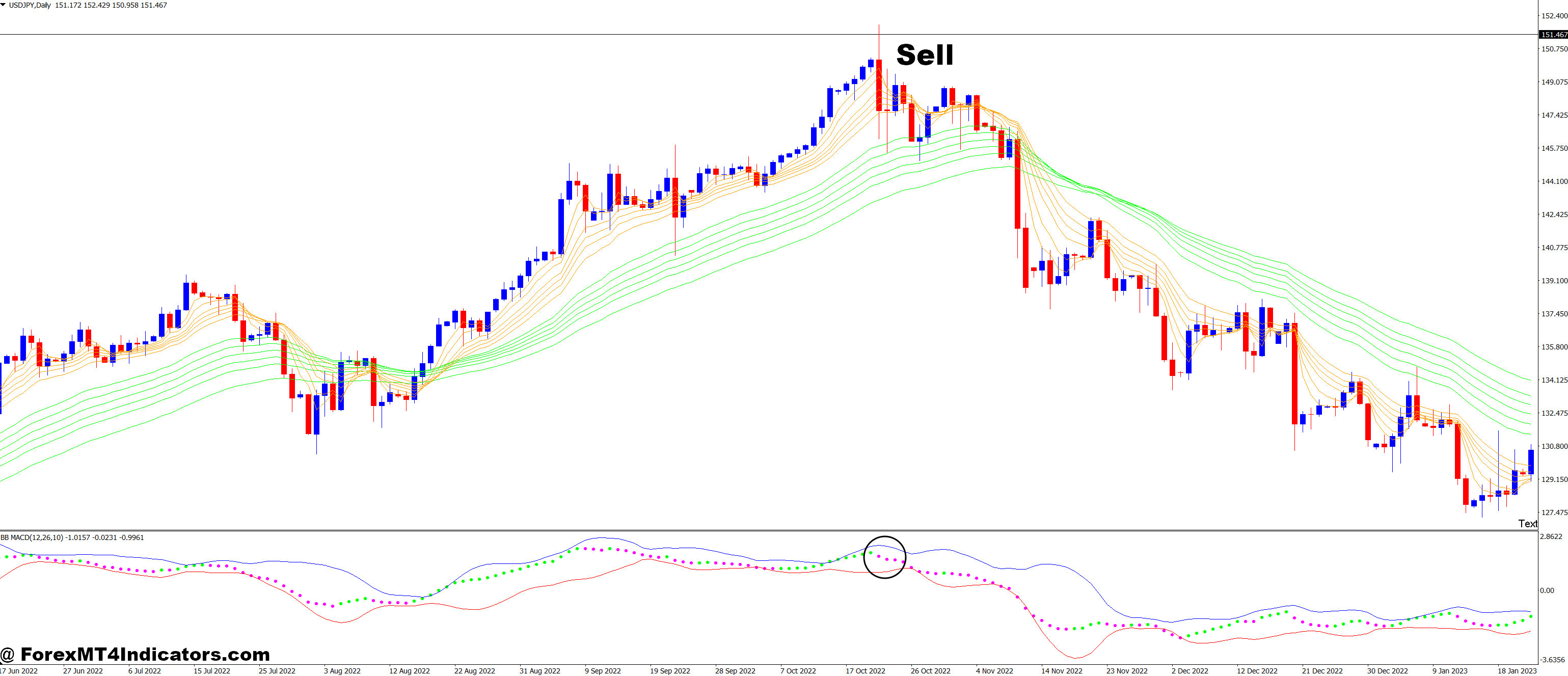

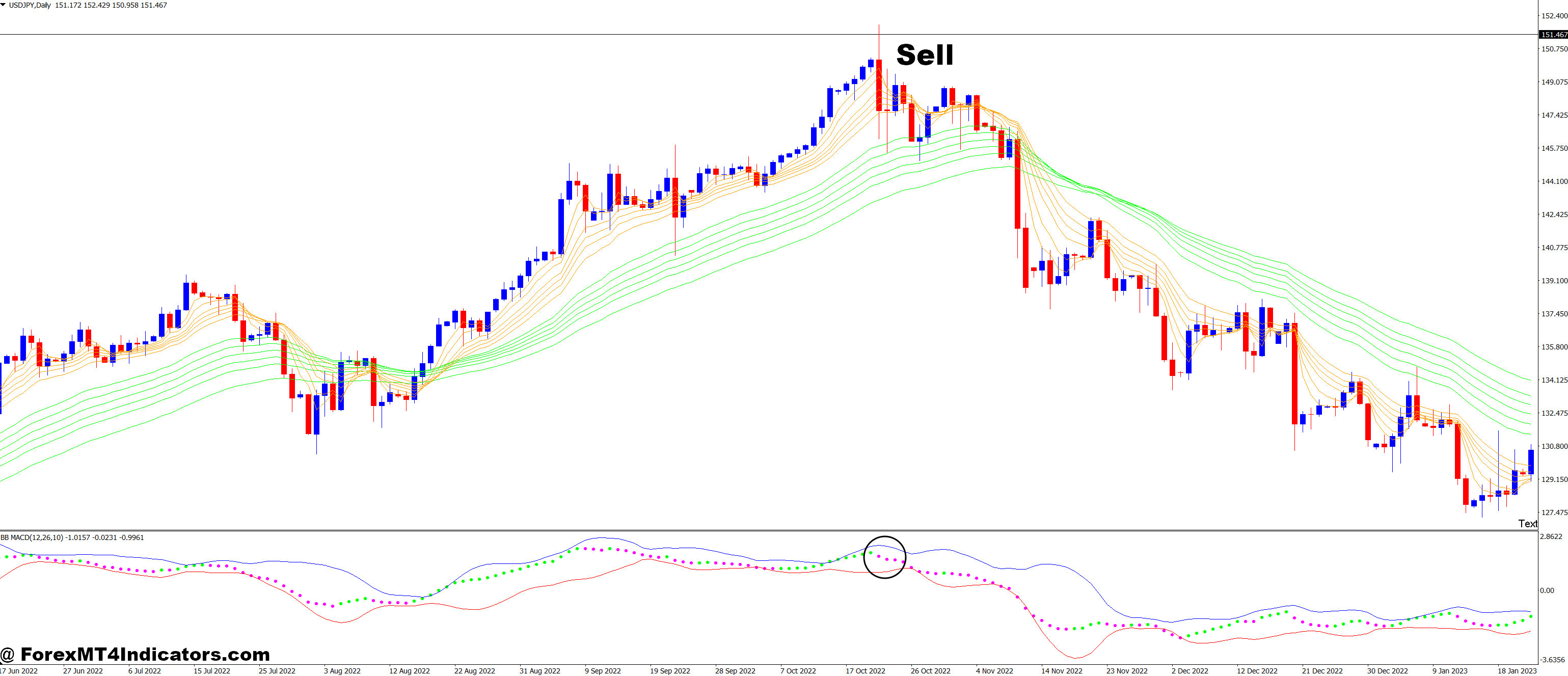

BB MACD and Guppy Long and Short Forex Trading Strategy

The BB MACD and Guppy strategy uses powerful tools for Forex trading. It combines Bollinger Bands, MACD, and Guppy Multiple Moving Averages. This mix helps find good trading signals and understand the market well.

Bollinger Bands has three lines that cover about 95% of recent price moves. They change width based on market volatility. This gives traders useful insights.

MACD is a key indicator that works with Real MACD to improve trade timing. The Guppy Multiple Moving Averages add to trend analysis. They show both long-term and short-term trends.

This strategy works well on 1-hour, 4-hour, and daily charts. It’s best for major and minor currency pairs. Traders do best during Tokyo, London, and New York sessions.

| Setup | Conditions | Stop Loss |

|---|---|---|

| Buy | Price above green MAs, red MAs above green | Below red MAs |

| Sell | Price below green MAs, red MAs below green | Above red MAs |

Traders close trades when the MACD histogram shows a trend shift. This strategy is good for deeper retracements. It works best with breakouts of diagonal support and resistance levels.

Essential Trading Tools and Timeframes

Successful Forex trading needs the right tools and understanding of timeframes. Let’s look at what’s needed for the BB MACD and Guppy strategy.

Required Technical Indicators

The main tools for this strategy are Bollinger Bands, MACD, and Guppy Multiple Moving Average. Bollinger Bands show market volatility based on a 20-day moving average. The MACD uses 12-day and 26-day averages with a 9-day signal line.

These tools help spot trends, support and resistance, and market reversals.

Optimal Timeframe Selection

Choosing the right timeframe is key. Traders often use 15-minute to 4-hour charts for day trading. Longer timeframes give stronger band levels.

Lagging indicators work well from H1, leading to profits of 20-50 pips or more.

Currency Pair Compatibility

Choosing the right currency pairs is important. This strategy works best with major pairs because of their liquidity and tight spreads. Consider volatility when picking pairs.

About 68% of price movements are within one standard deviation of Bollinger Bands. This helps in choosing pairs and setting price movement expectations.

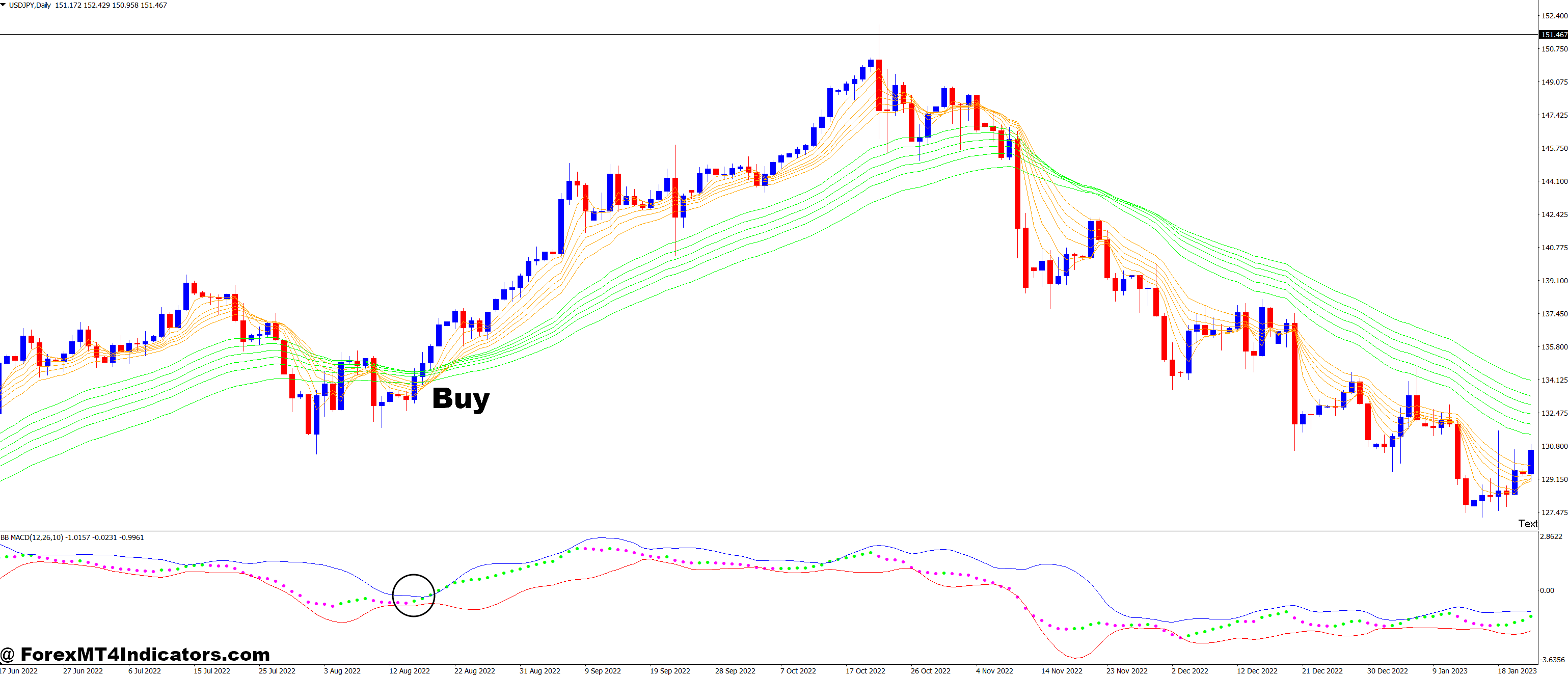

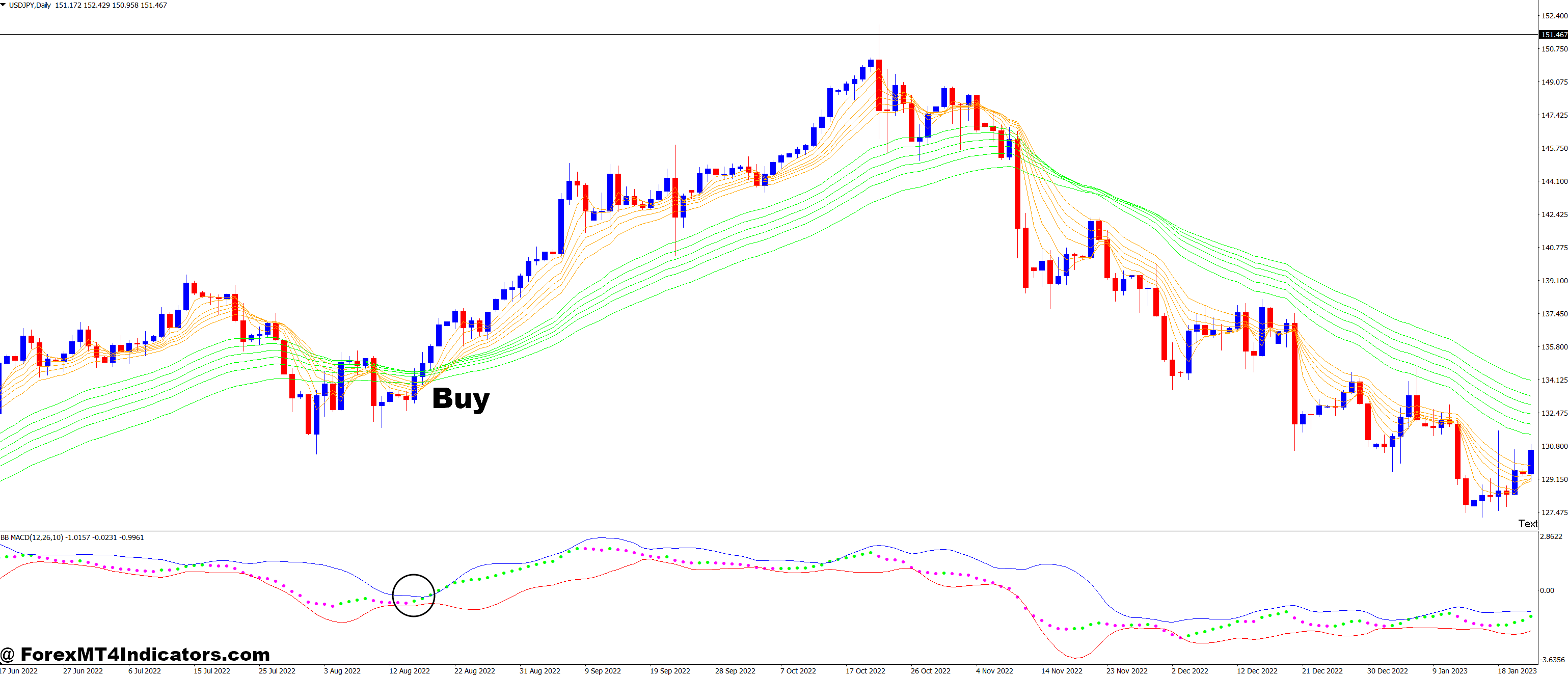

How to Trade with BB MACD and Guppy Long and Short Forex Trading Strategy

Buy Entry

- GMMA: The short-term moving averages (3, 5, 8, 10, 12, 15 EMAs) are above the long-term moving averages (30, 35, 40, 45, 50, 60 EMAs), confirming an uptrend.

- MACD: The MACD Line crosses above the Signal Line, indicating bullish momentum.

- Bollinger Bands: Price is near or touching the lower or middle band but moving towards the upper band, indicating possible continuation or breakout.

- Entry: Enter the trade when the price breaks above the upper Bollinger Band or when it shows strength above the middle band, confirming the uptrend continuation.

Sell Entry

- GMMA: The short-term moving averages (3, 5, 8, 10, 12, 15 EMAs) are below the long-term moving averages (30, 35, 40, 45, 50, 60 EMAs), confirming a downtrend.

- MACD: The MACD Line crosses below the Signal Line, indicating bearish momentum.

- Bollinger Bands: Price is near or touching the upper or middle band but moving towards the lower band, indicating possible continuation or breakdown.

- Entry: Enter the trade when the price breaks below the lower Bollinger Band or when it shows weakness below the middle band, confirming the downtrend continuation.

Setting Proper Stop Loss Levels

Stop-loss strategies are key for managing risk in forex trading. The BB MACD and Guppy strategy uses smart trade protection. Let’s look at how to set stop losses effectively.

Stop Loss Calculation Methods

Traders often use volatility indicators to stop losses. The Average True Range (ATR) is a common choice, based on 14 days. They usually set stop losses at 1-2 times the ATR below the entry price.

This method considers normal price swings without exiting too soon.

Currency Pair-Specific Adjustments

Different currency pairs have unique volatility levels. For example, EURGBP and EURCHF are less volatile and good for beginners. As you get more experience, you can handle more volatile pairs.

Risk Management Guidelines

Proper risk management is essential for long-term success. Never risk more than 1-2% of your account on one trade. For short positions in this strategy, place your stop loss 2 pips above the upper Bollinger Band.

This balance protects against early exits.

| Time Frame | Recommended Stop Loss | Take Profit Target |

|---|---|---|

| 15 minutes | Below lower envelope (long) | Below upper envelope (long) |

| 15 minutes | Above upper envelope (short) | Above lower envelope (short) |

Remember, stop losses aren’t set-and-forget. Adjust them as market conditions change for the best trade protection. By mastering these stop-loss strategies, you’ll improve your risk management in forex trading.

Take Profit Strategies

Learning how to use take-profit techniques is key to making more money in forex trading. The BB MACD and Guppy strategy has many ways to help traders lock in their profits.

Pivot Level Targets

Pivot levels are important to take profit points in this strategy. Traders aim to exit at these set price levels. For example, when trading the Euro/USD pair, profit targets are usually 5 pips on a 5-minute chart and 8 pips on a 15-minute chart.

Using Bollinger Bands for Exit Points

Bollinger Bands help find dynamic exit points for trades. The opposite band is often the take-profit target. For example, in a long trade, the upper band is where you exit. This method adjusts to market changes, as Bollinger Bands grow during high volatility and shrink during low.

Multiple Target Approach

Using multiple targets can increase profits and manage risk. Traders can set several profit levels:

- First target: Close 1/3 of the position at a conservative level

- Second target: Exit another 1/3 at a moderate level

- Final target: Let the remaining 1/3 run for maximum gain

This strategy helps traders get profits early and also take advantage of longer moves. With a profit target ratio of 1:1.1 to 1:1.2, it has a success rate of about 77.78% in backtesting.

Market Volatility Considerations

Understanding market volatility is key to trading success. The BB MACD and Guppy strategies use volatility analysis to make decisions. Bollinger Bands show market conditions, getting wider in high volatility and narrower in calm times.

Traders need to adjust their strategies based on market conditions. High volatility means wider bands, showing more risk and big price swings. Low volatility means narrower bands, showing a stable market.

- Width of Bollinger Bands: A wider band suggests higher volatility, while a narrower band indicates lower volatility.

- MACD histogram: Larger histogram bars often coincide with increased market volatility.

- Trading volume: Higher volume typically accompanies volatile market conditions.

It’s important to avoid certain setups in very high or low volatility. In very volatile markets, use wider stop-loss levels and smaller positions to manage risk. In low volatility, use tighter stop-losses and bigger positions.

| Market Condition | Bollinger Band Width | Trading Adjustment |

|---|---|---|

| High Volatility | Wide | Wider stop-loss, smaller position size |

| Low Volatility | Narrow | Tighter stop-loss, larger position size |

| Normal Volatility | Average | Standard strategy parameters |

By adding these volatility thoughts to your trading plan, you can handle changing markets better. This will help improve your trading results.

Risk Management and Position Sizing

Effective risk management and position sizing are key for forex trading success. They work together with trading psychology for a strong trading plan.

Account Risk Parameters

It’s important to set the right risk parameters for your account. Many traders risk 1-2% of their account balance per trade. This protects your capital and lets you trade more without big losses.

Position Size Calculation

Figuring out your position size is a big part of risk management. It’s about how many units to trade based on your account size and risk level. For example, with a $10,000 account and a 2% risk per trade, you risk no more than $200 on one trade.

| Account Size | Risk Percentage | Maximum Risk per Trade |

|---|---|---|

| $1,000 | 2% | $20 |

| $10,000 | 2% | $200 |

| $100,000 | 1% | $1,000 |

Trading Psychology Aspects

Trading psychology is very important for managing risk. You need to control your emotions and stick to your trading plan. Don’t make quick decisions based on fear or greed. Stay focused on following your strategy and risk management rules.

Backtesting and Strategy Optimization

Strategy backtesting is key to good trading systems. By using the BB MACD and Guppy strategy on past data, traders can see how profitable it might be. They can also make it better by analyzing old market moves to guess future ones.

Getting the most out of your trades means optimizing performance. Look at average monthly profits for different currency pairs. For example, GBPUSD averages about 160 pips a. EURJPY is around 104 pips.

The strategy works best on 1H or 30M timeframes. Remember, the strategy’s success depends on the right settings in MetaTrader. Also, think about how volatile the market is when you start a trade.

| Currency Pair | Average Monthly Profit (Pips) |

|---|---|

| GBPUSD | 160 |

| EURJPY | 104 |

| EURUSD | 100 |

| GBPJPY | 95 |

| USDCHF | 85 |

When making the strategy better, focus on the settings. For instance, the DMI strategy works best on Daily charts. It suggests a smoothing of 2 for 4-hour charts. It also uses a 377-period Hull Moving Average as a signal filter.

Managing risk is important in making the strategy better. You can set limits on how much you can lose. Also, use alerts to get notifications when it’s time to act. This makes trading more efficient.

Conclusion

The BB MACD and Guppy Long and Short Forex Trading Strategy is a strong tool for traders. It combines technical indicators like Bollinger Bands, MACD, and Guppy. This helps traders make better choices.

Real trading data shows the strategy’s ups and downs. One trader made $9,297.16 from 32 trades. Another lost $646.57 in 14 trades.

Trading success comes from knowing the market and managing risks. The strategy works well across different time frames. It spots trends on monthly, weekly, and daily charts.

Traders need to watch important price levels, like a 61% retracement around 167. They should also use tools like the Stock RSI to see when prices are too high.

Learning never stops in trading. Traders should learn about indicators like the Absolute Price Oscillator and Accumulation/Distribution Line. Knowing how these indicators work together helps make better trading choices.

For example, ADX values above 35 show strong trends. This helps traders time their trades better.

In short, the BB MACD and Guppy strategy is promising. But, traders should practice on demo accounts first. By using this strategy in a personal trading plan and always learning, traders can aim for steady profits in the Forex market.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Cash Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Get Download Access

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰