Learn How to Trade Forex: Complete Beginner’s Guide

[ad_1] Feeling lost in the world of forex trading? You’re not alone. Many beginners find it hard to understand this complex market. The market is huge, with $7.5 trillion traded every day. But don’t worry. This guide will make the basics easy to learn. We’ll cover everything from currency pairs to winning strategies. You’ll learn

[ad_1]

Feeling lost in the world of forex trading? You’re not alone. Many beginners find it hard to understand this complex market. The market is huge, with $7.5 trillion traded every day.

But don’t worry. This guide will make the basics easy to learn. We’ll cover everything from currency pairs to winning strategies. You’ll learn how to trade like a pro.

Ready to start your forex journey? Let’s begin your path to becoming a confident trader. With the right knowledge and tools, you’ll be trading like a pro in no time.

Key Takeaways

- The forex market trades $7.5 trillion daily

- Forex operates 24/5, giving you flexibility

- High liquidity makes buying and selling easy

- Leverage can make both gains and losses bigger

- Mini accounts are perfect for beginners

- Stop-loss orders help manage risk

- Forex is a zero-sum game

Understanding the Forex Market Fundamentals

The forex market is key to global currency trading. It runs 24/7, five days a week. This lets traders trade currency pairs worldwide.

What is Forex Trading and How it Works

Forex trading means buying one currency and selling another. Traders make money from value changes. For example, buying EUR/USD if you think the Euro will grow stronger.

Trades are often done quickly, in seconds.

Key Players in the Forex Market

Many groups shape the forex world:

- Central Banks

- Commercial Banks

- Investment Firms

- Multinational Corporations

- Retail Traders

Central banks are very important. Their interest rate choices can move the market a lot. For example, a 0.25% interest rate increase can make dollar assets more appealing.

Market Size and Daily Trading Volume

The forex market is the biggest in finance. In North America, it trades over $1.17 trillion daily.

| Region | Average Daily Volume |

|---|---|

| North America | $1.17 trillion |

| Europe | $1.3 trillion |

| Asia | $0.9 trillion |

This huge volume makes it easy for traders to buy and sell. It’s why many investors find forex appealing.

Currency Pairs and Market Structure

The forex market is open 24/7, five days a week. It starts on Sunday evening and ends on Friday evening Eastern time. This means traders can react to global news anytime, making trading flexible and easy.

Major Currency Pairs Explained

Major currency pairs are the most traded in the forex market. The EUR/USD pair is the most popular, making up over 20% of all trades in 2022. Other favorites include GBP/USD, USD/JPY, and USD/CHF. These pairs are great because they have high liquidity and tight spreads.

Understanding Pips and Spreads

Pips are the smallest price change in forex. For most pairs, a pip is the fourth decimal place. Spreads are the difference between the buy and sell price. Tighter spreads mean lower costs and more liquidity.

Trading Sessions and Market Hours

The forex market has four main sections: Sydney, Tokyo, London, and New York. Each has its busy hours, which affect the movement of currency pairs. The forex trading hours when London and New York overlap are the busiest, which is a great time for traders to find opportunities.

| Session | Opens (EST) | Closes (EST) | Major Currencies |

|---|---|---|---|

| Sydney | 5:00 PM | 2:00 AM | AUD, NZD |

| Tokyo | 7:00 PM | 4:00 AM | JPY |

| London | 3:00 AM | 12:00 PM | EUR, GBP |

| New York | 8:00 AM | 5:00 PM | USD, CAD |

How to Trade Forex

Forex trading can lead to profits and protect against currency changes. Knowing the basics is key to success in this fast-paced market.

Basic Trading Mechanics

Forex trading means buying and selling currency pairs. There are over 80 pairs, from big ones like GBP/USD to rare ones like HUF/EUR. Traders use CFDs to trade these pairs with less money, making their bets bigger.

Types of Orders in Forex Trading

Traders use different orders to carry out their strategies. Market orders are filled at the current price. Limit orders let you buy or sell at a set price. Stop orders close positions at set levels to manage risk.

Reading Currency Quotes

Currency quotes are the base of forex trading. For example, GBP/USD at 1.28000 means £1 is worth $1.28. Prices are shown to five decimal places, with the fourth decimal being a pip. A change from 1.17666 to 1.17676 is one pip.

| Aspect | Details |

|---|---|

| Standard CFD Size | 100,000 units of base currency |

| Mini CFD Size | 10,000 units of base currency |

| Leverage Example | EUR/USD at 50:1 (2% margin) |

| Margin Requirement | $58.82 for 10,000 EUR position |

| Pip Value | Fourth decimal place (e.g., 1.17666) |

Knowing these basics helps traders navigate the forex market better. High leverage can increase profits but also risk big losses. Always manage your risk well in your trading strategies.

Essential Tools and Platforms for Forex Trading

Forex trading platforms are key to success in currency trading. They connect traders to the global market, providing real-time data. Popular ones like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are known for their features and ease of use.

When picking a platform, consider reliability, ease of use, and technical tools. Look for tools like moving averages and Bollinger Bands. These help spot market trends and when to buy or sell.

Traders also need economic calendars and news feeds. These give vital info on market events and indicators. Using these tools can help you stay ahead in the fast forex market.

Choosing a good broker is very important. Go for brokers regulated by top authorities like the FCA or CySEC. They offer safety and access to advanced forex trading tools and learning resources.

| Platform | Key Features | User Base |

|---|---|---|

| MetaTrader 4/5 | Expert Advisors, Custom Indicators | Widely used globally |

| TradingView | Social features, Multiple indicators | Over 50 million users |

| cTrader | Market depth, Copy trading | High-frequency traders |

| NinjaTrader | Advanced charting, Trading tools | Over 800,000 traders |

The forex market is open 24/7, five days a week. It needs tools that can keep up. Use stop-loss and take-profit orders to manage risk, even when you’re not watching the markets.

Developing a Forex Trading Strategy

Creating a solid forex trading strategy is key to success. It should match your financial goals, risk level, and trading style. Let’s look at what makes a good forex strategy.

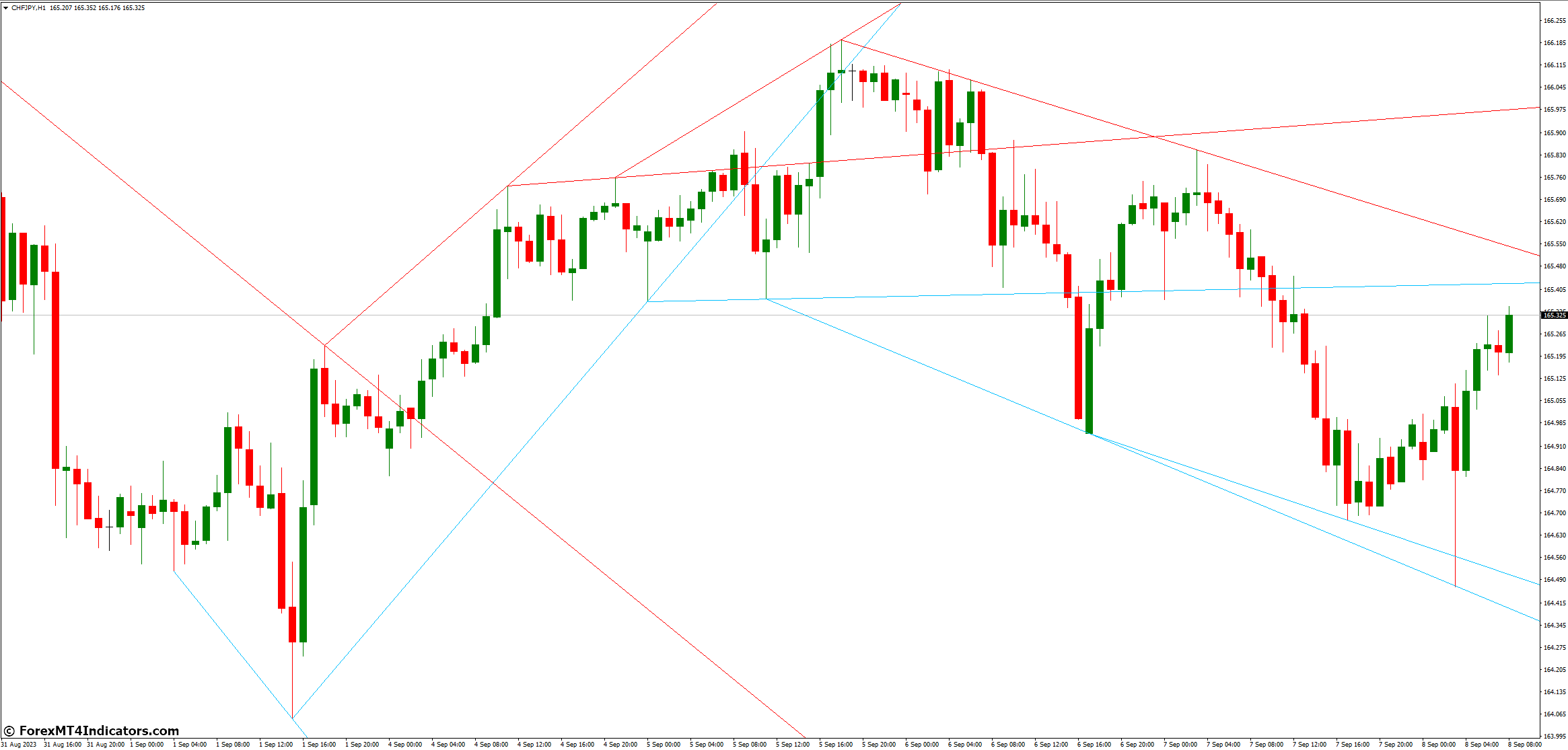

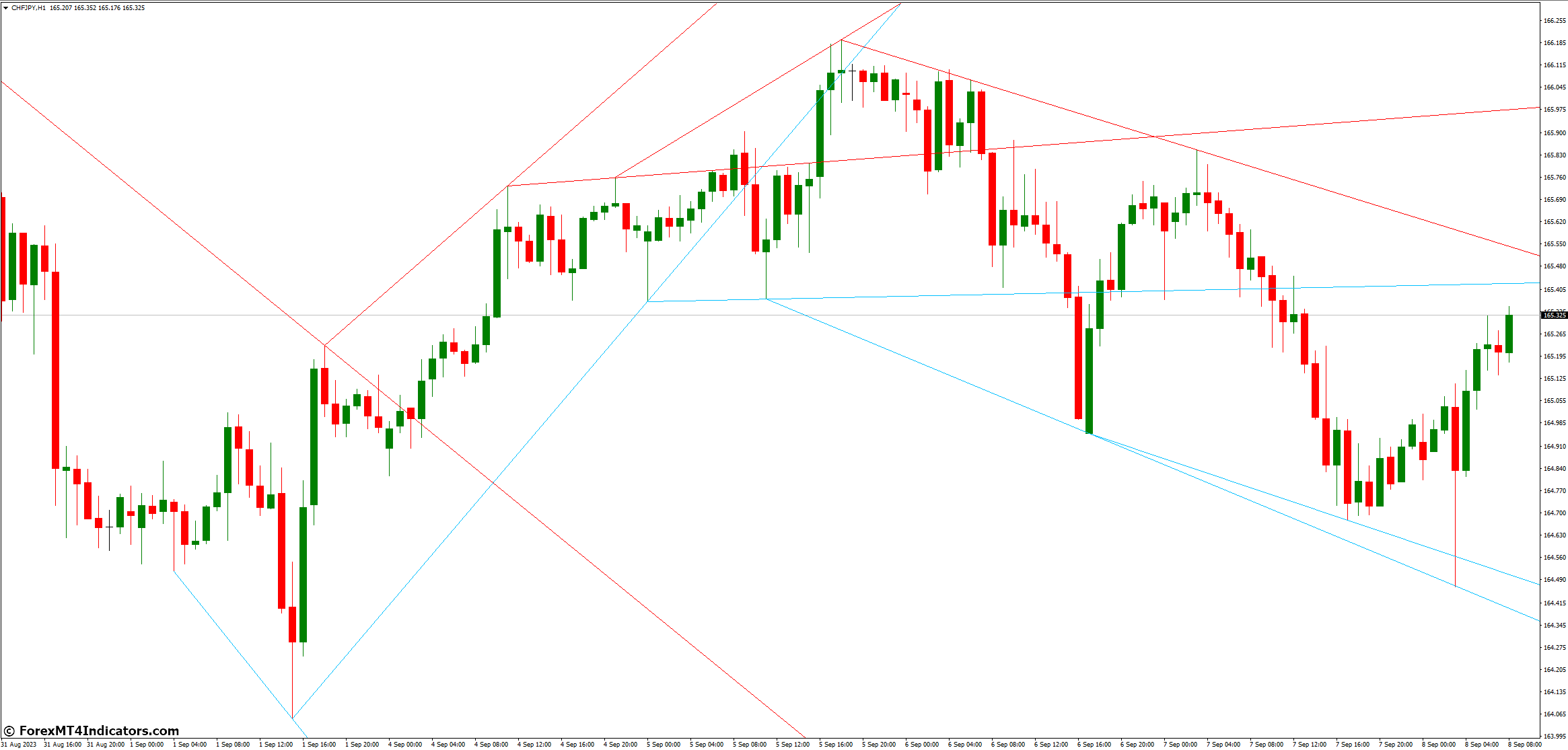

Technical Analysis Basics

Technical analysis looks at price charts and indicators to guess future market moves. Traders use support and resistance levels, moving averages, and patterns to decide. For example, a currency might bounce off certain levels by a set percentage or pips.

Fundamental Analysis Approach

Fundamental analysis looks at economic data and news that affect currency values. Traders watch interest rates, GDP, and employment to understand a country’s economy. The carry trade strategy, which profits from interest rate differences, is a common approach.

Risk Management Techniques

Managing risk is vital for long-term success in forex. Stop-loss orders help control losses. Experts suggest a daily loss limit of 5%. Position sizing is also important, with standard accounts needing 100,000 units, and mini and micro accounts smaller sizes.

Creating a detailed trading plan is essential for success. It should cover your strategy, risk tolerance, and goals. Always test your strategy and practice with a demo account before trading real money. Update your plan often based on performance and market changes.

| Account Type | Base Units | Percentage of Standard Lot |

|---|---|---|

| Standard | 100,000 | 100% |

| Mini | 10,000 | 10% |

| Micro | 1,000 | 1% |

| Nano | 100 | 0.1% |

Common Forex Trading Mistakes to Avoid

Forex trading pitfalls can ruin even the best trading careers. Knowing these common mistakes is key to success in currency trading.

Emotional Trading Pitfalls

Emotional trading is a big problem for many traders. Fear and greed can lead to bad decisions and big losses. A trader who loses half their money needs a 100% return just to get back to square one.

To fight this, many traders use systematic ways to reduce emotional impact.

Over-leveraging Risks

Leverage can be both good and bad in forex trading. It can increase profits but also losses. Most successful traders use small leverage ratios.

It’s wise not to risk more than 1% of your capital on one trade. For a $50,000 account, that means a max loss of $500 a day.

Poor Money Management

Good money management is vital in forex trading. Many beginners risk too much on one trade or don’t use stop-loss orders. Using stop and limit orders is important, even if they can’t always stop losses.

A solid trading plan is essential. It helps avoid unrealistic hopes and costly errors.

| Risk Management Guideline | Recommended Practice |

|---|---|

| Maximum Risk per Trade | 1% of total capital |

| Leverage Usage | Conservative ratios |

| Stop-Loss Orders | Mandatory for all trades |

| Trading Plan Review | Regular adjustment based on performance |

Getting Started with Your First Trade

Are you ready to start forex trading? Let’s go through your first trade step by step. It’s important to begin with a practice trading account. This lets you try out strategies without losing real money.

Choose a currency pair for your first trade. Beginners often pick major pairs like EUR/USD or GBP/USD. They have high liquidity and tight spreads, which means lower costs.

Next, decide on your position size. Start small to keep risk low. Many brokers offer mini accounts with a $250 minimum deposit. These accounts are great for beginners because you can trade smaller amounts.

Set your stop-loss and take-profit levels. These orders help manage risk and secure profits. It’s wise to risk no more than 1-2% of your account on one trade.

Now, it’s time to execute your trade. Open your trading platform and place your order. Remember, forex markets are open 24 hours a day, so timing is flexible.

Keep a trading journal to track your decisions and outcomes. This helps you learn from each trade and improve your strategy over time.

| Aspect | Recommendation |

|---|---|

| Account Type | Demo or Mini Account |

| Initial Capital | $250 – $2,000 |

| Risk per Trade | 1-2% of Account |

| Leverage | Start Low (e.g., 50:1) |

Success in forex trading takes practice and patience. Use your practice trading account to build confidence before trading live.

Advanced Trading Concepts and Techniques

To get better at forex trading, you need to learn advanced strategies and understand trading psychology. These skills can help you do well in the $6 trillion daily forex market.

Position Sizing and Portfolio Management

Smart position sizing is key for trading success. It helps manage risk and increase returns. A good portfolio has a mix of currency pairs, with major ones like USD/EUR and USD/JPY at the center.

Trading Psychology

Understanding trading psychology is essential for success. You need to control your emotions and stay disciplined in volatile markets. Successful traders follow these rules:

- Start small

- Use stop-loss orders

- Avoid over-leveraging

- Diversify currency pairs

- Review trading records regularly

Market Analysis Tools

Advanced traders use special tools for market analysis. They look at multi-timeframe analysis and how currency pairs relate to each other. For example, advanced forex strategies often use bond spreads and forex movements, with a 0.7 correlation.

| Strategy | Description | Typical Time Frame |

|---|---|---|

| Scalping | Multiple small gains, few pips per trade | Seconds to minutes |

| Day Trading | Positions closed within same day | Minutes to hours |

| Swing Trading | Capitalize on price swings | Days to weeks |

| Position Trading | Long-term trend following | Weeks to months |

Conclusion

Starting your forex trading journey is thrilling. The market is huge, with over $6 trillion traded daily. But, it’s important to be careful and always keep learning.

Don’t look for quick profits. Success in forex comes from a good plan, managing risks, and staying focused. With 28 major currency pairs and leverage up to 50:1, you can grow your money. But, remember, high leverage means higher risks too.

Start by learning and practicing. Use demo accounts to improve your skills without losing real money. Keep a journal to track your progress and learn from your mistakes. This way, you’ll become a skilled trader who finds good opportunities and avoids big losses.

The forex market is always open, 24/7. It’s influenced by global events, making it exciting for those who are willing to learn. So, start today. Remember, in forex, patience and persistence are the keys to success.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0