Diversification in Forex Trading: Smart Risk Management

Forex trading is exciting but risky. Many traders put all their money in one place. This can lead to big losses, even wiping out their accounts. Diversification is a smarter way. It means spreading investments across different currency pairs and trading styles. This reduces risk and allows for profitable trades. It’s not just about surviving;

Forex trading is exciting but risky. Many traders put all their money in one place. This can lead to big losses, even wiping out their accounts.

Diversification is a smarter way. It means spreading investments across different currency pairs and trading styles. This reduces risk and allows for profitable trades. It’s not just about surviving; it’s about thriving in the forex world.

Key Takeaways

- Diversification is key for long-term success in forex trading.

- Spreading investments reduces risk from market changes.

- A mix of major, minor, and exotic pairs balances stability and returns.

- Different currency pairs react differently to economic changes.

- Combining various trading styles improves risk management.

Understanding the Forex Market Fundamentals

The Forex market is the biggest financial market worldwide. It trades $7.5 trillion daily. It’s open 24/7, five days a week, from Sunday 5 p.m. ET to Friday 5 p.m. ET. The Forex market structure lets traders work across time zones. This supports many trading strategies.

Global Currency Market Overview

The Forex market focuses on trading currency pairs. Major pairs like EUR/USD and USD/JPY are very popular. They offer lots of liquidity and tight spreads.

Cross pairs, without the US dollar, also offer trading chances. They help diversify trading options.

Market Participants and Their Roles

Many players shape the Forex market. Big banks do most spot trades. Retail traders, though many, trade less.

Central banks are key in setting currency values. They do this through their policies. Each group affects the market’s liquidity and prices.

Key Trading Sessions and Market Hours

The Forex market has three main sections: Asian, European, and North American. Each has its trading conditions and volatility. The overlap between sessions sees more trading.

Knowing these hours helps traders plan their trades. It’s key for working with different currency pairs.

| Session | Major Financial Centers | Peak Trading Hours (ET) |

|---|---|---|

| Asian | Tokyo, Hong Kong, Singapore | 7:00 PM – 4:00 AM |

| European | London, Frankfurt, Paris | 3:00 AM – 12:00 PM |

| North American | New York, Chicago, Toronto | 8:00 AM – 5:00 PM |

Diversification in Forex Trading

Forex diversification is more than just trading different currency pairs. Smart traders also spread their risk in other market areas. This way, they can find opportunities in various conditions while controlling risks.

The Forex market is open 24/5, with over 180 currencies available. It trades more than $6.6 trillion daily, making it the biggest financial market. This means there are plenty of chances for portfolio allocation and risk management.

Effective diversification means:

- Trading different currency pairs.

- Using multiple timeframes.

- Employing various trading strategies.

It’s important to know how currency pairs relate to each other. For instance, EUR/USD and GBP/USD often move together. But EUR/USD and USD/CHF tend to go in opposite directions. This info helps traders avoid too much risk in similar markets.

| Diversification Method | Benefit | Risk Reduction |

|---|---|---|

| Multiple Currency Pairs | Exposure to different economies | Up to 30% |

| Various Timeframes | Capture short and long-term trends | 20-25% |

| Different Strategies | Adapt to changing market conditions | 15-20% |

By using these Forex diversification methods, traders can cut down on portfolio volatility by up to 30%. This is very helpful when other investments don’t do well. Forex becomes a key part of a balanced investment plan.

Core Principles of Risk Management in Currency Trading

Forex risk management is key to successful trading. It helps protect investments and increase returns. Let’s look at the main principles for better Forex market navigation.

Position Sizing Strategies

Smart position sizing is vital in Forex trading. Risk only 1-2% of your capital on each trade. This keeps your account safe from big losses.

Some use the Pareto principle. They put 20% of their capital into trades that make up 80% of their profits.

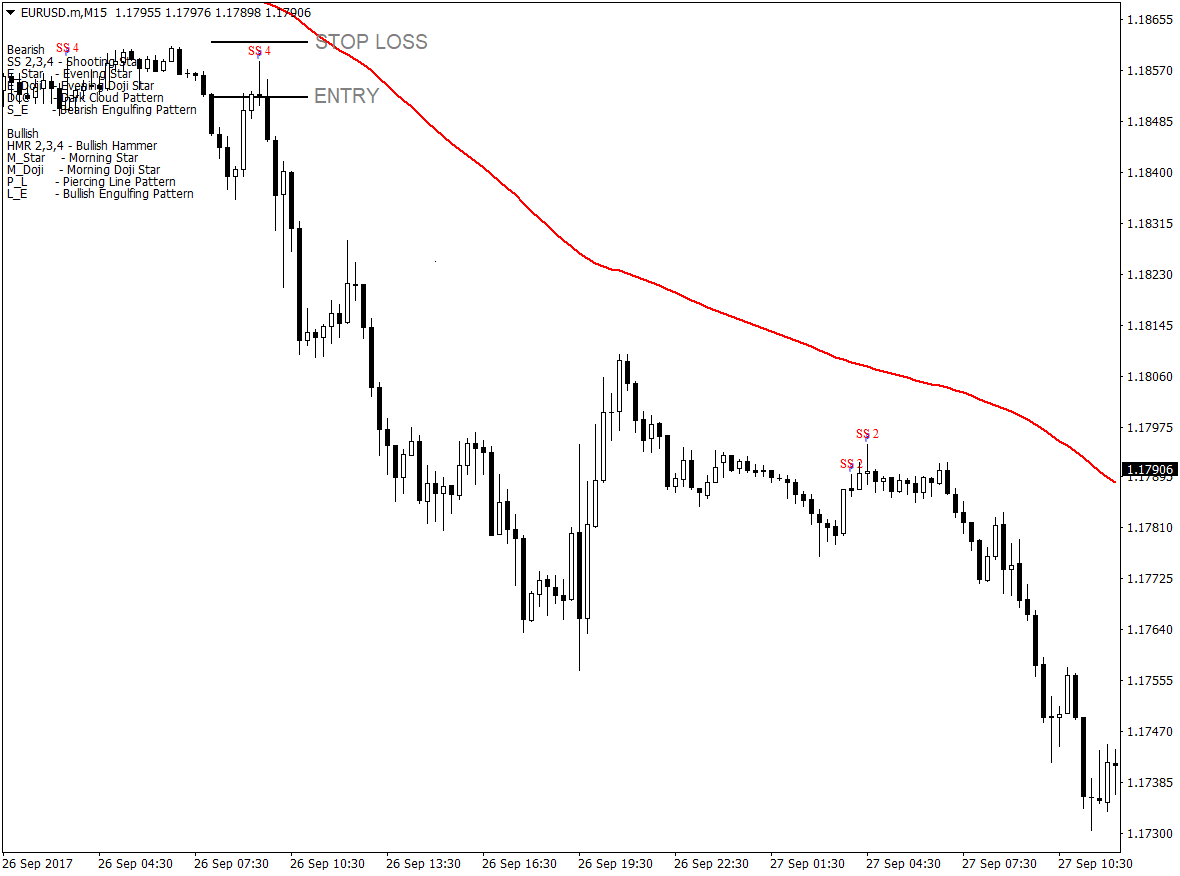

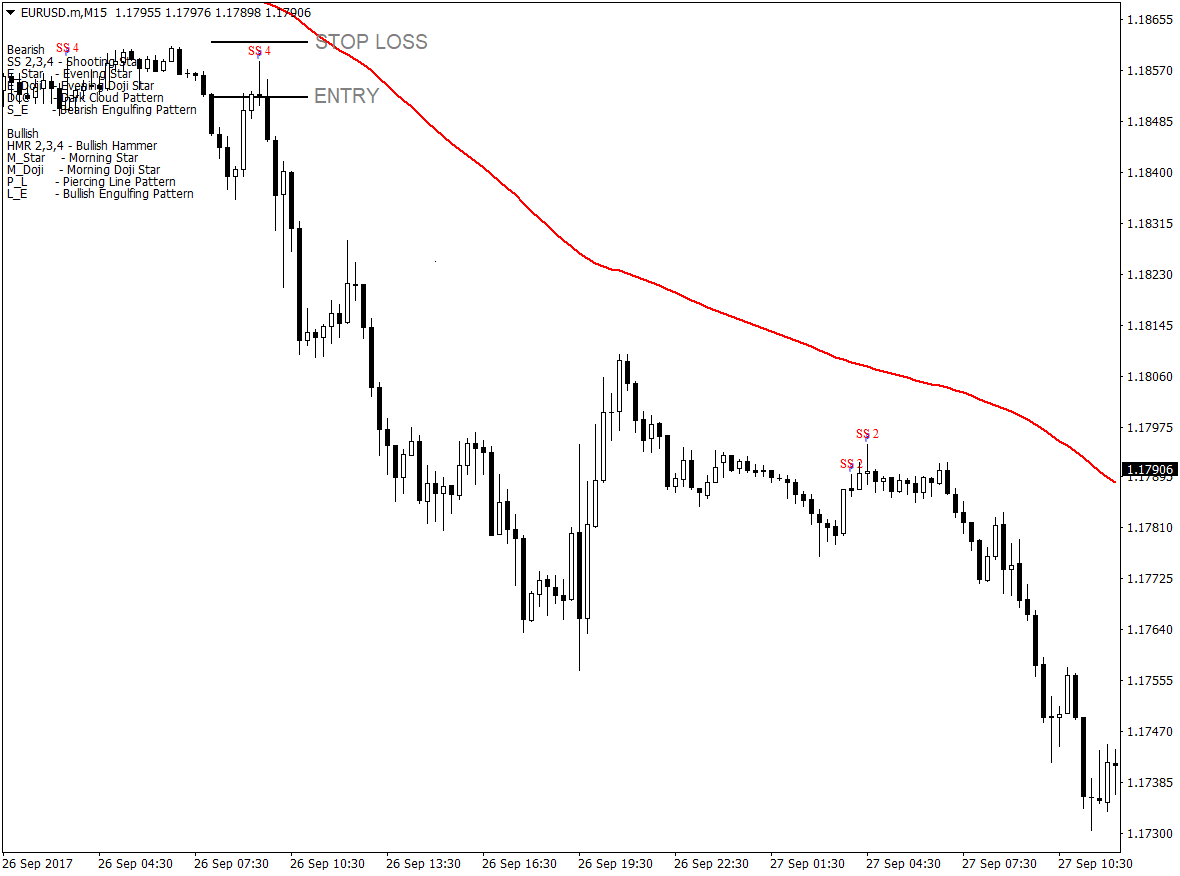

Stop-Loss Implementation

Stop-loss orders are essential in Forex risk management. They limit losses by closing trades at set prices. Choose stop-losses wisely to protect your capital.

Risk-Reward Ratios

Good risk-reward ratios are vital for success. Aim for gains that are more than your losses. For example, risk $1 to make $2. This helps balance out losses.

| Risk Management Principle | Recommended Practice | Benefit |

|---|---|---|

| Position Sizing | Risk 1-2% per trade | Preserves capital |

| Stop-Loss Orders | Set for each trade | Limits possible losses |

| Risk-Reward Ratio | Aim for 1:2 or better | Improves profitability |

Effective Forex risk management needs constant checking and tweaking. Adjust your strategies as the market changes. By following these principles, you can trade with more confidence and success in the dynamic currency market.

Currency Pair Correlation Analysis

Understanding Forex correlations is key to smart trading. Currency pair relationships can make or break your strategy. Let’s dive into the world of correlations and how they shape the Forex market.

Major Currency Correlations

Major currencies often move in sync. Take EUR/USD and GBP/USD. These pairs showed a strong positive correlation of 0.95 over one month. This means they moved in the same direction 95% of the time. But watch out! Over six months, this correlation weakened to 0.66. Correlations change, so stay alert.

Cross-Pair Relationships

Cross-pairs can tell a different story. EUR/USD and USD/CHF had a near-perfect negative correlation of -1.00. When one went up, the other went down. This relationship can help balance your portfolio and manage risk.

Correlation Matrix Understanding

A correlation matrix is a trader’s best friend. It shows how currency pairs move relative to each other. The matrix uses values from -1 to +1. A score of +1 means perfect positive correlation, while -1 indicates perfect negative correlation. Here’s a simplified matrix:

| Pair | EUR/USD | GBP/USD | USD/CHF |

|---|---|---|---|

| EUR/USD | 1.00 | 0.95 | -1.00 |

| GBP/USD | 0.95 | 1.00 | -0.95 |

| USD/CHF | -1.00 | -0.95 | 1.00 |

Remember, correlations shift. Update your data every few weeks to stay on top of market trends. By mastering currency pair relationships, you’ll be better equipped to diversify and manage risk in your Forex trading journey.

Portfolio Allocation Strategies

Smart Forex portfolio management starts with good asset allocation. Traders can get better returns by spreading out across different currency pairs and trading styles. This way, they avoid big risks and aim for more profits.

A good mix usually has 20% in high-risk pairs and 80% in safer ones or cash. This follows the Pareto principle, balancing growth with safety. Pairs like GBP/NZD and EUR/JPY can move over 100 pips a day, great for bold traders.

Time-based diversification is also key. By trading in the four main Forex sessions, traders catch different market moves. This mix helps with quick wins and long-term growth.

| Strategy | Benefit | Example |

|---|---|---|

| Volatility targeting | Balanced risk exposure | Combining USD/CHF (low volatility) with GBP/AUD (high volatility) |

| Geographical diversification | Reduced regional risk | Pairing EUR/USD with AUD/JPY |

| Correlation analysis | Avoid overexposure | Monitoring EUR/USD and GBP/USD correlations |

Keeping your portfolio balanced is key. As markets change, adjust your mix to meet your goals and risk level. This, along with learning about market trends, is the heart of Forex’s success.

Time-Based Diversification Techniques

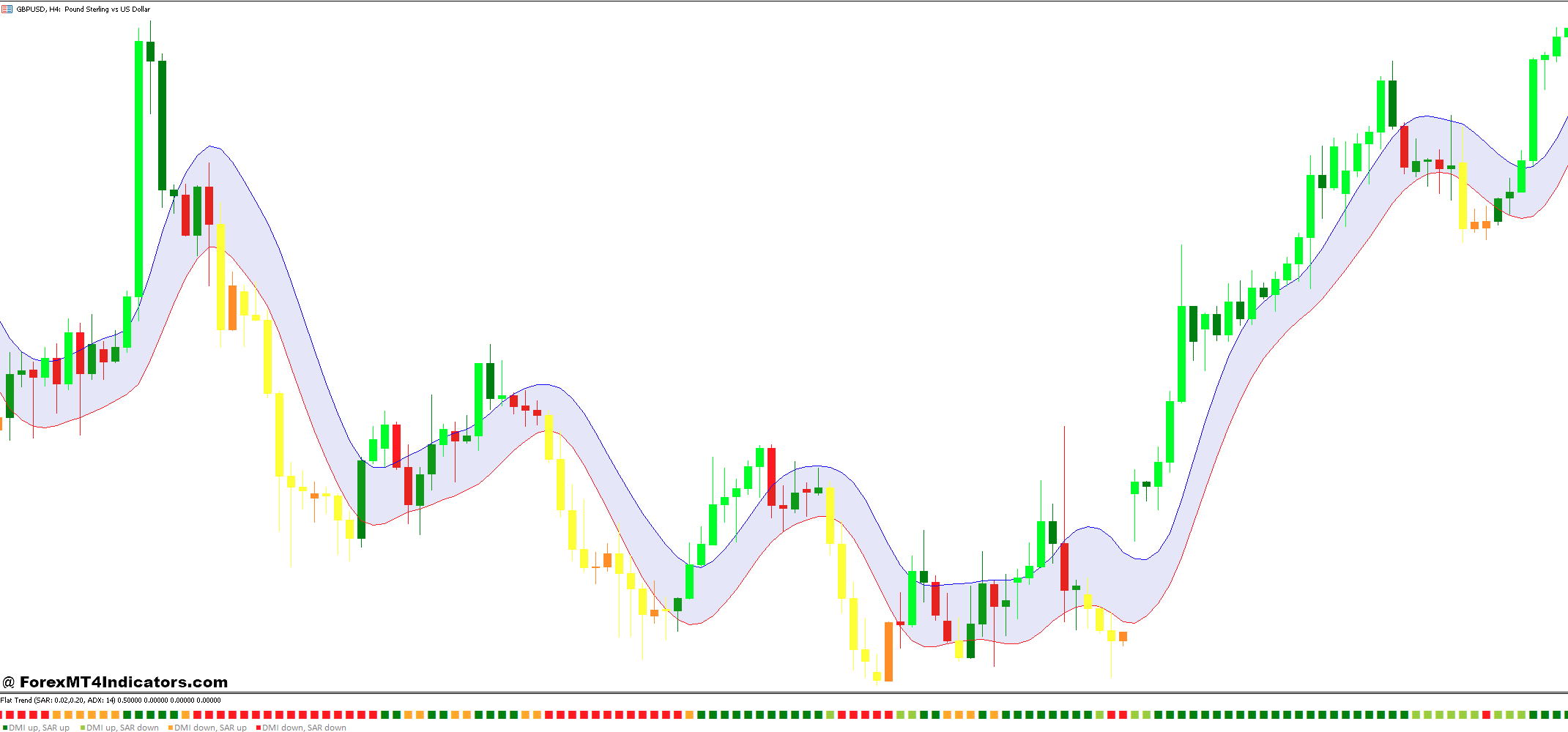

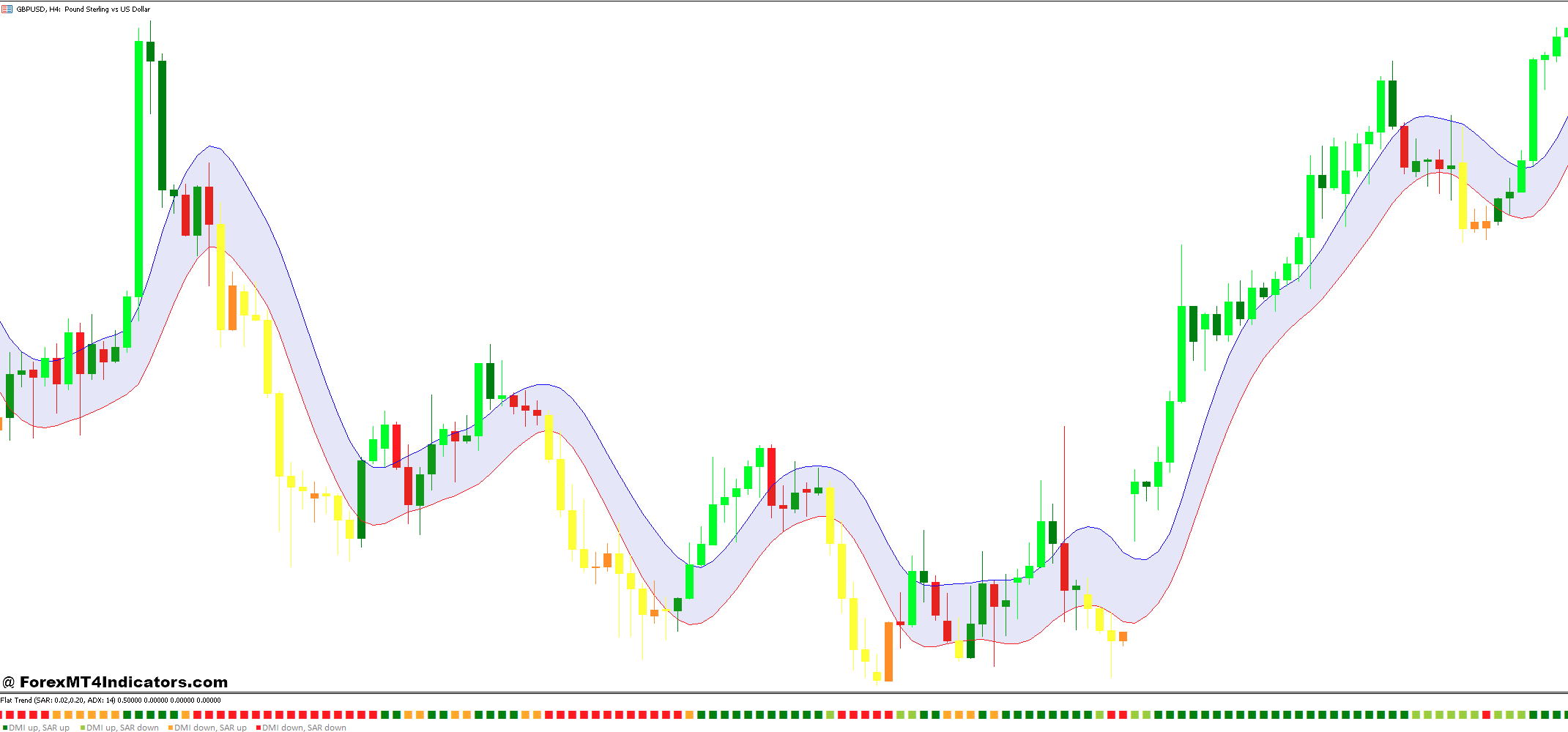

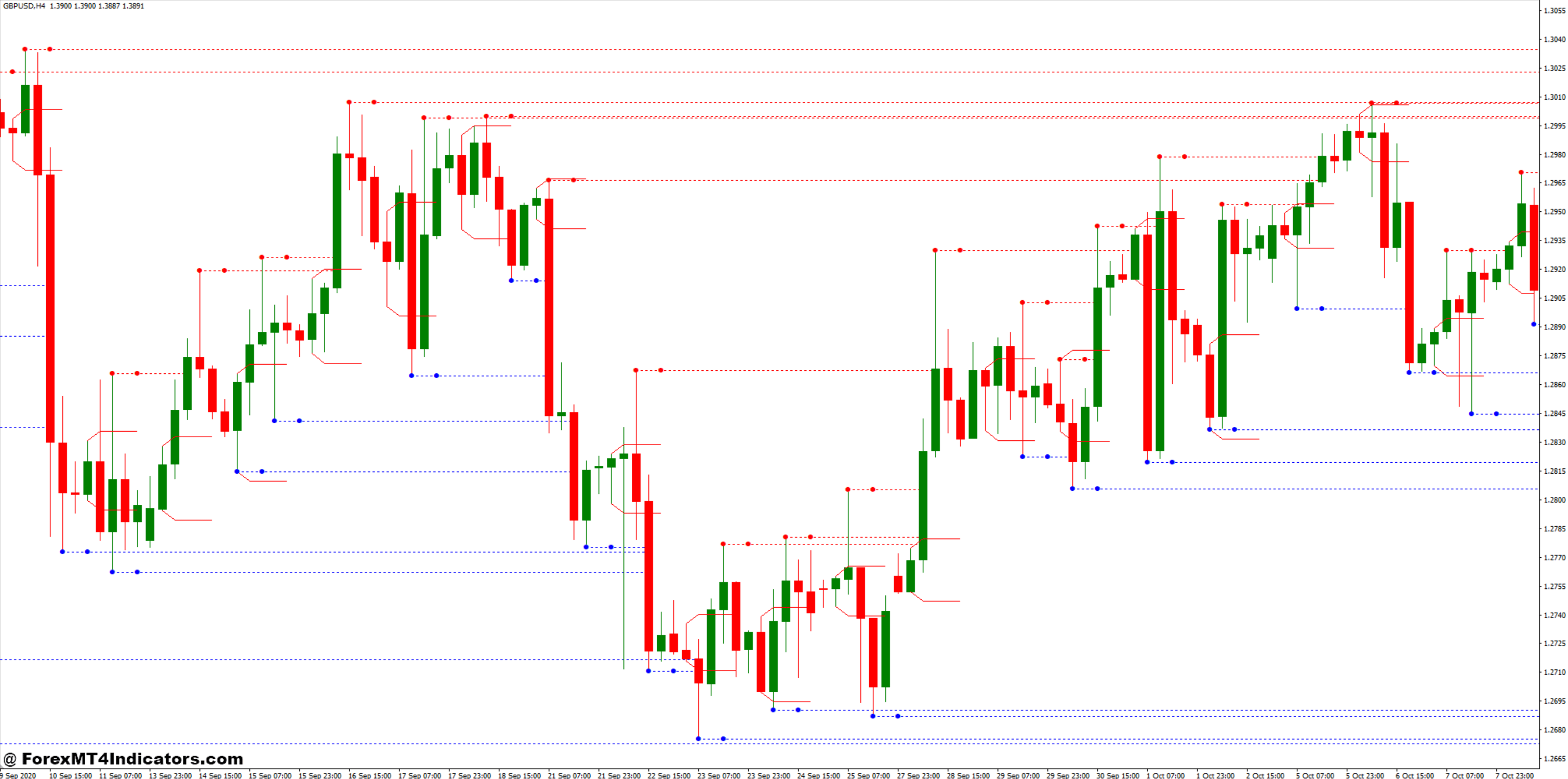

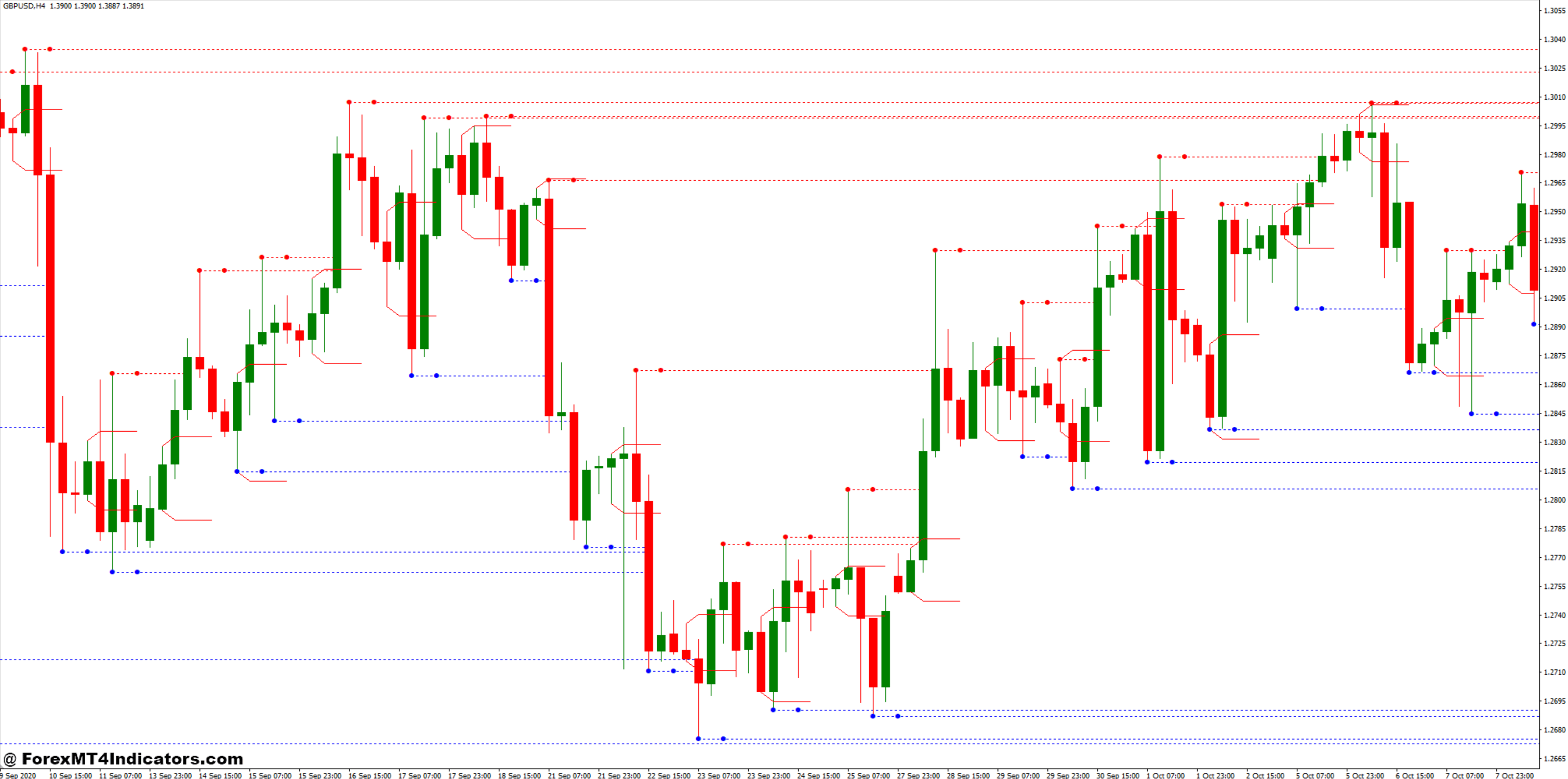

Forex traders use time-based diversification to manage risk and seize opportunities. They do this by analyzing time frames, choosing trading sessions, and varying position duration.

Multi-Timeframe Analysis

Multi-timeframe analysis gives traders a full view of the market. They look at charts in different time frames to spot trends and entry points. This helps them make better decisions and manage risk.

Trading Session Selection

The Forex market is open 24/5, split into three main sections: Asian, European, and North American. Each session has its traits. Traders who trade in all sessions can catch different market moves and lower risks.

Long-term vs Short-term Positions

Traders mix long-term and short-term positions for diversification. Long-term trades go for big trends, while short-term trades aim for quick gains. This mix can lead to steady profits and better risk control.

| Position Type | Duration | Advantage |

|---|---|---|

| Short-term | Minutes to hours | Quick profits, less exposure |

| Medium-term | Days to weeks | Balanced risk-reward |

| Long-term | Weeks to months | Captures major trends |

Using these time-based diversification methods, traders can build a strong trading plan. This way, they can handle risks in different market conditions and improve their trading results.

Trading Style Diversification

Forex trading styles offer different ways to tackle the market. Mixing various strategies helps traders adjust to changes and lower risk. Let’s look at three key styles: trend following, range trading, and breakout strategies.

Trend Following Strategies

Trend following rides on long-term price trends. Traders aim to make money from these trends. But, it may not work as well in markets that don’t trend much.

Range Trading Approaches

Range trading plays on price swings within set limits. Traders buy at support and sell at resistance. This method does well in stable markets but can fail during big changes.

Breakout Trading Methods

Breakout strategies look for big price moves beyond usual ranges. Traders jump in when prices hit new highs or lows. This style does well in volatile times but can give false signals in calm markets.

Mixing these Forex trading styles can boost performance. By combining trend following, range trading, and breakout strategies, traders can handle different market situations. This mix can help manage risk and possibly lead to better results over time in the ever-changing Forex market.

| Trading Style | Best Market Condition | Risk Level |

|---|---|---|

| Trend Following | Strong directional movement | Medium |

| Range Trading | Stable, sideways market | Low |

| Breakout Trading | Volatile, news-driven market | High |

Managing Inter-Market Correlations

Inter-market analysis is key in Forex trading. John J. Murphy introduced it in 1991. It looks at how different assets relate to each other. This helps traders make smart choices and reduce risks.

Asset class correlations are vital for trading success. For example, Forex and commodities’ relationship affects currency values. Here are some important correlations:

| Asset Pair | Correlation Coefficient | Relationship |

|---|---|---|

| USD Index (DXY) & Gold | -0.98 | Strong negative |

| Gold & AUD/USD | 0.83 | Strong positive |

| Oil (WTI) & USD/CAD | -0.96 | Strong negative |

| Dow Jones & Nikkei Index | 0.92 | Strong positive |

These correlations show how global markets are connected. For example, oil prices and USD/CAD have a strong negative link. This is because Canada exports a lot of oil. When oil prices go up, the Canadian dollar gets stronger against the US dollar.

Traders can use this info to spread out their investments. For instance, buying oil futures and selling the currency of a big oil producer can balance things out. This helps manage risks in different asset classes.

It’s key to remember that market correlations can change. They shift with economic changes or global events. Keeping an eye on these changes and adjusting your portfolio is vital for a good trading strategy in Forex and commodities.

Advanced Risk Mitigation Tools

Forex trading needs smart risk management. Advanced tools can improve your trading strategy and keep your investments safe. Let’s look at some key ways to protect your portfolio.

Hedging Techniques

Forex hedging is a strong way to guard against bad market moves. By opening positions in opposite directions, traders can reduce losses. For example, you might buy EUR/USD and sell GBP/USD. This can cut down risk in shaky markets.

Portfolio Insurance Strategies

Portfolio insurance uses derivatives to limit risk. Options contracts are often used for this. For instance, buying a put option on a currency pair can protect against price falls. This way, traders can keep their positions while limiting losses.

Risk Assessment Tools

Good risk assessment is key for long-term success in forex trading. Tools like Value at Risk (VaR) help figure out possible losses. Stress tests show how a portfolio might do in extreme markets. Using these tools regularly helps traders make better decisions about how much to risk.

Remember, successful risk management uses a mix of these tools. Always check and tweak your strategies to stay on top in the fast-changing forex market. By using these advanced methods, you can protect your investments better and maybe do better in trading.

| Risk Mitigation Tool | Key Benefit | Typical Usage |

|---|---|---|

| Forex Hedging | Offsets possible losses | Opening opposite positions |

| Portfolio Insurance | Limits downside risk | Using options contracts |

| Risk Assessment | Quantifies possible losses | VaR and stress testing |

Conclusion

Forex diversification helps traders in many ways. It protects them from market ups and downs. The forex market is open 24/5 and very liquid, making it great for managing risks.

Safe-haven currencies like USD and CHF are key during tough times. They show why spreading investments across different currency pairs is so important.

Traders who diversify can handle big market changes better. For example, the 2016 Brexit caused big changes in GBP. But traders who put money in EUR/USD and USD/JPY did okay.

In 2020, the COVID-19 pandemic made markets very volatile. Traders used put options to protect themselves from big losses.

Using different trading styles and tools like forward contracts and options can lead to better risk-adjusted returns. By investing in many currency pairs, traders avoid big losses from one currency. This, along with smart position sizing and stop-loss, helps traders succeed in the long run.

While diversification can’t get rid of all risks, it helps manage them well. By following these tips and keeping up with world news, traders can build a strong forex portfolio. This portfolio is set for steady growth and stability.

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :DIVERSIFICATION ، Forex ، Management ، Risk ، Smart ، Trading

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰