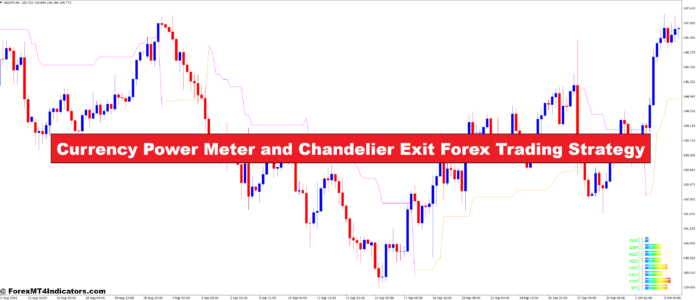

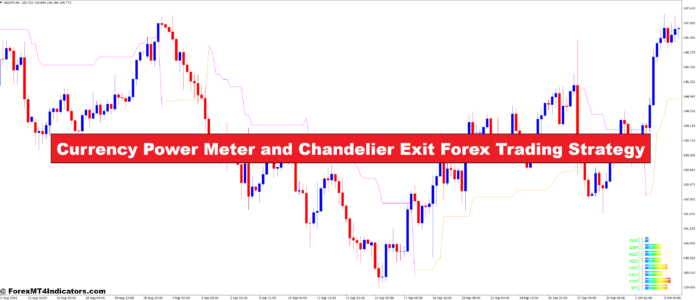

Currency Power Meter and Chandelier Exit Forex Trading Strategy

[ad_1] Are you having trouble making money in forex trading? You’re not the only one. Many traders get lost in too many signals and indicators. This can lead to big mistakes and missed chances. But what if you could find a way to cut through all the noise? What if you could make better choices?

کد خبر : 563029

تاریخ انتشار : سهشنبه 25 فوریه 2025 - 4:41

[ad_1]

Are you having trouble making money in forex trading? You’re not the only one. Many traders get lost in too many signals and indicators. This can lead to big mistakes and missed chances.

But what if you could find a way to cut through all the noise? What if you could make better choices?

The Currency Power Meter and Chandelier Exit strategy is here to help. It’s a new way to look at currency strength and manage risks. With these tools, traders can see the market more clearly and might do better.

Key Takeaways

- Combines Currency Power Meter for strength analysis with Chandelier Exit for risk management.

- Utilizes Average True Range (ATR) for volatility-based calculations.

- Provides possible entry points based on price crossover.

- Supports trading across various timeframes and currency pairs.

- Recommends using additional technical analysis tools for confirmation.

- Suggests a 1:2 or higher risk-to-reward ratio for take profit.

Understanding the Fundamentals of Forex Trading Indicators

Forex trading indicators are key in technical analysis today. They help traders understand market data and make smart choices. Let’s look at the main points of these indicators and their role in analyzing the market.

Role of Technical Analysis in Modern Trading

Technical analysis looks at past price data and trends to guess future market moves. It’s a big part of forex trading. It helps traders spot patterns and when to buy or sell. The strength of technical analysis is its clear view of market behavior.

Importance of Multiple Indicator Approach

Using many indicators together gives a full view of the market. This method helps confirm signals and avoid wrong ones. For instance, mixing trend indicators like Moving Averages with momentum indicators like the Relative Strength Index (RSI) gives stronger trading signals.

Basic Market Analysis Principles

Forex trading market analysis looks at price changes, volume, and time frames. It’s about finding trends, support and resistance levels, and analyzing price actions. These basics help traders grasp market movements and make smart choices.

| Indicator Type | Example | Function |

|---|---|---|

| Trend | Moving Averages | Identify market direction |

| Momentum | RSI | Measure trend strength |

| Volume | On-Balance Volume | Confirm trend strength |

| Volatility | Bollinger Bands | Measure price fluctuations |

Knowing these basics helps traders build strong strategies. They use technical analysis and a multiple indicator approach for better market analysis in forex trading.

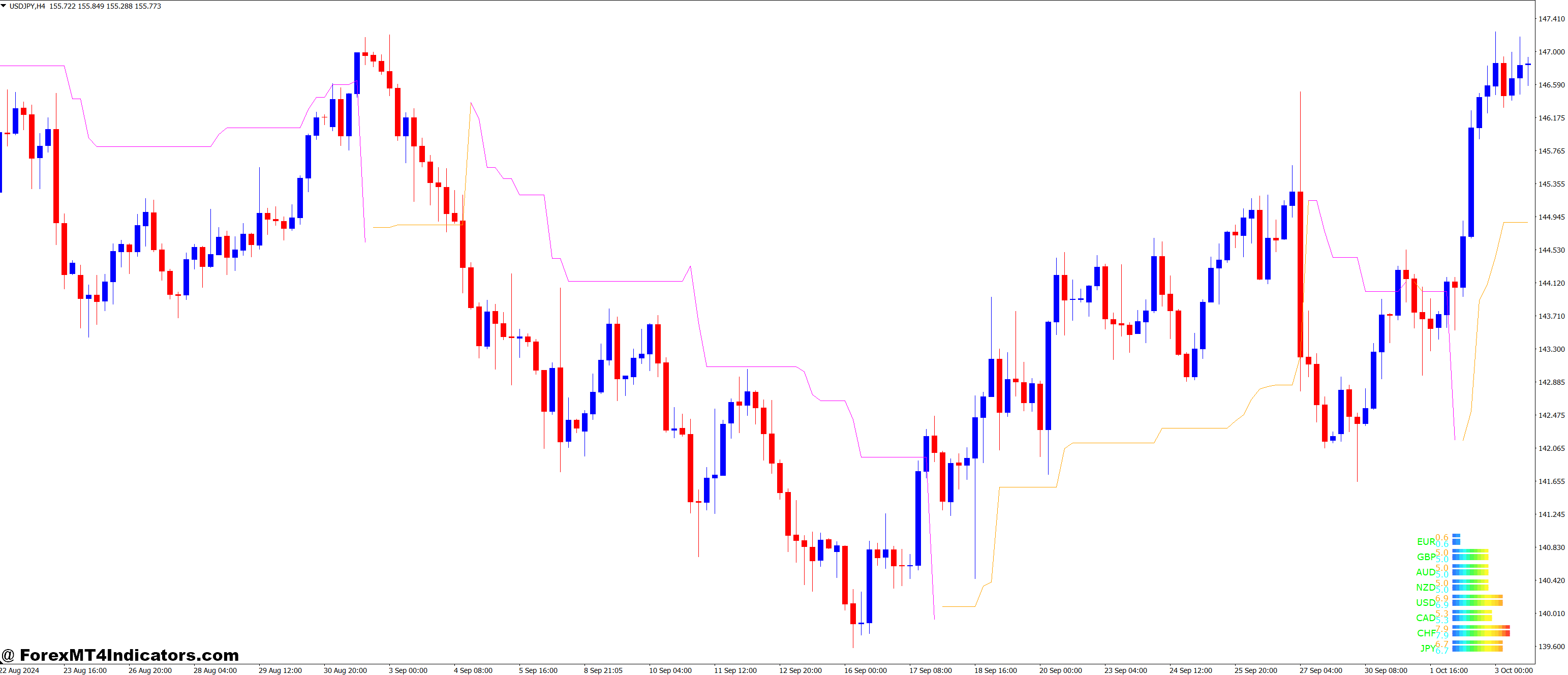

Currency Power Meter and Chandelier Exit Forex Trading Strategy

The forex strategy mix of Currency Power Meter and Chandelier Exit is very useful. It combines the best of both tools for a deep look at currency moves and exit times.

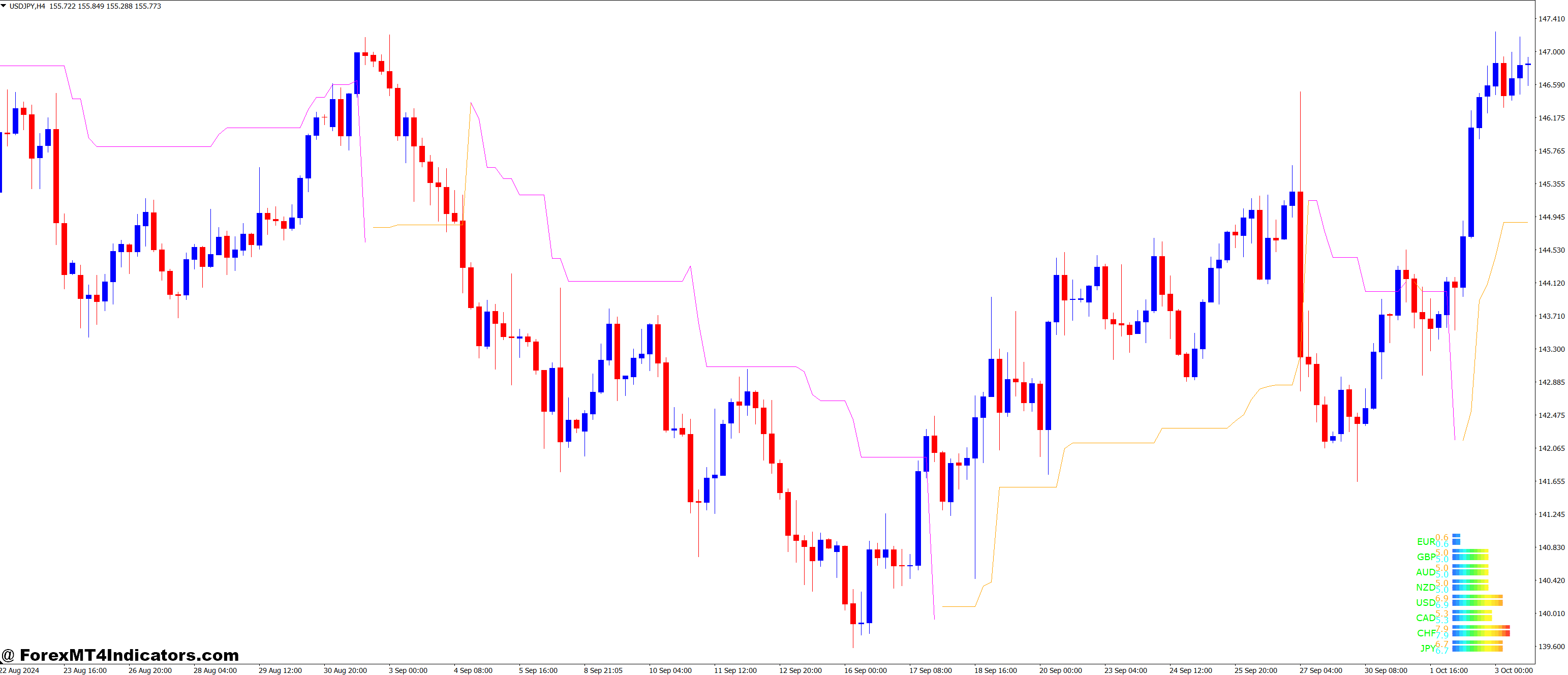

Currency Power Meter shows which currencies are strong to buy or sell. It looks at wave cycles and their heights to see market ups and downs. Wave heights, usually 80 to 100 pips for big pairs, show how volatile the market is.

Chandelier Exit, on the other hand, sets stop-loss levels based on market volatility. It uses a 14-day Average True Range (ATR) with a 2 to 4 multiplier. For example, if the ATR is 100 pips, a 2 ATR stop is 200 pips from the start.

| Indicator | Key Metric | Typical Value |

|---|---|---|

| Currency Power Meter | Wave Height | 80-100 pips (major pairs) |

| Chandelier Exit | ATR Period | 14 days |

| Chandelier Exit | ATR Multiplier | 2-4 |

By using these indicators together, traders can spot strong currencies and set exact exit points. This mix helps make better trading choices, leading to more wins.

Deep Dive into Currency Power Meter Analysis

The Currency Power Meter is a key tool for forex traders. It gives a quick look at currency strength. This helps traders make better choices.

How Currency Strength is Measured

Currency strength is measured in several ways. The Currency Power Meter scores are based on trend, momentum, and volume. It shows up to 10 green dots for strong currencies and 10 red dots for weak ones.

Lighter dots mean less strength. Missing dots show the market is neutral.

Identifying Strong and Weak Currencies

To find strong and weak currencies, look at the dots. A currency with 6-10 green dots is strong. Mostly red dots mean it’s weak.

Optimal Timeframes for Analysis

Choosing the right timeframes is key in forex trading. The Currency Power Meter works on many timeframes. But, 4-hour and daily charts are the most popular.

These timeframes offer enough data for good analysis. They avoid too much noise.

| Timeframe | Advantages | Best For |

|---|---|---|

| 15-minute | Quick market changes | Scalping |

| 1-hour | Intraday trends | Day trading |

| 4-hour | Medium-term trends | Swing trading |

| Daily | Long-term trends | Position trading |

Learning the Currency Power Meter can improve traders’ skills. It helps them make more profitable trades.

Mastering the Chandelier Exit Indicator

The Chandelier Exit setup is a key tool for forex traders. It mixes technical analysis with a trailing stop strategy. This helps traders keep their profits safe while they’re in a good trade.

Components of Chandelier Exit

The Chandelier Exit has two main parts: the highest high over a set time and the Average True Range (ATR). The ATR shows how volatile the market is. It changes the stop-loss levels to fit the market’s mood.

Setting Up Proper Parameters

To use the Chandelier Exit, traders pick a lookback period and an ATR multiplier. A usual setup is a 22-day lookback with an ATR multiplier of 3. These settings can change based on the trader’s style and the market.

Understanding ATR Multiplier Effects

The ATR multiplier changes how sensitive the trailing stop is. A bigger multiplier means a wider stop, letting prices move more. A smaller multiplier makes the stop tighter, leading to exits sooner.

| ATR Multiplier | Stop Distance | Trade Duration |

|---|---|---|

| 1.5 | Close | Shorter |

| 3 | Moderate | Balanced |

| 4.5 | Farther | Longer |

Learning the Chandelier Exit indicator can boost a trader’s forex strategy. It balances making profits and avoiding losses. This is key for success in the fast-changing forex market.

Combining Indicators for Enhanced Trading Decisions

Forex trading decisions are better with multiple indicators. Using the Currency Power Meter and Chandelier Exit together gives a full view of the market. This way, traders can make smarter, more balanced choices.

The Currency Power Meter shows which currencies are strong or weak. The Chandelier Exit finds the best times to get out. Together, they help spot market trends and when to switch directions.

Adding candlestick patterns to these indicators makes decisions even better. Studies show mixing candlestick analysis with advanced models boosts prediction accuracy. This method helps cut through market noise, making it easier to see trends on charts.

To see how powerful this indicator combination strategy is, look at this data:

| Indicator | Function | Reliability |

|---|---|---|

| Currency Power Meter | Identifies strong/weak currencies | High on all timeframes |

| Chandelier Exit | Signals of possible exit points | More reliable on higher timeframes |

| Candlestick Patterns | Provides insights into price action | Boosts predictions of bullish trends |

Using these tools together helps traders make more precise decisions. This can lead to better results than using just one indicator. It also helps in timing entries and exits, and managing risks in different market situations.

Practical Applications in Different Market Conditions

It’s important to adjust your trading plan to match the market. We’ll look at how to use the Currency Power Meter and Chandelier Exit in different situations.

Trading During Trending Markets

The Chandelier Exit is great for trend trading. This versatile indicator sets stop-loss levels based on market changes. For long trades, enter when the price goes above the Exit Will Alert signal. Short trades are the opposite.

Sideways Market Strategies

Sideways markets need special strategies. The Currency Power Meter finds breakout chances. Use the DEMA indicator for its balance of speed and smoothness.

Adding RSI or MACD for extra confirmation helps avoid false signals in choppy markets.

Volatile Market Approaches

Volatility trading needs fast actions. The HMA indicator is excellent here because it responds quickly. Adjust the JMA parameters based on market volatility.

Trade only when volatility goes up in 4-hour and daily timeframes for the best results.

| Market Condition | Recommended Indicator | Key Strategy |

|---|---|---|

| Trending | Chandelier Exit | Follow the trend, use 1:1.1 profit to stop the ratio |

| Sideways | Currency Power Meter | Look for breakouts, confirm with DEMA |

| Volatile | HMA | Quick entries/exits, adjust JMA parameters |

Backtesting across different assets and timeframes is essential. It helps refine your strategies for any market. This way, you can improve your trading performance.

Risk Management and Position Sizing

Managing risk and setting the right position sizes are key to trading success. These steps protect your money and help you make more profit. Let’s look at some important ideas and how to use them.

The Average True Range (ATR) shows how much the market moves. For example, an ATR of 0.55 for AUY means the market is a bit volatile. Traders use this to set stop-loss levels and figure out how big their trades should be.

Choosing the right size for your trades is very important. A good rule is to risk only 1-2% of your account on one trade. This keeps your money safe and lets you trade more often.

Leverage can be both good and bad in forex trading. It can make your profits bigger, but it also ups the risk. With a 1:100 leverage ratio, you can control $100,000 with just $1,000. But, if not managed well, it can cause big losses.

| Leverage Ratio | Margin Requirement | Control Amount |

|---|---|---|

| 1:50 | 2% | $50,000 |

| 1:100 | 1% | $100,000 |

| 1:200 | 0.5% | $200,000 |

Using the ATR with other tools can make your trading better. Day traders often use a 15-minute chart, while swing traders might choose a 10-period ATR. A rising ATR means the market is getting more volatile. A falling ATR might mean the market is calming down.

Common Trading Mistakes and How to Avoid Them

Forex trading can be tricky, even for experts. One big mistake is counting too much on tools like the Currency Power Meter or Chandelier Exit. These tools are helpful, but they shouldn’t decide everything for you.

Learning about the market basics is the first step to avoid mistakes. Don’t just look at charts; also pay attention to economic news. A mix of technical and fundamental analysis is best for trading.

How you feel can also affect your trading. Making decisions based on emotions can lead to bad choices. Stay calm and follow your trading plan to handle market ups and downs better.

| Common Mistake | Prevention Strategy |

|---|---|

| Overreliance on indicators | Use multiple analysis methods |

| Ignoring fundamentals | Incorporate economic news in the analysis |

| Emotional trading | Develop and stick to a trading plan |

| Poor risk management | Set proper stop-loss and take-profit levels |

Success in forex trading comes from always learning and changing. By knowing these common errors and how to dodge them, traders can do better in the long run.

Backtesting and Strategy Optimization

Forex backtesting is key to a good trading strategy. It lets traders check their strategy’s past performance. They can then tweak it for better results. The Currency Power Meter and Chandelier Exit strategy benefit from this.

Historical Data Analysis

Traders should look at data from months or hundreds of signals. This deep dive reveals patterns and checks the strategy’s performance in different markets. For example, the Algoman Backtest V1 (PAC) tool uses a Step-and-match algorithm. It helps set up complex entry and exit rules based on price movements.

Performance Metrics Evaluation

Key metrics help improve a strategy. A win rate of 56-70% is good during backtesting. Other important metrics include:

- Risk per trade: 1-2% of account balance

- Profit target ratio for stop loss: 1:1.1

- Trading timeframe: 15 minutes or higher

Strategy Refinement Techniques

Improving your strategy means tweaking settings and adding new indicators. Here are some ways to do it:

| Technique | Description |

|---|---|

| Indicator Optimization | Adjust LWMA Algo Alpha period (default 50) based on timeframe and asset volatility |

| Volatility Filter | Apply strategy during high volatility periods, confirmed on 4H and daily timeframes |

| Additional Confirmations | Integrate RSI or MACD to avoid false signals before trade entries |

| Risk Management | Implement fixed stop-loss levels alongside the Exit Will Alert |

Keep refining your strategy through backtesting and optimization. This makes it work better with different assets and market conditions.

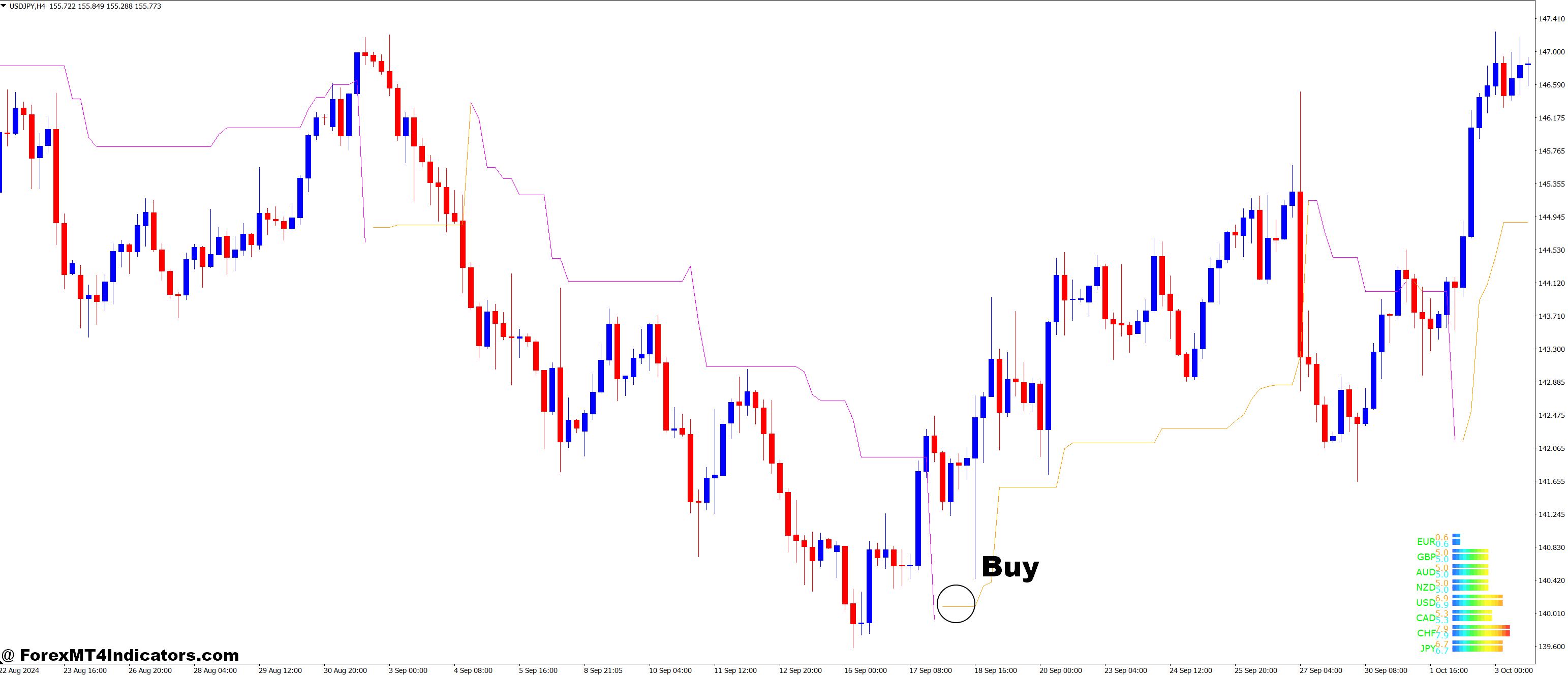

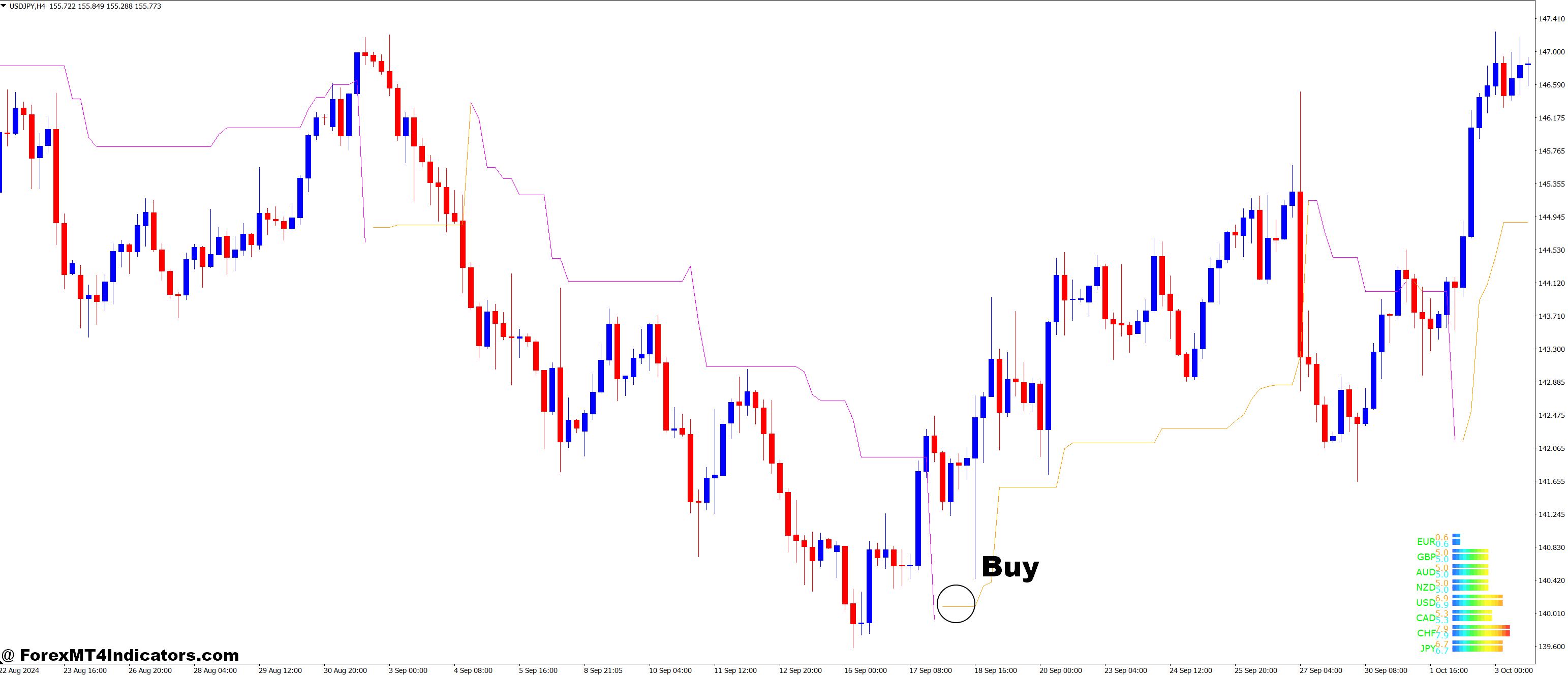

Buy Trade

- The Currency Power Meter shows that the USD is strong and the EUR is weak.

- The Chandelier Exit indicates that the price exceeds the Chandelier Exit line (confirming an uptrend).

- Enter Buy at market price when the trend is confirmed.

- Stop-loss is below the most recent swing low (or the Chandelier Exit line).

- Use the Chandelier Exit as a trailing stop to lock in profits if the price moves in your favor.

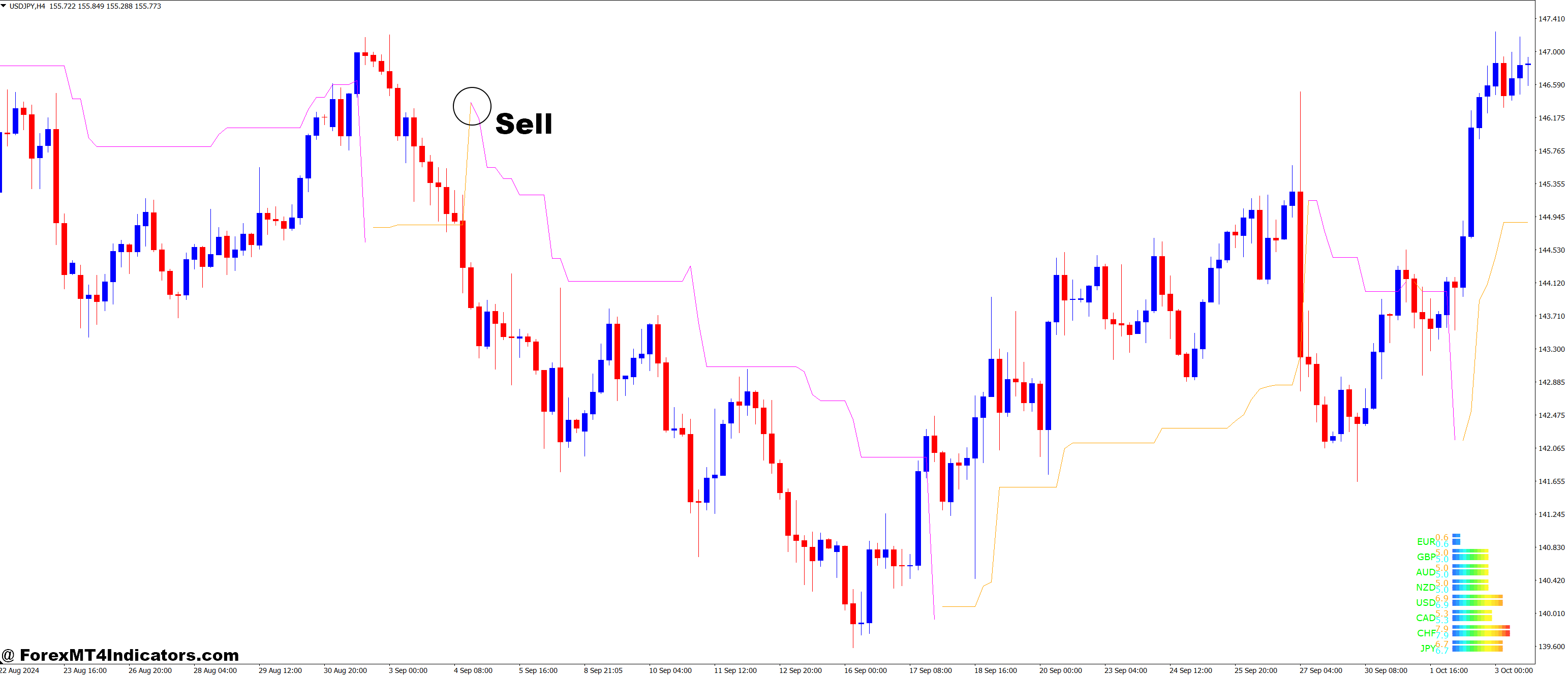

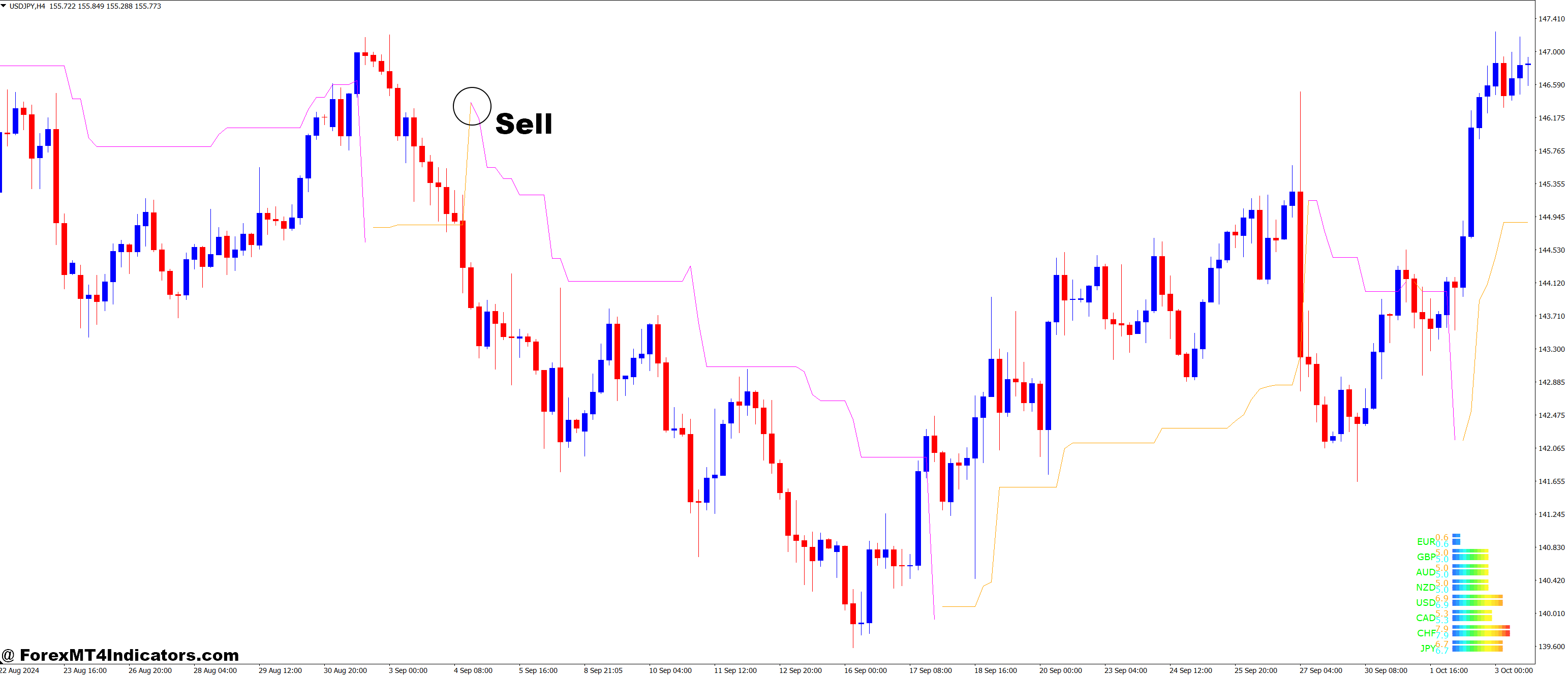

Sell Trade

- The Currency Power Meter shows that the EUR is weak and the USD is strong.

- The Chandelier Exit shows the price is below the Chandelier Exit line (confirming a downtrend).

- Enter Sell at market price when the trend is confirmed.

- Stop-loss is placed above the most recent swing high (or the Chandelier Exit line).

- Use the Chandelier Exit as a trailing stop to lock in profits as the price moves in your favor.

Conclusion

The Currency Power Meter and Chandelier Exit Forex Trading Strategy are great for traders. They use these tools with others like Lucky Reversal and Volume Profile. This gives a full view of the market.

The Chandelier Exit, by Charles Le Beau, helps manage exit points well. It changes with the market’s ups and downs.

Learning never stops in forex trading. Traders use tools like Order Block Breaker and Buy Sell Magic. They find the best times to buy and sell.

The Stop Loss Clusters (SLC) Indicator also helps. It shows where big price changes might happen. A 2:1 risk-reward ratio for Take Profit is a good start.

But forex trading is more than knowing indicators. It needs practice, being flexible, and always learning. Tools like the Super Arrow Indicator and Elliott Wave Count Indicator help improve strategies.

As traders get better, they adjust their methods based on the market. Always remember to manage risks well.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Cash Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Get Download Access

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0