How To Predict Forex Price Movements Accurately

Struggling to predict forex price movements? The foreign exchange market trades over $5 trillion daily, making it fast-paced and challenging. This article will explain key strategies like analyzing trends, using tools, and understanding economic factors to improve accuracy. Learn how to make informed trading decisions today! Key Takeaways Forex markets trade over $5 trillion daily.

Struggling to predict forex price movements? The foreign exchange market trades over $5 trillion daily, making it fast-paced and challenging. This article will explain key strategies like analyzing trends, using tools, and understanding economic factors to improve accuracy.

Learn how to make informed trading decisions today!

Key Takeaways

- Forex markets trade over $5 trillion daily. Predicting price movements requires skill, tools, and an understanding of global trends.

- Economic factors like GDP growth, interest rates, and inflation heavily affect currency values, and central bank decisions also play a key role.

- Technical tools like moving averages, RSI, and candlestick charts help track trends and forecast future forex moves accurately.

- Sentiment analysis and methods like Purchasing Power Parity (PPP) compare economic strength to effectively predict exchange rate shifts.

- Staying updated on global events using an economic calendar improves market predictions during volatile situations or major announcements.

How To Predict Forex Price Movements Accurately

Predicting forex price movements requires skill and knowledge. Traders analyze market trends and key factors that affect currency values to make better decisions.

Importance of Understanding Market Trends

Market trends show how currency prices move over time. They help traders spot patterns in price action. By studying trends, traders understand supply and demand changes in the forex market.

This knowledge allows them to predict movements in exchange rates better.

Major banks, retail traders, and corporations rely on these trends daily. The forex market handles over $5 trillion a day globally understanding its direction is key to making informed decisions.

Trends also highlight shifts caused by interest rate changes or global economic news that affect currency pairs like the U.S. dollar or Japanese yen.

Key Factors Influencing Forex Price Movements

Economic data heavily affects currency movements. Reports like GDP growth reveal a country’s economic strength. For example, strong GDP boosts investor confidence and strengthens the national currency.

Interest rates also play a major role. Higher rates attract foreign investments, increasing demand for that currency. Inflation changes prices too—higher inflation weakens purchasing power.

Global news shapes market sentiment quickly. Political instability or economic crises often lead to high volatility in forex trading. Major currencies like EUR/USD or USD/JPY see sharp price changes during these events.

Central banks’ decisions on monetary policy can shift trends in the forex market rapidly, influencing traders’ strategies and predictions directly.

Fundamental Analysis for Forex Predictions

Fundamental analysis helps traders predict currency movements by studying economic factors. Focus on key data like employment rates, GDP growth, and interest rate changes to assess market direction.

Economic Indicators and their Impact

Economic indicators like GDP, CPI, and RPI directly affect currency values. Strong economic growth measured by GDP often strengthens a nation’s currency due to higher investor confidence.

For example, the U.S. dollar gains value if quarterly GDP reports show strong growth.

High inflation shown by CPI or RPI can weaken currencies. Central banks may raise interest rates to control this, which attracts foreign investments and boosts the currency’s value.

Employment numbers also matter—higher job levels indicate economic health, supporting a stronger exchange rate for that country’s currency.

Using an Economic Calendar Effectively

An economic calendar helps traders predict market movements. It tracks key events that affect forex price fluctuations.

- Check for scheduled speeches by central banks, like the Fed or BoE. These can signal changes in monetary policy.

- Focus on major announcements tied to interest rates and inflation data. Higher interest rates often strengthen a currency’s value.

- Watch releases of economic indicators like GDP and the Consumer Price Index (CPI). These reflect a country’s financial health.

- Use tools like IG’s economic calendar for detailed event tracking across markets.

- Pay attention to country-specific factors, such as China’s manufacturing data or the UK’s services sector performance.

- Note patterns in past market moves during similar events for better predictions.

- Review calendars daily to stay updated on global changes impacting major currency pairs.

Interest Rates and Monetary Policy

Higher interest rates often attract foreign investments. This demand for higher-yielding assets strengthens the currency, making it more valuable. The Real Interest Rate (RIR) model directly links rising rates to currency appreciation.

Forex traders use this connection to predict future movements in the forex market.

Central banks like the Fed or ECB set monetary policy. They raise, lower, or maintain interest rates based on economic goals. Their decisions influence exchange rates quickly and significantly.

Speeches from key entities like Jerome Powell can cause sudden volatility in forex prices—traders must track these changes using tools like an economic calendar before identifying trends with price charts.

Technical Analysis for Forex Predictions

Technical analysis uses past price data to forecast future forex movements. By studying patterns and trends, traders can spot potential market changes and plan their strategies.

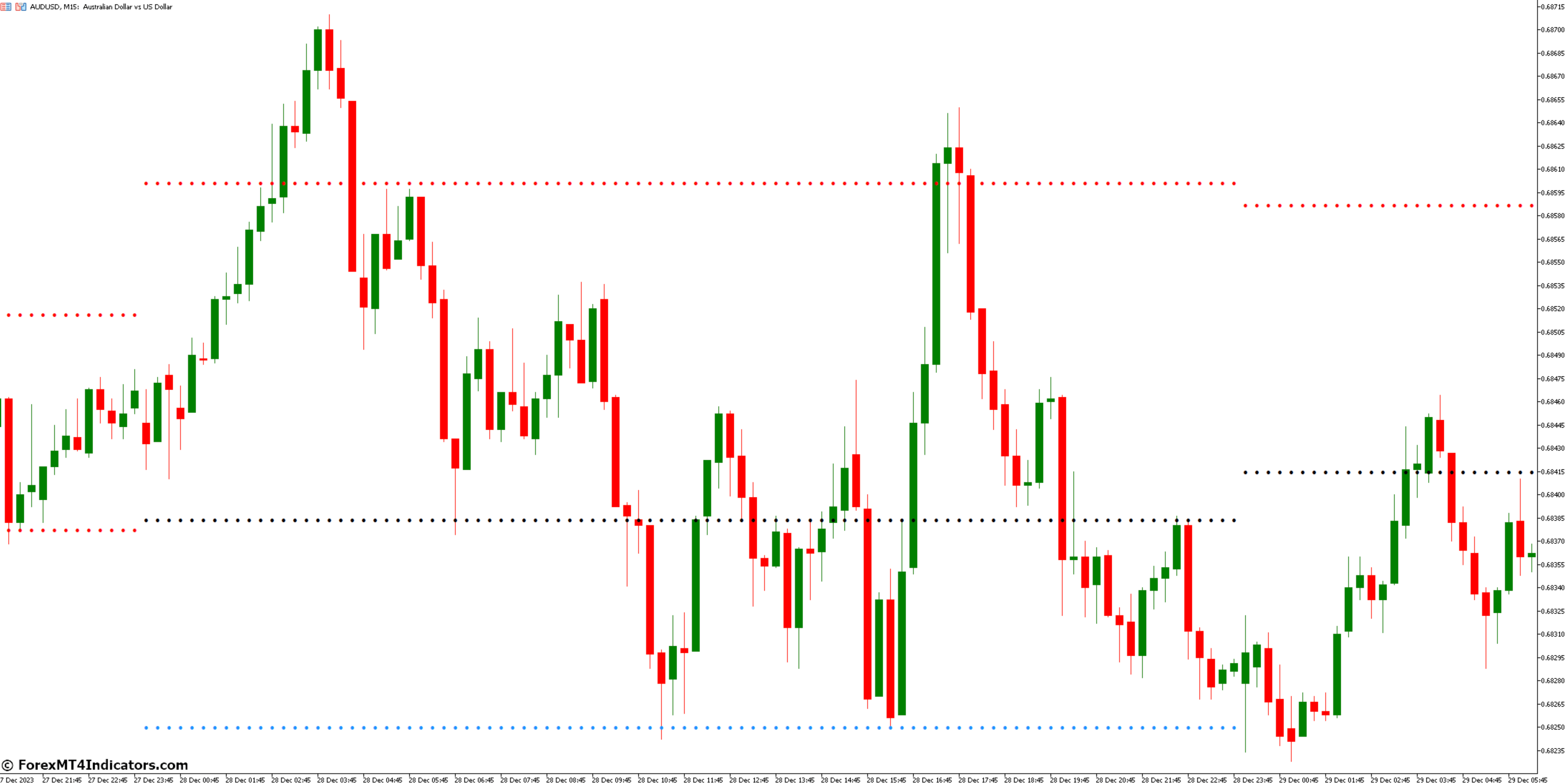

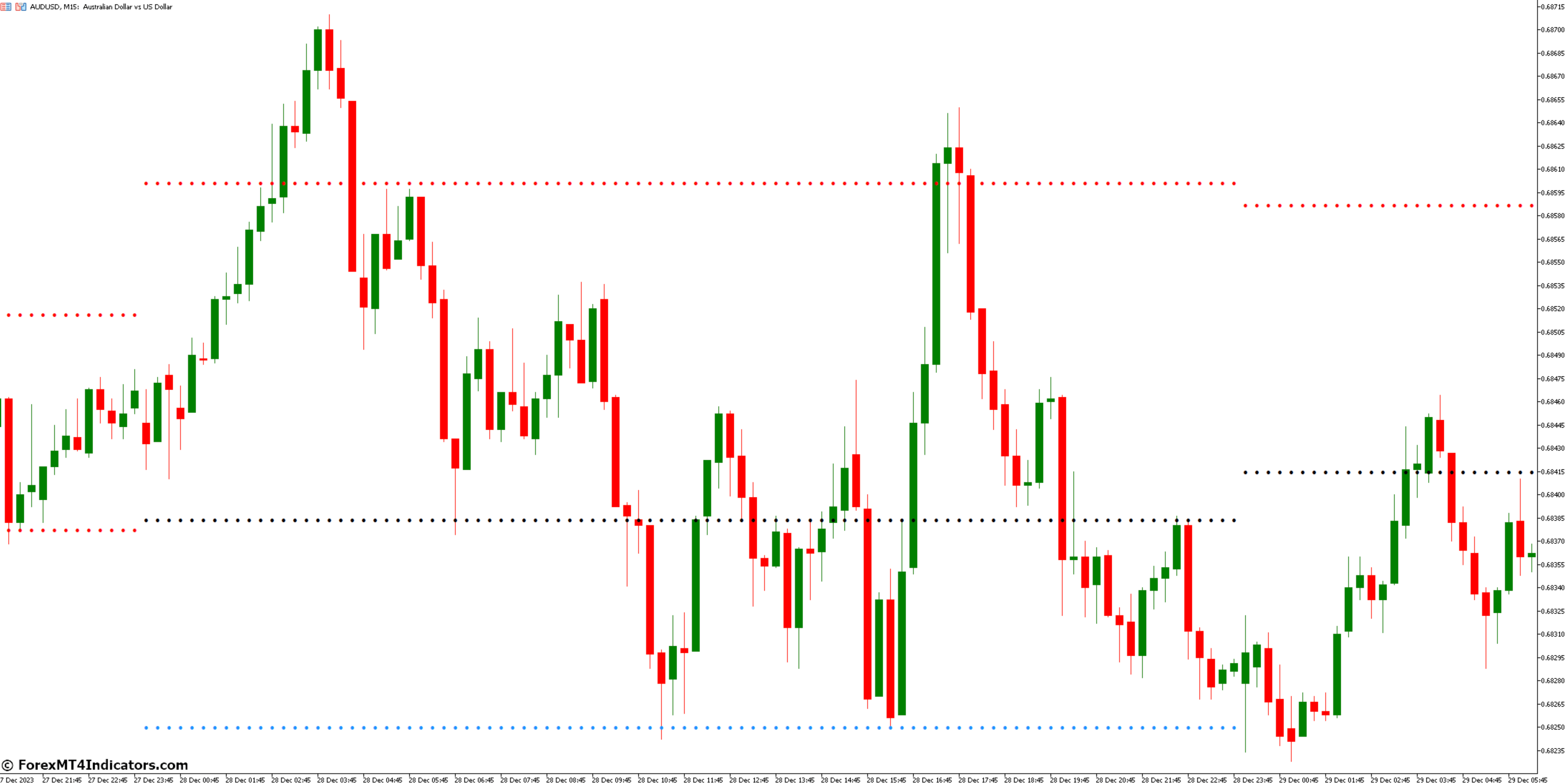

Identifying Trends Using Price Charts

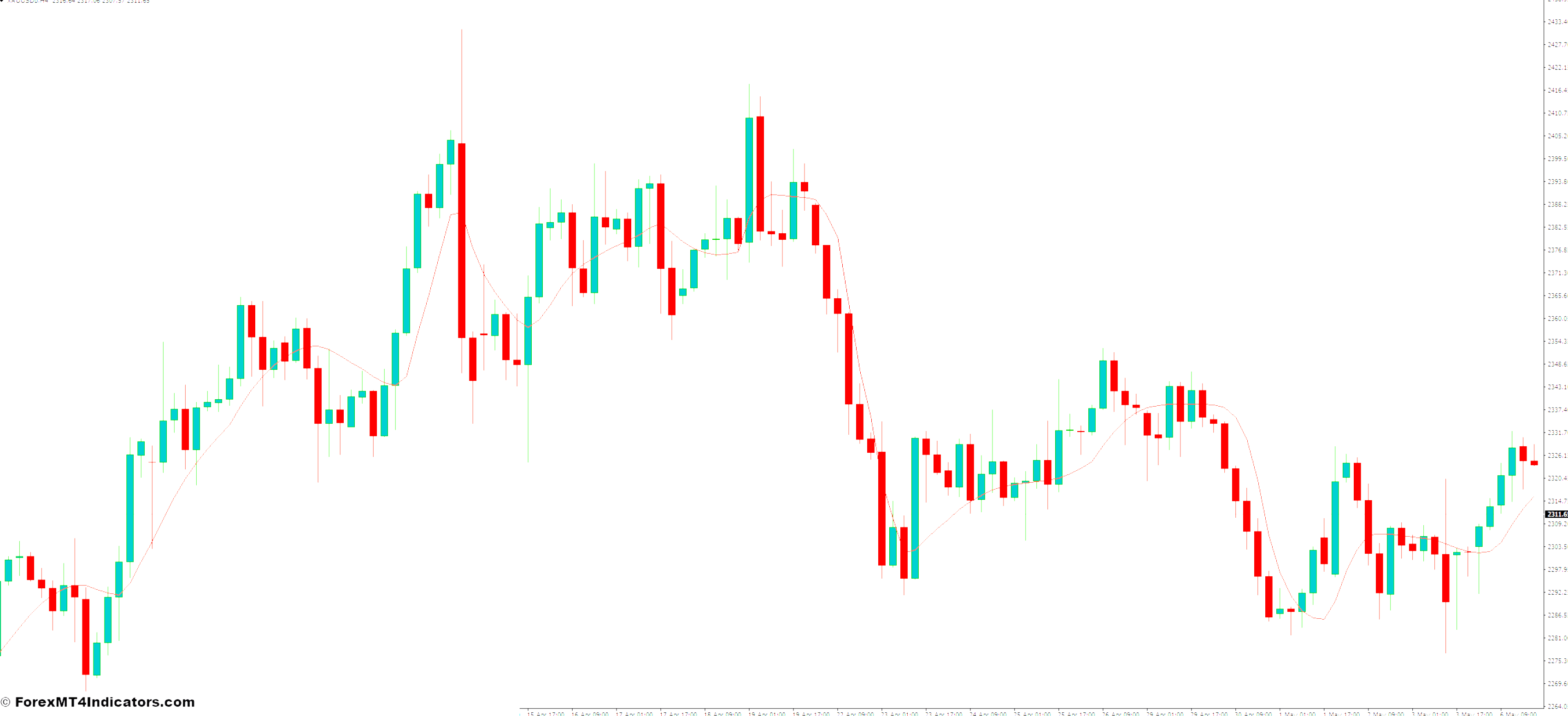

Price charts help traders understand forex market trends. They show how prices move over time and reveal patterns.

- Price charts display historical price data, including opening, highest, lowest, and closing values. These data points help traders spot trends.

- Trends can be uptrends (rising prices), downtrends (falling prices), or sideways trends (stable prices). Recognizing these is essential for forex predictions.

- Candlestick charts are the most used chart type because they give clear visual details of price movements within a specific time frame.

- Trendlines drawn on price charts indicate the trend direction—connecting higher lows in an uptrend or lower highs in a downtrend helps confirm the pattern.

- Moving averages smooth out market noise and show the overall direction of exchange rates over a set period like 50 or 200 days.

- Combining support and resistance levels with trendlines gives traders insight into where a currency might reverse or continue its path.

Analyzing price charts leads naturally to using support and resistance levels for deeper insights into forex trading strategies.

Support and Resistance Levels

Support and resistance levels are key tools for forex market predictions. These levels help traders identify where prices may pause or reverse.

- Support levels act as a price floor. Traders expect prices to bounce back up when they hit this level. For example, if the EUR/USD pair repeatedly finds support at 1.1000, that spot is the support level.

- Resistance levels are the opposite—a price ceiling. Prices often struggle to climb above this point. If USD/JPY fails to move past 150 multiple times, this becomes a strong resistance.

- Knowing these levels helps in planning trades. Traders often buy near support and sell near resistance.

- Bollinger Bands can confirm potential breakouts beyond these levels. When forex trends push outside the bands, major moves might follow.

- The Ichimoku Cloud measures trend strength around support or resistance points, adding clarity to forecasts.

These concepts connect directly with technical analysis tools like moving averages and RSI indicators…

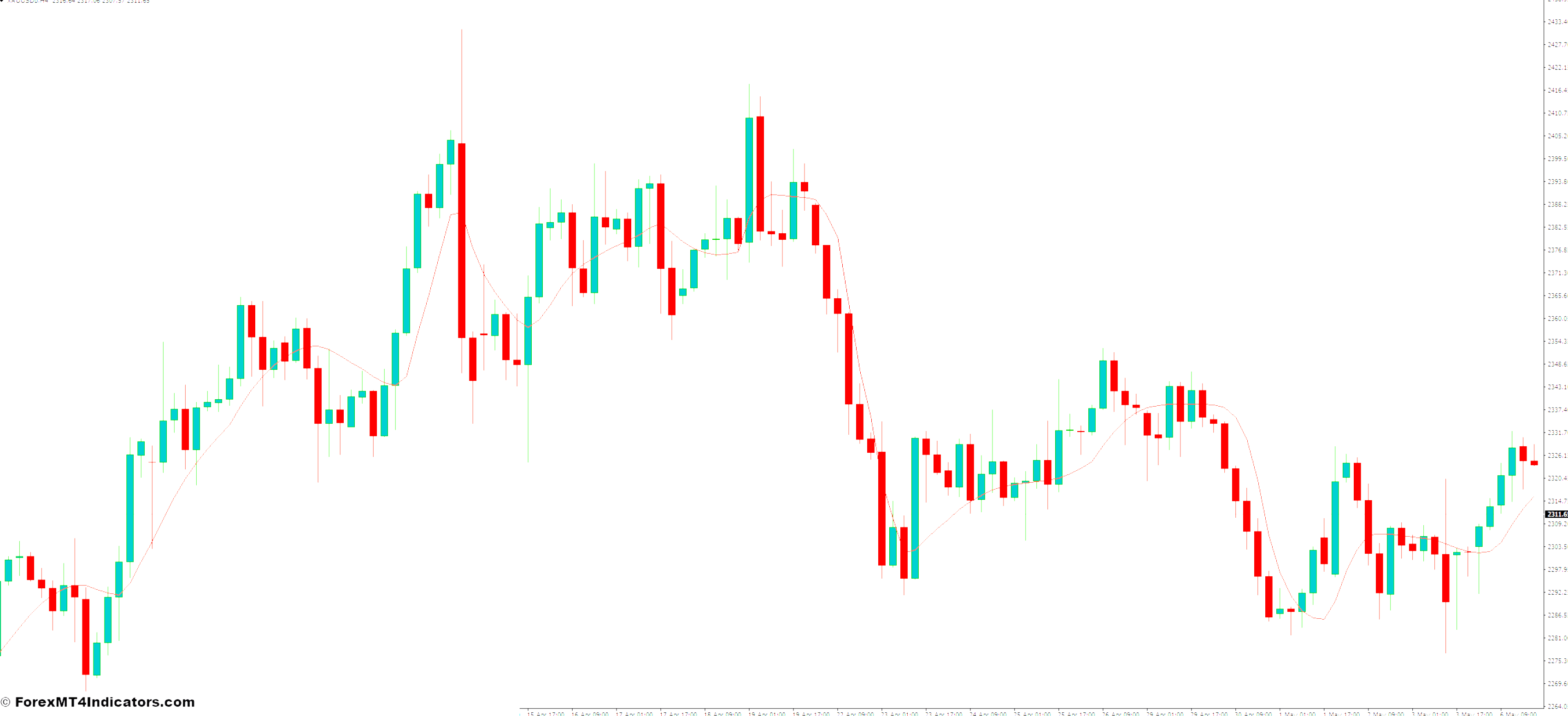

Key Technical Tools: Moving Averages and RSI

Moving averages and RSI are essential tools in forex analysis. They help traders identify trends, momentum, and future price movements.

- Moving averages smooth out past market data. A 20-day moving average shows the average of daily prices over 20 days. It helps traders track long-term trends.

- MACD compares short- and long-term moving averages. It highlights changes in market momentum for trade forex decisions.

- RSI measures momentum over a 14-day timeframe. It finds if assets are overvalued or undervalued between 0 to 100 levels.

- RSI above 70 often signals overbought conditions, while below 30 suggests oversold currency exchange rates.

These tools support better market analysis and help predict forex movements accurately.

Alternative Approaches to Forex Prediction

Explore unique methods like sentiment analysis and economic strength comparisons to forecast currency price shifts these strategies offer fresh ways to increase trading success.

Sentiment Analysis in Forex Markets

Sentiment analysis helps traders gauge market emotion. Tools like the Commodity Futures Trading Commission’s Commitment of Traders report offer valuable insights. This report shows positions held by large players, such as hedge funds or banks.

Traders can predict currency movements based on these trends.

The forex futures market gives clues, but it’s smaller than the spot market. Spot trading reflects broader opinions and real-time actions. Combining futures data with live price moves boosts accuracy.

Next, explore how the relative economic strength approach supports predictions.

Relative Economic Strength Approach

Strong economies attract investors. The relative economic strength approach compares two countries’ GDP growth, inflation rates, and wage trends. For example, a country with higher GDP growth often sees currency appreciation.

Interest rate differences play a key role too—higher rates can strengthen a nation’s currency.

Econometric models analyze these factors to forecast forex movements. They use data like inflation or capital flow trends to indicate value changes in the currency market. Traders watch indicators such as the U.S. dollar against currencies like the Canadian dollar for clear signals of strength or weakness.

Purchasing Power Parity and Interest Rate Parity

Purchasing Power Parity (PPP) compares currency values by looking at goods’ prices in two countries. If a Big Mac costs $5 in the U.S. and €4.50 in Europe, the estimated exchange rate is $1.11 for EUR/USD.

It shows how much one currency can buy versus another.

Interest Rate Parity (IRP) checks asset prices using interest rates between countries. Higher interest rates may make a currency stronger because investors seek better returns there.

Both PPP and IRP help traders predict exchange rate movements more accurately.

Tips for Enhancing Prediction Accuracy

Combine different analysis methods to get a clearer view of forex trends. Focus on major global events that could change currency values quickly.

Combining Fundamental and Technical Analysis

Using both fundamental and technical analysis improves forecasting currency movements. Fundamental analysis examines events like GDP growth, interest rates, or monetary policies from central banks.

Technical tools, such as RSI or moving averages, track price patterns to identify trends and determine support levels.

Each method has limits on its own. News often lacks clear links to market changes. Common indicators may lose value due to widespread use. Combining these approaches offsets weaknesses while increasing prediction accuracy in volatile forex conditions.

Testing the Strength and Stability of Trends

Spotting strong forex trends helps traders make better decisions. Tools like the Relative Strength Index (RSI) and Bollinger Bands show if a trend is steady or weak. The Ichimoku Cloud shows support, resistance, and momentum in one glance.

These tools confirm if price movements have enough force to continue or may reverse soon.

Volatility matters too. The Average True Range (ATR) shows how much prices move over time. A high ATR means more market action; a low ATR signals stability. Standard Deviation checks how far prices stray from their average, helping predict possible shifts.

Staying Updated with Global Economic Events

Global economic events greatly impact forex markets. Traders must follow these events to make informed decisions and lower risks.

- Track key political and economic news from major economies like the United States or China, as they influence currency movements directly.

- Use an economic calendar, such as IG’s, to monitor upcoming events like GDP reports, inflation rates, or employment data that affect market dynamics.

- Follow central bank announcements on interest rates since changes can shift the value of currencies significantly.

- Watch global trade reports to gauge export and import trends, which reveal a country’s market strength in forex trading.

- Stay aware of geopolitical tensions—events like trade wars or sanctions affect forex volatility worldwide.

- Analyze oil prices when trading oil-linked currencies like the Canadian dollar, as commodity prices create ripple effects across financial markets.

- Observe natural disasters or pandemics because these disrupt supply chains and cause major currency shifts globally.

- Pay attention to consumer sentiment indices—they reflect public spending power and often predict daily forex price trends.

- Follow updates on monetary policies globally for insights into long-term interest rate forecasts affecting currency value correlations.

- Stick to reliable news sources like Bloomberg for accurate real-time updates on significant price changes in the stock market.

Conclusion

Predicting forex price movements requires skill and strategy. Combining fundamental and technical analysis improves accuracy. Focus on trends, use tools like charts and RSI, and stay updated on economic news.

Practice with different methods to find what works best. Success comes from learning, adapting, and staying consistent in the market.

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Accurately ، Forex ، Movements ، Predict ، Price

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰