Capital Preservation in Forex Trading

[ad_1] Are you struggling to keep your money safe in the forex market? Many traders find it hard to protect their capital while trying to make profits. The temptation of quick money often leads to risky choices, risking everything. But, there’s a way to keep your investments safe and do well in forex trading. Forex

[ad_1]

Are you struggling to keep your money safe in the forex market? Many traders find it hard to protect their capital while trying to make profits. The temptation of quick money often leads to risky choices, risking everything.

But, there’s a way to keep your investments safe and do well in forex trading.

Forex risk management is key to success. By using tested strategies to protect your capital, you can face market ups and downs with confidence. Let’s look at how to keep your money safe from big losses and build a lasting trading career.

Key Takeaways

- Implement stop-loss orders to limit possible losses.

- Use proper position sizing to manage risk well.

- Diversify across many currency pairs to cut overall risk.

- Maintain emotional discipline for better choices.

- Develop a solid trading plan with realistic goals.

- Use leverage wisely to avoid too much risk.

Understanding the Fundamentals of Capital Preservation

Capital preservation is key in forex trading. It’s about keeping your money safe while making profits. Let’s explore how to protect your trading capital.

Defining Trading Capital Protection

Trading capital protection means keeping your funds safe from big losses. It’s like having a safety net for your money. Good strategies help you stay in the game longer, even when the market is tough.

The Role of Risk Management

Risk management is the heart of capital preservation. It’s about making smart choices to avoid big losses. For example, setting stop-loss orders at 2% below the purchase price can limit losses on volatile trades. Effective risk management is key to avoiding big hits to your trading capital.

Key Components of Capital Safety

To keep your capital safe, you need a mix of tools and techniques. Here are some important ones:

- Diversification: Spread your trades across different currency pairs.

- Position sizing: Don’t put too much money in one trade.

- Leverage control: Use leverage wisely to avoid big losses.

- Regular forex risk assessment: Keep an eye on market conditions.

By using these capital protection strategies, you can reduce risks and protect your trading funds. Remember, in forex trading, keeping your money safe is just as important as making profits.

Capital Preservation in Forex Trading

Forex capital safety is key for trading success. The market is open 24/7 and uses high leverage. This makes it vital to protect your funds.

Keeping your capital safe is more than just avoiding losses. It’s about staying in the market for a long time. By protecting your money, you can keep trading and grab good opportunities when they come.

Good ways to keep your forex capital safe include:

- Setting strict stop-loss orders.

- Implementing smart position sizing.

- Managing leverage wisely.

- Diversifying currency pairs.

Here are some important stats about keeping your capital safe:

| Aspect | Data |

|---|---|

| Recommended risk per trade | 1-2% of total account |

| FDIC insurance limit | $250,000 |

| Inflation impact (3% annually) | 50% value reduction in 24 years |

Keeping your trading funds safe is not just about tech. It’s also about emotional control. Avoiding revenge trading and knowing when to stop during losses is key. By focusing on capital preservation, traders become stronger and set themselves up for long-term success in the forex market.

Essential Risk Management Strategies

Forex trading needs smart risk management to keep your money safe. Let’s look at key strategies to protect your investments and improve your trading success.

Setting Effective Stop-Loss Orders

A stop-loss in forex is key to limit losses. It closes your trade at a set price. For example, in EUR/USD, you might set a 50-pip stop-loss.

This means if the trade goes against you by 50 pips, it closes. This limits your loss to $500 for a standard lot.

Position Sizing Techniques

Position sizing is important for risk management. Risk no more than 1-2% of your account per trade. For a $10,000 account, risking 2% means a max loss of $200 per trade.

To find your position size, use this formula: Position Size = Risk Amount / (Stop-Loss Distance × Pip Value). Risk management and capital preservation are key in forex trading.

Managing Leverage Wisely

Leverage management is critical in forex. Leverage can increase profits but also losses. Use conservative ratios like 1:10 or 1:20 to manage risk.

Remember, emotional decisions with high leverage can cause big losses. Always use stop-losses with leveraged trades, even in volatile markets.

| Strategy | Recommendation |

|---|---|

| Risk per Trade | 1-2% of account balance |

| Stop-Loss Range (Scalping) | 10-20 pips |

| Stop-Loss Range (Swing Trading) | 50-100 pips |

| Leverage Ratio | 1:10 to 1:20 |

| Risk-to-Reward Ratio | Minimum 1:2 |

By using these strategies, you’ll protect your capital and succeed in the forex market. Remember, consistent use of these techniques is vital for long-term success.

Psychological Aspects of Trading

Forex trading psychology is very important for success. Trading can be an emotional rollercoaster. This can lead to bad decisions if not managed well.

Studies show that 60-80% of traders face overconfidence. This can cause them to take too much risk and act impulsively.

Keeping emotions in check is key to protecting your money. Traders who do this well see a 20-25% boost in performance. This shows how important mindfulness and managing emotions are in forex trading.

Fear and greed are big traps for traders. About 70% of forex traders feel these emotions more when using leverage. This can lead to making bad choices.

To avoid this, successful traders work on:

- Building a strong trading mindset.

- Using risk management tools.

- Following a clear trading plan.

- Learning constantly.

Only 15% of traders use tools like stop-loss orders regularly. But, knowing about forex psychology and using these tools can cut losses by up to 40%.

| Psychological Trait | Impact on Trading |

|---|---|

| Discipline | 70% more likely to stick to trading plans |

| Patience | 20% more profitable in the long run |

| Resilience | 25% more successful in bouncing back from losses |

| Emotional Control | 40% fewer impulsive trades during volatile times |

By focusing on these psychological aspects, traders can do better in the complex world of forex. They can increase their chances of success over time.

Advanced Risk Assessment Methods

Forex market analysis is key for advanced risk assessment. Traders use many techniques to spot threats and make smart choices. Let’s look at some important methods to protect your money.

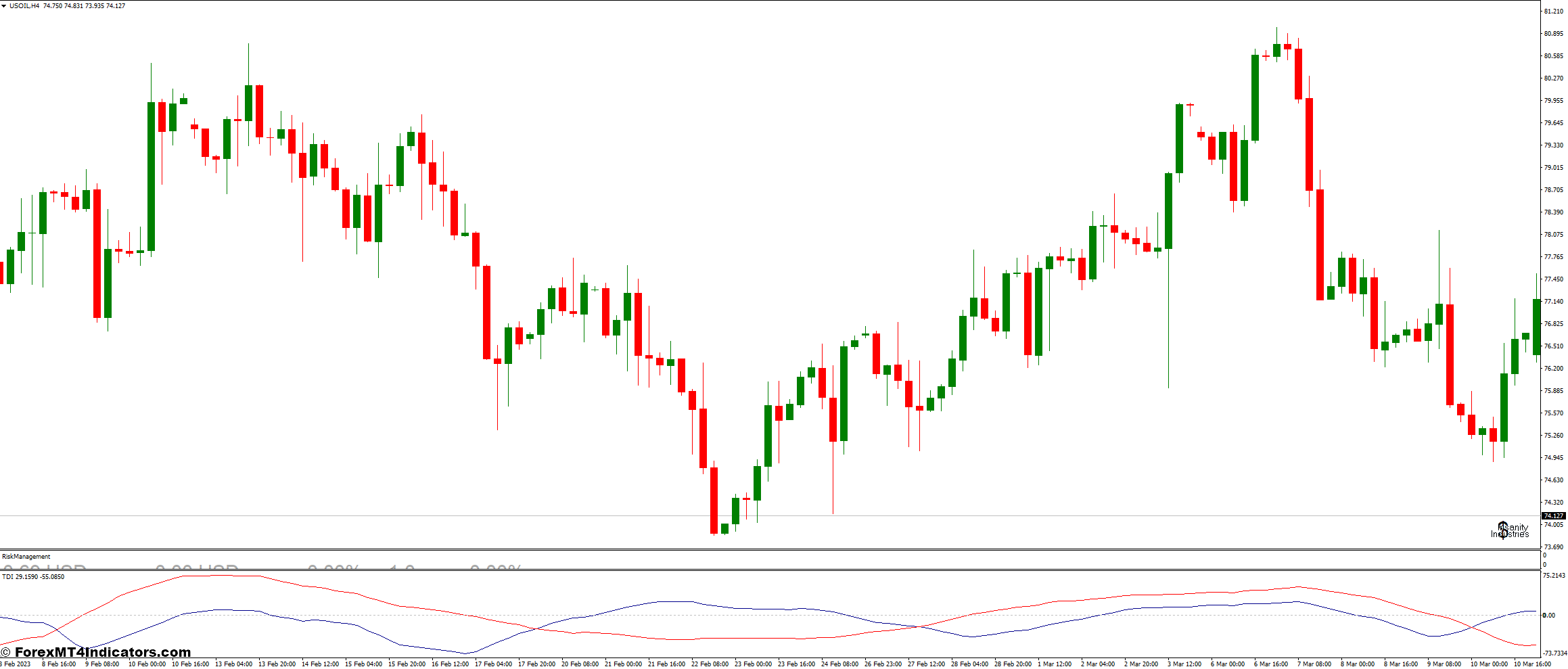

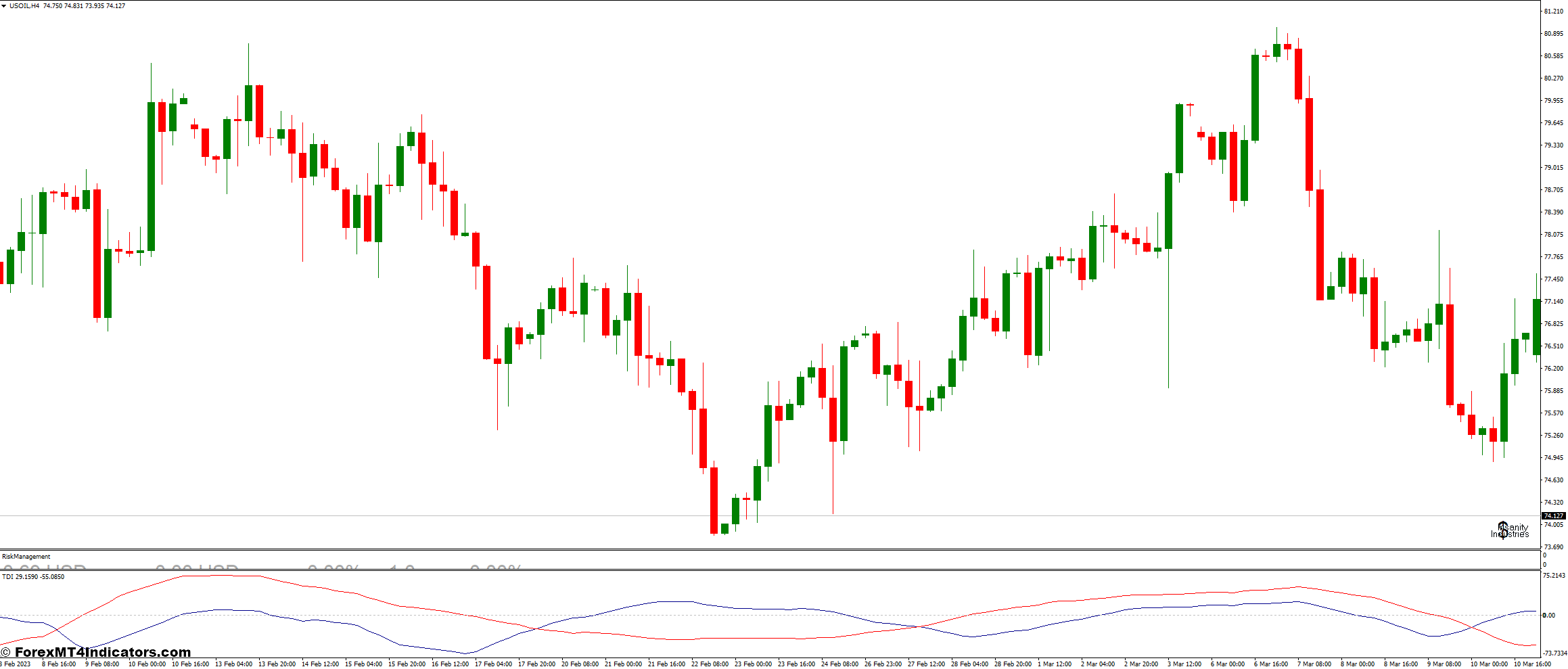

Market Analysis Techniques

Good forex market analysis means studying price patterns and trends. Traders use chart patterns and candlestick formations to guess future prices. Knowing these patterns helps you spot risks and change your strategy.

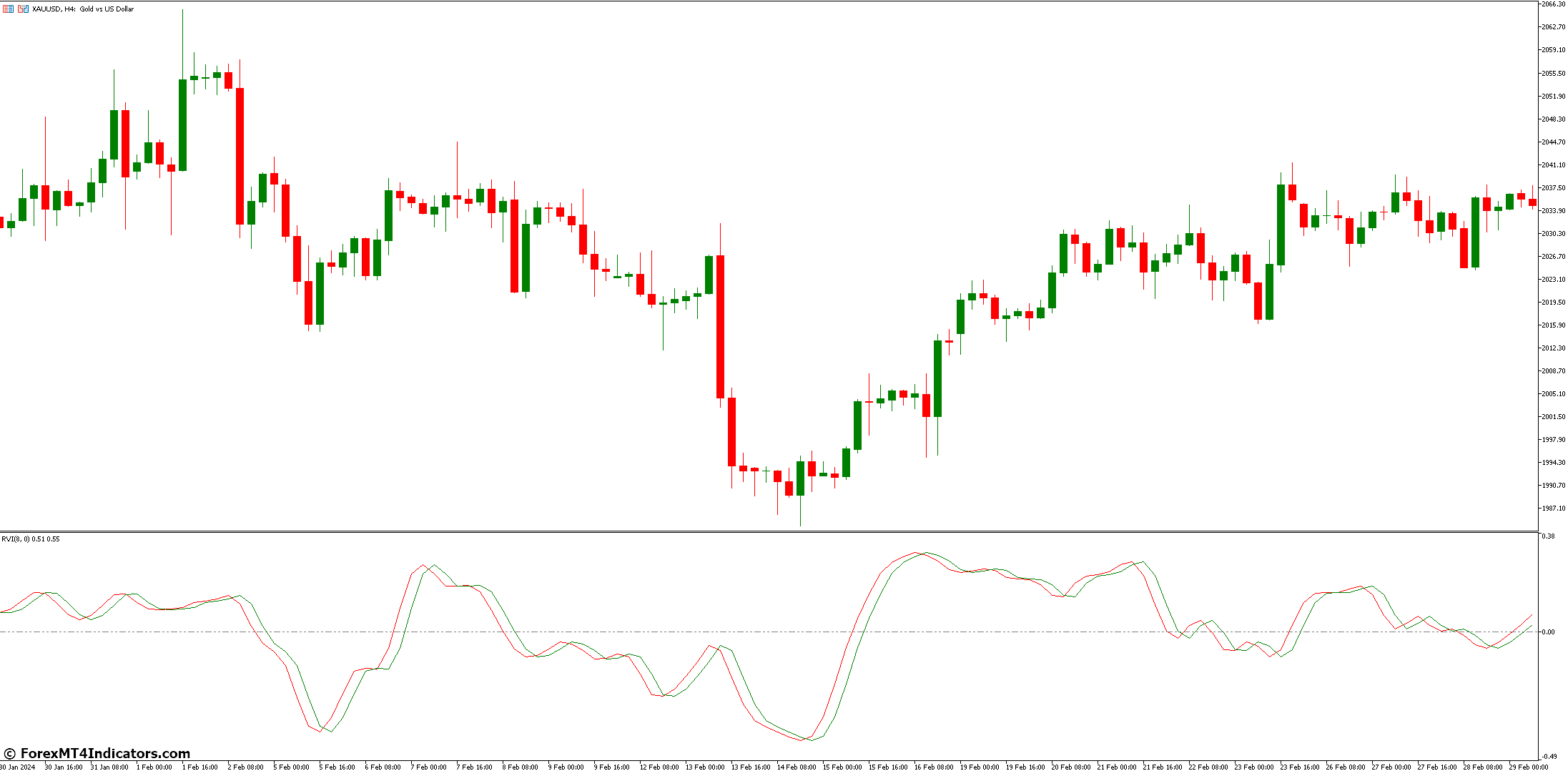

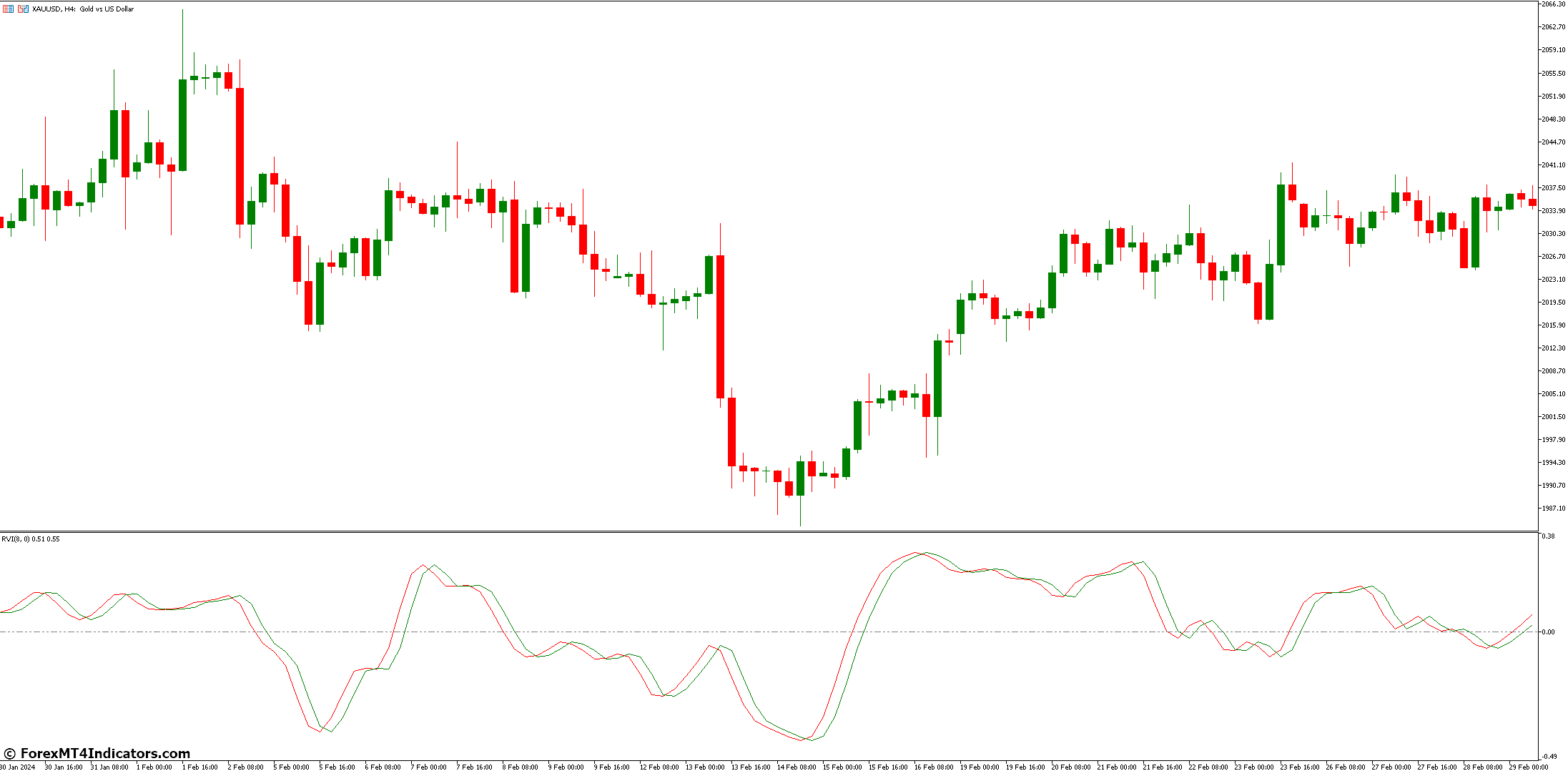

Technical Indicators for Risk Management

Technical indicators are great for managing risk in forex trading. Popular ones include:

- Moving Averages

- Relative Strength Index (RSI)

- Bollinger Bands

These tools help find overbought or oversold conditions and trend reversals. For example, setting a stop-loss order at 1.1950 when buying at 1.2000 limits loss to 50 pips.

Fundamental Analysis in Risk Assessment

Fundamental analysis is vital for long-term risk assessment. It looks at economic indicators, political events, and central bank policies. Traders who use fundamental analysis can predict market changes better. This helps them adjust their positions.

By using these advanced methods, traders can keep their capital safe and make consistent profits in the forex market.

Diversification Strategies in Forex

Forex diversification is key to building a strong trading portfolio. By investing in different currency pairs, traders can manage risk and increase returns. Let’s look at how to create a balanced forex portfolio.

Currency Pair Selection

Choosing the right currency pairs is important. Major pairs like EUR/USD and USD/JPY have high liquidity and tight spreads. Minor pairs, such as AUD/CAD, offer unique chances. Exotic pairs like USD/ZAR add excitement but are riskier.

Cross-Market Correlation

It’s vital to understand currency pair correlation for effective diversification. Pairs like EUR/USD and GBP/USD move together, increasing risk if traded together. Mix correlated and uncorrelated pairs to balance your portfolio.

| Pair Type | Example | Characteristics |

|---|---|---|

| Major | EUR/USD | High liquidity, low spreads |

| Minor | AUD/CAD | Moderate liquidity, big moves possible |

| Exotic | USD/ZAR | More volatility, wider spreads |

Portfolio Balance Techniques

To keep a balanced portfolio, trade in different timeframes. Short-term trades on 1-minute charts offer many chances. Weekly charts give a more relaxed pace. Mixing strategies like trend-following and range-bound trading makes your portfolio stronger.

Remember, a well-diversified Forex portfolio needs regular checks and tweaks. By spreading risk and using different market conditions, traders can aim for steady performance and better capital protection.

Monitoring and Performance Tracking

Keeping an eye on your trading performance is vital for forex success. A trading journal is like a personal scorekeeper. It tracks your wins, losses, and progress. By recording trades, you learn about your habits and find ways to get better.

Forex performance analysis means looking at numbers to see how well you trade. Let’s look at some key metrics:

- Win Rate (WR): (Number of Winning Trades / Total Trades) × 100

- Risk-Reward Ratio (RR): Compares profit to loss

- Expected Value (EV): Shows the average outcome of trades

- Total Profit and Loss (P&L): Adds up your trading results

- Return on Investment (ROI): Shows profit compared to investment

Checking these metrics often in your journal helps improve your strategies. For instance, a win rate of over 50% is good. But, your risk-reward ratio matters too. Aim for a 3:1 ratio, where you make $3 for every $1 risked.

| Metric | Formula | Importance |

|---|---|---|

| Win Rate | (Winning Trades / Total Trades) × 100 | Measures trading success frequency |

| Risk-Reward Ratio | Potential Profit / Potential Loss | Evaluates trade risk management |

| Expected Value | (WR × Avg Profit) – (Loss Rate × Avg Loss) | Predicts long-term profitability |

By tracking these metrics well, you’ll understand your trading strengths and weaknesses. Remember, regular monitoring leads to long-term trading success.

Building a Sustainable Trading Plan

A good forex trading plan is key to keeping your money safe. It sets clear rules for trading. This helps traders stay focused and disciplined, even when the market is wild.

Setting Realistic Goals

Setting goals that match your risk level and money is important. For example, you might aim for a 10% return in three months. Or, you could aim for a 5% profit in two months with a swing trading strategy. These goals should be reachable without taking too many risks.

Risk-to-Reward Ratios

In forex trading, a good risk-reward ratio is 1:2. This means risking $100 to make $200. It’s important to risk no more than 1-2% of your total capital on any trade. This helps keep your money safe when the market changes.

Trade Documentation Methods

Keeping good records of your trades is essential for getting better. Write down every trade in a trading journal. This helps you spot patterns and improve your strategies over time. Include details like when you entered and exited the trade, how big the trade was, and why you made the decision.

| Element | Recommendation |

|---|---|

| Risk per Trade | 1-2% of total capital |

| Risk-Reward Ratio | 1:2 or better |

| Goal Setting | 10-15% return in 3-6 months |

| Documentation | Detailed trading journal |

By using these elements in your forex trading plan, you build a strong base for keeping your capital safe. This leads to success in the long run.

Market Volatility and Capital Protection

Forex market volatility can greatly affect a trader’s success. It’s important to know how to handle it well. This way, you can keep your investments safe.

Handling Market Turbulence

In unpredictable markets, traders need to be quick and smart. Using stop-loss orders is very important. They help limit losses and protect your money from sudden changes.

It’s wise to risk only 1-2% of your total money on one trade.

Adapting to Market Conditions

Adaptive trading strategies are vital in the volatile forex market. Regularly checking your strategies is key. Watch economic news and global events closely, as they affect currency prices a lot.

Emergency Risk Protocols

Having risk plans can save your trading account in extreme times. Here are some important points:

- Use leverage carefully, aiming for a 2:1 ratio or less

- Spread your investments across different currency pairs to lessen the loss impact

- Set up automatic stop-loss orders to avoid making rash decisions

- Keep learning about market trends to make better choices

| Risk Management Technique | Benefit |

|---|---|

| Stop-loss orders | Caps possible losses |

| Leverage limitation | Reduces risk exposure |

| Diversification | Acts as a buffer against market shifts |

| Continuous learning | Enhances decision-making |

By using these strategies and risk plans, traders can manage forex market volatility better. This helps protect their capital.

Conclusion

Forex capital preservation is key to long-term trading success. The forex market is huge, full of chances but also risks. Traders who focus on keeping their capital safe often do better than those who just look for profits.

Only one in three traders with similar skills make it in the tough trading world. This is because of good bankroll management and careful risk control. Winners often set a limit on their losses, like $100 per trade, to manage risk.

Even traders who win less than 25% of the time can make money. They do this by keeping small losses low and grabbing big wins. This shows how important managing risk is, not just winning.

In short, forex capital preservation is not just about being careful. It’s about being smart and staying in the game. By managing money well and using good trading strategies, traders can succeed in the fast-paced forex market.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Capital ، Forex ، Preservation ، Trading

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0